Diaphragm Pumps Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Diaphragm Pumps Market is segmented By Mechanism (Air Operated, Electrically Operated), By Operation (Double, Single), By End Use (Oil & Gas, Food & B....

Diaphragm Pumps Market Size

Market Size in USD Bn

CAGR5.86%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 5.86% |

| Market Concentration | High |

| Major Players | IDEX Corporation, Yamada Corporation, Flowserve Corporation, Ingersoll Rand, Grundfos Holding A/S and Among Others. |

please let us know !

Diaphragm Pumps Market Analysis

The diaphragm pumps market is estimated to be valued at USD 7.04 Bn in 2024 and is expected to reach USD 10.49 Bn by 2031. It is projected to grow at a compound annual growth rate (CAGR) of 5.86% from 2024 to 2031. The diaphragm pumps market is expected to witness steady growth due to factors such as growing need for fluid transfer applications, rising infrastructure development activities, and increasing investments in wastewater management.

Diaphragm Pumps Market Trends

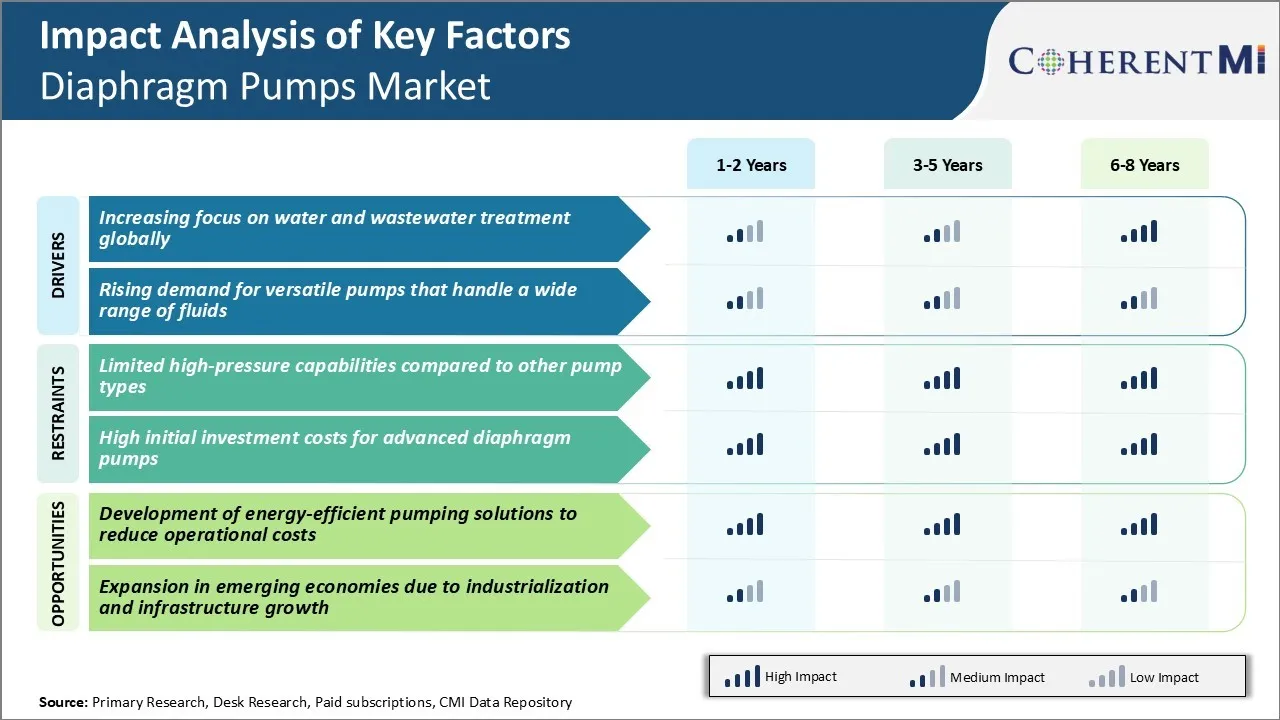

Market Driver - Increasing Focus on Water and Wastewater Treatment Globally

The global demand for clean water has been rising continually along with the growing population. With rapid urbanization as well, the pressure on water resources to meet the needs of municipal, commercial and industrial sectors has increased manifold. Diaphragm pumps are highly versatile and suitable for a variety of applications in water and wastewater treatment processes. Their self-priming feature along with the ability to run dry for short periods enables efficient transportation of liquids through long distances in pipeline networks.

