Solar Generator Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

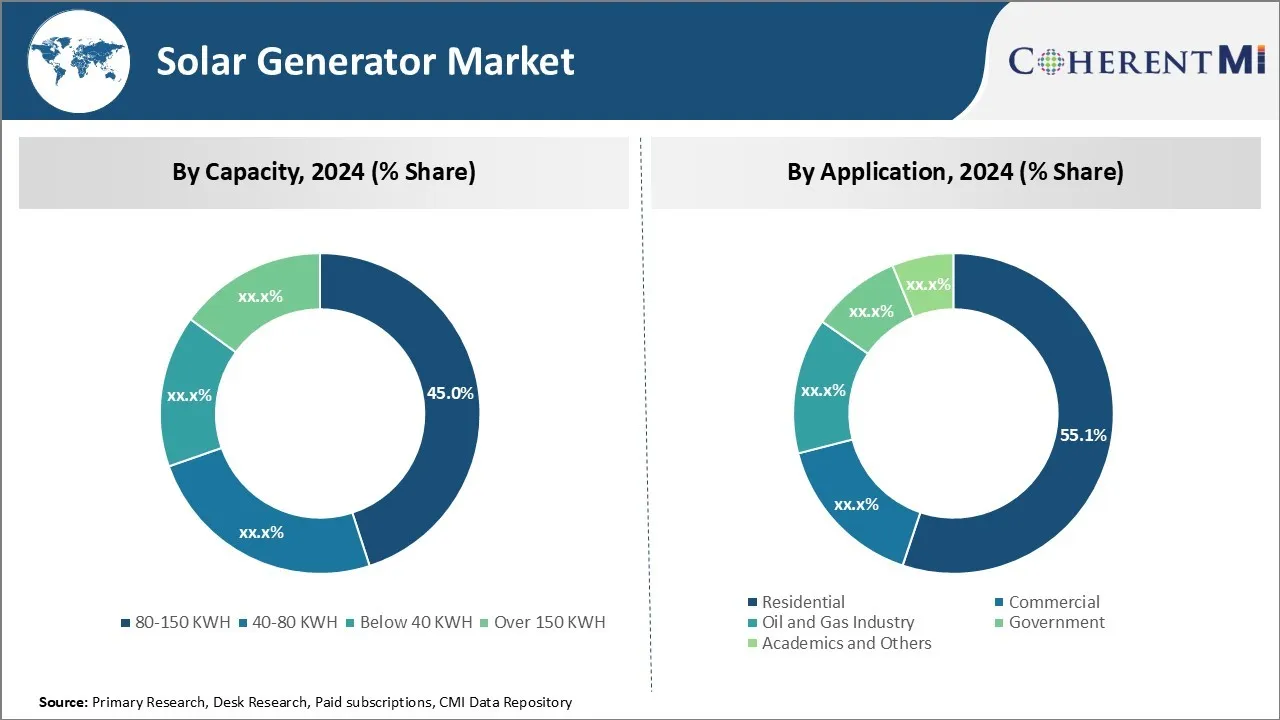

Solar Generator Market is segmented By Capacity (80-150 KWH, 40-80 KWH, Below 40 KWH, Over 150 KWH), By Application (Residential, Commercial, Oil and ....

Solar Generator Market Size

Market Size in USD Mn

CAGR6.59%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6.59% |

| Market Concentration | Medium |

| Major Players | Goal Zero LLC, Duracell, Jackery Inc., Voltaic System, Sunvis Solar and Among Others. |

please let us know !

Solar Generator Market Analysis

The solar generator market is estimated to be valued at USD 627.27 Mn in 2024 and is expected to reach USD 980.95 Mn by 2031. It is projected to grow at a compound annual growth rate (CAGR) of 6.59% from 2024 to 2031. Rising concerns towards environmental pollution due to carbon emissions generated from conventional generators using fossil fuels is driving the growth of solar generator market.

