Рынок 3D сканеров АНАЛИЗ РАЗМЕРОВ И ДОЛЕЙ - ТЕНДЕНЦИИ РОСТА И ПРОГНОЗЫ (2024 - 2031)

Рынок 3D-сканеров сегментируется по типу продукта (лазерный сканер, структурированный световой сканер, оптический сканер, другие), по диапазону (корот....

Рынок 3D сканеров Размер

Размер рынка в долларах США Bn

CAGR13.72%

| Период исследования | 2024 - 2031 |

| Базовый год оценки | 2023 |

| CAGR | 13.72% |

| Концентрация рынка | Medium |

| Основные игроки | Шестиугольник AB, FARO Технологии, Inc., Nikon Metrology NV, Trimble Inc., Creaform Inc. и среди других |

дайте нам знать!

Рынок 3D сканеров Анализ

Рынок 3D-сканеров оценивается как $1,98 млрд в 2024 году Ожидается, что он достигнет USD 4,87 млрд к 2031 году, растущие с совокупной годовой скоростью роста (CAGR) 13,72% с 2024 по 2031 год. Растущее использование 3D-сканеров в таких отраслях, как автомобилестроение, здравоохранение и строительство для приложений, включая контроль качества, реверс-инжиниринг и частичный контроль, стимулирует рост рынка 3D-сканеров.

Рынок 3D сканеров Тенденции

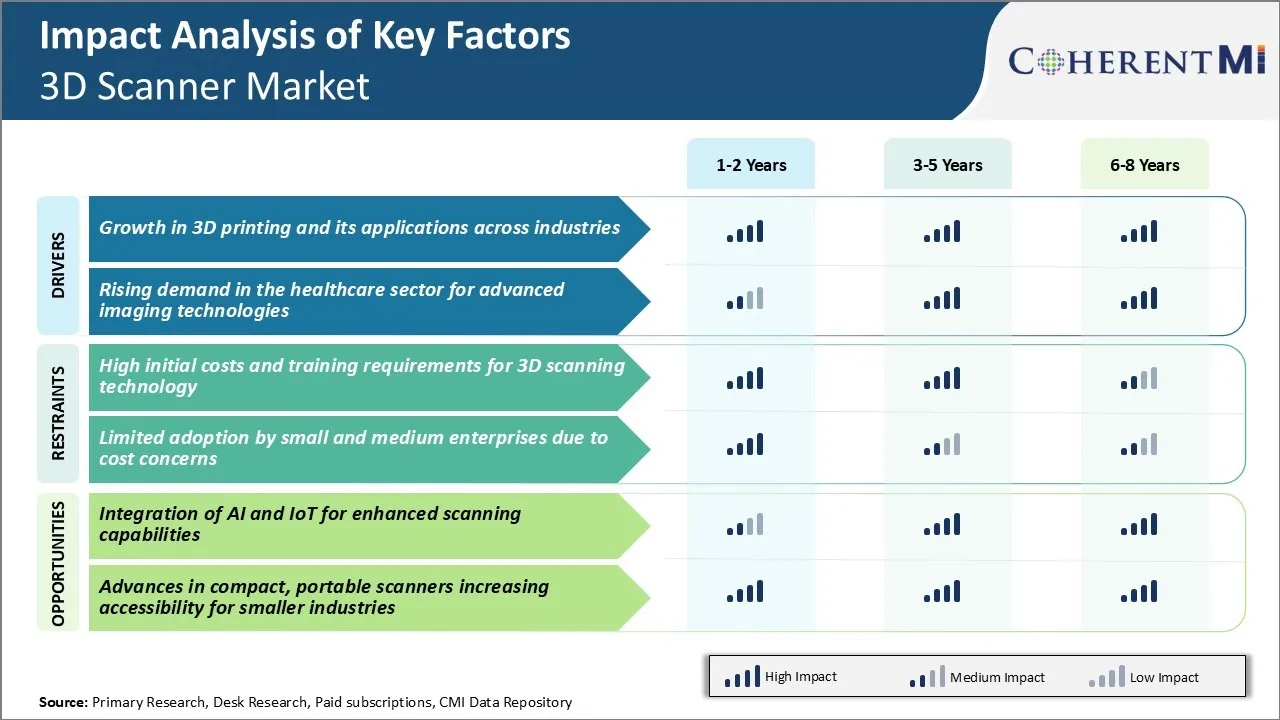

Рыночный драйвер - рост в 3D-печати и ее применения в различных отраслях промышленности

Технология 3D-печати нашла широкое распространение в различных отраслях промышленности, таких как автомобилестроение, аэрокосмическая промышленность, здравоохранение и потребительские товары.

