与年龄有关的远景功能市场 规模与份额分析 - 成长趋势与预测 (2024 - 2031)

与年龄有关的视觉功能失调市场按疾病划分(与年龄有关的肌肉衰竭、糖尿病肾上腺病、Cataracts、Glaucoma、Presbyopia)、治疗(抗阳性药物、激光治疗、光动力激光治疗、最小侵入性青光眼外科手术)、产品(处方药、外科设备)、地理(北美、拉丁美洲、亚太、欧洲、中东和非洲)。 报告提供了上....

与年龄有关的远景功能市场 规模

市场规模(美元) Bn

复合年增长率6.1%

| 研究期 | 2024 - 2031 |

| 估计基准年 | 2023 |

| 复合年增长率 | 6.1% |

| 市场集中度 | High |

| 主要参与者 | 诺华, Regeneron 制药公司, 罗什, 拜尔, 阿尔康 以及其他 |

请告诉我们!

与年龄有关的远景功能市场 分析

与年龄有关的视觉功能失调市场估计价值为: 2024年3.8 Bn美元 预计将达到 5.75 Bn 到2031年以复合年增长率增长 从2024年到2031年(CAGR)为6.1%. 发达国家预期寿命增加和老年人口激增等因素正在促使因正常老化和与年龄有关的疾病引起的视力问题不断增多。 此外,改善获得诊断技术和治疗的机会有助于扩大与年龄有关的视觉功能失调市场。