Solar Generator Market Trends

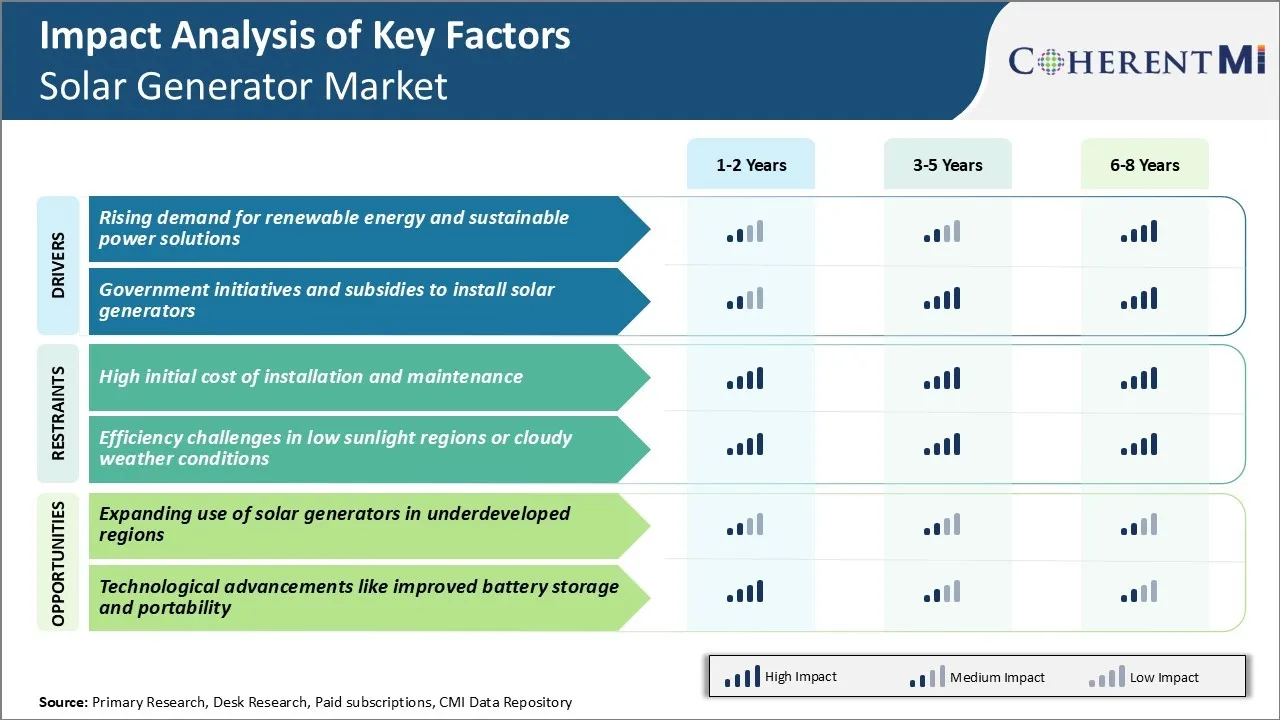

Market Driver - Rising Demand for Renewable Energy and Sustainable Power Solutions

The dependency on non-renewable energy sources and their potential harmful impact on the environment has been a major cause of concern globally. People are becoming increasingly aware about the need to switch to cleaner and greener sources of energy that do not deplete natural resources or contribute to global warming.

However, the intermittent nature of solar power poses challenges for its use, especially in off-grid locations that are not connected to central power grids. This is where solar generators have found widespread adoption in recent years. The flexibility and portability provided by solar generators have made them a popular choice for outdoor recreational activities. They are also extensively used in remote telecom towers, security devices, irrigation pumps and disaster relief operations that require uninterrupted power supply at all times.

Utility companies have also realized the potential of distributed renewable energy generation and some are promoting solar generator systems as a viable option for their customers. The growing demand for sustainable and eco-friendly power solutions is expected to significantly accelerate the adoption in the solar generators market.

Market Driver - Government Initiatives and Subsidies to Install Solar Generators

Another key driver contributing to the growth of solar generator market is the participation of various governments worldwide in promoting the use of renewable energy through supportive regulations and funding schemes. With the looming threat of climate change, most countries have realized the importance of transitioning to low-carbon economies powered predominantly by clean and green energy sources.

Many national and local governments offer rebates amounting to 20-50% of the installed price of residential solar equipment including solar panels and solar generators. Financing programs are also in place that facilitate affordable loans and alternative methods of payment. Some regions and states further supplement the federal programs with their own customized incentive packages to strengthen their position as forerunners in solar adoption.

Today, more individuals and businesses are open to the idea of integrating solar power to take advantage of government incentives and subsidies on offer. This, in turn, is having a positive impact on the burgeoning demand and sales in the solar generators market globally.

