Akute intermittierende Porphyria Markt GRÖSSEN- UND MARKTANTEILSANALYSE - WACHSTUMSTRENDS UND PROGNOSEN (2024 - 2031)

Acute Intermittent Porphyria Market wird durch Behandlung (RNA Interference-based Therapy, Givosiran, Symptomatic Treatment), By Distribution Channel ....

Akute intermittierende Porphyria Markt Größe

Marktgröße in USD Bn

CAGR6.1%

| Studienzeitraum | 2024 - 2031 |

| Basisjahr der Schätzung | 2023 |

| CAGR | 6.1% |

| Marktkonzentration | High |

| Wichtige Akteure | Alnylam Pharmaceuticals, Recordati Seltene Krankheiten, Mitsubishi Tanabe Pharma, Dicerna Pharmazeutika, Moderne und unter anderem |

Bitte lassen Sie es uns wissen!

Akute intermittierende Porphyria Markt Analyse

Der akute intermittierende Porphyria-Markt wird geschätzt auf USD 1.43 Milliarden in 2024 und wird voraussichtlich erreichen USD 2.17 Milliarden von 2031Wachstumsrate (CAGR) von 6,1 % von 2024 bis 2031. Der Markt hat sich in den letzten Jahren durch die steigende Prävalenz der akuten intermittierenden Porphyrien weltweit erweitert. Faktoren wie das wachsende Bewusstsein über den Zustand und seine Behandlungsoptionen unterstützen das Wachstum dieses Marktes.