Diaphragm pumps play a critical role in wastewater treatment plants for relocating water from one unit to other during different stages of treatment. Furthermore, water scarcity issues in many parts of the world are driving initiatives for recycling of treated wastewater. This in turn, boosts installations of advanced wastewater treatment infrastructure involving diaphragm pumping solutions. Thereby, this is expected to boost growth of the diaphragm pumps market.

Market Driver - Rising Demand for Versatile Pumps that Handle a Wide Range of Fluids

Diaphragm pumps have seen increasing popularity across various end-use industries owing to their versatility in handling variety of corrosive, abrasive and mixed liquids. Their self-priming function permits them to transfer both thin and viscous liquids efficiently over short or long distance. Whereas the diaphragm, which acts as the sealing component, effectively isolates the fluid being pumped from the pumping mechanism.

Process industries nowadays require pumps that can pump multiple type of fluids involved in a production process without any need for modification in between. Diaphragm pumps fulfill this need of multipurpose pumping with minimum downtime.

Similarly, diaphragm pumps have found increased application in construction sector for transporting cement slurries, grouts and mixed concretes at construction sites. The versatility and robust nature of diaphragm pumps allows them to overcome such tough working conditions efficiently without breaking down. This versatility to handle variety of fluids at varied conditions is acting as a driving factor for diaphragm pumps market.

Market Challenge - Limited High-pressure Capabilities Compared to Other Pump Types

One of the key challenges faced by the diaphragm pumps market is their limited high-pressure capabilities when compared to other types of pumps. While diaphragm pumps are well-suited for low to moderate pressure applications such as transferring oils, solvents and other viscous liquids, they typically can only generate pressures up to 15 bar. This restricts their usage in industries and processes that require higher pressure pumping. Centrifugal pumps, peristaltic pumps and gear pumps are often preferred over diaphragm pumps when higher discharge pressures exceeding 15 bar are necessary. The inability of diaphragm pumps to meet these high-pressure pumping demands acts as a constraint in further market growth. Pump manufacturers need to focus on innovation to enhance the pump design in a way that allows diaphragm pumps to achieve competitive discharge pressures for high-pressure applications as well.

Market Opportunity - Development of Energy-efficient Pumping Solutions to Reduce Operational Costs

The development of energy-efficient pumping solutions represents a major opportunity for the diaphragm pumps market to drive further adoption. Operational cost associated with power consumption forms a significant portion of total pumping costs over the product's life. Thereby, there exists a strong value proposition for manufacturers to develop diaphragm pumps with optimized designs focused on minimal energy usage.

Incorporating features such as advanced motors, variable speed control, and innovative materials could help lower the power ratings and kW requirements of diaphragm pumps. Given their inherent advantages in leak-proof and quiet operation, optimized energy-efficient diaphragm pumps can help reduce the total cost of ownership for end-users. This will enhance the value proposition of diaphragm pumps especially against alternatives and promote increased sales and market expansion opportunities for market players.

Key winning strategies adopted by key players of Diaphragm Pumps Market

Product innovation has been a core strategy for leading players like Dover Corporation, Flowserve Corporation, Yamada Corporation etc. Another strategy adopted is expansion into growing end-use industries and regions. For example, Ingersoll Rand entered the pharmaceutical industry in 2018 by launching diaphragm pumps compliant with stringent regulations for handling critical and toxic fluids. This helped them tap into the lucrative and demanding pharmaceutical manufacturing market.

Focus on aftermarket services and solutions has also aided players. Dover acquired several fluid handling firms since 2010 to bolster its global service network. Today, it has service centers across 50+ countries ensuring quick response. This enhances customer loyalty and repeat purchases in an asset-intensive industry.

Partnerships with OEMs has been a route for many players. For instance, Flowserve partnered with Hyundai Engineering in 2017 to supply customized pumps for major infrastructure projects in Korea. Such tie-ups provide entry into new projects and long-term supply agreements.