与年龄有关的远景功能市场 趋势

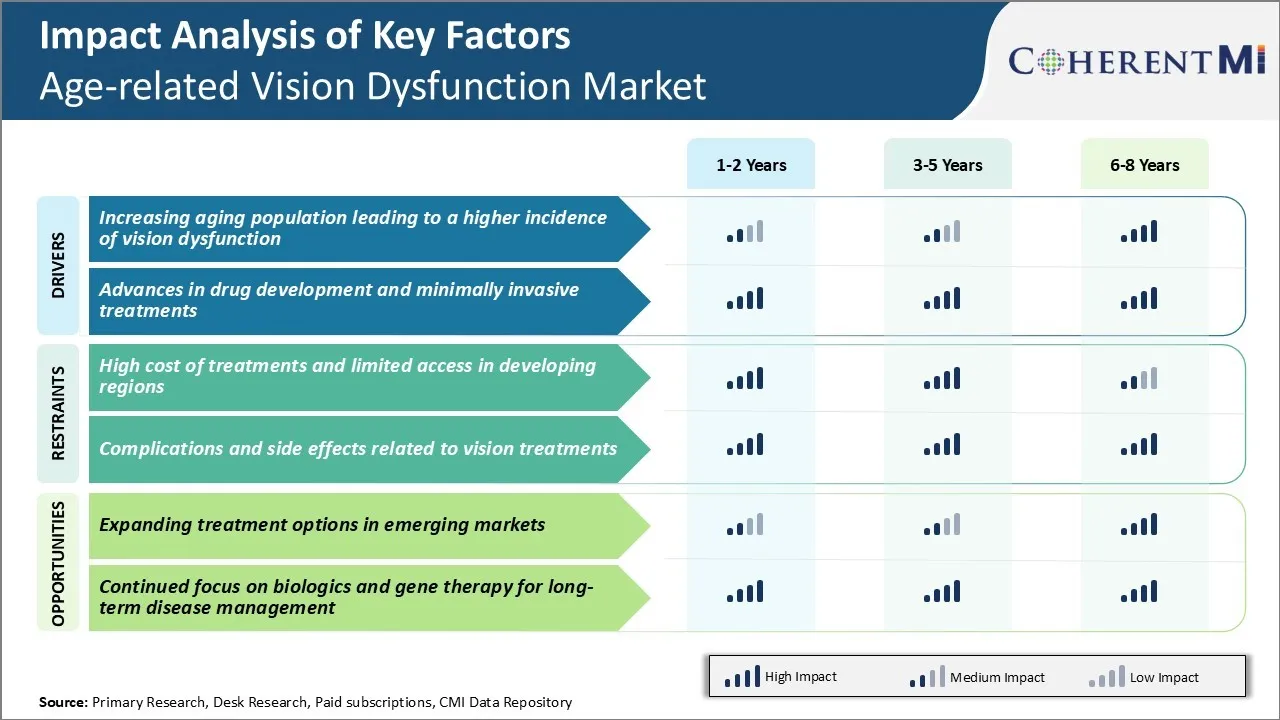

市场驱动力 -- -- 人口老龄化导致愿景功能失调率上升

据一些估计,在2015年至2050年期间,65岁或以上的人口预计将增加一倍,从大约7亿增至近15亿。 同时,80岁或80岁以上者的人数预计在同一期间将增加两倍,从1.25亿增至4.34亿。

随着年龄的增长,仙人掌越来越普遍,是全球失明的主要原因。 即使在发达国家,75岁或以上的人中,一半以上已经患有白内障,或将在一生中发展。 据了解,青光眼对老年人的影响率也较高,在75岁或以上的人中,这种病情比45-54岁的人多8倍。

随着今后人口继续灰暗,这种削弱能力和威胁视力的情况也将大大增加。 随着更多社会阶层的退休,视力功能失调将成为一个主要的保健挑战,预计将对视力护理资源和相关行业造成巨大压力。

市场驱动器 -- -- 药物开发和最小侵入治疗的进展

研究人员正在不懈地努力开发更新和更有效的治疗方案,改进安全情况,采用更方便的管理方法。 例如,目前临床试验中的一些转基因药物疗法显示,有可能减缓或阻止诸如以前无法治疗的乳腺退化等衰弱状况的发展。

使用可植入装置持续和受管制地提供药物也是一个积极研究领域。 此外,激光光凝胶和光动力疗法等非侵入性外科技术继续发展,分别作为视网膜疾病和青光眼传统内科手术的替代品. 这些先进的疗法有助于保持患者的自然视力,而不会有感染风险、恢复时间长以及通常与常规手术有关的副作用。

新技术能否被广泛接受,取决于能否在临床上证明其优越性,尽管其商业认可和市场吸收可望促进这一部门的增长。 创新治疗概念的不断流动和经过改进的最小侵入性备选方案,解决了在与年龄有关的视力丧失作斗争方面大量未得到满足的需求,同时改善了患者的生活质量、临床结果和长期坚持护理计划。

市场挑战 -- -- 发展中区域的治疗成本高和获得机会有限

与年龄有关的远景功能失调的市场面临重大挑战,其形式是发展中区域的治疗费用高昂和获取机会有限。 许多常见的与年龄有关的病症,如白内障,青光眼,糖尿病性肾上腺病,都需要昂贵的手术程序或长期药物治疗,以便管理病症并减缓病情的发展. 这给许多老年病人,特别是那些收入较低和公共卫生系统较不全面的发展中国家的病人带来了沉重的财政负担。

即使在有公共选择的地方,由于预算限制,治疗积压和长时间等候也是常见的。 视力功能失调治疗中使用的较新药物和装置价格较高,也意味着较贫穷国家的病人往往很少或根本无法获得最新的治疗创新。 这不成比例地影响到世界发展中区域迅速增长的老年人口。

在许多中低收入国家,保健基础设施有限,眼科专业人员短缺,使问题更加复杂。 克服这些负担能力和准入障碍将是与年龄有关的市场功能失调问题需要解决的一项重大挑战,以便在全世界充分发挥其潜力。

市场机会----扩大新兴市场的治疗选择

与年龄有关的愿景功能失调市场通过扩大新兴市场区域现有的治疗选择,为增长提供了重要机会。 目前,由于上述挑战,这些领域在全球市场中所占的份额过低。

然而,随着经济的发展和中产阶级的扩张,对视力护理的需求将急剧上升。 制药和器械制造商应推行战略,使这些新兴人口更负担得起、更易获得创新产品和治疗方法。 这可能包括基于价值的定价模式、与当地制造和分销供应商的伙伴关系,或慈善方案。 还可以提供便携式或基于智能手机的筛选工具和远程眼科选项,以扩大眼科专业人员的接触范围。

