Asia Fast Fashion Market Size - Analysis

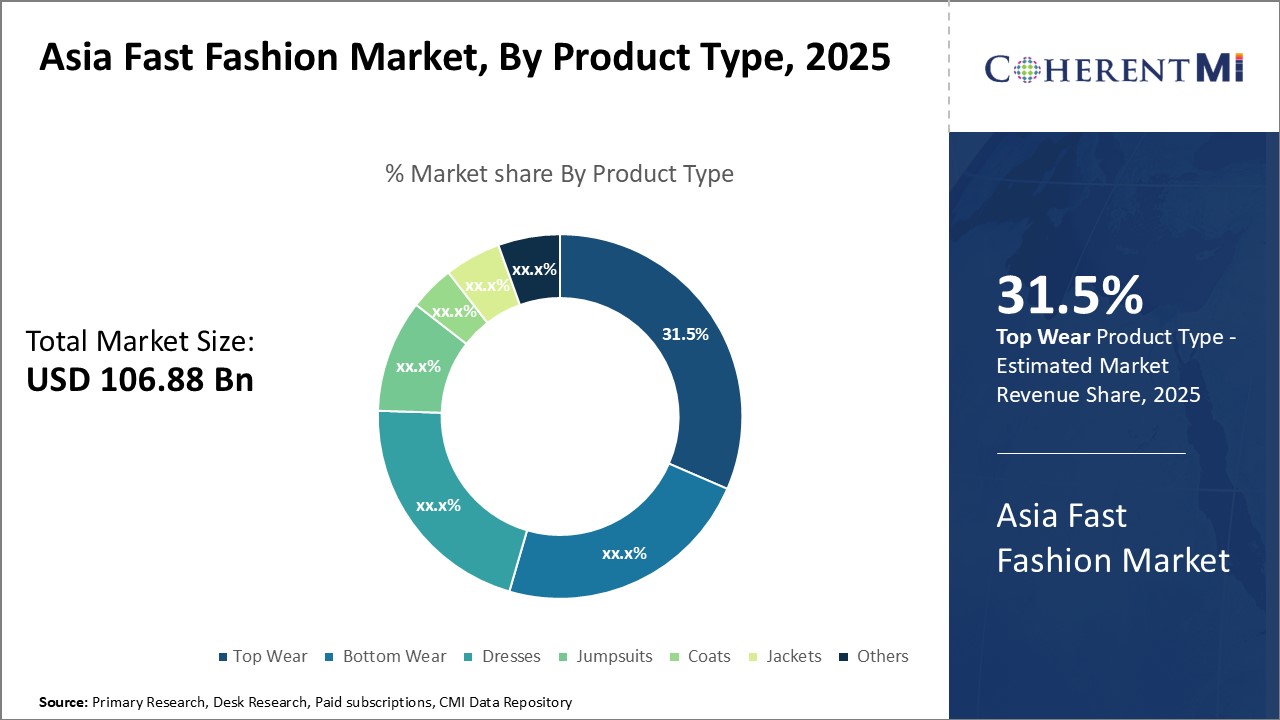

The Asia fast fashion market is segmented by product type, end user, price range, age group, distribution channel, and region. By product type, the top wear segment accounted for the largest market share in 2025. The rising demand for stylish and affordable tops and t-shirts among young consumers is driving the growth of the top wear segment in the Asia fast fashion market.

Asia Fast Fashion Market Drivers:

- Rising disposable incomes and growing middle-class population: The steady economic growth in Asian countries such as China, India, Indonesia, and Vietnam has led to increasing disposable incomes and an expanding middle class. This is resulting in higher discretionary spending on fashion clothing and accessories. The growing middle class with higher purchasing power and aspiration for fashion is a key driver for the fast fashion market. For instance, in October 2025, according to Source of Asia the size of Vietnamese middle-class households is expected to double within the next decade, significantly increasing the demand for services and higher-quality products. Vietnam's goal is to become an upper-middle-income country by 2035 and a high-income country by 2045. The country has the 7th fastest-growing middle class in the world

