Radar Sensors Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Radar Sensors Market is segmented By Device Type (Imaging, Non-Imaging), By Range (Medium Range, Short Range, Long Range), By End User (Automotive, Ae....

Radar Sensors Market Size

Market Size in USD Bn

CAGR12.7%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 12.7% |

| Market Concentration | Medium |

| Major Players | Texas Instruments, Infineon Technologies, NXP Semiconductors, Bosch Sensortec, Qualcomm Technologies and Among Others. |

please let us know !

Radar Sensors Market Analysis

The radar sensors market is estimated to be valued at USD 14.81 Bn in 2024 and is expected to reach USD 34.28 Bn by 2031. It is projected to grow at a compound annual growth rate (CAGR) of 12.7% from 2024 to 2031. Rising adoption of unmanned aerial vehicles and increasing defense budgets of major economies is also contributing to the growth of the radar sensors market.

Radar Sensors Market Trends

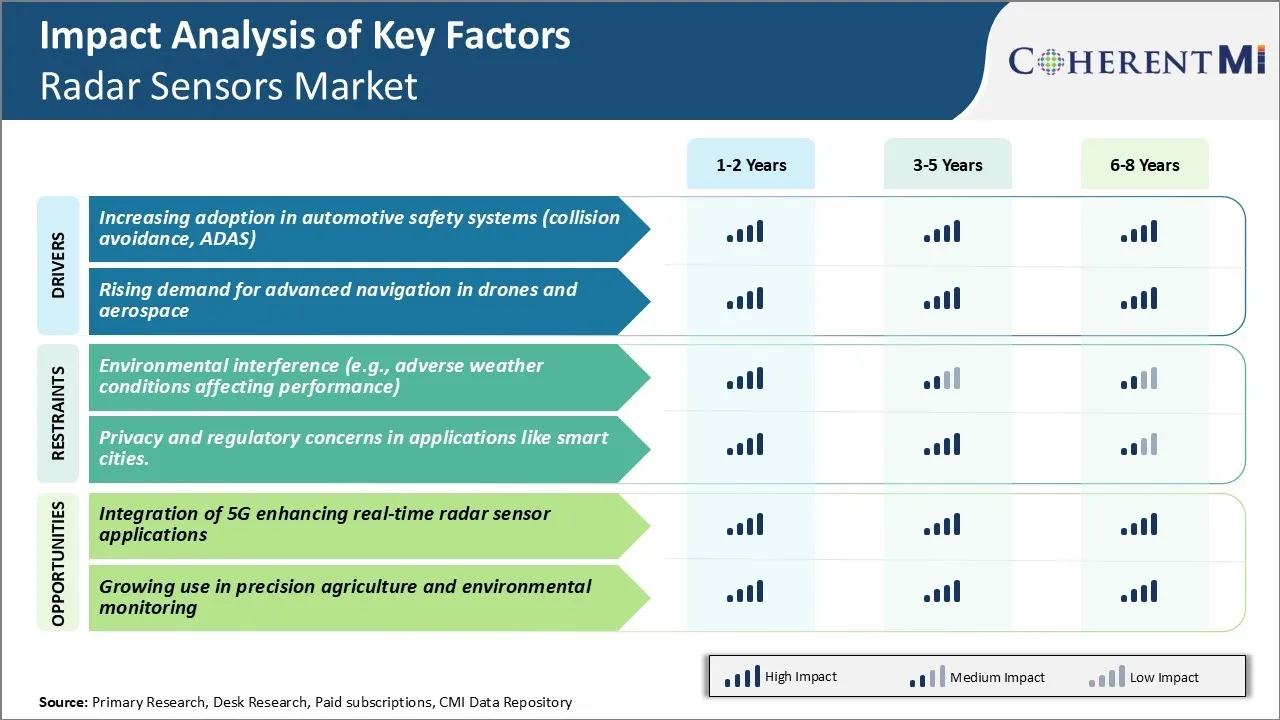

Market Driver - Increasing Adoption in Automotive Safety Systems

The radar sensor has become an integral part of modern vehicle safety systems in recent times. Automakers across the world are increasingly incorporating active safety features such as adaptive cruise control, automatic emergency braking, lane departure warning, blind spot detection and others, into their vehicle lineup.

As vehicles get smarter with assisted and even self-driving capabilities going forward, safety remains the top priority for automakers as well as customers. Most luxury cars now offer a suite of advanced safety features as standard while their proliferation to mainstream vehicles is also rising steadily. Radar sensors play a crucial role in achieving higher levels of safety.

