Diesel Exhaust Fluid Market Trends

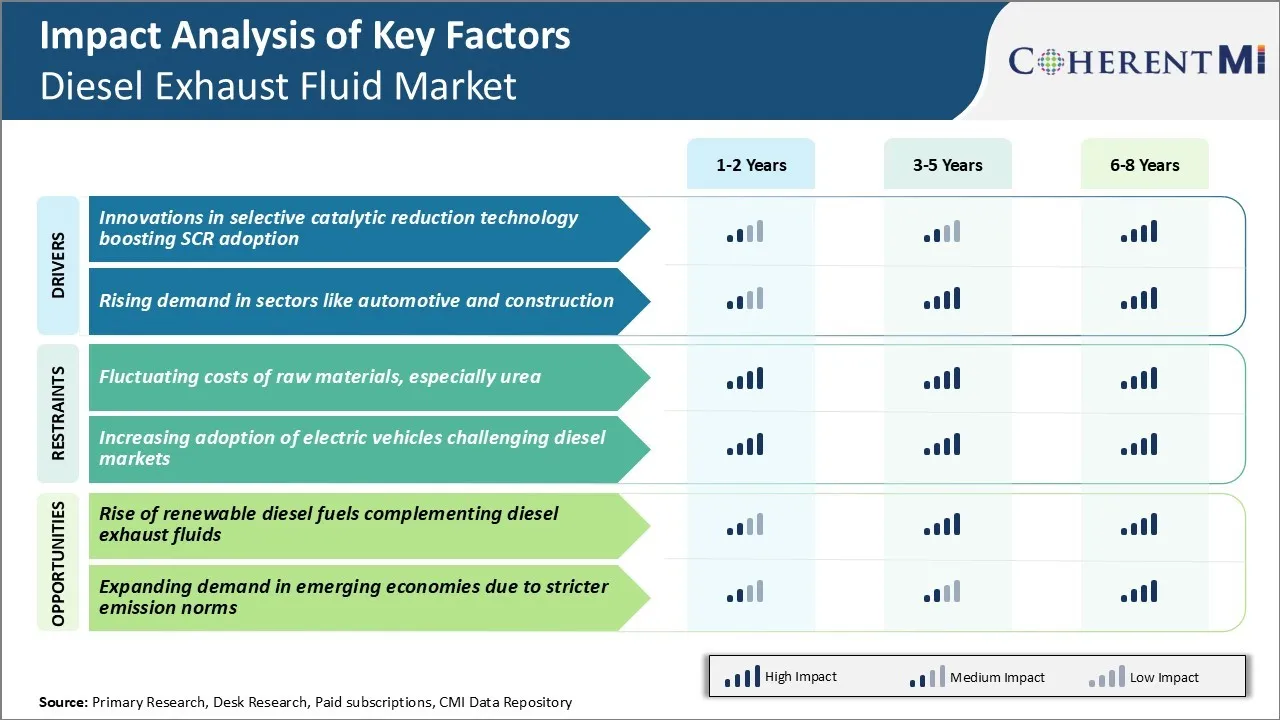

Market Driver - Innovations in Selective Catalytic Reduction Technology Boosting SCR Adoption

With stringent emission norms around the world, reducing nitrogen oxide (NOx) emissions from diesel engines has become a major focus area for automakers and other diesel engine manufacturers. Selective catalytic reduction (SCR) technology has emerged as one of the most effective solutions to lower NOx emissions from diesel engines.

Over the years, SCR system manufacturers have been innovating to make SCR technology more efficient and cost-effective. Newer SCR catalyst formulations have improved conversion efficiency, enabling them to meet tougher emission standards while using less DEF per kilometer. Automakers have been quick to adopt the latest SCR technologies to comply with the strictest emission norms. Many truck manufacturers now offer SCR systems as standard fitment across their model ranges. Passenger car manufacturers are also increasingly turning to SCR to meet norms like Euro 6 and BS-VI in key markets.

Growing adoption of SCR technology across multiple industries is propelling the demand for diesel exhaust fluid. With further innovations promising to enhance SCR system efficiency and drivability, diesel exhaust fluid market is expected to witness healthy growth.

Market Driver - Rising Demand in Sectors like Automotive and Construction

The automotive and construction industries have seen robust growth globally in recent years. Both sectors rely heavily on diesel-powered vehicles and equipment for transportation and moving bulk materials. In the automotive sector, commercial vehicles were the early adopters of SCR systems to meet stringent norms in key regions.

The growing vehicle parc accompanied by stricter emission control is thus fueling DEF consumption. Meanwhile, off-highway original equipment manufacturers supplying excavators, bulldozers, cranes etc. to the construction industry are also adopting SCR solutions in a big way. Equipment dealers then need to maintain adequate DEF inventory for refilling the SCR tanks during periodic maintenance visits.

Countries investing heavily in infrastructure also experience a parallel rise in construction activity and demand for earthmoving machinery. The infrastructure push in developing nations is further accentuating DEF requirements. Tier-1 manufacturers will need to ramp up DEF production and this will drive up growth of the diesel exhaust fluid market.

Market Challenge - Fluctuating costs of raw materials, especially urea

One of the main challenges facing the diesel exhaust fluid market is the fluctuating costs of raw materials, especially urea. Urea is the key ingredient in DEF and accounts for a major portion of the manufacturing cost. The prices of urea are highly dependent on natural gas prices as natural gas is the main feedstock used in urea production.

Natural gas prices have been quite volatile over the past few years due to various macroeconomic and geopolitical factors. Any increase in natural gas prices often translates to a corresponding rise in urea prices.

The fluctuating input costs make it difficult for DEF companies to undertake efficient capacity planning and long-term investments. It also increases the risks associated with long-term supply contracts signed by diesel exhaust fluid producers with their customers. If urea prices spike, it can significantly impact the profitability of DEF manufacturers unless they have properly hedged their urea procurement. The volatile raw material environment poses a major ongoing challenge for the diesel exhaust fluid market.

Market Opportunity - Rise of Renewable Diesel Fuels Complementing Diesel Exhaust Fluid Market

One promising opportunity for the diesel exhaust fluid market is the rise of renewable diesel fuels which can complement DEF solutions. Renewable diesel, also known as green diesel, is a cleaner burning diesel fuel produced from renewable feedstocks like vegetable oils and animal fats. As renewable diesel gradually replaces conventional diesel fuel in vehicles and fleet applications, it allows compliance with stringent vehicle emission standards with lesser requirement for additional emissions after-treatment using DEF.

Furthermore, with supportive policy push for renewable fuels especially in regions like Europe and California, the market for renewable diesel is expected to grow substantially over the coming years. As renewable diesel complement diesel exhaust fluid usage, it opens up a new avenue of opportunities for manufacturers to target applications. This collaboration between renewable diesel producers and DEF companies can help unlock sustainable growth opportunities in the diesel exhaust fluid market.