澳大利亚办事处家具市场 规模与份额分析 - 成长趋势与预测 (2024 - 2031)

澳大利亚办公室家具市场按产品类型(座位、办公桌和桌子、工作站、附属设备、储存单位)、最终用户(公司办公室、其他办公室、政府办公室)划分。 本报告为上述各部分提供了价值(百万美元)。....

澳大利亚办事处家具市场 规模

市场规模(美元) Bn

复合年增长率2.4%

| 研究期 | 2024 - 2031 |

| 估计基准年 | 2023 |

| 复合年增长率 | 2.4% |

| 市场集中度 | High |

| 主要参与者 | 池岛 Pty有限责任公司, 哈维·诺曼控股有限公司, 生活边缘(澳洲)有限公司, 绝妙的家具, Amart家具有限公司 以及其他 |

请告诉我们!

澳大利亚办事处家具市场 分析

澳大利亚办事处家具市场估计价值 2024年1.14 Bn美元 预计将达到 1.44 Bn 2031年之前以复合年增长率增长 2024至2031年占2.4%。 。 。 过去几年来,市场略有增长,预计在预测期间将继续增长。

办公室家具采购往往是在为商业办公空间装配或改造时考虑的最后一件物品。 近年来出现了灵活,工艺家具的趋势,随着团队结构和工作空间需要的改变,这些家具可以重新排列. 由于雇主和雇员认识到工作场所流动对健康的益处,高调的办公桌和坐/站办公桌越来越受欢迎。

澳大利亚办事处家具市场 趋势

市场驱动力----初创企业和中小企业数量增加

近年来,澳大利亚经济的初创企业和中小企业数量稳步增长。 方便做生意、强有力的知识产权法和获得风险资本,使澳大利亚成为企业家有吸引力的目的地。 虽然许多全球公司拥有大型的常设办事处,但正是这些新企业驱动着对灵活办公家具解决方案的需求。

创业企业和青年企业在建立自己的初始阶段倾向于降低经营成本。 购买家具直接给现金流动带来压力。 这导致了对灵活家具租赁和租赁选择的强烈兴趣。 主要家具零售商已认识到这一新趋势,并扩大了产品种类以满足这些具体需求。 事实证明,根据不断变化的业务要求可以进行组装、重组和升级或缩小的模块化家具系统很受欢迎。 共同工作空间也遍布各大城市,以支持独立专业人员和初创企业之间的合作。 虽然早期的玩家提供基本的便利设施,但新的运营商正注重设计和便利设施,以吸引租户。 这增加了对符合当代办公设计的高质量、工学和美学家具的需求。 由于企业希望出示负责任的证书,用可持续材料制造的家具越来越优先。

随着这些新企业的成熟和扩张,他们的家具需求也不断演变. 知名家具品牌推出了专门方案,帮助这些企业分阶段升级。 空间规划和后勤方面的设备融资和专业服务是这一提议的一部分。 这确保了在启动时没有大笔预付资本支出的平稳过渡。

市场驱动力-商业建筑部门的增长

强劲的人口增长以及大量投资流入澳大利亚的商业房地产市场,对商业建筑业的企业来说是一个好兆头。 全国主要城市有雄心勃勃的基础设施和建设计划,涉及新的商业区、商业中心、教育区和其他发展。

这种高水平的建筑活动直接刺激了对包括各种家具在内的商业室内的需求。 开发人员在工作场所室内装修期间与专业承包商密切合作。 在占领者搬进之前,需要为主办公空间提供设备和装饰,使其达到高标准。 这可靠地转化为家具、墙面板、地毯、照明和其他装修物品的批量订单。 随着经济向这一流行病过渡,公司也在重新思考其房地产足迹和办公室设计。 混合工作模式和注重雇员福利等趋势促使对现有办公存量进行翻新和改造。 这为家具和室内装修零售商提供了开展升级项目的机会。 纳入现代设计原则和技术整合的自定义解决方案正在得到推动。

市场挑战: 贸易壁垒和高税收

由于贸易壁垒和高税收环境,澳大利亚办公家具市场面临持续的挑战。 对办公家具征收大量进口关税,使外国供应商的产品在澳大利亚市场上比当地制造的产品更为昂贵。 这保护了当地制造商,但限制了顾客的选择和承受能力。 对进口的木制和金属办公家具征收高达5-10%的关税,限制了获得全球设计和最新趋势的机会。 此外,澳大利亚30%的公司税率给当地制造商和经销商造成了相当大的成本负担。 高商业税吞噬了公司利润,使澳大利亚产品在全球的竞争力降低. 这不利于有助于建立规模经济和解决通货膨胀造成的生产成本上升的扩张和投资。 更严格的排放标准也涉及驱动式间接费用。 虽然贸易壁垒和税收旨在保护当地就业,但它们最终使市场更小、更昂贵,限制了其长期增长潜力。

市场机会: 共同工作空间增加和非核心职能外包

也出现了一些积极的趋势,为供应商提供了机会。 主要城市合作和灵活办公空间的兴起,对适合热桌和自由职业者的现代模块家具的需求不断增加。 随着更多的初创企业和小公司采用这一模式削减成本,这种共享工作空间配件的市场正在增长。 与此同时,许多大型企业将设施和采购等非核心职能外包给专家。 这种与家具供应商签订合同的机会能够更好地处理大规模安装、定制和生命周期管理服务。 通过提供动态工作空间需求的全面解决方案,供应商将获得经常性收入流。 它们还可以针对一些区域中心,在这些中心,公司正在下放一些职能,以减少首都的租金。 有了利用这些市场变化的正确战略,供应商就可以部分地抵消政策问题带来的挑战。

