Akute Myeloid Leukemia AML Markt GRÖSSEN- UND MARKTANTEILSANALYSE - WACHSTUMSTRENDS UND PROGNOSEN (2024 - 2031)

Akute Myeloide Leukämie (AML) Markt wird von Therapy (Chemotherapy, Targeted Therapy, Immuntherapie), By Route of Administration (Oral, Intravenous), ....

Akute Myeloid Leukemia AML Markt Größe

Marktgröße in USD Bn

CAGR7.5%

| Studienzeitraum | 2024 - 2031 |

| Basisjahr der Schätzung | 2023 |

| CAGR | 7.5% |

| Marktkonzentration | Medium |

| Wichtige Akteure | Bristol-Myers Squibb, AbbVie, Pfeifen, F. Hoffmann-La Roche, Novartis und unter anderem |

Bitte lassen Sie es uns wissen!

Akute Myeloid Leukemia AML Markt Analyse

Der Markt der Acute Myeloid Leukemia (AML) wird geschätzt auf 1.613 Milliarden USD im Jahr 2024 und wird voraussichtlich erreichen 2.68 Milliarden USD bis 2031Wachstumsrate (CAGR) von 7,5% von 2024 bis 2031.

Die wachsende geriatrische Bevölkerung, die anfällig sind, AML zu entwickeln, kombiniert mit der steigenden Nachfrage nach gezielter Medikamententherapie für bessere Behandlungsergebnisse sind wichtige Faktoren erwartet, um das Wachstum des AML-Marktes zu treiben.