Segmental Analysis of Diaphragm Pumps Market

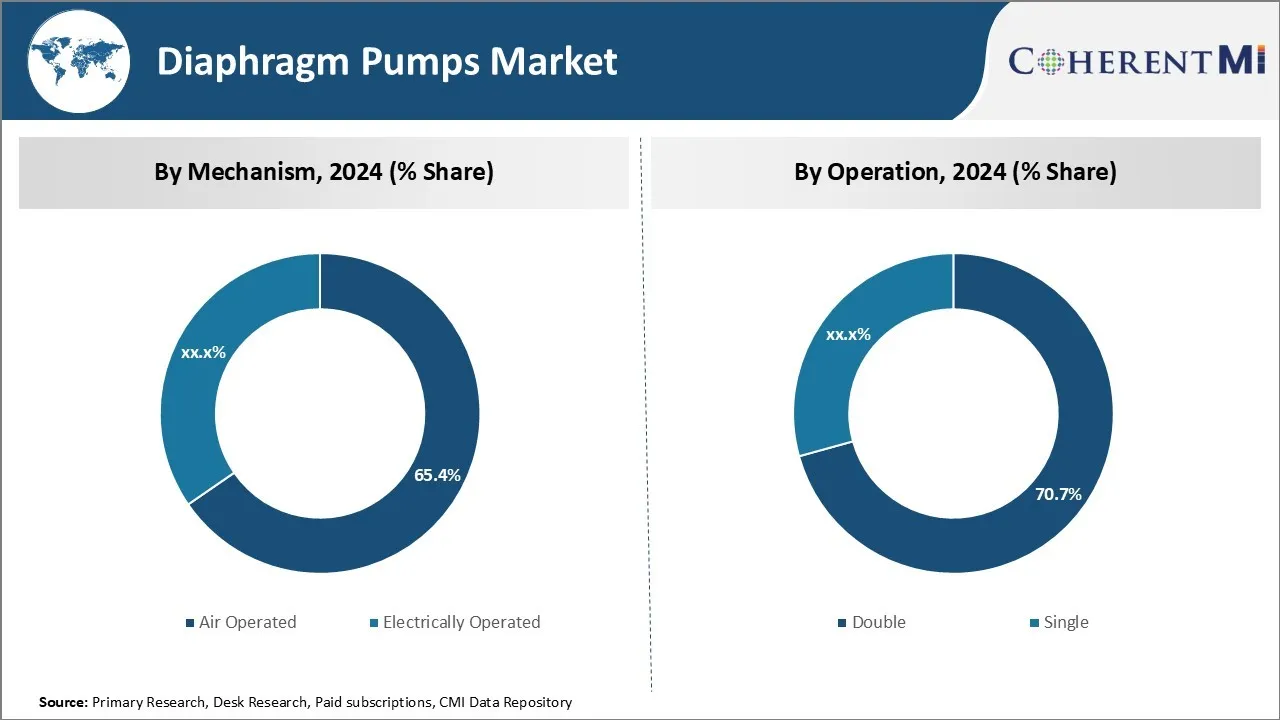

Insights, By Mechanism: Robust Operations and Cost-Effectiveness Drive Air Operated Segment Growth

Within the mechanism segment of the diaphragm pumps market, the air operated segment holds 65.4% share due to its robustness and cost-effectiveness. Air operated diaphragm pumps use compressed air or another gas to drive the diaphragm and transfer the liquid. This makes them very reliable as they have no moving parts in contact with the pumped liquid. Thus, they are resistant to wear and contamination, giving long operation life without maintenance.

The use of compressed air also provides these pumps great operational flexibility. They can smoothly handle both thin and viscous liquids with precision flow control. Operators appreciate how easy they are to install and start up, as all that is required is connecting an airline.

Combination of robustness, flexibility, and affordability explains the widespread adoption of air operated diaphragm pumps across many industries. Fields like oil & gas production, chemical processing, and water treatment have come to rely on their trouble-free performance day after day. This will shape upcoming trends in the diaphragm pumps market.

Insights, By Operation: Double Diaphragm Pumps Lead Throughput and Safety

In the operation segment, double diaphragm pumps account for 70.7% share of the diaphragm pumps market in 2024. This is due to their higher throughput capabilities and safety advantages over single diaphragm models. Double diaphragm pumps use two flexible diaphragms that alternately compress and expand to draw in and expel the fluid through non-return valves.

This twin diaphragm arrangement nearly doubles the pump's flow rate and delivery pressure compared to a single diaphragm design of equal size. Processes requiring higher flow volumes thus turn to double diaphragm pumps for their superior pumping capacity. Industries like food & beverage production in particular need these higher throughput levels to maximize processing equipment efficiency.

Applications pumping hazardous chemicals greatly value the fail-closed containment and anti-siphonage design of double diaphragm models. Their chemical and pressure resistance frequently exceeds standards like CE, UL, CSA and FM. This regulatory compliance makes double diaphragm pumps the pump of choice when safety is a top priority during fluid transfer operations.

Insights, By End Use: Process Requirements Drive Oil & Gas Dominance

In the end use segment of the diaphragm pumps market, the oil & gas sector has grown to dominate due to the industry's exacting process needs. Diaphragm pump characteristics make them indispensable throughout oil & gas production, processing and transportation operations.

