Bacterial Vaginosis Markt GRÖSSEN- UND MARKTANTEILSANALYSE - WACHSTUMSTRENDS UND PROGNOSEN (2024 - 2031)

Bacterial Vaginosis Markt wird durch Behandlung (Antibiotics (Metronidazole, Clindamycin, Tinidazole), Antifungal AgentsProbiotics), By Route of Admin....

Bacterial Vaginosis Markt Größe

Marktgröße in USD Bn

CAGR8.7%

| Studienzeitraum | 2024 - 2031 |

| Basisjahr der Schätzung | 2023 |

| CAGR | 8.7% |

| Marktkonzentration | Medium |

| Wichtige Akteure | Symbiomix Therapeutics (Lupin Pharmaceuticals), Bayer AG, Pfizer Inc., Sanofi S.A., Teva Pharmaceutical Industrien und unter anderem |

Bitte lassen Sie es uns wissen!

Bacterial Vaginosis Markt Analyse

Der bakterielle Vaginosemarkt wird geschätzt auf 3,48 Milliarden USD in 2024 und wird voraussichtlich erreichen 6,26 Milliarden USD bis 2031, Wachstumsrate (CAGR) von 8,7% von 2024 bis 2031.

Der Markt erlebt in den letzten Jahren positive Trends. Faktoren wie die steigende Prävalenz von bakteriellen Vaginoseinfektionen und das Wachstum der weiblichen Bevölkerung haben die Einführung von bakteriellen Vaginosebehandlung und Diagnostik vorangetrieben.

Bacterial Vaginosis Markt Trends

Markttreiber - Global Rise in Bacterial Vaginosis Cases erhöht die Nachfrage nach effektiven Behandlungen

Bakterielle Vaginose oder BV ist eine der häufigsten Ursachen für vaginale Infektionen unter Frauen. Nach unserer Forschung hat die weltweite Prävalenz von BV-Fällen in den letzten Jahren einen bemerkenswerten Anstieg gezeigt. BV verursacht oft unangenehme Symptome wie anormale vaginale Entladung und fischiger Geruch, der die Lebensqualität und das Wohlbefinden der betroffenen Frauen beeinflusst. Dies hat zu einer wachsenden Nachfrage nach effektiven Therapien, die Beschwerden schneller lindern und die Infektion vollständig heilen kann.

Pharmaunternehmen, die an der Entwicklung von Behandlungsoptionen für BV beteiligt sind, haben beträchtliche Gewinne gemeldet, da mehr Patienten jetzt für Medikamente entscheiden, anstatt das Problem zu ignorieren oder sich nur auf überzählige Heilmittel zu verlassen, die oft vorübergehende Erleichterung bieten. Verschreibungspflichtige Medikamente, die antibakterielle und entzündungshemmende Mittel enthalten, werden für ihren gezielten Ansatz bevorzugt, um die kausativen Bakterien loszuwerden und Wiederauftreten zu verhindern, sobald der Kurs abgeschlossen ist.

Die steigende globale Krankheitsprävalenz veranlasst somit die Gesamtnachfrage nach zuverlässigen BV-Therapien. Pharmafirmen arbeiten aktiv an neuen Medikamentenformulierungen, Kombinationstherapien und diagnostischen Tools, um die Bedürfnisse zu erfüllen und ihren Marktanteil zu erweitern. Insgesamt scheint die moderne Medizin von diesem Aufwärtstrend bei Infektionen profitieren, die durch Bakterienvaginose weltweit verursacht werden.

Markttreiber - Enhanced Public Health Campaigns erhöhen Aufmerksamkeit über Frauen reproduktive Gesundheit

In letzter Zeit, mit der Verbesserung der Bildungsniveaus und der wachsenden Offenheit in der Gesellschaft, Gespräche über Frauen reproduktive Gesundheitsprobleme sind weniger Tabu geworden. Verschiedene gemeinnützige Organisationen und öffentliche Einrichtungen haben umfangreiche Aufklärungsprogramme durch verschiedene Medien gestartet, um Frauen über häufige gynäkologische Infektionen wie bakterielle Vaginose oder BV und die Bedeutung der rechtzeitigen Diagnose und Behandlung zu erziehen.