Akute Myeloid Leukemia AML Markt Trends

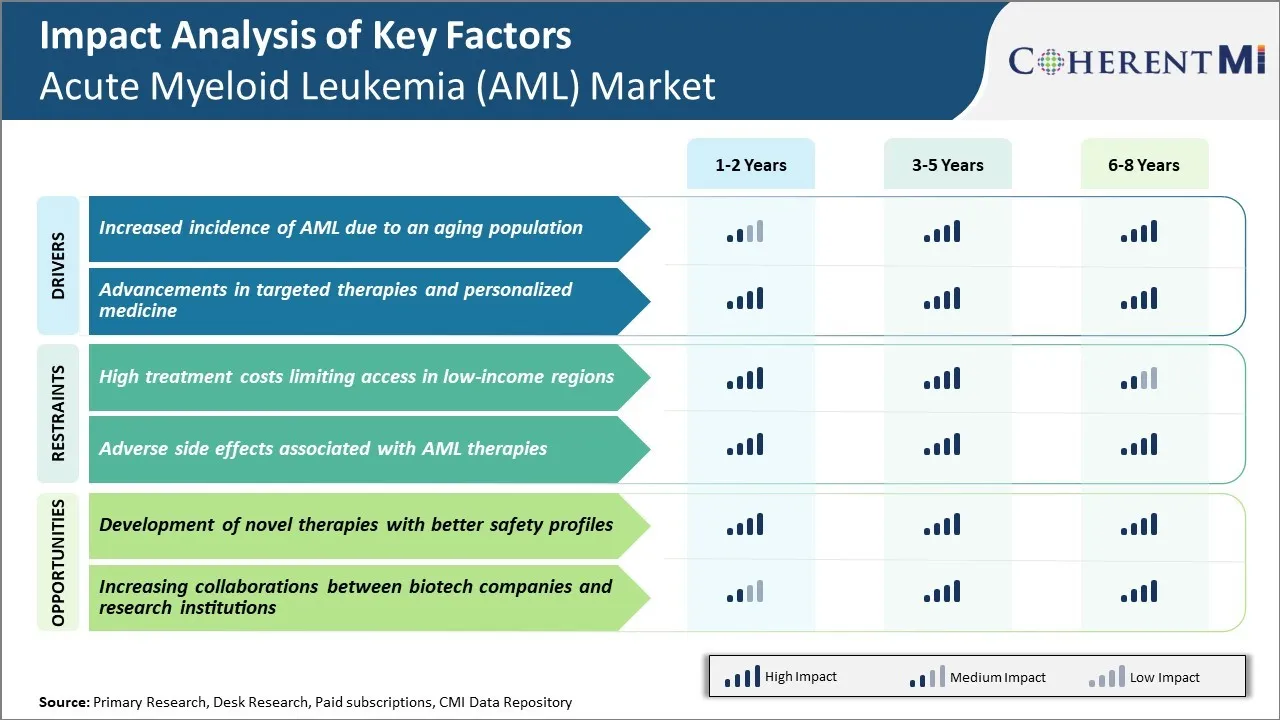

Markttreiber - Erhöhte Inzidenz von AML aufgrund einer alternden Bevölkerung

Da die Bevölkerung weltweit altert, dürften in den kommenden Jahren die Häufigkeiten der akuten myeloiden Leukämie deutlich steigen. Es ist eine etablierte Tatsache, dass AML Erwachsene mit rund 70 % der Fälle beeinflusst, die bei Menschen über 65 Jahren diagnostiziert werden.

Es wird projiziert, dass die Zahl der Menschen im Alter von 65 Jahren oder älter weltweit von den gegenwärtigen Ebenen bis 2050 auf über 1,5 Milliarden verdoppelt wird. Menschen in dieser Altersgruppe haben deutlich höhere Chancen, AML im Vergleich zu jüngeren Personen zu kontrahieren. Mit mehr der Bevölkerung, die in die Hochrisikoalterswinkel eintritt, können die absoluten AML-Fälle nicht unverändert bleiben. Auch in den entwickelten Märkten, in denen Gesundheitssysteme gut ausgestattet sind, wird eine höhere Caseload auf vorhandene Ressourcen und Infrastrukturen Druck setzen.

Abnehmendes Immunsystem und erhöhte Anfälligkeit für DNA-Schäden können ältere Menschen anfälliger für Blutkrebse wie AML machen. Höhere Prävalenz von Komorbiditäten trägt auch zu schlechteren Ergebnissen bei älteren Patienten bei. Während die FuE-Bemühungen weiterhin sicherere und effektivere Behandlungsoptionen entwickeln, garantiert die steigende geriatrische Bevölkerung allein in Zukunft steigende AML-Inzidenzraten.

Auch wenn die Kurzinsen sich geringfügig verbessern, wird der erwartete Spieß bei älteren Demografie solche Gewinne überwiegen, was zu einer Nettozunahme von AML-Patientenzahlen führt, die Pflege erfordern.

Markttreiber - Fortschritte in gezielten Therapien und personalisierter Medizin

Das Onkologiefeld hat in den letzten zehn Jahren transformative Forschung in gezielten Therapien und Präzisionsmedizin-Ansätzen für Blutkrebs gesehen. Das anspruchsvollere Verständnis der molekularen Pathogenese auf genetischer Ebene hat die Entwicklung neuartiger Behandlungsregime ermöglicht, die auf das individuelle Krankheitsprofil des Patienten zugeschnitten sind. Diese Umstellung auf biomarkergetriebene personalisierte Pflege bietet vielversprechende Perspektiven für die Verbesserung des AML-Managements.

Mit dem Aufkommen genomischer Profiling-Technologien können Kliniker nun spezifische genetische Mutationen und Anomalien identifizieren, die die Leukämie eines Patienten antreiben. Anhand solcher molekularer Erkenntnisse können gezielte Medikamente ausgewählt werden, die kritische pathogenetische Pfade und Proteine blockieren. Mehrere gezielte Wirkstoffe, die Mutationen in Genen wie FLT3, IDH1/2, BCL-2 angreifen, haben klinisch sinnvolle Reaktionen in klinischen Studien nachgewiesen. Weitere untersuchte Zielklassen umfassen Tyrosinkinaseinhibitoren, Hypomethylierungsmittel, BCL-2 Inhibitoren und Immuntherapiemittel.

Darüber hinaus werden adaptive Testdesigns zunehmend genutzt, um eine rasche regulatorische Zulassung neuer Therapien zu ermöglichen, die für bestimmte biomarkerdefinierte Subsets wirksam sind. Dies ermöglicht einen schnelleren Zugriff auf benutzerdefinierte Behandlungen. Kombinatorische Regime, die mehrere gezielte Medikamente verwenden, haben auch Potenzial, verbesserte Remissionsraten zu erreichen, indem sie gleichzeitig mehrere Krebswachstumswege blockieren. Insgesamt bietet die technologische Evolution viel Optimismus in Bezug auf verbesserte Ergebnisse, erhöhte Überlebenszeiten und höhere Lebensqualität für AML-Patienten.