Akute intermittierende Porphyria Markt Trends

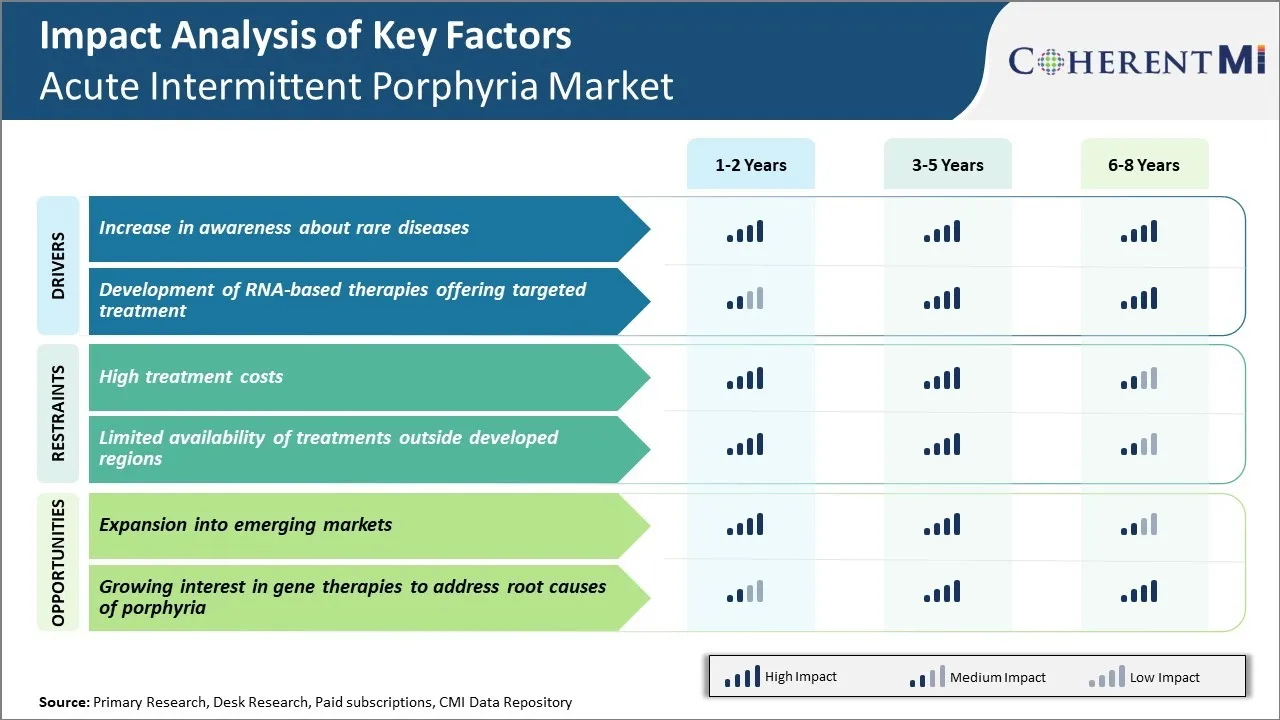

Markttreiber - Erhöhung der Bewusstsein über seltene Krankheiten

Mit der Weiterentwicklung von Technologie und Internet steigt das Bewusstsein über seltene Krankheiten exponentiell. Nicht mehr sind diese Krankheiten aufgrund fehlender Informationen verborgen. Ärzte und Forscher sind auch mehr Gesang über diese seltenen Bedingungen. Sie veröffentlichen Forschungspapiere und geben Interviews zu Mainstream-Medien. Der internationale seltene Krankheitstag ist jedes Jahr mit Kampagnen in verschiedenen Ländern markiert.

Patienten, die früher in der Stille litten, sind nun befugt, eine Stimme zu haben. Ihre Fragen zu Ursachen, Heilungen und Management der Krankheit werden schnell behandelt. Dies lässt weniger Spielraum für Fehlinformationen und unnötige Angstzustände. Bei steigendem Bewusstsein steigt auch der Fokus auf seltene Krankheiten in medizinischen und Pflegeschulen. Neue Ärzte und Gesundheitspersonal lernen in ihrer Karriere früher über solche Bedingungen.

Alle diese kombinierten Faktoren haben maßgeblich zum Wachstum des akut intermittierenden Porphyrienmarktes beigetragen. Die Früherkennung ermöglicht zeitnahe Interventionstechniken und Symptommanagement-Ansätze. Es verhindert Komplikationen und verschlechternde Gesundheitsbedingungen. Patienten können eine entsprechende Behandlung bekommen, anstatt endlos nach einer richtigen Diagnose zu suchen. Bewusstsein entfernt das Stigma um seltene Krankheiten und bringt mehr Finanzmittel sowie tiefere Forschungsverpflichtungen von verschiedenen Akteuren.

Markttreiber - Entwicklung von RNA-basierten Therapien mit gezielter Behandlung

RNA-basierte Therapien bieten einen vielversprechenden Ansatz für genetische Störungen wie akute intermittierende Porphyria, die klare Erbfaktoren und genetische Mutationen in ihrer Pathologie beteiligt hat. Insbesondere werden RNA-Interferenz (RNAi)-Techniken untersucht, die die Produktion von erringem Enzym selektiv blockieren können, ohne andere lebenswichtige Zellwege zu beeinträchtigen. Diese einzigartige Stärke der gezielten Wirkung mit minimalen Nebenwirkungen macht RNAi zu einem spannenden Bereich.

Mehrere Biotechs führen klinische Studien von RNAi-Medikamenten für akute intermittierende Porphyria durch. Wenn bewährt, können sie Wettbewerbsvorteile gegenüber generischen Medikamententherapien erhalten, die derzeit gegeben werden.

Neben RNAi bietet die Gentherapie als neue Modalität auch Hoffnung. Die Korrektur der genetischen Mutation an ihrer Wurzel durch Genersetzung oder Bearbeitung kann das Auftreten von Angriffen auf lange Sicht beseitigen. Frühe Gentherapie-Studien zeigen ermutigende Ergebnisse und dieses Feld geht mit jedem Jahr schnell voran. Fortschritte in der Vektor-Engineering und Targeting-Fähigkeit von Vektoren sind weitere Verbreitung solcher Techniken.

Daher sind die Durchbrüche in RNA-basierten Plattformen, um gezielt genetische seltene Krankheiten wie akute intermittierende Porphyria anzuvisieren, wichtige Treiber. Sie bieten Lösungen, die direkt die zugrunde liegenden Ursachen ansprechen und nicht nur Symptome. Diese differenzierte Herangehensweise, die ungerechtfertigte Bedürfnisse erfüllt, wird starke Auswirkungen auf das Marktwachstum in den kommenden Zeiten haben.