With more functions relying on them, automakers also need high performance radar units capable of detecting objects at longer ranges as well as providing richer data about the surroundings. This is attracting heavy investments in radar research. Players in the radar sensors market are working on developing compact, high resolution and multi-beam radar modules for advanced applications in the domain of automated driving.

Market Driver - Rising Demand for Advanced Navigation in Drones and Aerospace

Unmanned systems across diverse sectors are revolutionizing many industries and improving operational efficiencies. In the air, drones are finding exponentially expanding applications for commercial and defense purposes. Advanced navigation capabilities are a necessity for the unmanned systems of tomorrow to achieve their true potential. This is where radar sensors come in as an indispensable technology.

Advanced applications in domains like precision agriculture, infrastructure inspection, aerial photography and surveillance need drones and air taxis to have high resolution mapping and imaging radar for accurate 3D rendering of the operating environment. Aerospace radar is also critical for functions like aircraft guidance, terrain mapping and precision landing. With billions being invested in urban air mobility worldwide, the demands on radar capabilities will continuously rise in the radar sensors market.

New radar technologies optimized for small sizes, low power consumption, high resolution and multi-functionality are being aggressively pursued. Overall, the field of unmanned aviation is generating strong pull for radar innovations. This assures rising demand for more advanced radar sensors across drones, air taxis as well as wider aerospace applications going forward.

Market Challenge - Environmental Interference (e.g., Adverse Weather Conditions Affecting Performance)

One of the key challenges faced by the radar sensors market is environmental interference. Radar sensors use electromagnetic waves to detect objects and their movement. However, adverse weather conditions like heavy rain, fog or snow can negatively impact the performance of radar sensors.

Heavy rain or snow can attenuate the electromagnetic waves emitted by radar sensors, decreasing their range and ability to accurately detect objects. Thick fog or snowstorms can even block the electromagnetic signals completely. This poses serious safety issues for applications like autonomous vehicles that rely on radar sensors for navigation.

Manufacturers in the radar sensors market are working on developing advanced algorithms and signal processing techniques that can filter out environmental interference to some extent. However, adverse weather continues to remain a roadblock, especially for long-range radar applications. The ability of radar sensors to deal with diverse and extreme environmental conditions needs further improvement for their widespread adoption.

Market Opportunity - Integration of 5G Enhancing Real-Time Radar Sensor Applications

The integration of fifth generation (5G) wireless connectivity represents a major opportunity for radar sensor applications requiring real-time data transfer and analysis. 5G technologies are enabling higher bandwidth, lower latency and more reliable connectivity compared to previous generations. This enhances the ability of radar sensors to transfer high-volume radar data to the cloud or networked devices in real-time.

Applications like autonomous vehicles, drones and smart cities can leverage 5G to access and process radar data almost instantaneously from centralized sources. For example, a fleet of autonomous vehicles equipped with radar sensors can use 5G to share their collective radar data in real-time, building a highly detailed radar picture of the surrounding environment.

Traffic management systems and emergency response vehicles can tap into this shared data. 5G is thus opening up new opportunities to develop collaborative and data-driven radar sensor applications across industries. This will drive meaningful innovation and help address various challenges around traffic management, emergency response, security monitoring, and beyond.

Key winning strategies adopted by key players of Radar Sensors Market

Focus on innovation and product development - Continuous innovation to introduce advanced radar sensor technologies has helped players gain an edge. For example, in 2020, Texas Instruments launched an ultra-compact 77GHz automotive radar that enables short-range detection of objects. Its small size allows for flexible placement and cutting-edge capabilities helped automakers develop advanced driver assistance systems.

Leverage partnerships and collaborations - Strategic partnerships with automakers and other ecosystem players have boosted market reach and scaling of new technologies.

Target niche applications and segments - While larger players focus on mass market, niche players have found success by targeting specific applications like parking assistance, blind spot detection etc.

Regional expansion - Leading players have expanded globally through strategic acquisitions and build-outs that give them access to new geographies, customers and talent.

Focus on economies of scale - Mass production helps drive down costs while allowing ongoing investment in R&D. In the last 5 years, top radar sensor suppliers like Robert Bosch, Denso, and Continental increased global market share by aggressively scaling production capacity across regions in line with demand.