Market Challenge - High initial cost of installation and maintenance

The high initial capital cost of installing solar power systems remains one of the biggest challenges in the solar generator market. It restricts widespread adoption, especially in cost-sensitive residential and small commercial sectors. Cost of solar panels and other hardware have declined significantly in the past decade. However, setting up a full-fledged solar power system often requires significant investment. This is further amplified by additional installation and wiring costs.

Once installed, regular maintenance and repair costs are also incurred to keep the system functional over the years. The levelized cost of electricity from solar continues to be higher than traditional grid electricity in most parts of the world.

Incentives and financing schemes have helped address this to some extent. However, high upfront costs remain a barrier for many potential consumers and small businesses to switch to solar generators. This bottleneck needs to be overcome through further cost reductions, innovative financing models, and support incentives to realize the full potential of the solar generator market.

Market Opportunity - Expanding Use of Solar Generators in Underdeveloped Regions

One of the biggest opportunities for the global solar generator market is their expanding use in underdeveloped and rural regions across the world that still have limited access to centralized electricity grids and power infrastructure. Over 800 million people worldwide still lack access to reliable electricity, mostly in remote off-grid areas in Asia, Africa, and Latin America.

Deploying small to medium solar power systems with storage capability provides a sustainable and low-cost solution to meet their basic energy needs. It can power essential appliances, charge phones, operate water pumps and grain mills, and support micro-enterprise and community services.

As the technology advances and economics continue to improve, solar generators can help accelerate energy access in rural populations worldwide, thereby boosting quality of life as well as overall socio-economic development. This presents a massive growth potential for the global solar generator market in the coming years.

Key winning strategies adopted by key players of Solar Generator Market

Focus on product innovation - One of the most successful strategies adopted by solar generator market leaders like Bluetti and Jackery has been continuous product innovation. In the last 2-3 years, both companies have launched multiple new products with improved features like higher power/capacity, faster charging, additional ports etc. For example, in 2020 Bluetti launched its EB55 and EB70 models which were 30-40% more powerful than previous gen products yet 20% smaller/lighter.

Develop energy storage technology - Another key strategy has been developing superior battery packs and energy storage technology. Solar generator market leader Goal Zero invested heavily in R&D since 2015 to introduce more efficient and longer lasting lithium ferrous phosphate battery packs.

Expand distribution channels - Leading brands have also expanded distribution via multiple channels like e-commerce platforms, big box retailers as well as through dealers/distributors. For example, Jackery expanded from online channels in 2010 to selling via Home Depot, Costco, Walmart etc. since 2017.

Influence social media marketing - Reviews and word-of-mouth have been influential in this market. Pioneers like Goal Zero tapped social media influencers/bloggers since 2012 to create awareness.

Segmental Analysis of Solar Generator Market

Insights, By Capacity: Affordability drives adoption of 80-150 KWH capacity solar generators

In terms of capacity, the 80-150 KWH segment contributes 45% share of the solar generator market in 2024. This is owing to its affordable price point and ability to provide power backup for mid-sized needs. Solar generators in this range are sized adequately to run essential appliances, electronics, and lighting for average-sized households or small businesses. Their lower upfront cost compared to larger systems makes them accessible to mainstream consumers.

Many users find these solar generators to be a sweet spot where costs are balanced against requirements for basic power backup during outages. Improvements in lithium-ion battery technology have also made 80-150 KWH solar generators a cost-effective solution that can reliably provide a day's worth of power.

Insights, By Application: Residential Needs Drive Demand for Portable Solar Generators

In terms of application, the residential segment contributes 55.1% share of the solar generator market as portable solar generators fulfill key power needs of homes. Their mobility and ease-of-use make portable systems ideal for supplementing electricity in residential settings.

Homeowners appreciate having reliable standalone power sources for emergencies, camping, tailgating events, and powering devices outdoors. Portable solar generators allow residents to continuously charge devices anywhere on their property during outages.

The self-contained, plug-and-play nature of portable systems also appeals to households seeking hassle-free backup power without installation headaches. Their versatility to function indoors or outdoors further cements portables as the preferred solar solution for residential applications.

Insights, By Type: Reliable Off-grid Power Fuels Adoption of Stationary Solar Generators

In terms of type, the stationary segment is gaining prominence in the solar generator market as it provides steadier power availability compared to portables. While portables maintain an edge in terms of mobility, stationary systems have greater power capacity to reliably meet the continuous energy needs of locations far from grid access.

