美国自治 汽车市场 规模与份额分析 - 成长趋势与预测 (2024 - 2031)

美国自动车市场按车辆类型(装车、商用车辆、特殊用途车辆)、自主等级(第1级、第2级、第3级、第4级、第5级)、应用等级(运输和后勤、军事和国防、农业、制造、保健、其他)、组件(硬件(雷达、摄像机、超音速传感器、其他)、软件)划分。 本报告为上述部分提供了价值(10亿美元)。....

美国自治 汽车市场 规模

市场规模(美元) Bn

复合年增长率20.5%

| 研究期 | 2024 - 2031 |

| 估计基准年 | 2023 |

| 复合年增长率 | 20.5% |

| 市场集中度 | High |

| 主要参与者 | 特斯拉股份有限公司., 通用汽车, 福特 福特 福特 福特 福特 福特, 韦莫, 奥罗拉 以及其他 |

请告诉我们!

美国自治 汽车市场 分析

美国自动汽车市场估计价值为: 14.79美元 2024年学士 预计将达到 37.56美元 到2031年时,生长在一个 CAGR从2024年到2031年占20.5%.

美国的自主汽车市场预计将因各种趋势而出现显著增长。 研究表明,千年人更愿意使用自驾车,因为他们对新技术更加舒适.

美国自治 汽车市场 趋势

市场驱动力-技术进步

技术进步大大推动了美国自主汽车市场的增长. 人工智能、机器学习、传感器和移动连接等技术的发展使车辆具备了自驾能力。 汽车越来越多地配备了适应性巡航控制,盲点监测和自动应急制动等先进的驾驶辅助系统. 特斯拉,GM和福特等主要汽车制造商也引进了具有SAE二级和三级自主能力,用于高速公路驾驶和停车的车辆.

这些进步正在吸引汽车制造商和技术公司对研究与发展进行大量投资。 例如,特斯拉仅在2021年就投资了超过20亿美元用于研发,通过它的定制AI芯片和神经网络来开发完全自主的驱动系统. 例如Cruise、Waymo和Argo AI等创业企业也在几个美国州的公共道路上测试没有司机的自主车辆。 他们收集了大量真实世界的驱动数据,以不断提高自驾系统的能力. 测试正在帮助确定和应对剩余挑战,以便在没有任何人力干预的情况下实现真正的无驱动能力。

市场驱动力-监管支持和立法

监管支持和立法是美国自主汽车市场增长的主要动力. 随着自主驾驶技术的进步,几个州主动推出新的立法,在公共道路上测试和操作无驾驶车辆. 例如,加利福尼亚州是2014年第一个引入自主车辆法规的美国州. 它允许Waymo, Cruis和Moton等公司在没有备用司机的情况下测试全无驾驶的汽车. 其他几个州如德克萨斯州,佛罗里达州,宾夕法尼亚州,密歇根州,华盛顿州和内华达州也通过了新的法律,取消了以前的法律障碍,允许在某些条件下在没有人驾驶的情况下进行自主车辆的上路测试和操作.

联邦政府也支持自主汽车的研发. 2016年,美国交通部发布了新的联邦指南和37个自主车辆的安全设计要素. 这为自主技术的测试和部署建立了一个框架。 DOT公司还投资1亿多美元,在美国多个城市进行需求沙箱试点项目,测试自主穿梭. 2021年国会通过的两党基础设施协议包括75亿美元用于支持电动车辆基础设施,75亿美元用于资助全国替代燃料走廊的新方案.

市场挑战-安全和责任问题

安全和责任问题继续严重限制美国自主车辆市场的增长。 关于如何解决在将人类驱动力从驱动力任务中脱颖而出时出现的法律和政策问题存在重大不确定性。 没有关于自行驾驶汽车的测试和部署的明确联邦标准和条例,由于如何确保安全的不确定性,消费者对采用这种新技术仍然犹豫不决.

此外,尚不清楚发生涉及自主车辆的事故时,由谁负责----乘客、制造商或软件开发商。 汽车制造商和技术公司担心要承担全部责任,特别是在技术的早期阶段,才充分了解潜在问题的根源。 在法律责任和保险问题上缺乏共识,阻碍了汽车制造商对研发的重大投资。 如果不能就应对这些挑战的监管框架达成一致,自主车辆的广泛商业化将面临延误。

市场机会 -- -- 服务流动的增长

在美国汽车自主市场上,移动服务的增长可提供巨大机会。 有了流动服务(MaaS),个人可以通过智能手机的应用程序购买不同的交通工具。 用户可以自由地从各种自主的车辆选项中选择自己的交通需求,无论是使用自驾出租车,巴士还是租用车辆,都是通过单一的平台. 这将有助于减少对个人车辆的依赖,并促进采用共享和可持续的运输办法。

MaaS预计将通过将重点从车辆所有权转向机动性使用,使个人运输发生革命性变化。 这一变化将鼓励更多的人使用自主车辆作为他们的首选交通方式. 随着MaaS平台融合了各种运输选项,用户将有一个方便的"一站式服务"来满足其多样化的移动要求. 与维持个人车辆相比,它将使交通更加负担得起、方便和经济。 随着MaaS和自主车队的更多采用,私人车辆造成的停车位和交通拥堵等问题预计也会减少。

美国交通部的数据显示,目前交通是仅次于住房的第二大家庭开支.