Marktherausforderung - Hohe Behandlungskosten Begrenzung des Zugangs in Niedrigeinkommensregionen

Bei fast $150.000 pro Patient in den Vereinigten Staaten stellen die hohen Kosten der AML-Behandlung eine große Herausforderung für den Zugang in Niedrigeinkommensregionen weltweit dar. Die meisten AML-Medikamente benötigen längere Krankenhausaufenthalte für eine intensive Chemotherapie-Administration und viele Patienten benötigen auch Knochenmarktransplantation, erhöhen die Kosten weiter.

In Entwicklungsländern und Schwellenländern sind die Gesundheitsbudgets viel eingeschränkter und Standard-AML-Regime können über das hinausgehen, was die öffentliche Versicherung oder die Nicht-Pocket-Zahlungen unterstützen können. Dies schafft Ungerechtigkeit, wo Patienten in wohlhabenden Ländern Zugang zu den neuesten Medikamenten haben, während Patienten anderswo schlechtere Ergebnisse aufgrund nur finanzieller Einschränkungen auftreten.

Bei der Bewältigung dieser Zugangsprobleme durch Bemühungen wie z.B. verkettete Preismodelle oder Partnerschaften mit globalen Gesundheitsorganisationen könnte die Verfügbarkeit neuer Agenten in Regionen, in denen die Kosten als primäre Barriere für die Behandlung dienen, erweitert werden.

Marktchance - Entwicklung von neuartigen Therapien mit besseren Sicherheitsprofilen

Es besteht das Potenzial für neuartige AML-Therapien, nicht nur die Überlebensraten zu verbessern, sondern auch einige der Herausforderungen zu bewältigen, die mit den negativen Nebenwirkungen und Toleranzen der bestehenden Regimens verbunden sind. Zu den Explorationsgebieten gehören gezielte Therapien, die spezifische molekulare Pfade stören, die Leukämiezellen oder Immuntherapien antreiben, die das eigene Immunsystem des Körpers nutzen.

Eine vielversprechende neue Klasse ist Antikörper-Medikament konjugiert, dass Home Payload Antikrebs-Medikamente direkt an Leukämiezellen. Die Entwicklung von Therapien mit verbesserten Sicherheitsprofilen könnte Behandlungen für ältere oder krankere Patientenpopulationen besser geeignet machen und Krankenhausaufenthalte für die Chemotherapie-Administration vermeiden. Dies könnte die Gesamtkosten der Pflege senken, während die Märkte für neue Agenten zugänglich sind.

Präferenzen der Verschreiber von Akute Myeloid Leukemia AML Markt

Acute Myeloid Leukemia (AML) wird typischerweise durch Induktions-Chemotherapie behandelt, um die Krankheit in die Remission zu bringen. Die Frontline-Behandlung für jüngere Patienten beinhaltet eine "7+3"-Regelung - 7 Tage des Chemotherapeutikums Cytosin arabinoside (Markenname: Cytosar-U) kombiniert mit 3 Tagen eines Anthracyclins wie Daunorubicin (Markenname: Cerubidin) oder idarubicin (Markenname: Zavedos).

Für ältere oder ungeeignete Patienten, bei denen ein "7+3" als zu giftig angesehen wird, umfassen niedrigere Intensitätsoptionen allein oder in Kombination mit Hypomethylierungsmitteln wie Azacitidin (Markenname: Vidaza) oder Decitabin (Markenname: Dacogen). Nach der Remissionsbehandlung erfolgt dann die Konsolidierung der Chemotherapie unter Verwendung von hoch dosiertem Cytarabin, mit oder ohne Anthracyclin oder einer hämatopoietischen Stammzelltransplantation, wenn ein geeigneter Spender zur Verfügung steht.

Für rezidivierte oder feuerfeste Erkrankungen wenden sich Ärzte in der Regel zuerst an experimentelle Therapien. Venetoclax (Markenname: Venclexta) kombiniert mit Zytarabin mit niedriger Dosierung ist eine beliebte Option für ältere Patienten, die eine intensive Therapie nicht tolerieren können. Jüngere Patienten können Salvage Chemotherapie mit Mitoxantron, Etoposid und Cytarabin oder Clofarabin erhalten, bevor sie gegebenenfalls zu einer Stammzelltransplantation gelangen.

