马来西亚 移动电话附属市场 规模与份额分析 - 成长趋势与预测 (2024 - 2031)

马来西亚 移动电话附属市场由附属市场(无线电耳机、颈波带、耳机、TWS(耳芽)管理员、数据电缆、电力银行、智能监视器、演讲者)、产品类型(新、翻新)、分销渠道(在线、离线)分割。 本报告为上述各部分提供了价值(百万美元)。....

马来西亚 移动电话附属市场 规模

市场规模(美元) Bn

复合年增长率6.78%

| 研究期 | 2024 - 2031 |

| 估计基准年 | 2023 |

| 复合年增长率 | 6.78% |

| 市场集中度 | Medium |

| 主要参与者 | 苹果股份有限公司., 博斯公司, 贾布尔 并入, Koninklijke Philips N.V. (美国英语)., 单笔 以及其他 |

请告诉我们!

马来西亚 移动电话附属市场 分析

马来西亚移动电话附属设施 估计市场价值为: 1,361.61美元 Mn in 2024 (英语). 预计将达到 2,971.57美元 到2031年时以复合年增长率增长 (CAGR)从2024年到2031年占6.8%.

马来西亚的移动电话配件市场在过去几年里有了显著增长。 高智能手机普及率、可支配收入增加、对无线耳机、便携式电源库、电缆和适配器等先进智能手机配件的需求增加等因素一直在推动市场。 此外,马来西亚的年轻技术人员积极采用最新的移动电话配件。 领先品牌正定期推出创新配件,以满足消费者不断变化的偏好. 虽然保护箱和屏幕警卫等基本配件仍然畅销,但对具有强化功能的智能配件的需求却在稳步增长。 然而,市场激烈的竞争导致供应商采取竞争性定价战略,从长远来看可能影响利润率。 为了保持增长势头,在这一空间运营的公司需要强调新产品开发,并保持不同价格点的质量。