Markt Challenge - hohe Reatkosten

Eine der großen Herausforderungen des Marktes Acute Intermittent Porphyria sind die hohen Behandlungskosten, die mit der Verwaltung des Zustands verbunden sind. AIP erfordert ein kostspieliges lebenslanges Management, um Angriffe und mögliche Komplikationen zu verhindern. Die primären Behandlungen für AIP-Angriffe umfassen intravenöse Hämin-Injektionen, die Tausende von Dollar pro Injektion kosten können.

Darüber hinaus ist eine langfristige Pflege und Überwachung durch häufige Labortests, Fachbesuche, diagnostische Tests und Medikamente zur Behandlung von Symptomen erforderlich. All diese tragen zu einer schweren wirtschaftlichen Belastung für Patienten und das gesamte Gesundheitssystem bei. Die Seltenheit der Erkrankung bedeutet, dass es relativ wenige Patienten gibt, um die hohen Forschungs- und Entwicklungskosten neuer Therapien zu kompensieren.

Drogenhersteller sind zögerlich, in die Entwicklung günstiger Behandlungsoptionen aufgrund der geringen potenziellen Marktgröße zu investieren. Sofern das Bewusstsein und die entsprechende Diagnose nicht wesentlich verbessert werden, werden hohe Kosten den Zugang der Patienten zu Pflege und das Wachstum des AIP-Marktes weiter beschränken.

Marktchance - Expansion in Schwellenländer

Eine der wichtigsten Chancen für den Acute Intermittent Porphyria Markt ist die Expansion in Schwellenländer. Derzeit wird der Markt von entwickelten Ländern in Nordamerika und Westeuropa dominiert, wo das Bewusstsein höher ist und die diagnostischen Fähigkeiten weiter fortgeschritten sind.

AIP hat jedoch eine globale Prävalenz und bleibt in vielen Entwicklungsregionen unterschieden. Es besteht großes Potenzial, den Markt zu wachsen und die Patientenergebnisse zu verbessern, indem die Diagnoseraten und der Zugang zu bestehenden Therapien in Schwellenländern wie Lateinamerika, Asien und dem Nahen Osten erhöht werden. Diese Länder stellen schnell wachsende Gesundheitssektoren mit steigenden Einkommensniveaus dar, die die Behandlung im Laufe der Zeit erschwinglicher machen.

Unternehmen, die auf dem AIP-Markt tätig sind, könnten sich auf Partnerschaften mit lokalen Anbietern, Patientenvertretung Gruppen und Regierungen konzentrieren, um Sensibilisierungskampagnen, Bildungsprogramme für Ärzte und subventionierte Behandlungszugriffsmodelle zu starten.

Durch den Ausbau neuer Patientenpopulationen in Schwellenländern können Unternehmen ein signifikantes Umsatzwachstum und Skaleneffekte erzielen, um langfristig Rentabilität und Investitionen in die Entwicklung von Therapien der nächsten Generation zu fördern.

Präferenzen der Verschreiber von Akute intermittierende Porphyria Markt

Acute Intermittent Porphyria (AIP) präsentiert sich typischerweise in drei Stufen, die unterschiedliche Behandlungslinien erfordern. Die Anfangsphase besteht aus weniger schweren Angriffen und Symptomen, die oft zu Hause mit Diät-Modifikationen und Kohlenhydrat-Ergänzung verwaltet werden können. Verschreibungen können Glukosepolymerprodukte wie Polycal empfehlen, um einen weiteren Aufbau toxischer Metaboliten zu verhindern.

Da sich die Anschläge in der zweiten Phase verschlechtern, benötigen Patienten eine Krankenhausisierung für die intravenöse Hämin-Administration. Hemin (Panhematin) wirkt als primäre Behandlung, da es hilft, ALA- und PBG-Spiegel zu reduzieren. Es wird alle 12-24 Stunden verabreicht, bis die Symptome sich verbessern, die 3-5 Tage dauern kann. Aggressive Kohlenhydrataufnahme setzt sich neben Hämin fort.