Zu den wichtigsten Faktoren, die die Vorlieben der Vorschreiber beeinflussen, gehören Alter, Leistungsstatus, Komorbiditäten und genetische/molekulare Risikofaktoren, die die Aggressivität der Behandlung bestimmen. Die Versicherungsdeckung und die Kosten sind auch wachsende Überlegungen.

Analyse der Behandlungsoptionen von Akute Myeloid Leukemia AML Markt

AML kann auf Basis von Zytogenetik und molekularer Anormalitäten in Standard-Risiko- und Hochrisiko-Krankheit eingestuft werden. Die Behandlung beinhaltet die Induktions-Chemotherapie in beiden Risikogruppen mit dem Ziel, Remission zu erreichen.

Für jüngere Patienten (<60yrs) mit Standard-Risiko AML ist die Standard-First-Line-Behandlung ein "7+3"-Regime mit kontinuierlicher Infusion von Cytarabin (Ara-C) für 7 Tage zusammen mit einem Anthracyclin wie Daunorubicin für 3 Tage. Dies induziert Remission bei 70-80% der Patienten. Post-Remission, Konsolidierung Chemotherapie mit High-Dosis Ara-C wird gegeben, um Rückfälle zu verhindern.

Für hochrisikoreiche AML- oder rezidivierte/refraktäre Krankheit handelt es sich bei dem bevorzugten Regime um ein Anthracyclin wie idarubicin oder Mitoxantron anstelle von Daunorubicin für einen "3+7"-Zeitplan, mit Midostaurin oder gemtuzumab ozogamicin für Patienten mit FLT3-Mutationen. Stem-Zelltransplantation, wenn möglich, bietet die beste Chance, für solche Patienten in der ersten Remission zu heilen.

Für rezidivierte/refraktäre AML, die für die Transplantation nicht geeignet sind, haben venetoclax-basierte Kombinationstherapien vielversprechende Ergebnisse gezeigt. Venetoclax in Kombination mit niedrig dosiertem Ara-C führte zu einer vollständigen Remissionsrate von 54 % und Median Gesamtüberleben von 14,7 Monaten in dieser Hochrisikopopulation. Kindler et al etablierte dieses neuartige Regime als eine effektive Salvage-Behandlung Option.

Wichtige Erfolgsstrategien der Hauptakteure von Akute Myeloid Leukemia AML Markt

Eine der erfolgreichsten angenommenen Strategien war die Entwicklung gezielter Therapien mit neuartigen Handlungsmechanismen. Im Jahr 2017 wurde Pfizers Medikament Rydapt (Midostaurin) für FLT3 Mutante AML zugelassen. Es zielt auf FLT3-Mutationen, die in rund 30% der AML-Patienten vorhanden sind. Rydapt war das erste Medikament, das speziell für FLT3 Mutante AML zugelassen wurde. Es half, die Überlebensraten zu verbessern und ist immer noch eine Standardbehandlungsoption.

Ein weiteres Beispiel ist die 2018 genehmigte Tafinlar + Mekinist-Kombination von GSK. Es zielt gezielt auf Mutationen in Genen wie KIT und RAS. Vorher gab es für diese Mutationen keine gezielten Therapien. Diese erweiterten Behandlungsoptionen für Patienten mit bestimmten hochrisikoreichen genetischen Subtypen.

Celgene's Vidaza und Dacogen haben 2004 bzw. 2006 als erste Medikamente in über 30 Jahren für AML zugelassen. Sie halfen, den Pflegestandard in der Zeit durch die Verbesserung der Symptome und des Überlebens neu zu gestalten. Diese etablierten Hypomethylierungsmittel als Mainstay in AML-Therapie.

In jüngster Zeit im Jahr 2017 wurde Pfizers BCL-2 Inhibitor Venclexta in Kombination mit Azacitidin oder Decitabin oder Niederdosis Cytarabin für ältere AML-Patienten beschleunigt. Dies markierte die erste Genehmigung eines BCL-2 Inhibitors und erweiterte Optionen. In Versuchen half es, die vollständigen Reaktionsraten und die gesamten Überlebensperioden zu erhöhen.

