Global Luxury Upholstery Fabric Market Size - Analysis

The global luxury upholstery fabric market size is expected to reach US$ 10.70 Bn by 2032, from US$ 6.45 Bn in 2025, growing at a CAGR of 7.5% during the forecast period.

Luxury upholstery fabrics are high-end fabrics majorly made from premium natural fibers like wool, silk, cotton, linen, etc. They are characterized by their luxurious look and feel, durability, and aesthetic appeal. Luxury upholstery fabrics find application in upholstery, curtains, carpets, bags, apparel, and other end uses. The growth of the market is driven by rising construction activities, increasing urbanization, and growing hospitality sector.

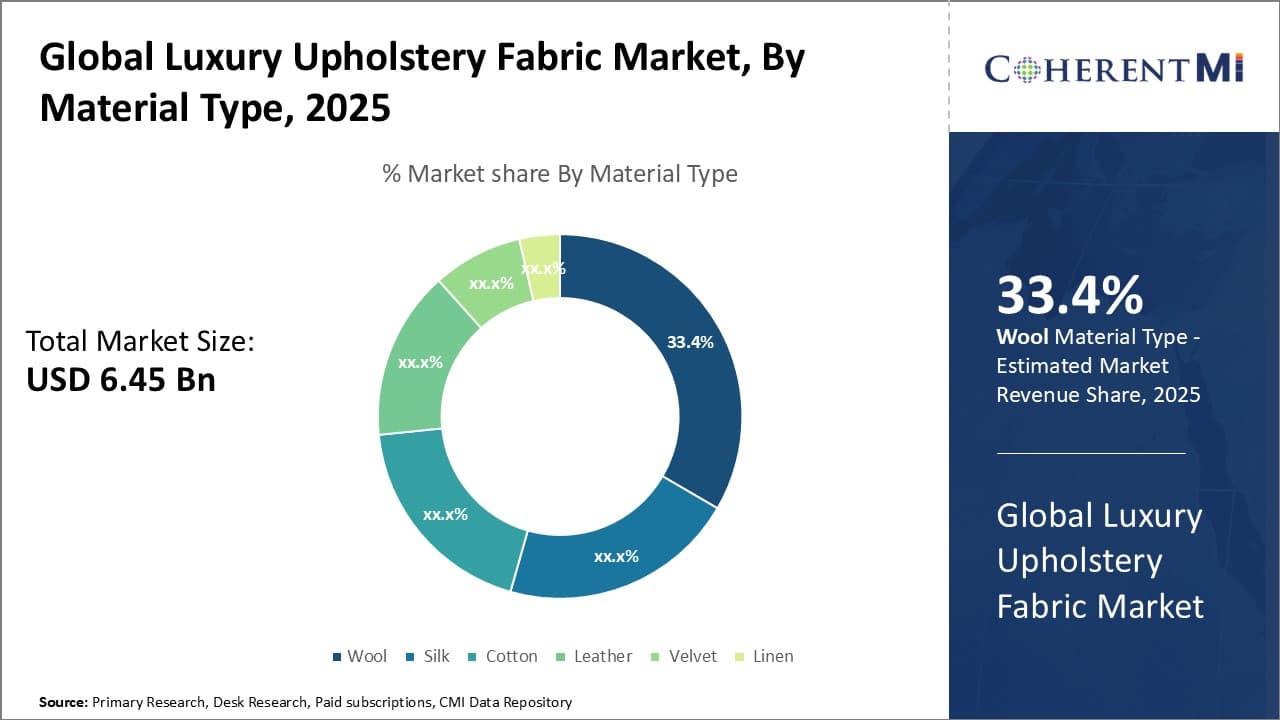

The global luxury upholstery fabric market is segmented by material type, application, end-use sector, distribution channel, and region. By material type, the market is segmented into wool, silk, cotton, leather, velvet, linen, and others. Wool is expected to dominate the material type segment owing to its natural elasticity, durability, and insulating properties.