Key factors driving adoption of stationary solar generators include their ability to consistently supply electricity for off-grid residential homes, remote cabins, telecom towers, water pumping stations, fishing/agricultural villages, and petrol pumps.

Their scale and fixed installation make stationary solar generators more suited for powering medium-load appliances on an ongoing basis without disruptions from recharging. Many remote communities and industries now rely on stationary solar generators for dependable distributed power generation utilizing free sunlight.

Additional Insights of Solar Generator Market

- North America captured a significant revenue share of the solar generator market in 2022, driven by supportive government policies, robust funding for sustainable projects, and a well-established solar infrastructure.

- Asia Pacific is expected to grow at the fastest rate in the global solar generator through 2032, underpinned by increasing investments in solar technologies, ambitious electrification targets, and growing environmental awareness among consumers and businesses alike.

- Homeowners increasingly install solar generators to maintain essential household functions—such as running refrigerators, lighting, and communication devices—during grid outages. This reliable backup mitigates disruption, prevents food spoilage, and improves overall living comfort and safety during emergencies.

- Campers, RV travelers, and outdoor enthusiasts adopt portable solar generators to power cooking equipment, communication devices, and lighting while off the grid. These generators eliminate noise and fuel costs associated with traditional gensets, enriching the outdoor experience sustainably.

Competitive overview of Solar Generator Market

The major players operating in the solar generator market include Goal Zero LLC, Duracell, Jackery Inc., Voltaic System, Sunvis Solar, Altern Limited, Biolite Powerenz, SolSolutions LLC (DolMan), Powerenz Inc., Hollandia B.V., Bluetti, Tesla Inc., EcoFlow Technology, Lion Energy, Westinghouse Electric Corporation, and Milwaukee Tool.

Solar Generator Market Leaders

- Goal Zero LLC

- Duracell

- Jackery Inc.

- Voltaic System

- Sunvis Solar

Solar Generator Market - Competitive Rivalry, 2024

Solar Generator Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Solar Generator Market

- In June 2024, Tesla Inc. partnered with a renewable energy supplier to integrate solar generators into home-based Powerwall systems. This synergy simplifies energy management, enhances grid stability, and accelerates the residential transition to sustainable, self-sufficient energy ecosystems.

- In September 2023, Jackery Inc. launched solar generator kits tailored for emergency preparedness and disaster relief. These specialized kits offer dependable, emission-free backup power, boosting community resilience, reducing reliance on traditional fuels, and reinforcing Jackery’s reputation as a crisis-ready energy provider.

- In August 2023, Goal Zero LLC introduced advanced portable solar generators with higher battery capacities and faster solar recharging. This upgrade strengthens their market position, enhances off-grid accessibility for consumers, and encourages adoption by delivering more reliable, eco-friendly power solutions.

Solar Generator Market Segmentation

- By Capacity

- 80-150 KWH

- 40-80 KWH

- Below 40 KWH

- Over 150 KWH

- By Application

- Residential

- Commercial

- Oil and Gas Industry

- Government

- Academics and Others

- By Type

- Portable

- Stationary

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the solar generator market?

The solar generator market is estimated to be valued at USD 627.27 Mn in 2024 and is expected to reach USD 980.95 Mn by 2031.

What are the key factors hampering the growth of the solar generator market?

High initial cost of installation and maintenance and efficiency challenges in low sunlight regions or cloudy weather conditions are the major factors hampering the growth of the solar generator market.

What are the major factors driving the solar generator market growth?

Rising demand for renewable energy and sustainable power solutions and government initiatives and subsidies to install solar generators are the major factors driving the solar generator market.

Which is the leading capacity in the solar generator market?

The leading capacity segment is 80-150 KWH.

Which are the major players operating in the solar generator market?

Goal Zero LLC, Duracell, Jackery Inc., Voltaic System, Sunvis Solar, Altern Limited, Biolite Powerenz, SolSolutions LLC (DolMan), Powerenz Inc., Hollandia B.V., Bluetti, Tesla Inc., EcoFlow Technology, Lion Energy, Westinghouse Electric Corporation, and Milwaukee Tool are the major players.

What will be the CAGR of the solar generator market?

The CAGR of the solar generator market is projected to be 6.59% from 2024-2031.