通过克服进入壁垒,首先提供符合新兴市场需要的成本效益高的解决办法的公司将获得巨大的先入为主优势。 这样做不仅将开辟大量新的病人库,而且有助于解决全球迫切需要的与年龄有关的视觉服务未得到满足的问题。 它为愿意采用包容性和创新性商业模式的市场参与者提供了一个重大机会。

处方者偏好 与年龄有关的远景功能市场

与年龄有关的视力功能障碍一般会发展到早期、中等和高级阶段。 对于与早干年龄有关的乳腺退化(AMD),处方者通常建议改变生活方式,如营养补充剂含有抗氧化剂和锌。 如果病情好转,可以考虑开具抗VEGF药物处方.

在中度非排泄性AMD阶段,开具处方者定期规定不贴标签使用维生素和矿物质,以减少进展风险。 如果病情发展成AMD的湿性或显性形式,如EYLEA(flibercept)或LUCENTIS(ranibizumab)等抗VEGF疗法是标准的一线治疗方法. 两者似乎都同样有效,但LUCENTIS由于市场供应时间较长和熟悉程度较高,其规定往往更多。

在“法律失明”的高级阶段,选择有限,但如果一个人只用一只眼睛获得有意义的视力,处方医生可以考虑手术治疗。 硬体细胞疗法是一个新出现的感兴趣领域,但仍是实验性领域。

处方药的偏好还受到患者需求、保险范围、接受频繁眼注射的意愿以及品牌药和生物类似抗VEGF药之间的成本考虑的影响。 正在进行的临床试验可能揭示出新的治疗战略,扩大更先进的病例的视力质量。

治疗方案分析 与年龄有关的远景功能市场

与年龄有关的视力功能障碍通常通过三个主要阶段 -- -- 早期、中等和高级阶段 -- -- 取得进展。

在早期,在低光线下轻度模糊和难以看到的情况下,生活方式的改变和场外阅读眼镜通常是一线治疗.

随着疾病进入中度阶段,中心视力下降,处方眼滴经常被开出. 最常见的两种处方眼滴是Latanoprost(萨拉坦)和Travoprost(特拉瓦坦Z). 两者都是亲子素类比,可以降低眼压,改善血液流向视网膜. 有些医生比较喜欢特拉沃普罗斯特, 因为每天只需要施药一次,

对于正在进入中央视力严重丧失的后期阶段的人,治疗可能涉及入侵性选择。 如果macula仍然起作用,医生可以推荐Ranibizumab(Lucentis)或Aflibercept(Eylea)等抗VEGF注射. 这些治疗方法通过抑制血管内皮生长因子——一种促进血管异常生长的蛋白质——来帮助减缓进展. 对于肿瘤受损的地理萎缩病例,选择有限,但视网膜植入临床试验正在进行。

关键参与者采用的关键制胜策略 与年龄有关的远景功能市场

研发投资新疗法:

- Alcon、Bausch + Lomb和Allergan等公司在研发方面进行了大量投资,为与年龄有关的乳腺退化、白内障和其他视觉状况开发新的治疗疗法。 例如,在2015-2020年间,阿尔康在研发方面花费了超过15亿美元,从而推出了Lucentis和Eyelea等治疗方法,为治疗湿的AMD创造了数十亿美元的收入.

在数字视觉辅助技术方面与技术参与者建立伙伴关系:

- 玩家与技术公司合作开发数字视觉辅助设备,如负担得起的计算机和智能手机应用软件,帮助为低视力患者放大文本和图像. 例如2018年,埃西洛与Facebook合作,将埃西洛的Varilux镜头技术整合到Facebook的雷班故事智能眼镜中.

