Diesel Exhaust Fluid Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Diesel Exhaust Fluid Market is segmented By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), By Application (Const....

Diesel Exhaust Fluid Market Size

Market Size in USD Bn

CAGR7.93%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 7.93% |

| Market Concentration | Medium |

| Major Players | Yara International ASA, CF Industries Holdings, Inc., BASF SE, Royal Dutch Shell PLC, TotalEnergies SE and Among Others. |

please let us know !

Diesel Exhaust Fluid Market Analysis

The diesel exhaust fluid market is estimated to be valued at USD 39.59 Bn in 2024 and is expected to reach USD 67.55 Bn by 2031. It is projected to grow at a compound annual growth rate (CAGR) of 7.93% from 2024 to 2031. The diesel exhaust fluid market is expected to witness positive growth owing to rising vehicle miles travelled and stricter emission standards.

Diesel Exhaust Fluid Market Trends

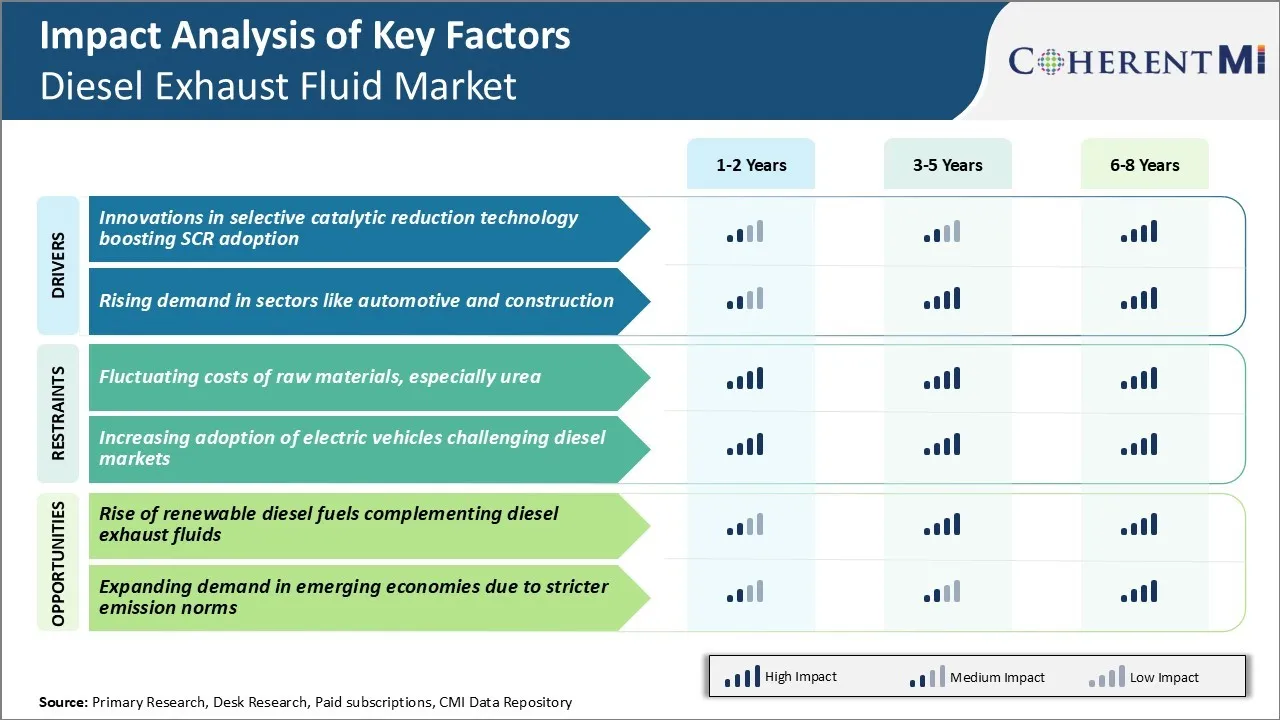

Market Driver - Innovations in Selective Catalytic Reduction Technology Boosting SCR Adoption

With stringent emission norms around the world, reducing nitrogen oxide (NOx) emissions from diesel engines has become a major focus area for automakers and other diesel engine manufacturers. Selective catalytic reduction (SCR) technology has emerged as one of the most effective solutions to lower NOx emissions from diesel engines.

Over the years, SCR system manufacturers have been innovating to make SCR technology more efficient and cost-effective. Newer SCR catalyst formulations have improved conversion efficiency, enabling them to meet tougher emission standards while using less DEF per kilometer. Automakers have been quick to adopt the latest SCR technologies to comply with the strictest emission norms. Many truck manufacturers now offer SCR systems as standard fitment across their model ranges. Passenger car manufacturers are also increasingly turning to SCR to meet norms like Euro 6 and BS-VI in key markets.

Growing adoption of SCR technology across multiple industries is propelling the demand for diesel exhaust fluid. With further innovations promising to enhance SCR system efficiency and drivability, diesel exhaust fluid market is expected to witness healthy growth.