Автопроизводители широко используют 3D-сканеры для быстрого прототипирования, а также для производства запасных частей для улучшения времени оборота. Aerospace — это еще один сектор, где 3D-печать трансформирует производство. Сложные внутренние каналы охлаждения компонентов реактивного двигателя, которые ранее было невозможно изготовить, теперь могут быть напечатаны на 3D-принтере. На медицинском фронте 3D-печать позволяет изготавливать индивидуальные имплантаты, хирургические руководства и модели на основе уникальной анатомии пациента. Этот подход «персонализированной медицины» значительно улучшил результаты для сложных случаев.

Благодаря широкому промышленному охвату в ближайшие годы 3D-сканер будет продолжать распространяться в новые области и создавать более сложные приложения. Таким образом, ожидается, что рост внедрения 3D-печати значительно подстегнет рынок 3D-сканеров.

Рыночный драйвер - растущий спрос в секторе здравоохранения на передовые технологии визуализации

Сектор здравоохранения стал одним из крупнейших конечных пользователей технологии 3D-сканирования. Продвинутые 3D-сканеры меняют способ оказания медицинской помощи, позволяя проводить точные предоперационные оценки, моделирование лечения, установку имплантатов и мониторинг заболеваний или травм с течением времени.

Области, где наблюдается растущее проникновение этих сканеров, включают стоматологическую имплантологию, реконструктивные операции, физиотерапию и ортопедию. Стоматологические клиники широко используют 3D-сканеры для создания 3D-печатных хирургических руководств и точных реставраций. Это улучшило результаты, особенно в сложных случаях.

В ортопедии 3D-сканеры исключительно полезны для генерации индивидуальных имплантатов, протезов и устройств внешней фиксации на основе уникальной костной структуры пациента. Этот индивидуальный подход обеспечивает лучшую послеоперационную функциональность для пациентов.

Больницы развертывают полнофункциональные и портативные 3D-сканеры в операционных театрах для создания 3D-печатных хирургических репетиционных моделей и предварительно изогнутых пластин или инструментов, необходимых для сложных процедур. Это обеспечивает тщательный предоперационный анализ, а также внутриоперационную навигационную поддержку, что приводит к новым тенденциям на рынке 3D-сканеров.

Вызов рынка: высокие первоначальные затраты и требования к обучению технологии 3D-сканирования

Одной из основных проблем, с которыми в настоящее время сталкивается рынок 3D-сканеров, являются высокие первоначальные затраты и требования к обучению, связанные с технологией. 3D-сканеры могут стоить от нескольких тысяч долларов для базовых настольных и портативных моделей до сотен тысяч долларов для крупномасштабных промышленных сканирующих систем. Высокая цена на оборудование представляет собой значительный барьер для входа, особенно для малого и среднего бизнеса.

Кроме того, 3D-сканирование требует специальных навыков для эффективной работы программного и аппаратного обеспечения. Обычно требуется обширное обучение, чтобы научиться выполнять сканирование, обрабатывать данные облака точек и использовать файлы в приложениях проектирования. Расходы на это обучение могут еще больше увеличить необходимые финансовые вложения.

В то время как ожидается, что цены будут постепенно снижаться по мере развития технологии, текущая крутая кривая обучения и высокие первоначальные расходы ограничивают способность многих потенциальных клиентов использовать 3D-сканирование в своих рабочих процессах.

Возможности рынка: интеграция ИИ и IoT для расширения возможностей сканирования

Одна из важных возможностей для рынка 3D-сканеров заключается в дальнейшей интеграции технологий искусственного интеллекта (ИИ) и Интернета вещей (IoT). Поскольку ИИ и алгоритмы машинного обучения продолжают развиваться, их можно применять для улучшения различных аспектов процесса 3D-сканирования.