竞争概览 美国自治 汽车市场

在美国自主汽车市场运营的主要玩家包括特斯拉股份有限公司,通用汽车,福特,韦莫,奥罗拉,Uber先进技术集团,阿普蒂夫,莱夫特,努罗和图西普.

美国自治 汽车市场 领导者

- 特斯拉股份有限公司.

- 通用汽车

- 福特 福特 福特 福特 福特 福特

- 韦莫

- 奥罗拉

美国自治 汽车市场 - 竞争对手

美国自治 汽车市场

(主要参与者主导)

(竞争激烈,参与者众多。)

最新发展 美国自治 汽车市场

- 2024年4月19日,梅赛德斯成为第一位在美国销售自驾汽车而无需司机观看道路的汽车制造商.

- 2024年1月17日,德国开机 Vay首次在美国提出其 " 电信 " 解决方案。 这一举动使得Vay在流动技术部门与资金充足的美国公司直接竞争.

美国自治 汽车市场 细分

- 按车辆类型

- 客车

- 商用车辆

- 特殊用途车辆

- 按自治级别

- 1级

- 2级

- 第3级

- 4级

- 5级

- 通过应用程序

- 运输和后勤

- 军事和国防

- 农业

- 制造业

- 保健

- 其他人员

- 按构成部分

- 硬件

- 李达尔

- 雷达

- 摄影机

- 超声波传感器

- 其他人员

- 软件

- 李达尔

- 硬件

您想要了解购买选项吗?本报告的各个部分?

常见问题 :

哪些关键因素阻碍了美国汽车自主市场的增长?

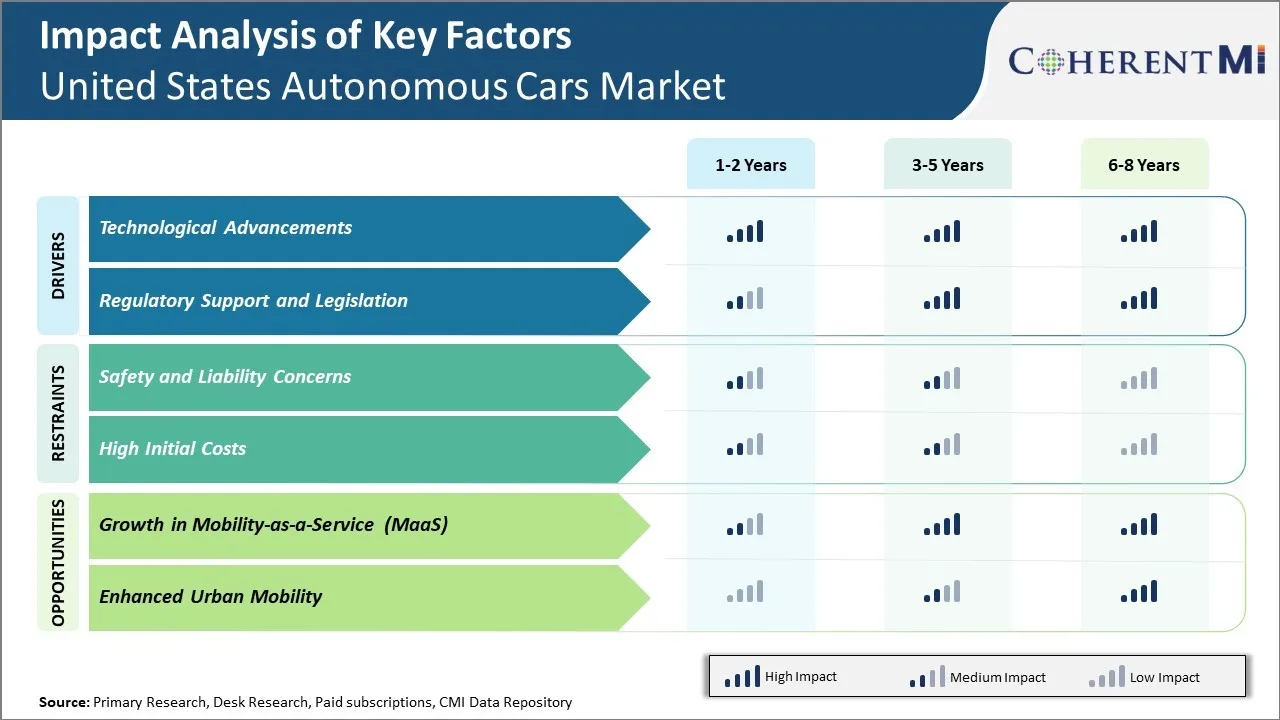

安全和赔偿责任问题和高昂的初始成本是阻碍美国汽车自主市场增长的主要因素。

驱动美国自主汽车市场增长的主要因素是什么?.

技术进步以及监管支持和立法是推动美国汽车自主市场的主要因素。

美国自动汽车市场的主要车型是什么?

主要车辆类型段为客车.

在美国自主汽车市场运营的主要角色是哪些?

特斯拉股份有限公司,通用汽车公司,福特公司,韦莫公司,奥罗拉公司,Uber先进技术集团,阿普蒂夫公司,莱夫特公司,努罗公司,图西普尔公司是主要角色.

美国汽车自主市场CAGR将是什么?.

美国自动动车市场CAGR预计2024-2031年占20.5%.