收购辅助企业:

- Johnson & Johnson等主要角色收购了眼科公司,以扩大其产品组合和全球存在. 例如,2017年,约翰逊&约翰逊以43亿美元收购了Abbott Medical Optics,获得了白内障和反射激光手术的领导权. 这扩大了J&J的全球销售网络和进入亚洲等新市场的机会,加强了其在眼科护理中的地位.

分段分析 与年龄有关的远景功能市场

洞察力、疾病:推进年龄驱动与年龄有关的男性衰老的增长

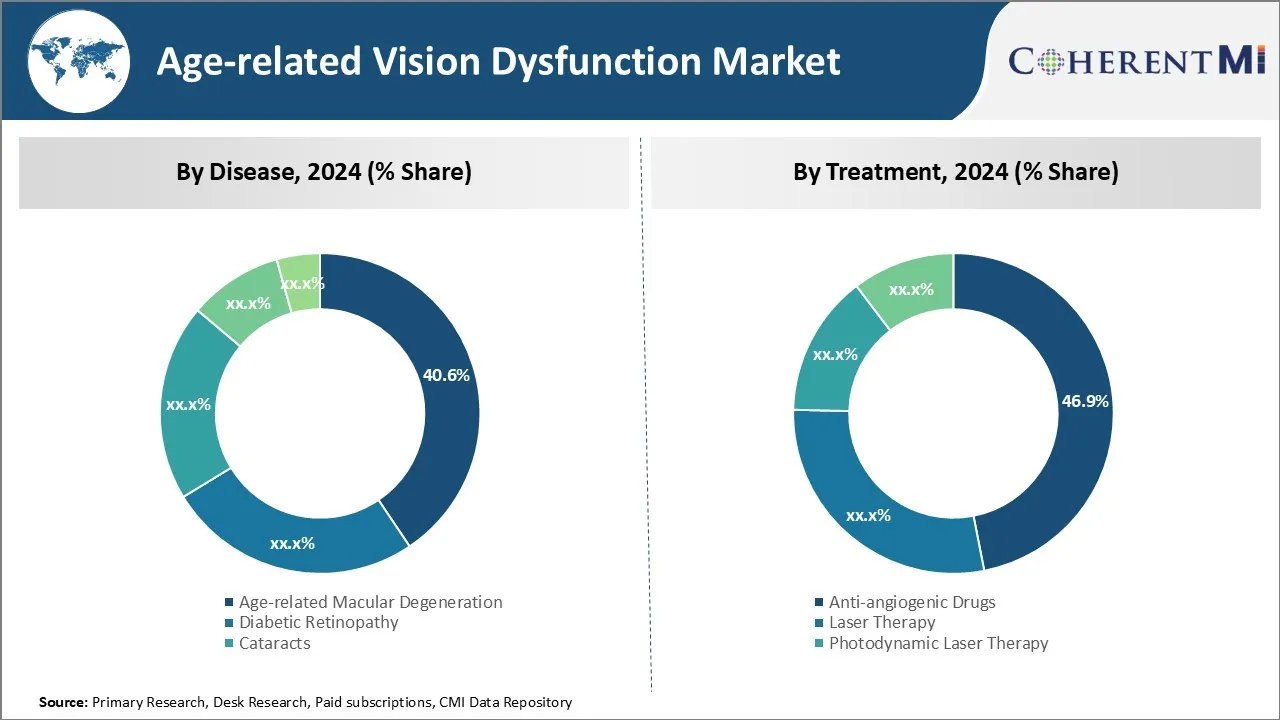

在疾病方面,与年龄有关的乳腺退化部分预计将在2024年与年龄有关的视觉功能失调市场中占40.6%,这与年龄增加与AMD风险之间的强烈关联有关。 随着全球人口继续迅速老化,面临发展AMD风险的人数呈指数增长。

AMD影响macula,负责用于阅读,驾驶,面部识别等任务的中央视觉. 晚期AMD会导致严重的视力丧失或失明. 随着人们寿命的延长,更多的人活到八九年代,当AMD的风险急剧上升时. 环境因素和生活方式因素也可能影响AMD的流行。