Bei schweren, lebensbedrohlichen Angriffen handelt es sich bei der dritten Stufe um intensive Pflegeunterstützungsmaßnahmen. Neben der Hämintherapie können Opioide benötigt werden, um schwere Bauchschmerzen zu bewältigen. Medikamente wie Tramedo oder Dilaudid werden über intravenösen Tropf verschrieben. Eine enge Überwachung ist in diesem Stadium für Komplikationen, die Nieren, Leber oder Blut beeinflussen, unerlässlich.

Das Ausmaß des Angriffs, der Dosierung und der Dauer der Behandlung variiert von Fall zu Fall auf Schwere und individuelle Antwort. Kosten Implikationen beeinflussen auch Produktwahlen mit billiger oralen Alternativen gewinnen Traktion. Hemin bleibt die Mainstay, aber Optionen wie Normosang können eine erhöhte Aufnahme sehen, wenn nachgewiesen kostengünstig. Auch die Patientenausbildung wirkt sich auf Compliance und Ergebnisse aus.

Analyse der Behandlungsoptionen von Akute intermittierende Porphyria Markt

Acute Intermittierende Porphyria (AIP) hat vier Hauptstufen - Remission, Pre-Krise, akuter Angriff und Revaleszenz. Die bevorzugte Behandlung hängt von der Stufe ab.

Bei der Remission und Pre-Krise ist Prävention der Schlüssel. Patienten wollen bekannte Auslöser wie bestimmte Medikamente vermeiden.

Wenn ein akuter Angriff auftritt, ist die Krankenhausisierung in der Regel für die intravenöse Hämin-Administration erforderlich. Hemin, ein Markenprodukt mit Panhematin, blockiert die Überproduktion von Porphyrinen. Es bleibt die First-Line-Behandlung für Angriffe, da es die Angriffsdauer von Wochen zu Tagen und das Risiko permanenter neurologischer Schäden deutlich reduziert.

Bei Patienten mit häufigen Anschlägen kann eine lebenslange Vorbeugung erforderlich sein. Zweitlinienale Optionen umfassen Beta-Blocker, die gedacht sind, hepatische ALA Synthase Aktivität zu verringern. Häufig verwendete Markendrogen sind Inderal und Tenormin.

Während der Rekonvaleszenz konzentriert sich die Pflege auf die Erholung, die Bekämpfung von jeglichen ernährungsbedingten Mängeln und psychologische Unterstützung. Erholung kann Wochen dauern.

Die Stadium und Schwere der Symptome bestimmen in der Regel den besten Behandlungsansatz. Hemin ist bei aktiven Angriffen sehr effektiv, wenn Symptome dringendes Management erfordern. Orale vorbeugende Medikamente können für häufige Leidende nachhaltig helfen. Dieser maßgeschneiderte Ansatz zielt darauf ab, Angriffe, ihre Auswirkungen und langfristige Komplikationen dieser seltenen, aber schweren Krankheit zu minimieren.

Wichtige Erfolgsstrategien der Hauptakteure von Akute intermittierende Porphyria Markt

Fokus auf klinische Entwicklung für neue Behandlungen - Eine der wichtigsten Strategien, die von Unternehmen angenommen wurde, investiert aggressiv in die klinische Forschung und Entwicklung für neue Medikamente zur Behandlung von Acute Intermittent Porphyria (AIP). So investierte Recordati Rare Diseases zwischen 2014 und 2018 über 100 Millionen Dollar in klinische Studien für seine orale Droge rigosertib für AIP. Die im Jahr 2018 abgeschlossene Phase 3 INSPIRE-Studie zeigte vielversprechende Ergebnisse und reduzierte AIP-Angriffe. Wenn genehmigt, rigosertib könnte die erste neue Behandlung in über 20 Jahren für AIP.