Интеграция IoT также позволит использовать возможности удаленного сканирования. Сканеры могут быть подключены к сети и сканировать задачи, управляемые из любого места через облачные платформы. Комбинированные технологии ИИ и IoT могут сделать 3D-сканирование более автономным, продуктивным и доступным. Эта повышенная автоматизация может снизить затраты с течением времени, расширяя спектр приложений для технологии 3D захвата, создавая новые возможности для игроков рынка 3D-сканеров.

Ключевые выигрышные стратегии, принятые ключевыми игроками Рынок 3D сканеров

Стратегия 1: Сосредоточение внимания на инновациях посредством НИОКР

Такие компании, как Artec 3D, Creaform, FARO Технологии последовательно инвестировали более 5-10% своих ежегодных доходов в НИОКР для разработки новых и улучшенных технологий 3D-сканирования. Например, в 2020 году Artec 3D запустила свои 3D-сканеры Eva и Leo, которые предлагают сканирование высокого разрешения до 0,1 мм со скоростью сканирования до 1 миллиона точек в секунду.

Стратегия 2: Разработка отраслевых решений для 3D-сканирования

Такие игроки, как Hexagon AB и Nikon Metrology, разработали решения для 3D-сканирования, предназначенные для конкретных отраслей, таких как автомобилестроение, здравоохранение, аэрокосмическая промышленность и т. Д.

Стратегия 3: Провести агрессивную стратегию приобретения

Такие компании, как 3D Systems, выросли как органически, так и неорганически благодаря стратегическим приобретениям. Одним из наиболее заметных приобретений Phenom-World в 2019 году стал доступ к настольным 3D-принтерам Phenom.

Стратегия 4: Фокус на выходе на развивающиеся рынки

Игроки, такие как Maptek, сосредоточились на Азиатско-Тихоокеанском регионе и регионах MEA, которые демонстрируют более высокий рост по сравнению со зрелыми рынками, такими как Северная Америка.