在发展中国家,更好的医疗保健意味着,与前几代人相比,现在有更多的风险老人能够获得检查和治疗。 所有这些人口趋势都趋同,促使AMD部分在与年龄有关的远景功能失调的总体市场中增长。 抗VEGF疗法的进展现在为湿性AMD患者提供了更好的结果,进一步刺激了部分的扩展。

透视、疾病:糖尿病增加导致糖尿病复发

在疾病方面,由于全球糖尿病肆无忌惮的流行,预计2024年糖尿病复发率占与年龄有关的视力功能失调市场46.9%。 随着肥胖症在世界范围内不断攀升,糖尿病成为导致失明的主要原因,更多的患者正在发展糖尿病眼病.

糖尿病还原性(diabetic retinopy)是视网膜小血管受损导致糖尿病的微血管并发症. 随着时间的推移,血糖水平持续高,可能导致这些视网膜血管弱化和漏出液体或出血,如果不进行治疗,可能会破坏视力。

目前全球有4.6亿多成年人患有糖尿病,预计这些数字在未来几十年内将急剧上升,更多的病人被诊断出患有糖尿病,需要接受医生治疗。 近年来,在抗VEGF治疗和通过药物和生活方式改变加强糖尿病控制方面取得的进展,也改善了DR患者挽救视力的结果。

然而,新的糖尿病病例数量之多,确保了视力失调市场内的DR部分持续强劲增长。

观察,按产品分列:增加获得护理靴处方药的机会

就产品而言,处方药对改善获得负担得起的护理的机会所推动的市场贡献最大。 Eylea和Lucentis等先进的抗VEGF生物学通过在医生办公室或诊所进行定期的静脉注射,改变了湿的AMD和糖尿病复方疗法。 这些处方药现在是与年龄有关的视力功能障碍的主要部分的护理标准。

随着发展中区域人口的收入水平提高,保险覆盖面在全球范围扩大,更多的病人能够负担节省视力的药物治疗。 政府和私营保险商越来越认识到这些药物能够防止更昂贵的后果,如失明和丧失生产力。 因此,偿还方案为更多的国家获得处方药物提供了便利。

自注射版本也赋予患者更积极参与自己护理的能力. 集体而言,增加可负担性和独立性正在刺激处方药市场的扩张,而不是手术选择。 创新也在继续迅速发展更有效和更方便的下一代视网膜药物。

附加见解 与年龄有关的远景功能市场

- 前期病例:美国占2023年湿润年龄相关乳腺退化病例的35%以上. 2023年日本捐献了50%的确诊早孕病例.

- 与年龄有关的情况造成视力失调,影响到全球超过1.5亿人,随着人口的不断老化,预期人数将急剧增加。 抗VEGF疗法和视网膜(IOLs)等疗法在管理这些疾病方面发挥着至关重要的作用。

- 采用较长期的治疗方法,如Regeneron新的抗VEGF药物,标志着与年龄有关的乳腺退化管理有了显著改善,减少了频繁注射的负担。

- 湿润年龄相关 Macular 降温: 像VABYSMO这样的新疗法正在通过针对特定疾病路径来改善病人的结果。

- 糖尿病 Retinopathy:FDA批准的LUCENTIS等治疗正在扩大,以涵盖更多的糖尿病相关疾病.

竞争概览 与年龄有关的远景功能市场

在与年龄相关的视觉功能失调市场中运营的主要角色包括诺华,雷吉纳龙制药公司,罗什,拜耳,阿尔康,热内科技,科迪亚克科学,Outlook治疗学,罗什,阿利梅拉科学.