Diese Kampagnen zeigen, wie häufige vaginale Infektionen die natürliche pH-Balance im Genitaltrakt stören können, wodurch Frauen anfälliger für die Kontraktion sexuell übertragbarer Krankheiten sind. Sie betonen, dass BV, obwohl ein milder Zustand von sich selbst nicht ignoriert werden sollte, da es möglicherweise opportunistische Infektionen zu halten ermöglichen könnte.

Mehrere Fernseh-, Radio- und Digitalwerbungen präsentieren kandidierte noch vernünftige Messaging auf Anzeichen und Symptome von Anomalien, die eine medizinische Überprüfung rechtfertigen. Während sie achtsam sind, keine unnötigen Sorgen zu verursachen oder Fehlinformationen zu verbreiten, motivieren sie Frauen, ihre Körper zu respektieren und fundierte Gesundheitsentscheidungen zu treffen, ohne sich der sozialen Stigma zu stellen.

Ein Ergebnis dieser nachhaltigen Antriebe war ein Anstieg des Gesundheitsverhaltens. Mehr Frauen besuchen jetzt allgemeine Ärzte oder Gynäkologen, um ungewöhnliche vaginale Entladung zu bemerken. Insgesamt hilft eine solche Kultivierung von Wissen sowohl individuelles Wohlbefinden als auch öffentliche Gesundheit, indem sie Komplikationen im Massenmaßstab hemmt.

Marktherausforderung - wachsender Widerstand gegen Standard-Antibiotika kann Behandlung Effizienz reduzieren

Eine der größten Herausforderungen, denen der Bakterienvaginosemarkt gegenübersteht, ist die zunehmende Resistenz gegen Standard-Antibiotikabehandlungen, die derzeit eingesetzt werden. Bakterielle Vaginose wird häufig mit Antibiotika wie Metronidazol und Clindamycin behandelt.

Studien zeigen jedoch, dass sich diese Erstlinienbehandlungsoptionen widersetzen. Die Resistenz gegen Metronidazol, das am häufigsten verschriebene Antibiotikum für BV, wurde berichtet, dass sich zwischen 15-40% weltweit. Ebenso steigt auch die Resistenz gegenüber anderen Standardbiotika. Dies stellt eine erhebliche Bedrohung dar, da sie die Wirksamkeit der gegenwärtigen Behandlungssysteme reduzieren und die BV immer schwieriger behandeln kann.

Bei begrenzten Behandlungsoptionen kann die Antibiotikaresistenz die Patientenergebnisse möglicherweise verschlechtern und zu häufigeren Rückfällen oder wiederkehrenden Infektionen führen. Es könnte auch die Gesundheitskosten erhöhen, wenn Patienten längere oder komplexere oder teure Therapiemöglichkeiten benötigen. Dieser wachsende Widerstand unterstreicht die Notwendigkeit neuartiger Behandlungsalternativen mit neuen Handlungsmechanismen, um aufstrebende Widerstandsprobleme zu umgehen und langfristig effektivere Lösungen für das BV-Management zu schaffen.

Marktchance - Entwicklung von neuartigen Behandlungen mit verbesserten Sicherheitsprofilen

Eine der großen Chancen auf dem bakteriellen Vaginosemarkt ist die Entwicklung neuartiger Behandlungsoptionen, die Sicherheitsprofile gegenüber Standard-Antibiotikum-Therapien verbessert haben. Aktuelle Erstlinienbehandlungen wie Metronidazol und Clindamycin sind oft mit Nebenwirkungen wie Übelkeit, Erbrechen und Durchfall verbunden, die die Patientenkonformität beeinflussen können.

Auch die jüngsten Studien haben potenzielle langfristige Nebenwirkungen mit verlängerter Antibiotika-Nutzung einschließlich erhöhter Risiken von Antibiotikaresistenz, Allergien und opportunistischen Infektionen angezeigt. Dies stellt einen großen Bedarf an sichereren und besser tolerierten nicht-antibiotischen Behandlungsalternativen dar.