Сегментарный анализ Рынок 3D сканеров

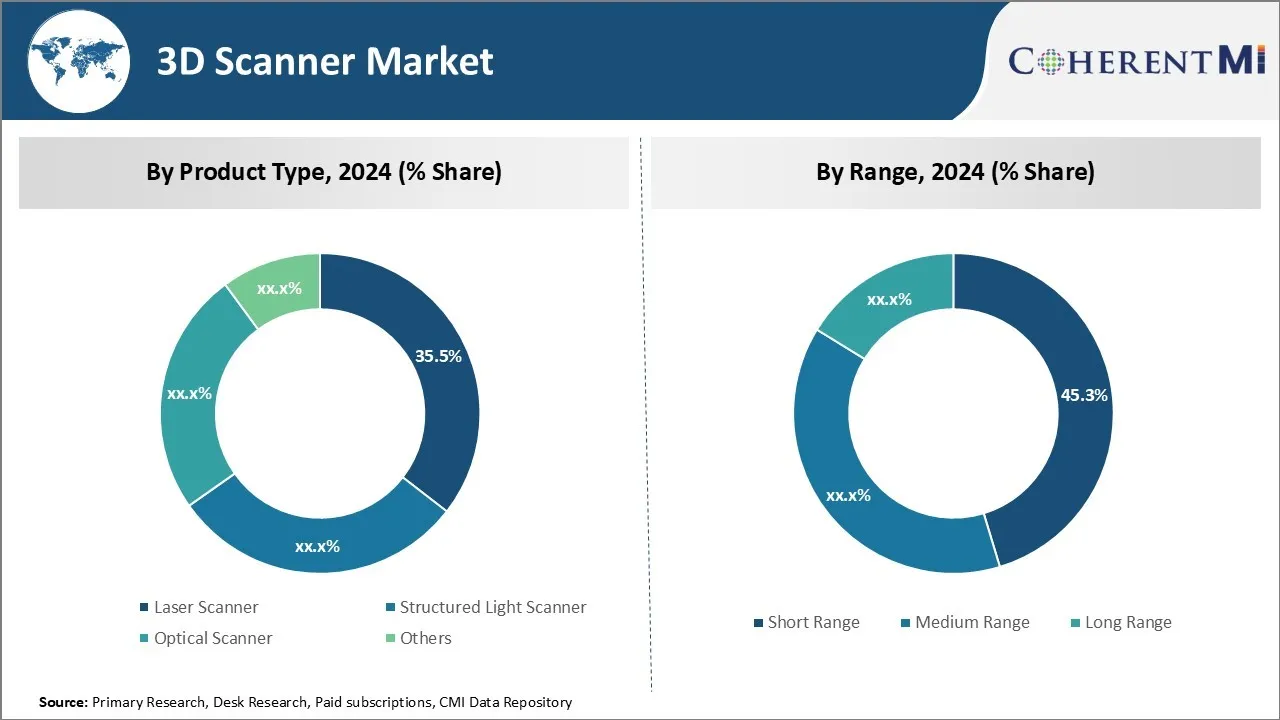

По типу продукта: технологические достижения спроса на топливный лазерный сканер

С точки зрения типа продукта, лазерный сканер вносит 35,5% доли рынка 3D-сканеров в 2024 году. Лазерные сканеры предлагают высокоточное 3D-сканирование с точностью до миллиметра благодаря непрерывным улучшениям в лазерной триангуляции и технологиях бесконтактной оцифровки. Интеграция синих лазерных диодов, которые обеспечивают более высокую скорость сканирования и более длинные диапазоны, повысила популярность лазерных сканеров среди отраслей, требующих качественных 3D-изображений.

Кроме того, встроенные обновления контроллеров, позволяющие сканировать с более высоким разрешением за меньшее время без ущерба для сбора данных, увеличили использование лазерных сканеров в промышленной автоматизации. Их способность сканировать сложные конструкции и сложную геометрию делает их пригодными для применения в автомобильном прототипировании, обратном проектировании и контроле качества производства.

Insights, By Range: Архитектурные приложения Дискография Short Range Scanner Рост

С точки зрения диапазона, в 2024 году доля короткого диапазона на рынке 3D-сканеров составляет 45,3%, что связано с ростом архитектурных приложений. Сканеры малой дальности, имеющие рабочее расстояние до 5 метров, отлично подходят для сканирования внутренних объектов и построения 3D-моделей помещений и зданий.

Они предлагают точность и высокое определение изображения, необходимое для сохранения архитектуры, планирования пространства и реконструкции жилых помещений. Компактный размер и простота позиционирования сканеров малой дальности в помещениях без необходимости длительного времени установки увеличили их спрос со стороны архитектурных фирм.

Кроме того, сканеры малой дальности широко используются в строительной отрасли для обнаружения неисправностей, измерения материалов и проектной документации. Это, как ожидается, будет стимулировать ключевые тенденции на рынке 3D-сканеров.

Insights, by End-user Industry: Automotive Design Innovation Fuels 3D Scanning in Vehicles

С точки зрения индустрии конечных пользователей, автомобильная промышленность обеспечивает наибольшую долю рынка за счет увеличения инноваций в области дизайна транспортных средств. 3D-сканирование играет ключевую роль в моделировании автомобильных концепций, исследованиях стиля, рабочих процессах САПР и цифровых макетах для ускорения цикла разработки продукта. Он стал незаменимым для быстрого прототипирования, производственных процессов, таких как строительство пресс-инструмента и планирование макета сборки.

Кроме того, 3D-сканеры используются для проверки качества автомобильных компонентов, сканирования сборок для технической документации, анализа отказов и многого другого. Сложные конструкции современных автомобилей и более короткое время разработки способствовали внедрению 3D-сканирования в автомобильных OEM-производителях и поставщиках, стремясь достичь большей гибкости дизайна с меньшими затратами и скоростью на рынке 3D-сканеров.

Дополнительные идеи Рынок 3D сканеров

- Более широкое внедрение технологии 3D-сканирования в реверс-инжиниринге, контроле качества и виртуальном моделировании продолжает играть важную роль в формировании рынка 3D-сканеров.

- Использование в таких отраслях, как автомобилестроение, здравоохранение, аэрокосмическая промышленность и строительство для различных применений.

- Расширенные возможности со структурированными световыми сканерами привели их сегмент рынка 3D-сканеров в 2023 году.