At the wellhead, air operated and electrically driven diaphragm mud pumps withstand the most punishing downhole drilling conditions to efficiently transfer drilling mud. Further downstream, their chemical compatibility handles highly corrosive hydrocarbons and treatment chemicals. Pipeline pigging also relies on robust and abrasion-resistant diaphragm pumps to force pipeline inspection gauges long distances, driving growth prospects of the diaphragm pumps market.

As new unconventional production like tight oil, heavy oil and oil sands emerge, severe process conditions place even higher demands on transfer equipment. Diaphragm pumps once again distinguish themselves through long-term reliability under extreme temperatures, pressures and fluid viscosity variations. Overall, no other pump type can match diaphragm pumps' all-round suitability for the refined requirements of the global oil & gas industry.

Additional Insights of Diaphragm Pumps Market

- Asia-Pacific holds the largest share of the diaphragm pumps market in 2023 due to rapid industrialization and increasing demand for advanced pumping solutions.

- North America is expected to grow fastest in the global diaphragm pumps market due to industrial advancements and energy-efficient pump adoption.

- Diaphragm pumps are vital for wastewater treatment, supporting chemical dosing and sludge handling processes.

- Air-operated diaphragm pumps dominate the mechanism segment with a 65% market share in 2023 due to their ability to handle abrasive and viscous fluids.

- Double diaphragm pumps held the largest operational share (70%) of the diaphragm pumps market in 2023 due to their higher flow rate and versatility.

Competitive overview of Diaphragm Pumps Market

The major players operating in the diaphragm pumps market include IDEX Corporation, Yamada Corporation, Flowserve Corporation, Ingersoll Rand, Grundfos Holding A/S, Xylem Inc., SPX Flow, Pump Solutions Group, LEWA GmbH, Verder International B.V., TAPFLO AB, Leak-Proof Pumps Pvt. Ltd., All-Flo Pump Co., AxFlow Holding AB, and KNF Neuberger.

Diaphragm Pumps Market Leaders

- IDEX Corporation

- Yamada Corporation

- Flowserve Corporation

- Ingersoll Rand

- Grundfos Holding A/S

Diaphragm Pumps Market - Competitive Rivalry, 2024

Diaphragm Pumps Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Diaphragm Pumps Market

- In November 2023, Honeywell introduced the EI5 diaphragm gas meter, certified for both natural gas and hydrogen usage, thereby expanding applications in the energy sector. This 100% hydrogen-capable smart gas meter, successfully piloted in the Netherlands, aligns with the European Green Deal's objectives.

- In December 2022, Graco Inc. introduced the QUANTM™ electric-operated double diaphragm pump, marking a significant advancement in pump technology for both industrial and hygienic applications. This innovative pump features a revolutionary electric motor design that is up to eight times more efficient than standard pneumatic pumps, leading to substantial energy savings and reduced operational costs.

Diaphragm Pumps Market Segmentation

- By Mechanism

- Air Operated

- Electrically Operated

- By Operation

- Double

- Single

- By End Use

- Oil & Gas

- Food & Beverages

- Water & Wastewater

- Chemicals

- By Pressure

- Up to 80 bar

- 80–200 bar

- Greater than 200 bar

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the diaphragm pumps market?

The diaphragm pumps market is estimated to be valued at USD 7.04 Bn in 2024 and is expected to reach USD 10.49 Bn by 2031.

What are the key factors hampering the growth of the diaphragm pumps market?

Limited high-pressure capabilities compared to other pump types and high initial investment costs for advanced diaphragm pumps are the major factors hampering the growth of the diaphragm pumps market.

What are the major factors driving the diaphragm pumps market growth?

Increasing focus on water and wastewater treatment and rising demand for versatile pumps that handle a wide range of fluids are the major factors driving the diaphragm pumps market.

Which is the leading mechanism in the diaphragm pumps market?

The leading mechanism segment is air operated.

Which are the major players operating in the diaphragm pumps market?

IDEX Corporation, Yamada Corporation, Flowserve Corporation, Ingersoll Rand, Grundfos Holding A/S, Xylem Inc., SPX Flow, Pump Solutions Group, LEWA GmbH, Verder International B.V., TAPFLO AB, Leak-Proof Pumps Pvt. Ltd., All-Flo Pump Co., AxFlow Holding AB, and KNF Neuberger are the major players.

What will be the CAGR of the diaphragm pumps market?

The CAGR of the diaphragm pumps market is projected to be 5.86% from 2024-2031.