Global Luxury Upholstery Fabric Market Drivers:

- The global construction industry has witnessed steady growth over the last decade, driven by rapid urbanization, population growth, and rising infrastructure spending. This proliferation in construction activities has led to higher demand for not just affordable housing but also luxury residential and commercial real estate.

- The expansion of luxury hotels, restaurants, malls, and corporate spaces has created significant demand for opulent, high-end furnishing fabrics like wool, silk, velvet, leather etc. Upholstery, wall coverings, and window treatments are key applications where luxury developers prefer finely crafted fabrics over regular commercial textiles. The growth of luxury real estate around the world has thus emerged as a major driver for the upholstery fabrics market. For instance, in November 2021, the increase in construction activities in the US in recent years, with the construction industry experiencing growth in 2025 and 2025.

- This growth is largely due to government investments in infrastructure and development, such as the Infrastructure Investment and Jobs Act (IIJA), the Inflation Reduction Act (IRA), and the Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act

- Premiumization trend driving adoption of luxury home furnishings: With growing disposable incomes, consumer preference has shifted towards premium, high-quality home furnishings and décor. This trend of premiumization has positively influenced the demand for luxury upholstery fabrics. Consumers today are willing to spend more on luxury cascade pillows, ornate curtains, or statement headboards that can elevate the aesthetic appeal of their living spaces.

- The millennial population, in particular, prefers statement upholstery that reflects their tastes and design sensibilities. Premium fabrics like velvet, leather, and embroidered textiles allow homeowners to attain a refined, grandiose look aligned with luxury living. The surging demand for premium furnishings and desire for personalized spaces bodes well for luxurious upholstery fabric sales. For instance, on 26th June 2025, More than 70% of respondents in a survey conducted in February 2025 indicated that they would be willing to pay more for goods that are produced responsibly.

Global Luxury Upholstery Fabric Market Opportunities:

- While conventional brick-and-mortar distribution channels dominate currently, online platforms provide an immense opportunity for luxury upholstery fabric brands to improve their reach and sales. As consumer comfort with online shopping rises, brands can leverage e-commerce sites and tools to offer curated digital catalogs, design visualization, customization options, transparent sourcing information, secure online payment, etc. Social media also enables the discovery and marketing of fine fabrics to the relevant target audience. Digital channels can effectively educate consumers about the value of investing in high-quality, durable upholstery fabrics versus cheaper ready-to-assemble furnishings.

- User-friendly webstores and social commerce will be pivotal to drawing millennial and Gen Z homemakers.

- Geographical expansion in emerging economies: Many developing economies around the world are witnessing exponential growth in luxury real estate, hospitality, and related sectors. Countries like China, India, United Arab Emirates, Brazil, and others have a fast-expanding affluent demographic willing to spend on upscale, branded consumer goods including home furnishings. By expanding their distribution networks in these countries, luxury upholstery brands can access this high-potential consumer base. Local partnerships, retail stores, and marketing campaigns tuned to regional preferences are key factors to succeeding in new geographical markets. Developing economies will be the future revenue growth drivers of luxury fabric brands.

Global Luxury Upholstery Fabric Market Restraints:

- The biggest restraint faced by manufacturers is justifying the high prices commanded by luxury upholstery fabrics relative to regular commercial textiles. Luxury fabrics in silk, wool, velvet, embroidered patterns, etc. cost intrinsically more owing to the expensive base materials, premium craftsmanship, and special finishing processes involved. These fabrics are priced nearly 3 to 5 times higher than commercial-grade polyester or acrylic textiles. Many middle-income consumers even in developed economies think twice before splurging on opulent textiles. Brands need to educate consumers on the value proposition of investing in timeless luxury fabrics versus cheaper inferior alternatives.

- Discount sales and bundling upholstery with other furnishings also improve affordability.