Segmental Analysis of Radar Sensors Market

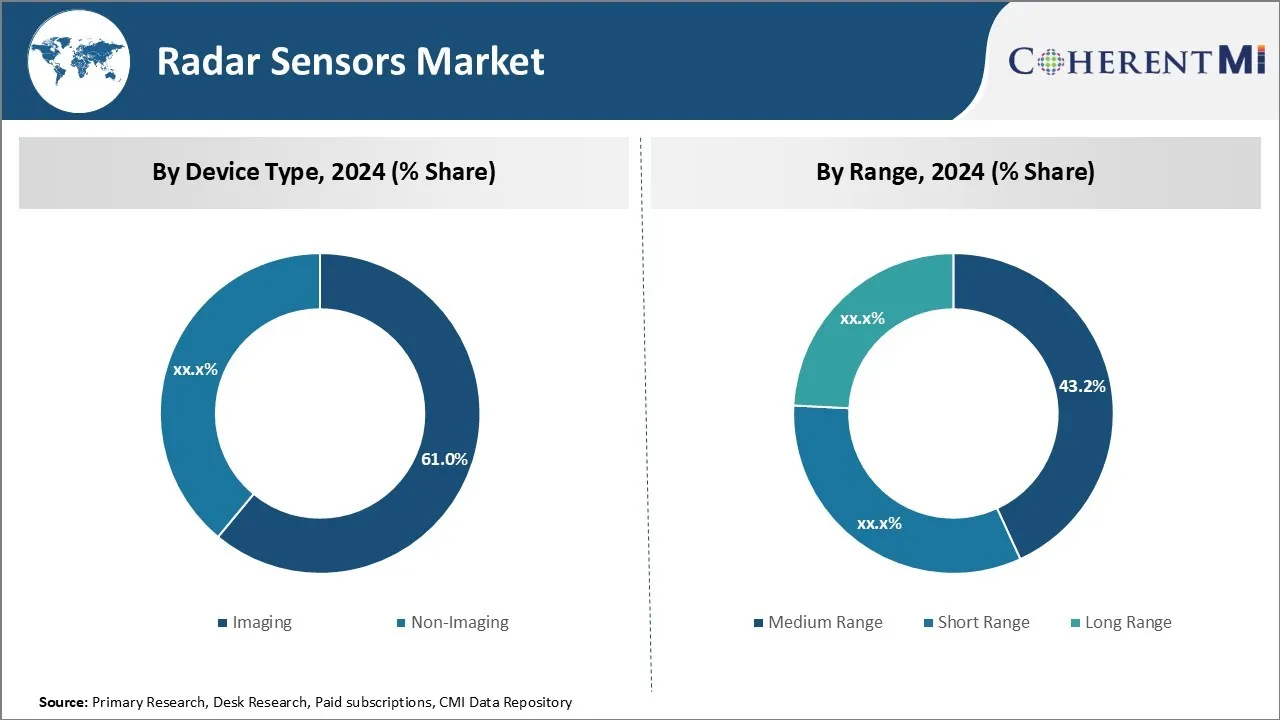

Insights, By Device Type: Precision Targeting Drives Growth in the Imaging Segment

In terms of device type, imaging radar sensors contribute 61% share of the radar sensors market in 2024. It is owning to its ability to provide precise detection and targeting capabilities. Imaging radars are commonly used for surveillance and reconnaissance by defense forces. Advanced militaries around the world are investing heavily in imaging radars due to their superior object detection and tracking performance compared to non-imaging devices.

The automotive industry is also increasingly leveraging imaging radars for advanced driver assistance systems. Automakers are incorporating imaging radars into adaptive cruise control, blind spot detection, emergency braking and other safety features. Imaging radars can accurately detect obstacles on roads, differentiate stationary objects from moving vehicles, and track multiple targets simultaneously.

Other applications witnessing rising deployment of imaging radars include drone surveillance, border security monitoring, non-destructive testing and agricultural crop monitoring. Precise detection of even small objects is crucial for these applications. The ability of imaging radars to accurately map and track multiple targets will sustain high demand growth in this segment of the radar sensors market.

Insights, By Range: Medium Range is Well-suited for Automotive and Industrial Use

In terms of range, medium range contributes 43.2% share of the radar sensors market owing to the segment being well-suited for key applications like automotive and industrial usage. Medium range radars have an operating distance between 50 meters to 200 meters which makes them ideal for monitoring activities within factories, warehouses, and other commercial facilities.