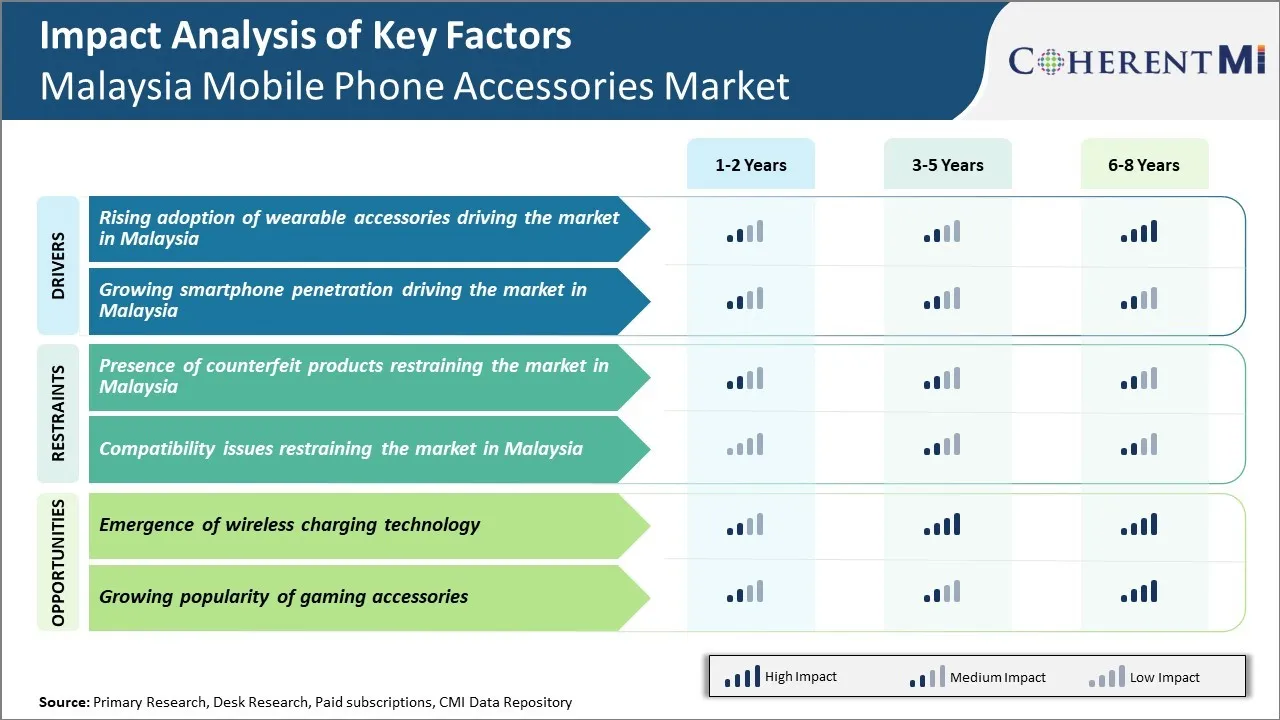

马来西亚 移动电话附属市场 趋势

市场驱动力:

马来西亚市场日益采用可穿戴配件

在过去几年中,马来西亚采用了智能表和健身跟踪器等可穿戴技术。 随着马来西亚人健康意识日益增强,技术融入日常生活,对辅助智能手机等生活方式设备的配件的需求也不断增长. 许多用户希望配件能够定期将电话留在家中,但仍通过智能观察通知或活动跟踪器保持连接. 随着这些可穿戴设备功能的扩大,更多人被激励购买额外的配件,如保护箱,充电电缆,便携式电池和无线耳机,以获得他们最丰富的连接体验.

可穿戴性收养的增加对推动更多销售辅助移动电话配件产生了显著影响。 附属零售商的反应是扩大其产品种类,以包括更多可穿戴的具体物品。 同时,传统的移动电话附属厂商也在设计符合智能表和健身带兼容性的产品。 随着马来西亚可穿戴市场继续增长,它正在扩大移动用户需要的附属类型的生态系统. 这相当于增加附属销售商的收入机会,以满足不断变化的各种需要。

马来西亚的智能手机渗透率不断提高,

马来西亚各地智能手机普及率不断提高,是推动该国移动电话配件市场增长的关键推动因素。 马来西亚统计局表示,马来西亚个人的智能手机采用率从2020年的65%上升到2022年的75%以上. 这种日益依赖智能手机执行日常任务的做法促使消费者定期购买充电器,电缆,电源库,耳机等辅助配件.

这个不断增长的智能手机拥有者基地要求拥有优越的电话配件经验,吸引了许多国内和国际玩家进入这个市场. 当地企业家正在抓住这个机会,推出创新的辅助品牌,以适应不断变化的消费者喜好。 电子商贸平台也翻了两番, 因此,市场经常出现各类新产品推出的情况。

市场挑战和机遇:

马来西亚存在限制市场的假产品

假冒产品的存在对马来西亚移动电话配件市场的增长构成重大挑战。 廉价假冒产品的供应正在吸引许多客户,这对合法品牌和制造商的销售产生不利影响。 当客户购买假产品时,他们认为自己得到了一笔好价钱,他们对这些产品质量低下的经历影响了他们未来的购买决定. 这导致消费者对此类产品的质量和可靠性产生不信任。 因此,许多客户往往转向知名品牌,即使这些品牌成本更高,限制了整个市场的增长。

假冒产品的扩散也损害了合法企业对研发的投资。 当地公司不鼓励投资于新的技术和创新,就削减了影响其提供更好的产品和服务的能力的开支。 它还使对知识产权得不到充分保护的市场持警惕态度的外国投资者望而却步。 这导致含有消费者偏爱的最新特点和规格的高质量配件供应量减少。 由于不合格假产品占据了市场主导份额,合法市场多年来不断扩大。