- Perception as old-fashioned and outdated: Luxury upholstery fabrics sometimes contend with the perception of being stuffy, outdated, or representative of an older generation’s tastes. Younger demographics may view conventional fibers like wool and silk as unfashionable. However, brands can counter this by partnering with modern artists and designers to create avant-garde, innovative fabrics targeted at younger sensibilities. Abstract patterns, 3D geometries, large-scale graphics, and bold color palettes attract youthful consumers. Digital printing and technical finishes add fresh appeal to classic luxurious textiles. Marketing should position them as speaking to contemporary lifestyle aesthetics.

Analyst’s Viewpoint: The global luxury upholstery fabric market continues to grow steadily, driven by rising disposable incomes and growing demand for high-end home furnishings. Asia Pacific has emerged as the fastest-growing region, led by China, India, and other developing economies experiencing strong economic growth. In Europe and North America, recovery in the real estate markets has bolstered demand for premium home décor options.

On the supply side, major fabric manufacturers are introducing new design-focused collections catering to evolving consumer preferences. For example, more sustainable fabrics made from organic cotton and recycled materials now offer an eco-friendly dimension to luxury without compromising on quality. Furthermore, the adoption of advanced weaving technologies allows manufacturers to replicate high-end textures like silk or cashmere at competitive price points.

However, fluctuations in raw material costs remain a concern for suppliers. Prices of cotton, viscose, and specialty fibers fluctuate due to changes in commodity markets. Along with this, the presence of cheaper alternatives from Asia and Eastern Europe poses threats to established Western brands. Additionally, the economic slowdown in certain major countries remains a challenge to be monitored.

Market Size in USD Bn

CAGR7.5%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 7.5% |

| Fastest Growing Market | Asia Pacific |

| Larget Market | North America |

| Market Concentration | High |

| Major Players | Fabricut Inc., Aquafil S.p.A., Brentano Inc., Carnegie Fabrics LLC, Designtex and Among Others |

please let us know !

Global Luxury Upholstery Fabric Market Trends

- Shift towards natural luxury fibers: Consumers today increasingly prefer natural luxury textiles like silk, cotton, wool, and linen over synthetic counterparts. The opulent drape, breathability, and hypoallergenic properties of such fibers account for their surging popularity in upholstery applications. 100% wool velvet, for instance, offers vibrant colors, inherent fire retardation, and unmatched durability. Wool also absorbs humidity and is biodegradable. Silk, though delicate, provides unparalleled luster, shine, and fluidity in drape. The shift towards eco-friendly fibers dovetails with the sustainability movement. Brands are responding by expanding their offerings of upholstery made from renewable fibers grown using organic methods.

- With rising ethical concerns over animal cruelty in sourcing leather, faux leathers have emerged as a popular alternative. Manufacturers are innovating high-performance, luxurious materials like velvet, microfibers, and plant leather to mimic the appearance and texture of real leather. Cactus, apple, mushroom, and grape leathers made from agricultural food waste offer cruelty-free durability. Technological advancements have improved the quality of synthetic leather as well. Leather alternatives that align with eco-values help brands attract and retain today’s ethically-minded luxury consumers.

- Smart temperature control fabrics: Phase change materials (PCM) technology integrated into textiles is an emerging trend enabling upholstery fabrics to dynamically adjust their temperature. Microcapsules containing special wax compounds have been incorporated into fabrics like polyester, wool, cotton, etc. This allows the textiles to heat up or cool down depending on ambient temperatures. Such smart temperature-control fabrics lend greater comfort to consumers using upholstered furniture or bedding. They also support energy efficiency in homes and commercial spaces by maintaining optimal thermal levels. The technology is gaining popularity for window treatments as well. Advancements in flexible electronics have made thermoregulating fabrics commercially scalable.

- Antimicrobial and self-cleaning finishes: In the post-pandemic era, consumers have become more aware of germs and hygiene. To address this need, manufacturers are enhancing luxury upholstery fabrics with antimicrobial and self-cleaning finishes that inhibit bacterial growth and contamination. Topical treatments or inherent engineering of nano-particles like titanium dioxide into textiles impart antibacterial properties. Self-cleaning coatings enable stains to slide off easily from fabric surfaces without harsh scrubbing. Such finishes maintain the pristine, hygienic look of upholstery fabrics, especially in high-traffic settings like offices, hospitals, and transit systems. The antimicrobial functionality also protects the textile itself from deterioration.