Neuartige Arzneimittelformulierungen, neue Arzneimittelklassen, Probiotika oder Mikrobiom-basierte Therapien können diese Notwendigkeit möglicherweise ansprechen, indem sicherere Optionen für BV mit freundlichen Profilen und potenziell verbesserten Wirksamkeit zu bieten. Ihre erfolgreiche Entwicklung und Kommerzialisierung wird einen bedeutenden Anteil am Markt erfassen, da sie die Verträglichkeitsbegrenzungen bestehender Standards von Pflege-Antibiotika stark verbessern die Patientenerfahrung und klinische Ergebnisse für die bakterielle Vaginosebehandlung.

Präferenzen der Verschreiber von Bacterial Vaginosis Markt

Bacterial Vaginosis (BV) wird häufig über einen Zweilinienansatz behandelt. Für milde Fälle verschreiben Ärzte typischerweise einen kurzen Verlauf der topischen Therapie mit Antibakterien wie Clindamycin Vaginalcreme (Clindesse). Diese Behandlungslinie bietet Erleichterung von Symptomen wie Entladung und Geruch innerhalb einer Woche.

Für moderate bis schwere Fälle entscheiden sich die Ärzte über einen Zeitraum von fünf Tagen für die orale Verabreichung. Zu den orale Erstlinienbehandlungen gehören Metronidazol (Flagyl) und Tinidazol (Tindamax), die allgemein kostengünstige generische Optionen sind. Wenn orale Therapien nicht funktionieren oder Symptome nach der ersten Linie wieder auftreten, wechseln Ärzte zu Zweitlinien-Regime. Secnidazol (Solosec) ist eine gute Zweitlinien-Option, da es nur eine einzige 2g Dosis benötigt. Eine weitere bevorzugte Wahl ist Clindamycin Kapseln (Cleocin), obwohl sein längerer siebentägiger Kurs die Einhaltung betrifft.

Die Stadiums- und Wiederauftretensrate der Infektion führt auch Vorschreiber. Chronische oder rezidive BV kann zugrunde liegende Probleme signalisieren, die Verwendung von Kombinationstherapie wie Metronidazol mit vaginalen Probiotika oder Östrogen. Kosten, einfache Verwaltung und Versicherungsdeckung weitere Auswirkungen Drogenauswahl bei jeder Behandlungslinie. Dies sorgt für eine Balance zwischen Wirksamkeit, Sicherheit, Haftung und Erschwinglichkeit für den Patienten.

Analyse der Behandlungsoptionen von Bacterial Vaginosis Markt

Bacterial Vaginosis hat drei Hauptstufen - mild, mittelschwer und schwer - bestimmt durch Symptome und Testergebnisse. Für milde Fälle, Über-die-Gegenbehandlung Optionen umfassen Clindamycin Cremes intravaginal für 5-7 Tage angewendet. Markennamen sind Clindagel und Clindesse. Dies ist eine gute First-Line-Option durch einfache Bedienung.

Für mäßige bis schwere Fälle werden orale Antibiotika bevorzugt. Metronidazol ist in der Regel die erste Wahl aufgrund von niedrigen Kosten und klinischen Nachweisen der Wirksamkeit. Häufige Marken sind Flagyl und Metrogel. Ein 7-Tage-Regime von 500mg zweimal täglich ist am effektivsten. Wenn Metronidazol fehlschlägt oder nicht geeignet ist, können Clindamycin Pillen (Markennamen Cleocin und Dalacin) für 7 Tage bei 300mg zweimal täglich verschrieben werden. Kombinationstherapie mit Metronidazol Pillen gefolgt von Clindamycin-Creme wird auch für schwere oder wiederkehrende Fälle zur Verbesserung der Heilungsraten empfohlen.