无线充电技术的出现

无线充电技术的出现为马来西亚的手机配件市场提供了巨大的机遇. 无线充电可以让用户简单地将手机放在充电垫或表面充电,而不是用电缆插上. 这带来了巨大的方便,因为用户不再需要担心寻找插座或电缆。 随着马来西亚逐渐成为一个生活水平不断提高的发达国家,消费者将要求节省时间和改善方便的产品。 无线充电直接满足这种不断增长的需要。

竞争概览 马来西亚 移动电话附属市场

苹果公司,博斯公司,JBL公司,Koninklijke Philips N.V.,OnePlus,Bose公司,JBL公司,Koninklijke Philips N.V.,OnePlus,Oppo,三星电子股份有限公司,SanDisk公司,索尼公司,小米公司.

马来西亚 移动电话附属市场 领导者

- 苹果股份有限公司.

- 博斯公司

- 贾布尔 并入

- Koninklijke Philips N.V. (美国英语).

- 单笔

马来西亚 移动电话附属市场 - 竞争对手

马来西亚 移动电话附属市场

(主要参与者主导)

(竞争激烈,参与者众多。)

最新发展 马来西亚 移动电话附属市场

- 2023年12月28日,JBL公司以JBL量子SURROUNDT推出JBL量子TWS航空. 由6.8毫米驱动器和2.4GHz USB-C 无线Dongle为低常量游戏供电

- 2023年9月,苹果股份有限公司推出了Apple Watch Series 9,采用新的芯片和更亮的显示,拥有41毫米或45毫米铝和不锈钢箱,带有各种带状样式. 它有手机连接

- 2023年4月,三星电子股份有限公司宣布在Galaxy Watch5和Watch4系列上发行Peloton的Watch App. 这种集成使用户能够将其智能手表与Peloton的设备范围同步,包括Bike,Bike+,Tread,Row,和Guide. 通过应用程序,个人现在可以在进行练习时监测显示时的心率。 Peloton Watch App通过为家庭健身常规提供更大的指挥和洞察力,增强用户体验

- 2024年1月23日,索尼公司推出了一个新的SRS-XV500,一个让人们在更长的时间里,在任何地方都更大声的演讲者. 这台扬声器装有强大的声音 内置的照明和长效电池

- 2024年1月,小米公司宣布推出Redmi Buds 5和Redmi Buds 5 Pro,两款新型无线真耳布型号,装备有主动除噪能力. 红米棒 5台载有12.4毫米大口径司机和一个双麦克风装置,使用人工智能技术加强消除噪音

马来西亚 移动电话附属市场 细分

- 由附属

- 有线耳机

- 颈带

- 耳机

- TWS( 梨芽)

- 充电器

- 数据电缆

- 电力银行

- 智能观察

- 发言者

- 按产品类型

- 新设

- 翻新

- 按分发频道

- 在线

- 公司拥有的频道

- 第三方频道

- 离线

- 多品牌存储

- 单一品牌存储器

- 雷斯勒尔

- 在线

您想要了解购买选项吗?本报告的各个部分?

常见问题 :

有哪些关键因素阻碍马来西亚移动电话接入市场的发展?

假冒产品在马来西亚限制市场的存在和在马来西亚限制市场的兼容性问题是阻碍马来西亚移动电话附属市场增长的主要因素。

推动马来西亚移动电话配件市场增长的主要因素是什么?

马来西亚日益采用可穿戴配件驱动市场,而智能手机渗透率不断提高驱动马来西亚市场,是推动马来西亚移动电话附属市场的主要因素。

马来西亚移动电话连线市场的主要附属公司是哪些?

主要附属部分为Wired耳机.

马来西亚移动电话辅助市场的主要运营商是哪些?

苹果公司,博斯公司,JBL公司,Koninklijke Philips N.V.,OnePlus,Oppo,三星电子股份有限公司,桑迪斯克公司,索尼公司,小米公司为主要角色.

马来西亚移动电话辅助市场的CAGR将是什么?

马来西亚移动电话附属公司的CAGR 预计2024-2031年市场为6.8%.