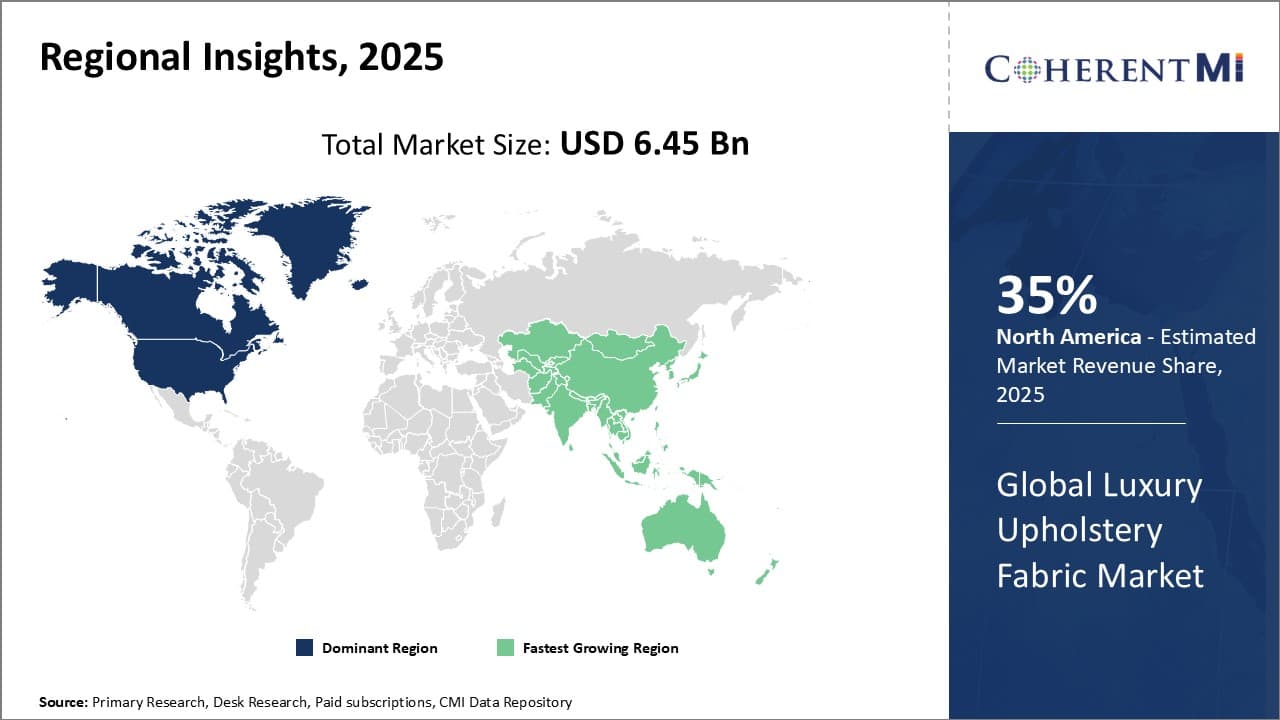

Global Luxury Upholstery Fabric Market Regional Insights:

- North America is the largest regional market for luxury upholstery fabric, accounting for over 35% of the global market in 2025. The high demand for luxury upholstery fabric in this region is attributed to the increasing disposable incomes of consumers, the growing trend of home improvement, and the increasing demand for high-end furniture.

- is the second-largest regional market for luxury upholstery fabric, accounting for over 25% of the global market in 2025.

- The high demand for luxury upholstery fabric in this region is attributed to the rich cultural heritage of the region and the high aesthetic standards of consumers.

- Asia Pacific is the fastest-growing regional market for luxury upholstery fabric, with a CAGR of over 15% during the forecast period. The high growth of the market in this region is attributed to the increasing urbanization, the rising disposable incomes of consumers, and the growing demand for luxury goods.