Market Driver - Rising Demand in Sectors like Automotive and Construction

The automotive and construction industries have seen robust growth globally in recent years. Both sectors rely heavily on diesel-powered vehicles and equipment for transportation and moving bulk materials. In the automotive sector, commercial vehicles were the early adopters of SCR systems to meet stringent norms in key regions.

The growing vehicle parc accompanied by stricter emission control is thus fueling DEF consumption. Meanwhile, off-highway original equipment manufacturers supplying excavators, bulldozers, cranes etc. to the construction industry are also adopting SCR solutions in a big way. Equipment dealers then need to maintain adequate DEF inventory for refilling the SCR tanks during periodic maintenance visits.

Countries investing heavily in infrastructure also experience a parallel rise in construction activity and demand for earthmoving machinery. The infrastructure push in developing nations is further accentuating DEF requirements. Tier-1 manufacturers will need to ramp up DEF production and this will drive up growth of the diesel exhaust fluid market.

Market Challenge - Fluctuating costs of raw materials, especially urea

One of the main challenges facing the diesel exhaust fluid market is the fluctuating costs of raw materials, especially urea. Urea is the key ingredient in DEF and accounts for a major portion of the manufacturing cost. The prices of urea are highly dependent on natural gas prices as natural gas is the main feedstock used in urea production.

Natural gas prices have been quite volatile over the past few years due to various macroeconomic and geopolitical factors. Any increase in natural gas prices often translates to a corresponding rise in urea prices.

The fluctuating input costs make it difficult for DEF companies to undertake efficient capacity planning and long-term investments. It also increases the risks associated with long-term supply contracts signed by diesel exhaust fluid producers with their customers. If urea prices spike, it can significantly impact the profitability of DEF manufacturers unless they have properly hedged their urea procurement. The volatile raw material environment poses a major ongoing challenge for the diesel exhaust fluid market.

Market Opportunity - Rise of Renewable Diesel Fuels Complementing Diesel Exhaust Fluid Market

One promising opportunity for the diesel exhaust fluid market is the rise of renewable diesel fuels which can complement DEF solutions. Renewable diesel, also known as green diesel, is a cleaner burning diesel fuel produced from renewable feedstocks like vegetable oils and animal fats. As renewable diesel gradually replaces conventional diesel fuel in vehicles and fleet applications, it allows compliance with stringent vehicle emission standards with lesser requirement for additional emissions after-treatment using DEF.

Furthermore, with supportive policy push for renewable fuels especially in regions like Europe and California, the market for renewable diesel is expected to grow substantially over the coming years. As renewable diesel complement diesel exhaust fluid usage, it opens up a new avenue of opportunities for manufacturers to target applications. This collaboration between renewable diesel producers and DEF companies can help unlock sustainable growth opportunities in the diesel exhaust fluid market.

Key winning strategies adopted by key players of Diesel Exhaust Fluid Market

Players like Yara International, BASF, Total, Cummins Filtration, CF International Holdings, and Royal Dutch Shell have adopted strategic supply agreements and partnerships to strengthen their market position in the DEF industry.

For example, in 2020, Yara International signed a 5-year supply agreement with Daimler to provide diesel exhaust fluid to its commercial vehicle fleets in Europe. This helped Yara secure a major customer and ensured a consistent demand for its DEF products.

Companies have also focused on expanding their production and distribution footprint to improve market access.

Adopting a consumer-oriented marketing approach has also worked in favor of key players. Through strategic collaborations, capacity expansions, marketing initiatives, and focused R&D - leaders in the diesel exhaust fluid market have established tightly-integrated supply chains. They also ensured broader product availability, enhanced brand visibility, and stayed ahead of evolving industry and regulatory needs. Solid execution of such strategies position them strongly to lead future growth in the rapidly growing diesel exhaust fluid market.

Segmental Analysis of Diesel Exhaust Fluid Market

Insights, By Vehicle Type: Rising Demand Propels Passenger Cars to the Top

In terms of vehicle type, passenger cars contributes 40.2% share of the diesel exhaust fluid market in 2024. This is owning to growing demand from personal commute and travel. As urbanization increases worldwide, more people are purchasing private vehicles instead of depending on public transportation.

The rising disposable incomes of the expanding middle class populations in developing nations allows more consumers to upgrade to a car from motorcycles or other modes of transport. Stringent emission regulations also drive the need for diesel passenger vehicles to be upgraded with selective catalytic reduction systems using diesel exhaust fluid.

Growing popularity of SUV body style vehicles especially in North America and Europe which predominantly use diesel engines further adds to the segment growth.

Insights, By Application: Infrastructure Growth Boosts Construction Equipment Segment

In terms of application, construction equipment contributes 42.7% share of the diesel exhaust fluid market in 2024. This is owing to increasing infrastructure development activities globally. Mega construction projects pertaining to roadways, buildings, bridges and other public works across major economies contribute significantly to the demand.

Both modernization of existing as well as development of new infrastructure especially in developing nations propels the need for construction machinery. The larger engine capacities and higher operation hours of construction vehicles compared to other applications increases their consumption of diesel exhaust fluid on a regular basis.