Segmentanalyse von Akute Myeloid Leukemia AML Markt

Insights, By Therapy: Die Dominanz von etablierten Medikamenten in der Behandlung Antriebe Chemotherapie hohen Anteil

Bei der Therapie trägt die Chemotherapie den höchsten Anteil des Marktes mit der Verfügbarkeit von mehreren etablierten Medikamentenoptionen bei, die die Haupthaltung der AML-Behandlung waren. Chemotherapie nutzt die Tatsache, dass AML ein Krebs des Blut- und Knochenmarks ist, mit malignen Zellen, die schneller als normale Zellen teilen.

Chemotherapeutische Drogen arbeiten daran, Krebszellen durch verschiedene Mechanismen schnell zu teilen. Medikamente wie Cytarabin, Anthracycline wie Daunorubicin und idarubicin und Hypomethylierungsmittel wie Azacitidin sind hochwirksam bei der Induktion von Remission bei AML-Patienten und haben jahrzehntelange klinische Beweise zur Feststellung ihrer Wirksamkeit und Sicherheitsprofile.

Die breite Akzeptanz und Vertrautheit von Onkologen und Patienten mit diesen Medikamenten trägt zur Chemotherapie bei, die die Behandlung der Wahl bleibt, insbesondere bei neu diagnostischen und älteren Patienten.

Insights, By Route of Administration: Oral Drugs führen Wachstum in der Route der Verwaltung

In Bezug auf den Verwaltungsweg trägt oral den höchsten Marktanteil des Marktes bei, der durch die zunehmende Akzeptanz neuartiger oraler Medikamente verursacht wird. Mehrere neuartige AML-Medikamente, die vor kurzem oder in späten Entwicklungsstadien zugelassen wurden, werden oral und nicht intravenös wie traditionelle Chemotherapie verabreicht.

Medikamente wie der BCL-2 Inhibitor venetoclax und FLT3 Inhibitor vergoldeteritinib haben sich als orale Formulierung erwiesen. Dies bietet deutliche Vorteile von Bequemlichkeit, Kostenersparnis durch die Verringerung von Krankenhausbesuchen und ambulante Medikamentenverwaltung. Die orale Verabreichung verbessert auch die Einhaltung der Behandlung und Compliance.

Das Wachstum in der Forschung zu oralen Formulierungen wird wahrscheinlich sehen, dass dieses Segment den Weg der Verabreichung für AML-Behandlung vorwärts dominiert.

Insights, By End User: Krankenhäuser Corner Major Disease Management Aufgrund der Infrastruktur

In Bezug auf Endverbraucher tragen Krankenhäuser aufgrund ihrer fortgeschrittenen Infrastruktur und Ressourcen für das Krebsmanagement den höchsten Anteil am AML-Markt bei. AML-Diagnose und Behandlung beinhaltet oft komplexe Regime wie Induktion, Konsolidierung und Wartung Chemotherapie, die stationäre Krankenhausaufenthalte erfordert.

Krankenhäuser haben Onkologieabteilungen, Knochenmarktransplantationsanlagen und gut ausgebildete Ärzte und Krankenschwestern gewidmet, die mit intensiven Chemotherapie-Protokollen vertraut sind. Das Verwalten von Nebenwirkungen von Therapien profitiert auch von den rund um die Uhr überwachten Krankenhäusern.

Während Spezialkliniken zunehmend an langfristigen Follow-ups beteiligt sind, bleiben Krankenhäuser der primäre Punkt der Pflege für die Erstverwaltung, Induktionstherapie und anschließende Behandlungslinien für AML. Dies treibt ihre Position als Hauptendbenutzersegment an.

Zusätzliche Einblicke von Akute Myeloid Leukemia AML Markt

- Die wichtigsten Daten unterstreichen die 42.000+ Fälle von AML in den wichtigsten Märkten im Jahr 2022, mit dieser Zahl erwartet rund 48.000 bis 2031 zu erreichen. Die hohe Prävalenz von AML in den USA und Japan treibt Marktwachstum an.

- Die Zunahme der Kooperationen zwischen Pharmaunternehmen für die seltene Krankheitsforschung hat die Fortschritte bei der Behandlung, insbesondere in den Bereichen Gentherapie und RNA-basierte Lösungen, beschleunigt.

Wettbewerbsübersicht von Akute Myeloid Leukemia AML Markt

Zu den wichtigsten Akteuren im Acute Myeloid Leukemia (AML) Markt gehören Bristol-Myers Squibb, AbbVie, Pfizer, F. Hoffmann-La Roche und Novartis.