Partnerschaften und Kooperationen zur Drogenentwicklung - Ja. Angesichts der Herausforderungen der kleinen Patientenpopulation und der wirtschaftlichen Lebensfähigkeit für Waisenarzneimittel sind Partnerschaften für Unternehmen wichtig, um Ressourcen zu maximieren und Risiken/Rewards zu teilen. Im Jahr 2019 arbeitete Alnylam Pharmaceuticals mit Dicerna Pharmaceuticals zusammen, um eine RNAi-Therapie (DCR-AIP) für AIP zu entwickeln. Durch die Kombination ihrer Expertise und Plattformen hoffen sie, die Entwicklung neuer Behandlungsoptionen zu beschleunigen.

Erwerb von vielversprechenden Pipelinevermögen - Akquisitionen haben es Unternehmen ermöglicht, Zugang zu klinischen Aktiva der mittleren Stufe zu erhalten und ihre Portfolios auf diesem Markt zu erweitern. Im Jahr 2020 erwarb Recordati Orphan Europe und erwarb die Vermarktungsrechte an Cysteamine Bitartrate, einem in Europa für AIP zugelassenen Medikament. Diese Ergänzung hat Recordatis Präsenz- und Kommerzialisierungsmöglichkeiten für AIP-Behandlungen verbessert.

Segmentanalyse von Akute intermittierende Porphyria Markt

Einblicke, Durch Behandlung: >RNA Interferenzbasierte Therapie - Eine bahnbrechende Option für akute intermittierende Porphyria

RNA Interference-based Therapy trägt in der Behandlung den höchsten Anteil des Marktes mit seinem neuartigen Wirkmechanismus und vielversprechenden klinischen Testergebnissen bei. RNA-Interferenz-basierte Therapien arbeiten, indem spezifische Gene, die mit akuten intermittierenden Porphyrien durch die Einführung kleiner interferierender RNAs (siRNAs) verbunden sind, silencing. Dieser Gen-Silencing-Ansatz hat das Potenzial, bei Patienten sicher und effektiv abnormale Mengen an Aminolevulinsäure und Porphobilinogen zu senken.

Ein wichtiges RNA-Interferenz-basiertes Medikament, Givosiran, hat signifikante Reduktionen in der Hyperphenylalanämie gezeigt, das Markensymptom der akuten intermittierenden Porphyrie, in klinischen Studien der Phase 3. Patienten, die Givosiran erhielten, erlebten viel weniger Angriffe als die auf Placebo. Seine innovativen Modalitäts- und starke Wirksamkeitsdaten haben sowohl von Ärzten als auch von Patienten großes Marktinteresse erfasst. Wenn genehmigt, Givosiran ist poised zu der ersten genehmigten Behandlung, die direkt auf die zugrunde liegende Ursache der akuten intermittierenden Porphyria.

Insights, By Distribution Channel: Krankenhaus Apotheken Hauptanteil der Akute Intermittent Porphyria Distribution

In Bezug auf den Vertriebskanal tragen Krankenhaus-Apotheken den höchsten Marktanteil des Marktes bei. Dies liegt daran, dass akute intermittierende Porphyrien häufig bei schweren Angriffen stationäre Pflege und Management erfordern. Symptome wie Bauchschmerzen, Erbrechen und neurologische Abnormalitäten können Krankenhauseintritt und Rund-um-die-Uhr-Überwachung erfordern, bis der Angriff nachlässt.

Krankenhaus-Apotheken spielen eine entscheidende Rolle bei der intravenösen Verabreichung von akuten Therapien, um schnell Angriffssymptome zu reduzieren. Sie beraten Patienten auch bei Langzeitbehandlungen und Strategien zur Früherkennung zukünftiger Angriffe.

Als erster Kontaktpunkt bei Angriffen bleiben die Krankenhaus-Apotheken zentral für die Behandlung von vielen akuten intermittierenden Porphyria-Patienten. Ihre Verfügbarkeit rund um die Uhr und ihr Know-how im Umgang mit spezialisierten akuten Medikamenten treiben ihren Vorsprung in der Vertriebslandschaft.

Zusätzliche Einblicke von Akute intermittierende Porphyria Markt

- Der Markt zeigt einen deutlichen Anstieg des Patientenbewusstseins und der Diagnostikraten, insbesondere in den USA und Europa. Darüber hinaus schafft der Markteintritt neuer Spieler ein dynamisches Wettbewerbsumfeld.