竞争概览 澳大利亚办事处家具市场

在澳大利亚办公室家具市场经营的主要角色包括:宜家家具有限公司、哈维·诺曼控股有限公司、生活边缘(澳洲)家具有限公司、Fantastic家具有限公司、阿马特家具有限公司、澳大利亚王家具有限公司、Saveba Pty有限公司作为可可共和国进行交易、Kogan Australia Pty有限公司

澳大利亚办事处家具市场 领导者

- 池岛 Pty有限责任公司

- 哈维·诺曼控股有限公司

- 生活边缘(澳洲)有限公司

- 绝妙的家具

- Amart家具有限公司

澳大利亚办事处家具市场 - 竞争对手

澳大利亚办事处家具市场

(主要参与者主导)

(竞争激烈,参与者众多。)

最新发展 澳大利亚办事处家具市场

- 2024年5月,已故澳大利亚建筑师Roy Grounds的家族透露了与K5家具公司合作的新家具收藏. 本集展现了带有现代感官色彩的经典剪辑,为当代曲折呈现了生机勃勃的花蕾中有限的剪辑范围.

- 2023年7月,澳大利亚设计公司Derlot推出了它的Strap收藏,由11种不同的座椅类型组成,这些座椅的灵感来自用织物串装的古董池家具. 藏品包括凳子,椅子,长椅,以及休息室,均以最小框架和坚固的铝条为特征. 这些要素结合在一起,提供了适合各种公共和私人环境的持久座位选择。

澳大利亚办事处家具市场 细分

- 按产品类型

- 席位

- 服务台和表格

- 工作站

- 附属设备

- 储存单位

- 按终端用户

- 公司办事处

- 其他人员

- 政府办公室

您想要了解购买选项吗?本报告的各个部分?

常见问题 :

阻碍澳大利亚办公室家具市场增长的关键因素是什么?

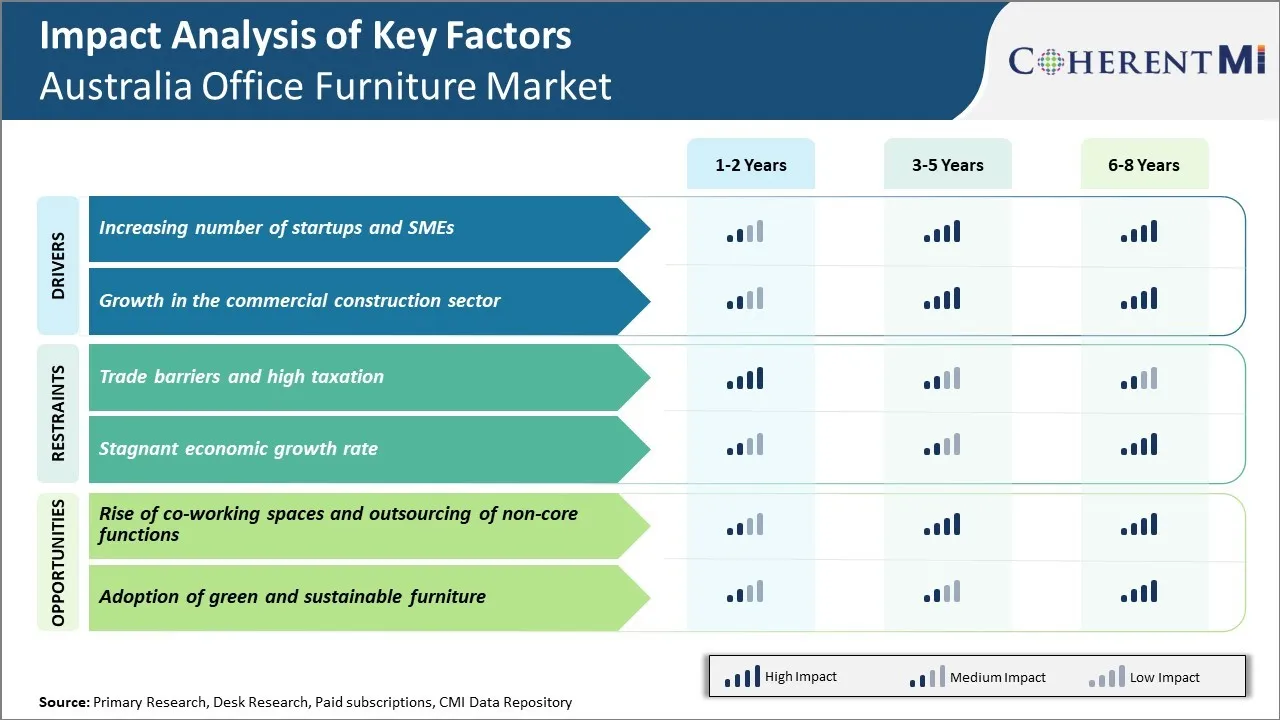

贸易壁垒、高税收和经济增长率停滞是阻碍澳大利亚办公室家具市场增长的主要因素。

澳大利亚办公室家具市场增长的主要因素是什么?

商业建筑部门开办企业和企业数量的增长是推动澳大利亚办公室家具市场的主要因素。

澳大利亚办公室家具市场的主要产品类型是什么?

主要产品类型部分是Seating。

在澳大利亚办公室家具市场运营的主要角色是哪些?

IKEA Pty有限责任公司,哈维·诺曼控股有限责任公司,生活边缘(澳洲)Pty有限公司,神奇家具,Amart家具Pty有限公司,澳大利亚国王家具Pty有限公司,Saveba Pty有限公司作为可可共和国贸易,Kogan Australia Pty Ltd是主要角色.

澳大利亚办公室家具市场的CAGR是什么?

澳大利亚办公室家具市场的CAGR预计将在2024-2031年达到2.4%.