The automotive industry deploys medium range radars extensively for adaptive cruise control, blind spot monitoring, and rear collision warning features in passenger vehicles. These radars can accurately detect other vehicles and obstacles on roads from a distance of 50-200 meters. The medium range offers sufficient visibility for driver assistance without excessive range that would detect false targets.

The adequate detection abilities within confined areas without over or under ranging issues makes this segment ideal for safety and security over medium distances. Its versatility across domains will continue bolstering growth for the radar sensors market.

Insights, By End User: Automotive Leads Demand as Radars Become Critical for Advanced Driving Features

In terms of end user, automotive contributes the highest share driven by radars emerging as indispensable sensors for advanced driver assistance systems and future autonomous vehicles. Automakers are incorporating radar systems as standard or optional features in most new vehicle models to enhance safety.

Radar sensors supplement camera and lidar technology by providing robust detection through adverse weather and lighting conditions where other sensors might fail. The advent of regulations mandating the inclusion of certain driver assistance systems will further stimulate radar sensor adoption.

Cutting edge innovations are expanding radar capabilities beyond basic range and presence detection. Modern radars bring high resolution imaging, object tracking for extended periods and even incorporate V2X connectivity. As radar systems evolve alongside driverless car development, the critical role of these sensors ensures automotive will maintain vital in growth of the radar sensors market.

Additional Insights of Radar Sensors Market

- Radar sensors are integral to ADAS, supporting collision avoidance and adaptive cruise control.

- Short-range sensors are increasingly used in urban infrastructure and vehicle parking systems. Medium-range sensors dominate automotive applications like cruise control.

- Europe held a 41% share of radar sensors market in 2023, the largest globally.

- The Asia-Pacific region is projected to grow fastest in the global radar sensors market due to rapid industrialization and smart city initiatives.

- Automotive segment accounted for 31% share of the radar sensors market in 2023.

Competitive overview of Radar Sensors Market

The major players operating in the radar sensors market include Texas Instruments, Infineon Technologies, NXP Semiconductors, Bosch Sensortec, Qualcomm Technologies, Analog Devices, STMicroelectronics, Continental AG, Denso Corporation, Delphi Automotive (Aptiv), Hella KGaA Hueck & Co., Lockheed Martin Corporation, Raytheon Technologies Corporation, and Northrop Grumman Corporation.

Radar Sensors Market Leaders

- Texas Instruments

- Infineon Technologies

- NXP Semiconductors

- Bosch Sensortec

- Qualcomm Technologies

Radar Sensors Market - Competitive Rivalry, 2024

Radar Sensors Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Radar Sensors Market

- In December 2022, Continental became the exclusive supplier of 4D imaging radar sensors for the Indy Autonomous Challenge (IAC). They provided their ARS540 4D imaging radar sensors for integration into the Dallara AV-21 autonomous racecars, enhancing the vehicles' ability to navigate high-speed courses without human drivers.

Radar Sensors Market Segmentation

- By Device Type

- Imaging

- Non-Imaging

- By Range

- Medium Range

- Short Range

- Long Range

- By End User

- Automotive

- Aerospace and Defense

- Environment and Weather Monitoring

- Industrial

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the radar sensors market?

The radar sensors market is estimated to be valued at USD 14.81 Bn in 2024 and is expected to reach USD 34.28 Bn by 2031.

What are the key factors hampering the growth of the radar sensors market?

Environmental interference (e.g., adverse weather conditions affecting performance) and privacy and regulatory concerns in applications like smart cities are the major factors hampering the growth of the radar sensors market.

What are the major factors driving the radar sensors market growth?

Increasing adoption in automotive safety systems (collision avoidance, ADAS) and rising demand for advanced navigation in drones and aerospace are the major factors driving the radar sensors market.

Which is the leading device type in the radar sensors market?

The leading device type segment is imaging.

Which are the major players operating in the radar sensors market?

Texas Instruments, Infineon Technologies, NXP Semiconductors, Bosch Sensortec, Qualcomm Technologies, Analog Devices, STMicroelectronics, Continental AG, Denso Corporation, Delphi Automotive (Aptiv), Hella KGaA Hueck & Co., Lockheed Martin Corporation, Raytheon Technologies Corporation, and Northrop Grumman Corporation are the major players.

What will be the CAGR of the radar sensors market?

The CAGR of the radar sensors market is projected to be 12.7% from 2024-2031.