- Influence of social media and digital marketing: Social media platforms like Instagram, Facebook, YouTube, and TikTok have become major marketing channels for fast fashion brands. Asian youth are heavily influenced by fashion trends, brands, and styles promoted by influencers and celebrities on these platforms. Brands are leveraging social media for targeted marketing campaigns and engagement. The outreach potential of digital marketing is enabling fast fashion brands to connect with customers. For instance on July 20, 2025, as per Social Pilot (Social media marketing tool to increase brand awareness & traffic), social media allowed fashion brands to engage directly with customers, providing exceptional customer service and building meaningful relationships

- Demand from millennials and generation Z: Millennials and Gen Z constitute a significant portion of the population in major Asian countries. Their preference for individuality, self-expression, and the latest trends make them the prime target audience for fast fashion brands. These demographics drive demand for affordable and trendy clothing for daily and casual wear. Fast fashion helps them follow the latest styles and fashion fads. The segment's high online engagement also allows brands to reach them.

- Growth of the e-commerce industry: The e-commerce market has exploded in Asia Pacific due to rising internet penetration and smartphone adoption. Online fast fashion retail is growing rapidly with major brands selling via their own websites and on popular marketplaces. Accessibility, discounts, and convenience of online shopping appeal to time-constrained and tech-savvy Asian consumers, further driving the fast fashion market growth.

- Expansion in Tier 2 and 3 cities: While major fast fashion brands have stores in metro cities, tier 2 and 3 cities in developing countries remain largely untapped. These cities have an emergent consumer class with fashion consciousness. Brands have significant room for expansion in small cities to access new demographics. Local partnerships and franchises can help build an omnichannel presence.

- Private labels and exclusivity: Private labels and capsule collections exclusive to certain brands and markets provide differentiation in an increasingly saturated market. Partnerships with local designers and influencers to launch private labels can resonate with consumers seeking exclusivity. Limited edition collections capitalize on trends like K-fashion, sustainable fashion, etc.

- Revamping brand identity and experience: Fast fashion brands need to revitalize their brand identity and shopping experience in Asia for the digital age. Elements like virtual trial rooms, interactive stores, elevated in-store experiences, and personalization can help brands stand apart. Marketing content focusing on Asian models, brand ambassadors, and celebrating local culture also helps build connections.

- Leveraging technologies in production and supply chain: Emerging technologies around forecasting, inventory management, logistics automation, AI-based design software, robotics, blockchain, etc. provide opportunities for fast fashion supply chains to be more agile and efficient. Adoption of such technologies can be a competitive advantage.

Asia Fast Fashion Market Restraints:

- Oversupply and decreasing profit margins: Intense competition is causing overcrowding and resultant price wars within the fast fashion segment. This is leading to declining margins as consumers have so many low-priced options. Heavy discounts and promotions are required to attract sales. Managing profitable growth is becoming difficult.

- High inventory and operational costs: The fast fashion model relies on significant inventory volumes across extended supply chains. This leads to high stocking, storage, markdown, and operational costs. Complex supply chains also make cost optimization difficult, especially with fluctuating material costs.

- Sustainability issues: Environmentally conscious consumers are concerned about the waste and pollution caused by fast fashion production systems. Brands have to invest significantly to improve processes, compliance, materials, etc. to address these concerns which impact revenues.

Analyst Viewpoint

However, market expansion can face challenges from increasing raw material costs and volatile cotton prices that may pinch margins for retailers. Additionally, strengthening local manufacturing in certain countries poses a threat to dominant low-cost hubs like Bangladesh and Cambodia. Sustainable practices still need more focus as the fast turnover of collections increases textile waste production in Asia.

Going forward, Southeast Asia is predicted to outpace others on the back of continued economic development and the rising spending power of digitally-savvy populations. Vietnam, the Philippines, and Indonesia specifically stand out as high-potential growth drivers for fast fashion companies looking to diversify operations beyond dominant China. Overall, the Asia market remains one of the brightest prospects.

Market Size in USD Bn

CAGR8.0%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 8.0% |

| Larget Market | Asia |

| Market Concentration | High |

| Major Players | Uniqlo, H & M, Zara, Mango, Forever 21 and Among Others |

please let us know !

Asia Fast Fashion Market Trends

- Sustainability through recycled materials and efficient processes: With growing awareness about sustainability, fast fashion brands are incorporating recycled polyester, nylon, cotton, and other materials into their collections. Production processes are being optimized to minimize waste and water usage. Consumers increasingly prefer brands with transparency and ethics around sourcing and labor.