- Северная Америка доминировала на рынке 3D-сканеров с долей 37% в 2023 году. Рынок 3D-сканеров в США составил 450 миллионов долларов США и, по прогнозам, достигнет 1,89 миллиарда долларов США к 2034 году.

- Азиатско-Тихоокеанский регион является самым быстрорастущим на мировом рынке 3D-сканеров. Это обусловлено индустриализацией и внедрением новых технологий.

Обзор конкурентов Рынок 3D сканеров

Основными игроками, работающими на рынке 3D-сканеров, являются Hexagon AB, FARO Technologies, Inc., Nikon Metrology NV, Trimble Inc., Creaform Inc., 3D Systems Corporation, Topcon Corporation, Carl Zeiss Optotechnik GmbH, Artec 3D, Autodesk Inc., David Vision Systems GmbH, Basis Software, Inc., Fuel3D Technologies Limited и GOM GmbH.

Рынок 3D сканеров Лидеры

- Шестиугольник AB

- FARO Технологии, Inc.

- Nikon Metrology NV

- Trimble Inc.

- Creaform Inc.

Рынок 3D сканеров - Конкурентное соперничество

Рынок 3D сканеров

(Доминируют крупные игроки)

(Высококонкурентный с большим количеством игроков.)

Последние разработки в Рынок 3D сканеров

- В январе 2024 года Siemens Healthineers представила SOMATOM Pro.Pulse, компьютерный томограф с двумя источниками, предназначенный для сердечной и общей визуализации. Эта система имеет две рентгеновские трубки и два детектора, что обеспечивает высокое временное разрешение и быструю скорость сканирования, что особенно полезно для визуализации сердца.

- В сентябре 2023 года 3DMakerpro представила Seal 3D Scanner, портативное портативное устройство, предлагающее высокоточные возможности 3D-сканирования. Представленный на выставке IFA NEXT в Берлине 1 сентября 2023 года, Seal признан первым в мире портативным 3D-сканером потребительского класса с точностью 0,01 мм и разрешением 0,05 мм.

- В июле 2023 года Hexagon AB представила новый сверхбыстрый лазерный сканер, улучшающий высокоточный захват данных. Ожидается, что этот прогресс упростит рабочие процессы в обрабатывающей и строительной отраслях.

Рынок 3D сканеров Сегментация

- Тип продукта

- Лазерный сканер

- Структурированный световой сканер

- Оптический сканер

- Другие

- По диапазону

- Короткий диапазон

- Средний диапазон

- Длинный диапазон

- Отрасль конечных пользователей

- автомобильный

- Аэрокосмическая и оборонная

- Медицинская помощь

- Архитектура и строительство

- Энергетика и власть

- Развлечения и медиа

Хотите изучить возможность покупкиотдельные разделы этого отчета?

Часто задаваемые вопросы :

Насколько велик рынок 3D-сканеров?

Рынок 3D-сканеров оценивается в 1,98 млрд долларов США в 2024 году и, как ожидается, достигнет 4,87 млрд долларов США к 2031 году.

Какие факторы препятствуют росту рынка 3D-сканеров?

Высокие первоначальные затраты и требования к обучению технологии 3D-сканирования и ограниченное внедрение на малых и средних предприятиях из-за проблем с затратами являются основными факторами, препятствующими росту рынка 3D-сканеров.

Каковы основные факторы роста рынка 3D-сканеров?

Рост 3D-печати и ее приложений в различных отраслях промышленности и растущий спрос в секторе здравоохранения на передовые технологии визуализации являются основными факторами, определяющими рынок 3D-сканеров.

Какая продукция является ведущей на рынке 3D-сканеров?

Ведущим сегментом продукции является лазерный сканер.

Каковы основные игроки на рынке 3D-сканеров?

Hexagon AB, FARO Technologies, Inc., Nikon Metrology NV, Trimble Inc., Creaform Inc., 3D Systems Corporation, Topcon Corporation, Carl Zeiss Optotechnik GmbH, Artec 3D, Autodesk Inc., David Vision Systems GmbH, Basis Software, Inc., Fuel3D Основными игроками являются Technologies Limited и GOM GmbH.

Каким будет CAGR рынка 3D-сканеров?

Прогнозируется, что CAGR рынка 3D-сканеров составит 13,72% с 2024 по 31 год.