与年龄有关的远景功能市场 领导者

- 诺华

- Regeneron 制药公司

- 罗什

- 拜尔

- 阿尔康

与年龄有关的远景功能市场 - 竞争对手

与年龄有关的远景功能市场

(主要参与者主导)

(竞争激烈,参与者众多。)

最新发展 与年龄有关的远景功能市场

- 2024年8月,诺华公司推出了一种新的生物学疗法,旨在治疗AMD的晚期,预计这将显著降低视力损失的进度. 诺华公司一直积极为AMD开发和推出生物疗法. 其关键药物之一,即早先批准的Beovu(brolucizumab),是湿性AMD治疗方面的一个重大进步,在治疗间提供了更长的间隔,改善了视网膜的流体减少.

- 2024年2月,Regeneron制药公司宣布批准新的抗VEGF治疗,提供了延长剂量时间表,提高了患者的坚持度. 最近从Regeneron获得的进展包括高剂量人工受体(EYLEA HD)的试验,其目的是延长12或16周的剂量间隔,以适应与湿年龄有关的乳腺退化(wAMD)和糖尿病乳腺水肿(DME)等情况。 这些试验,如PULSAR和PHOTON,在保持注射次数减少的功效方面,显示出有希望的结果,有可能改善病人的坚持程度。

- 2024年2月,Outlook治疗公司宣布,它计划在2024年底前重新提交ONS-5010的生物许可证申请(BLA). 这一重新提交是遵循林业发展局的反馈,包括进行额外临床试验的要求(NORSE EGHT),该试验定于2024年初开始。 林业发展局还就前一份完整答复函中强调的化学、制造和控制问题提供指导。 如果试验和所需工作取得成功,《基本法》的重新提交将包括这些结果。

- 2023年11月,科迪亚克科学公司(Kodiak Sciences)介绍了他们第三阶段GLOW研究中首次获得的糖尿病复健性初级终点数据. 这一介绍是在旧金山的美国眼科学会年度会议期间进行的。 该研究涉及非扩散性糖尿病复方疗法患者,并展示了有希望的成果,包括糖尿病复方疗法复方疗法(DRSS)的两步改进。 此外,Tarococimab tedromer显示,糖尿病乳腺水肿等威胁视力的并发症明显减少。

- 2023年4月,Allegro眼科公司在一项特别议定书评估下收到了美国林业发展局的一项协议,即其设计 IIb/III阶段 risuteganib(Lumnate)临床试验,用于治疗中间,非排出性年龄相关乳腺脱落(干AMD). 该协议不是批准协议,但表明林业发展局同意试验设计的关键方面,如入门标准、终点和分析,这对于支持今后的营销应用十分重要。

与年龄有关的远景功能市场 细分

- 按疾病分列

- 与年龄有关的残疾

- 糖尿病复方疗法

- 寄点

- 青光眼

- 长老会

- 治疗

- 抗阳性药物

- 激光治疗

- 光动力激光治疗

- 侵袭性青光眼外科

- 按产品分列

- 处方药

- 手术设备

您想要了解购买选项吗?本报告的各个部分?

常见问题 :

与年龄有关的视觉功能失调市场有多大?

2024年与年龄有关的视力功能失调市场估计价值为3.8 Bn,预计到2031年将达到5.75 Bn。

有哪些关键因素阻碍与年龄有关的远景功能失调市场的增长?

发展中地区治疗费用高、获取机会有限以及与视力治疗有关的并发症和副作用是阻碍与年龄有关的视力功能失调市场增长的主要因素。

推动与年龄有关的远景失调市场增长的主要因素是什么?

日益老龄化的人口导致视力功能失调和药物开发进步的发生率上升,以及极少侵入性治疗,是导致与年龄有关的视力功能失调市场的主要因素。

在与年龄有关的视力失调市场中,哪一种是主要疾病?

主要的疾病部分是与年龄有关的乳腺退化。

哪些主要角色在与年龄有关的视觉功能失调市场上运作?

诺华,雷热纳龙制药,罗什,拜耳,阿尔康,热内科技,科迪亚克科学,Outlook治疗学,罗什,阿利梅拉科学是主要角色.

与年龄有关的视觉功能失调市场的CAGR是什么?

2024-2031年,与年龄有关的视觉功能失调市场的CAGR预计为6.1%。