- Die Zunahme der Kooperationen zwischen Pharmaunternehmen für die seltene Krankheitsforschung hat die Fortschritte bei der Behandlung, insbesondere in den Bereichen Gentherapie und RNA-basierte Lösungen, beschleunigt.

Wettbewerbsübersicht von Akute intermittierende Porphyria Markt

Zu den wichtigsten Akteuren des Acute Intermittent Porphyria Market gehören Alnylam Pharmaceuticals, Recordati Rare Diseases, Mitsubishi Tanabe Pharma, Dicerna Pharmaceuticals und Moderna.

Akute intermittierende Porphyria Markt Marktführer

- Alnylam Pharmaceuticals

- Recordati Seltene Krankheiten

- Mitsubishi Tanabe Pharma

- Dicerna Pharmazeutika

- Moderne

Akute intermittierende Porphyria Markt - Wettbewerbsrivalität

Akute intermittierende Porphyria Markt

(Von großen Akteuren dominiert)

(Hoher Wettbewerb mit vielen Akteuren.)

Neueste Entwicklungen in Akute intermittierende Porphyria Markt

- Im November 2019 wurde Givosiran, Marke Givlaari, von der FDA für die Behandlung von akuter hepatischer Porphyria (AHP), einer seltenen genetischen Erkrankung, die schwere und möglicherweise lebensbedrohliche Angriffe verursacht, zugelassen. Das Medikament wurde gezeigt, um Porphyria-Angriffe um etwa 70-74% basierend auf klinischen Studien zu reduzieren.

- Im Juli 2023 kündigte Moderna seinen Eintritt in den seltenen Krankheitsraum mit potenziellen RNA Therapien für Porphyria an. Dies wird den Wettbewerb im Raum verbessern. Moderna erforscht verschiedene therapeutische Bereiche jenseits von COVID-19 Impfstoffen, einschließlich seltener Krankheiten. Ihre mRNA-Technologie bietet Potenzial bei der Behandlung von genetischen Störungen wie Porphyria.

Akute intermittierende Porphyria Markt Segmentierung

- Durch Behandlung

- RNA Interferenzbasierte Therapie

- Givosiran

- Symptomatische Behandlung

- Durch den Verteilerkanal

- Kliniken und Krankenhäuser

- Online-Apotheken

- Einzelhandel

Möchten Sie die Möglichkeit erkunden, einzelne Abschnitte dieses Berichts zu kaufen?

Häufig gestellte Fragen :

Wie groß ist der akute intermittierende Porphyria-Markt?

Der akute intermittierende Porphyria-Markt wird im Jahr 2024 auf USD 1.43 Milliarden geschätzt und wird voraussichtlich bis 2031 USD 2.17 Milliarden erreichen.

Was sind die wichtigsten Faktoren, die das Wachstum des akuten intermittierenden Porphyria-Marktes behindern?

Die hohen Behandlungskosten und die begrenzte Verfügbarkeit von Behandlungen außerhalb der entwickelten Regionen sind die Hauptfaktoren, die das Wachstum des akuten intermittierenden Porphyria-Marktes behindern.

Was sind die wichtigsten Faktoren, die das akute intermittierende Porphyria Marktwachstum treiben?

Die zunehmende Sensibilisierung für seltene Krankheiten und die Entwicklung von RNA-basierten Therapien, die eine gezielte Behandlung anbieten, sind die Hauptfaktoren, die den akuten intermittierenden Porphyria-Markt antreiben.

Welches ist die führende Behandlung im akuten intermittierenden Porphyria-Markt?

Das führende Behandlungssegment ist RNA Interference-basierte Therapie.

Welche sind die Hauptakteure, die im akut intermittierenden Porphyria-Markt tätig sind?

Alnylam Pharmaceuticals, Recordati Seltene Krankheiten, Mitsubishi Tanabe Pharma, Dicerna Pharmaceuticals und Moderna sind die wichtigsten Akteure.

Was wird das CAGR des akuten intermittierenden Porphyria-Marktes sein?

Die CAGR des akut intermittierenden Porphyria-Marktes wird von 2024-2031 auf 6,1 % prognostiziert.