Akute Myeloid Leukemia AML Markt Marktführer

- Bristol-Myers Squibb

- AbbVie

- Pfeifen

- F. Hoffmann-La Roche

- Novartis

Akute Myeloid Leukemia AML Markt - Wettbewerbsrivalität

Akute Myeloid Leukemia AML Markt

(Von großen Akteuren dominiert)

(Hoher Wettbewerb mit vielen Akteuren.)

Neueste Entwicklungen in Akute Myeloid Leukemia AML Markt

- Im Jahr 2022 genehmigte die FDA REZLIDHIATM (olutasidenib) zur Behandlung von erwachsenen Patienten mit rezidivierten oder feuerfesten akuten myeloiden Leukämie (AML), die eine anfällige IDH1-Mutation aufweisen. Olutasidenib zielt gezielt auf Mutationen im Isocitrat-Dehydrogenase-1 (IDH1)-Gen, das in einer Teilmenge von AML-Fällen impliziert wird. Diese Zulassung erweitert therapeutische Möglichkeiten für Patienten mit rezidiviertem oder feuerfestem AML und bietet eine gezielte Behandlung für diejenigen mit dieser genetischen Mutation, die das Gesamtmanagement der Krankheit verbessern.

- Bristol-Myers Squibb (BMS) gab bekannt, dass es in seiner Pipeline für Acute Myeloid Leukemia (AML) Therapien Fortschritte gemacht hat, insbesondere im Bereich der Kombinationstherapien. BMS konzentriert sich auf die Förderung innovativer Behandlungen durch die Kombination bestehender Medikamente und Untersuchungsmittel zur Verbesserung der Patientenergebnisse. Die Forschung des Unternehmens in der Onkologie, einschließlich AML, untersucht, wie Kombinationstherapien effektivere Behandlungsoptionen bieten können, insbesondere für anspruchsvolle Krebsarten wie AML, die traditionell schwierig mit einem einzigen Drogenansatz zu behandeln waren.

Akute Myeloid Leukemia AML Markt Segmentierung

- Von der Therapie

- Chemotherapie

- Gezielte Therapie

- Immuntherapie

- Durch die Route der Verwaltung

- Oral

- Intravenös (IV)

- Von Ende Benutzer

- Krankenhäuser

- Spezialkliniken

- Durch den Verteilerkanal

- Krankenhaus Apotheke

- Einzelhandel

Möchten Sie die Möglichkeit erkunden, einzelne Abschnitte dieses Berichts zu kaufen?

Häufig gestellte Fragen :

Wie groß ist die akute myeloide Leukämie (AML) Markt?

Der Acute Myeloid Leukemia (AML) Markt wird im Jahr 2024 auf 1,613 Milliarden USD geschätzt und wird voraussichtlich bis 2031 auf 2,68 Milliarden USD erreichen.

Was sind die wichtigsten Faktoren, die das Wachstum des Acute Myeloid Leukemia (AML) Markts behindern?

Die hohen Behandlungskosten begrenzen den Zugang in Niedrigeinkommensregionen und negative Nebenwirkungen im Zusammenhang mit AML-Therapien sind die Hauptfaktoren, die das Wachstum des Acute Myeloid Leukemia (AML) Markts behindern.

Was sind die wichtigsten Faktoren, die das Marktwachstum von Acute Myeloid Leukemia (AML) vorantreiben?

Die zunehmende Inzidenz von AML durch eine alternde Bevölkerung und Fortschritte bei gezielten Therapien und personalisierten Medikamenten sind die wichtigsten Faktoren, die den Acute Myeloid Leukemia (AML) Markt treiben.

Welches ist die führende Therapie im Acute Myeloid Leukemia (AML) Markt?

Das führende Therapiesegment ist die Chemotherapie.

Welche sind die Hauptakteure im Acute Myeloid Leukemia (AML) Markt?

Bristol-Myers Squibb, AbbVie, Pfizer, F. Hoffmann-La Roche undNovartis sind die wichtigsten Spieler.

Was wird das CAGR des Acute Myeloid Leukemia (AML) Markts sein?

Der CAGR-Markt der Acute Myeloid Leukemia (AML) wird von 2024-2031 auf 7,5% prognostiziert.