Wenn die ursprüngliche Antibiotikabehandlung nicht funktioniert, ist eine weitere Prüfung erforderlich, um andere Infektionen auszuschließen oder festzustellen, ob der identifizierte Organismus Widerstand entwickelt hat. Zweitlinienoptionen hängen von Risikofaktoren und Kultur/Sensitivitätsergebnissen ab, können aber 10–14-Tage-Kurse neuer Antibiotika wie Tinidazol (Tindamax) oder längerfristige Unterdrückungstherapie mit sauren Gelen wie Balance Activ umfassen. Eine enge Überwachung von Hochrisikofällen ist auch notwendig, um Recurrences frühzeitig zu verwalten.

Wichtige Erfolgsstrategien der Hauptakteure von Bacterial Vaginosis Markt

Produktinnovation und Erweiterung: Die Einführung neuer und verbesserter Behandlungslösungen hat den Unternehmen geholfen, einen Vorsprung zu erzielen. So startete Bayer im Jahr 2019 eine neue Behandlungsoption Clindamax CV, eine Erweiterung seiner bestehenden Clindamycin-Produkte für BV. Die Gelformulierung gewährleistet eine höhere Konzentration des Medikaments in den vaginalen Geweben, wo es benötigt wird.

Erwerb: Unternehmen haben ihren Marktanteil und ihre Produktportfolios durch strategische Akquisitionen gewachsen. Im Jahr 2020 erwarb Pfizer Array BioPharma und fügte mehrere klinisch-stufige Produkte zu seiner Pipeline hinzu, darunter ARRay 514, eine orale Behandlung unter Phasen-2-Studien für BV. Dies verstärkte die Position von Pfizer in der Frauengesundheit und die Übernahme brachte auch Arrays FuE-Know-how mit sich.

Kooperationsabkommen: Partnerschaften ermöglichen es Unternehmen, die Kernkompetenzen und Marketingnetzwerke gegenseitig zu nutzen. 2016 unterzeichnete Therapic eine Vereinbarung mit Meda Pharma, um sein verschreibungspflichtiges Gel für BV, Solosec, auf europäischen Märkten zu verkaufen. In einem Jahr des Starts verzeichnete Solosec 12 Millionen Euro Umsatz. Diese validierte Marketingstrategie der Therapie, sich mit einem erfahrenen Partner in der Gesundheit von Frauen zusammenzuarbeiten.

Fokus auf Schwellenländer: Mit zunehmendem Bewusstsein und einem verbesserten Zugang zu Pflege investieren Unternehmen in Schwellenregionen wie Asien-Pazifik und Lateinamerika, die voraussichtlich hohe Wachstumsmärkte sein werden.

Segmentanalyse von Bacterial Vaginosis Markt

Insights, Durch die Behandlung: Hohe Effizienz bei der Erstickung von Causative Bacteria Drives Antibiotics Segment Dominance

Antibiotika tragen aufgrund ihrer hohen Wirksamkeit bei der Ausrottung der Erreger den höchsten Marktanteil des Marktes bei. Antibiotika wie Metronidazol gelten als erste Linienbehandlung für Bakterienvaginose aufgrund ihrer Fähigkeit, anaerobe Bakterien wie Gardnerella vaginalis zu töten, die die Infektion verursachen.

Insbesondere Metronidazol ist aufgrund seiner Fähigkeit, das vaginale Epithel zu durchdringen und therapeutische Konzentrationen in der vaginalen Flüssigkeit für längere Zeiträume zu halten, sehr wirksam. Dies gewährleistet eine optimale Behandlung der Infektion.

Andere Antibiotika sind Clindamycin und Tinidazol, die auch eine starke bakterizide Wirksamkeit gegen Anaerobe zeigen. Die sofortige Linderung von Antibiotika-Symptomen erhöht die Patientenkonformität mit dem Behandlungsregime weiter. Dies führt zu höheren Heilungsraten und reduziert das Risiko von Wiederauftreten im Vergleich zu alternativen Behandlungsoptionen.

Der bewährte Nachweis von Antibiotika in Symptom-Auflösung zusammen mit Arztempfehlungen treiben ihre weit verbreitete Annahme bei Patienten und Ärzten gleichermaßen. Diese weit verbreitete Akzeptanz und bewährte Wirksamkeit haben es Antibiotika ermöglicht, den größten Teil des bakteriellen Vaginosemarktes zu erfassen.