Segmental Analysis of Global Luxury Upholstery Fabric Market

Competitive overview of Global Luxury Upholstery Fabric Market

Global luxury upholstery fabric market features a highly competitive landscape with several key players vying for market share. These players often distinguish themselves through product innovation, quality, and branding. Here is an overview of some of the major competitors and their strategies in the global luxury upholstery fabric market:

Global Luxury Upholstery Fabric Market Leaders

- Fabricut Inc.

- Aquafil S.p.A.

- Brentano Inc.

- Carnegie Fabrics LLC

- Designtex

Global Luxury Upholstery Fabric Market - Competitive Rivalry

Global Luxury Upholstery Fabric Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Global Luxury Upholstery Fabric Market

New product launches:

- In March 2022, Kravet Inc. (the industry leader in to the trade home furnishings industry) launched a new collection of luxury performance fabrics made from renewable plant-based materials. The fabrics are designed to be water-repellant, stain-resistant and easy to clean while retaining a soft, luxurious hand.

- In January 2021, Brentano Inc. (An international source for residential, hospitality, commercial, upholstery and drapery fabrics) introduced the Wander fabric line made from 100% wool. It features organic textures and neutral tones suitable for both residential and commercial settings. The fabric is fade- and stain-resistant.

- In September 2020, Carnegie Fabrics launched Xorel, a line of upholstery fabrics made from renewable fibers. It combines the look of high-quality leather with the durability and stain resistance of synthetic fiber.

Acquisition and partnerships:

- In October 2022, Lano Carpets (collection of premium carpets with unique styles that bring a luxury edge to classic and contemporary interiors)acquired Elton Group, a producer of custom rugs and broadloom carpets, to expand its portfolio of luxury wool carpets.

- In December 2021, Momentum Group (develop and acquire profitable sustainable companies with a strong market position) partnered with Camira Fabrics to distribute their upholstery fabrics in the UK and Ireland. The partnership expanded Momentum's range of high-performance textiles.

- In November 2020, Brentano acquired the luxury textile company JB Martin to gain access to their historic archive of intricate jacquard fabric designs dating back to 1866

Global Luxury Upholstery Fabric Market Segmentation

- By Material Type

-

- Wool

- Silk

- Cotton

- Leather

- Velvet

- Linen

- Others (Polyester, Acrylic, Nylon, Viscose, etc.)

- By Application

-

- Upholstery

- Curtains

- Carpets

- Wall Covering

- Bags & Accessories

- Apparel

- Others (Table Linen, Blankets, etc.)

- By End-use Sector

-

- Residential

- Commercial

- Hospitality

- Healthcare

- Institutional

- Others (Automotive, Aircraft, etc.)

- By Distribution Channel

-

- Online

- Offline

- By Region

-

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

Frequently Asked Questions :

How big is the Global Luxury Upholstery Fabric Market?

The Global Luxury Upholstery Fabric Market is estimated to be valued at USD 6.4 in 2025 and is expected to reach USD 10.7 Billion by 2032.

What are the major factors driving the global luxury upholstery fabric market growth?

Increasing construction activities, the growing hospitality industry, rising urbanization, and premiumization of products are the major factors driving the growth of the luxury upholstery fabric market.

Which is the leading application segment in the luxury upholstery fabric market?

The wool segment is the leading material type in the global luxury upholstery fabric market owing to its natural elasticity, durability and insulating properties.

Which are the major players operating in the luxury upholstery fabric market?

Some of the major players operating in the global luxury upholstery fabric market are Fabricut Inc., Aquafil S.p.A., Brentano Inc., Carnegie Fabrics LLC, Designtex, Kravet Inc., Maharam Fabric Corporation, Marvel Textiles, and others.

Which region will lead the luxury upholstery fabric market?

North America will lead the global luxury upholstery fabric market in terms of market share.

What will be the CAGR of the luxury upholstery fabric market?

The CAGR of the global luxury upholstery fabric market is projected to be 7.5% from 2025-2032.