- Online to offline commerce: Many pure online fast fashion retailers are now exploring physical stores to establish an omnichannel experience. A unified brand image and inventory system online and offline helps attract new customers and drive loyalty. High-street retail spaces also act as brand awareness and engagement channels.

- Personalization and customization: Younger demographics expect a personalized shopping experience both online and offline. Fast fashion brands allow the selection of customizable elements like prints, embroideries, buttons, lace, etc. while designing clothes on the website. Made-to-measure services in stores also provide curated options specific to body types.

- Mobile shopping: Smartphones are emerging as the primary mode for accessing fast fashion websites and apps. Brands are launching features like save to cart, social sharing, personalized recommendations, etc. targeted at mobile users. Easy payment options, discounts, and sales promotions are being offered to boost mobile purchases.

Segmental Analysis of Asia Fast Fashion Market

Competitive overview of Asia Fast Fashion Market

The Asia Fast Fashion Market is competitive and consists of some players in the market such as New Look, River Island, Matalan, Vero Moda, Only, Jack & Jones, Stradivarius, Bershka, Pull & Bear, Uniqlo, H&M, Zara, Mango, Forever 21, Topshop, Marks & Spencer, GAP, C&A, Benetton, Esprit

Asia Fast Fashion Market Leaders

- Uniqlo

- H & M

- Zara

- Mango

- Forever 21

Asia Fast Fashion Market - Competitive Rivalry

Asia Fast Fashion Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Asia Fast Fashion Market

New product launches

- In March 2022, H&M (shopping destination for fashion, home, beauty, kids' clothes and more) launched a new sustainable fashion line made from recycled polyester and organic cotton. The collection is aimed at young and environmentally conscious consumers.

- In January 2021, Uniqlo unveiled its new UTme! personalization service that allows customers to customize t-shirts with their own designs and text. This provides a unique fast fashion experience.

- In April 2020, Zara introduced its first-ever home decor line with more than 400 affordable pieces for living rooms, bedrooms, kitchens, and bathrooms reflecting the latest interior design trends.

Acquisition and partnerships

- In January 2022, Fast Retailing, the parent company of Uniqlo, acquired a minority stake in the luxury brand JW Anderson to strengthen its portfolio of brands across segments.

- In March 2021, H&M partnered with the China-based e-commerce giant Alibaba to launch the first H&M flagship store on Alibaba's Tmall marketplace to boost its online presence in China.

- In October 2020, Inditex, the parent company of Zara, partnered with the technology company Infinited Fiber to develop sustainable textiles using regenerated cotton and recycled materials in Zara's collections.

Asia Fast Fashion Market Segmentation

- By Product Type

- Top Wear

- Bottom Wear

- Dresses

- Jumpsuits

- Coats

- Jackets

- Others (lingerie, swimwear, accessories, etc.)

- By End User

- Men

- Women

- Kids

- Unisex

- Plus Size

- Petite

- Others (maternity, tall, big & tall, etc.)

- By Price Range

- Low

- Medium

- High

- Premium

- Luxury

- Runway

- Others (couture, bespoke, etc.)

- By Age Group

- Infants

- Toddlers

- Kids

- Teens

- Young Adults

- Adults

- Senior Citizens

- By Distribution Channel

- Online

- Offline

- Company Owned Stores

- Multi-Brand Stores

- Department Stores

- Supermarkets/Hypermarkets

- Others (TV, catalog, etc.)

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

Frequently Asked Questions :

How big is the Asia Fast Fashion Market?

The Asia Fast Fashion Market is estimated to be valued at USD 106.9 in 2025 and is expected to reach USD 183.2 Billion by 2032.

What are the major factors driving the Asia fast fashion market growth?

Rising disposable incomes, increasing youth population, growing e-commerce, penetration of social media, and demand for the latest fashion trends are factors that hamper the market

Which is the leading product segment in the Asia fast fashion market?

The top wear segment is the leading component in the Asia fast fashion market owing to the high demand for stylish and affordable tops and t-shirts.

Which are the major players operating in the Asia fast fashion market?

Major players include Uniqlo, H&M, Zara, Mango, Forever 21, Topshop, Marks & Spencer, GAP, and C&A among others.

Which region will lead the Asia fast fashion market?

The market is projected to grow at a CAGR of 8.0% from 2025 to 2032.