Insights, By Route of Administration: Oral Administration verbessert die Behandlung Convenience und Adherence

Unter den Verwaltungswegen für die bakterielle Vaginosebehandlung trägt das orale Segment aufgrund verbesserter Bequemlichkeit und Einhaltung den höchsten Anteil am Markt bei. Die orale Route bietet eine problemlose Selbstverwaltung von Medikamenten ohne Beteiligung eines Gesundheitsdienstleisters. Dies ermöglicht eine diskrete Behandlung der Infektion aus der Privatsphäre des eigenen Zuhauses.

Die oralen Medikamente benötigen auch keine speziellen Applikatoren zum Einfügen wie topische Formulierungen. Dies vermeidet jeden Schmerz oder Chaos mit Cremes und Gelen verbunden. Darüber hinaus haben orale Medikamente eine konsequente und anhaltende Freisetzung des Wirkstoffs, wodurch therapeutische Drogenwerte effizient erreicht werden. Ihre einfache ein- oder zweimal tägliche Dosierung passt gut in die Tagespläne des Patienten. Dies erhöht die Einhaltung der Behandlung und die Einhaltung erheblich.

Dadurch liefert die orale Route eine zuverlässigere Behandlungserfahrung im Vergleich zu aktuellen Optionen. Die nicht-invasive Natur und Bequemlichkeit der oralen Verabreichung richtet sich an eine große Patientenpräferenz für diskrete und stressfreie Behandlung. Dies treibt deutlich höhere Aufnahme und Einhaltung von oralen Medikamenten im Vergleich zu anderen Verabreichungswegen im bakteriellen Vaginosemarkt.

Einblicke, nach Verteilung Kanäle: Zugänglichkeit und breite Akzeptanz Antriebe Hospital Segment Leadership

Unter den Vertriebskanälen im bakteriellen Vaginosemarkt tragen Krankenhäuser aufgrund der weit verbreiteten Zugänglichkeit und Akzeptanz den höchsten Anteil bei. Als primärer Pflegepunkt für die meisten bakteriellen Vaginose-Patienten bieten Krankenhäuser einen einfachen Zugang zu Diagnose- und Behandlungsoptionen. Umfassende Gynäkologie-Dienste unter einem Dach Adresse alle Patienten braucht effizient.

Die Krankenhausinfrastruktur ermöglicht zudem eine nahtlose Koordination zwischen Fachärzten, Diagnoseeinrichtungen, Apotheken und Supportpersonal. Dadurch wird die Patientenreise von der Diagnose über das Rezept- und Compliance-Management beschleunigt. Krankenhäuser profitieren auch von großen Patientenmengen, die die Beschaffung von Qualitätsmedikamenten in Massen zu wirtschaftlichen Preisen ermöglichen. Die Kostenersparnis wird an Patienten in Form erschwinglicher Behandlungspakete weitergegeben.

Darüber hinaus genießen Krankenhäuser hohe Glaubwürdigkeit und Vertrauenswürdigkeit bei Patienten, die sich daran gewöhnt haben, spezialisierte Versorgung in diesem Umfeld zu erhalten. Gegründete Marken und positive Erfahrungen aus der Vergangenheit führen zu einer wiederholten Patronisierung der Krankenhausbehandlung. Das Vertrauen in das Krankenhaus-Know-how kombiniert mit Zugänglichkeit und Erreichbarkeit hat dies zum bevorzugten und am weitesten verbreiteten Kanal für das bakterielle Vaginosemanagement gemacht.

Zusätzliche Einblicke von Bacterial Vaginosis Markt

- Hohe Rekursivität Steuersätze Studien zeigen, dass bis zu 30 % der Frauen innerhalb von drei Monaten nach der Behandlung eine Wiederholung der bakteriellen Vaginose erfahren, was die Notwendigkeit einer effektiveren Therapie hervorhebt.