Insights, By Component: Selective Catalytic Reduction Dominates Component Demand

In terms of component, selective catalytic reduction (SCR) Catalyst contributes the highest share of the diesel exhaust fluid market. SCR technology has emerged as the most viable solution to comply with stringent emission norms globally. Its effectiveness in reducing nitrogen oxide emissions from diesel engines has led to its adoption across all key vehicle types and applications discussed earlier.

The need to periodically replace or upgrade SCR catalysts after a certain lifespan or mileage drives recurring demand. Other components like DEF tank and injectors are designed to efficiently deliver diesel exhaust fluid only to support the key SCR system.

Additional Insights of Diesel Exhaust Fluid Market

- The North American region currently commands a significant share of the global diesel exhaust fluid market, holding well over one-quarter of total revenues.

- Meanwhile, the Asia-Pacific region is anticipated to exhibit the fastest growth rate, driven by expanding vehicle fleets, tightening emission standards in emerging economies, and ongoing infrastructure development to support DEF distribution.

- Furthermore, as diesel exhaust fluid quality standards become more harmonized globally, manufacturers and distributors increasingly invest in quality control measures, certification processes, and advanced sensors, ensuring consistent product performance across all regions.

Competitive overview of Diesel Exhaust Fluid Market

The major players operating in the diesel exhaust fluid market include Yara International ASA, CF Industries Holdings, Inc., BASF SE, Royal Dutch Shell PLC, TotalEnergies SE, China Petrochemical Corporation (Sinopec), Air Liquide (Airgas), Brenntag AG, Nissan Chemical Industries, Ltd., Graco Inc., Mitsui Chemicals, Inc., Nutrien Ltd. (formerly PotashCorp), Cummins Filtration, CF Industries Holdings, Inc., Dyno Nobel, Agrium Inc., Honeywell International Inc., and Faurecia SE.

Diesel Exhaust Fluid Market Leaders

- Yara International ASA

- CF Industries Holdings, Inc.

- BASF SE

- Royal Dutch Shell PLC

- TotalEnergies SE

Diesel Exhaust Fluid Market - Competitive Rivalry, 2024

Diesel Exhaust Fluid Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Diesel Exhaust Fluid Market

- In August 2024, Global Partners LP launched Connecticut's first renewable diesel initiative by making the eco-friendly fuel available at the East Haven terminal. This development supports Connecticut's climate goals by providing a cleaner alternative to traditional petroleum diesel, offering up to 78% lower emissions.

- In July 2024, Volvo Trucks North America announced the availability of an engine that complies with the California Air Resources Board (CARB) 2024 Omnibus regulation for low nitrogen oxide (NOx) and particulate matter (PM) emissions standards.

- In February 2024, John Deere introduced new models in the 9RX tractor range, specifically the 9RX 710, 9RX 770, and 9RX 830. These tractors are equipped with the JD18 engine, an 18-liter power unit that meets Final Tier 4/Stage V emissions standards using exhaust-gas recirculation technology, eliminating the need for diesel exhaust fluid (DEF).

- In March 2024, Rislone introduced DEF Crystal Clean™ Diesel DEF & SCR Emissions System Cleaner, a product designed to remove crystal contaminants from the selective catalytic reduction (SCR) systems of diesel vehicles. This cleaner helps restore power and performance by dissolving crystal deposits throughout the entire SCR system, including the tank, pump, heater, sender, lines, injector, decomposition tube/reactor, and mixer.

Diesel Exhaust Fluid Market Segmentation

- By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- By Application

- Construction Equipment

- Agricultural Tractors

- Others

- By Component

- Selective Catalytic Reduction (SCR) Catalyst

- DEF Tank

- DEF Injector

- DEF Supply Module

- DEF Sensors

- By Supply Mode

- Bulk

- Intermediate Bulk Container (IBC)

- Cans & Bottles

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the diesel exhaust fluid market?

The diesel exhaust fluid market is estimated to be valued at USD 39.59 Bn in 2024 and is expected to reach USD 67.55 Bn by 2031.

What are the key factors hampering the growth of the diesel exhaust fluid market?

Fluctuating costs of raw materials, especially urea, and increasing adoption of electric vehicles challenging diesel markets are the major factors hampering the growth of the diesel exhaust fluid market.

What are the major factors driving the diesel exhaust fluid market growth?

Innovations in selective catalytic reduction technology boosting SCR adoption and rising demand in sectors like automotive and construction are the major factors driving the diesel exhaust fluid market.

Which is the leading vehicle type in the diesel exhaust fluid market?

The leading vehicle type segment is passenger cars.

Which are the major players operating in the diesel exhaust fluid market?

Yara International ASA, CF Industries Holdings, Inc., BASF SE, Royal Dutch Shell PLC, TotalEnergies SE, China Petrochemical Corporation (Sinopec), Air Liquide (Airgas), Brenntag AG, Nissan Chemical Industries, Ltd., Graco Inc., Mitsui Chemicals, Inc., Nutrien Ltd. (formerly PotashCorp), Cummins Filtration, CF Industries Holdings, Inc., Dyno Nobel, Agrium Inc., Honeywell International Inc., and Faurecia SE are the major players.

What will be the CAGR of the diesel exhaust fluid market?

The CAGR of the diesel exhaust fluid market is projected to be 7.93% from 2024-2031.