- Global Impact: Bacterial vaginosis betrifft geschätzt 21 Millionen Frauen weltweit jährlich, so dass es die häufigste vaginale Infektion unter Frauen des reproduktiven Alters.

- Einführung von Single-Dose Therapien: Die Zulassung von Einzeldosen oralen Behandlungen wie Solosec hat die Patientenhaftung durch die Vereinfachung der Dosierung wesentlich verbessert.

- Collaborative Research Efforts: Partnerschaften zwischen Pharmaunternehmen und Forschungseinrichtungen konzentrieren sich auf das Verständnis der Rolle des Mikrobioms bei der bakteriellen Vaginose, die zu gezielteren Therapien führen kann.

Wettbewerbsübersicht von Bacterial Vaginosis Markt

Zu den wichtigsten Akteuren des Bacterial Vaginosis Market gehören Symbiomix Therapeutics (Lupin Pharmaceuticals), Bayer AG, Pfizer Inc., Sanofi S.A., Teva Pharmaceutical Industries, Abbott Laboratories, Novartis AG, Johnson & Johnson und Merck & Co., Inc.

Bacterial Vaginosis Markt Marktführer

- Symbiomix Therapeutics (Lupin Pharmaceuticals)

- Bayer AG

- Pfizer Inc.

- Sanofi S.A.

- Teva Pharmaceutical Industrien

Bacterial Vaginosis Markt - Wettbewerbsrivalität

Bacterial Vaginosis Markt

(Von großen Akteuren dominiert)

(Hoher Wettbewerb mit vielen Akteuren.)

Neueste Entwicklungen in Bacterial Vaginosis Markt

- Im Juni 2023 erweiterte Symbiomix Therapeutics die Verfügbarkeit von Solosec auf europäische Märkte. Dieser Schritt zielt darauf ab, den Zugang zu Einzeldosierbehandlungen zu verbessern, die Patienten Compliance und Ergebnisse zu verbessern. Symbiomix Therapeutics wurde 2017 von Lupin Pharmaceuticals erworben. Während Lupin eine globale Präsenz hat, gab es keine offiziellen Erklärungen oder regulatorischen Genehmigungen berichtet, dass die Erweiterung von Solosec in Europa bis zu diesem Zeitpunkt bestätigt.

- Im September 2023 startete Pfizer Inc. eine klinische Studie für eine neue probiotische Therapie mit dem Ziel der Bakterienvaginose. Die Initiative könnte zu alternativen Behandlungen führen, die die Abhängigkeit von Antibiotika verringern und Antibiotikaresistenzbedenken ansprechen.

Bacterial Vaginosis Markt Segmentierung

- Durch Behandlung

- Antibiotika

- Metronidazol

- Clindamycin

- Tinidazol

- Antifungal Agents

- Probiotika

- Antibiotika

- Durch die Route der Verwaltung

- Oral

- Thema

- Cremes

- Gele

- Suppositorien

- Durch den Verteilerkanal

- Krankenhäuser

- Kliniken

- Einzelhandel

- Online-Apotheken

Möchten Sie die Möglichkeit erkunden, einzelne Abschnitte dieses Berichts zu kaufen?

Häufig gestellte Fragen :

Wie groß ist der bakterielle Vaginosemarkt?

Der bakterielle Vaginosemarkt wird im Jahr 2024 auf 3,48 Mrd. USD geschätzt und soll bis 2031 6,26 Mrd. USD erreichen.

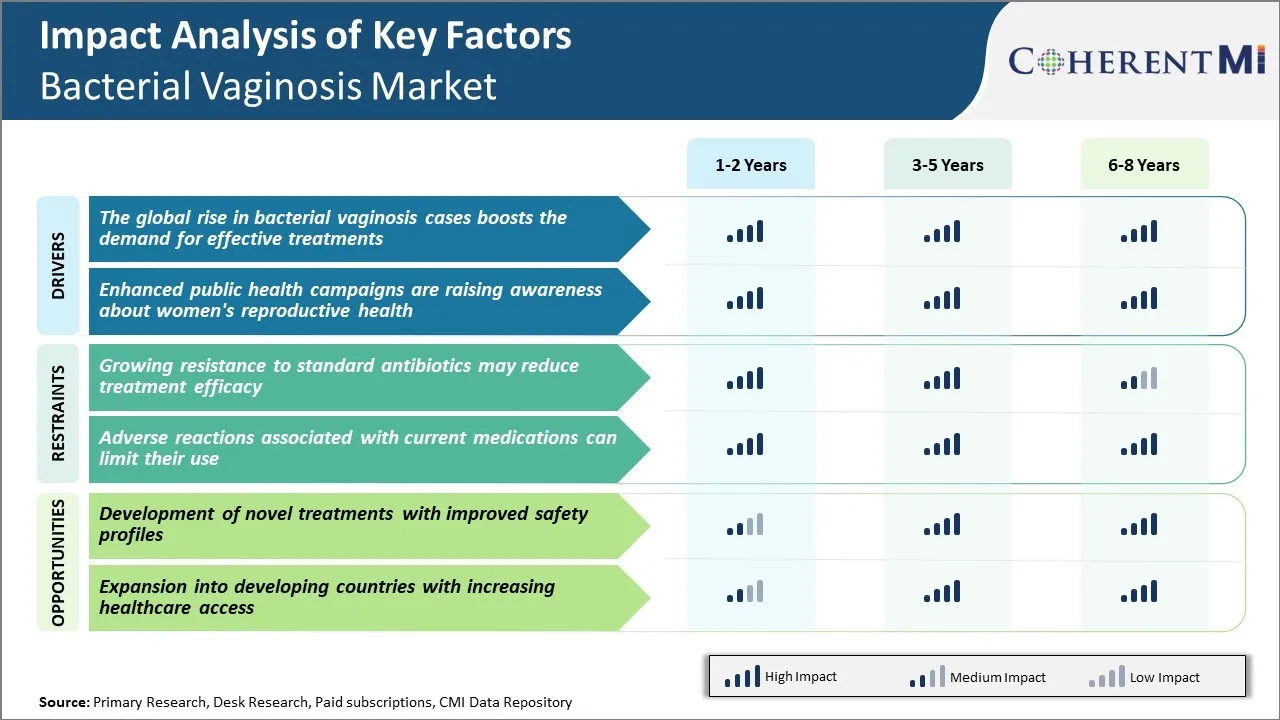

Was sind die wichtigsten Faktoren, die das Wachstum des bakteriellen Vaginosemarktes behindern?

Die zunehmende Resistenz gegen Standardantibiotika kann die Wirksamkeit der Behandlung reduzieren und negative Reaktionen, die mit aktuellen Medikamenten verbunden sind, können ihre Verwendung begrenzen, sind die wichtigsten Faktoren, die das Wachstum des Bakterienvaginosemarktes behindern.

Was sind die wichtigsten Faktoren, die das Wachstum des bakteriellen Vaginosemarktes treiben?

Der globale Anstieg der bakteriellen Vaginose-Fälle erhöht die Nachfrage nach effektiven Behandlungen und verstärkte öffentliche Gesundheitskampagnen erhöhen das Bewusstsein für die reproduktive Gesundheit der Frauen sind die wichtigsten Faktoren, die den bakteriellen Vaginosemarkt antreiben.

Welches ist die führende Behandlung im bakteriellen Vaginosemarkt?

Das führende Behandlungssegment ist Antibiotika.

Welche sind die wichtigsten Spieler, die im bakteriellen Vaginosemarkt tätig sind?

Symbiomix Therapeutics (Lupin Pharmaceuticals), Bayer AG, Pfizer Inc., Sanofi S.A., Teva Pharmaceutical Industries, Abbott Laboratories, Novartis AG, Johnson & Johnson und Merck & Co., Inc. sind die Hauptakteure.

Was wird das CAGR des bakteriellen Vaginosemarktes sein?

Der CAGR des Bacterial Vaginosis-Marktes wird von 2024-2031 auf 8,7% projiziert.