Industrial Air Filtration Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Industrial Air Filtration Market is segmented By Product Type (HEPA Filters (True HEPA Filters, ULPA Filters), Dust Collectors (Baghouse Filters, Cycl....

Industrial Air Filtration Market Size

Market Size in USD Bn

CAGR6.85%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6.85% |

| Market Concentration | Medium |

| Major Players | Honeywell International, Inc., MANN+HUMMEL, Daikin Industries, Ltd., Danaher Corporation, Donaldson Company Inc. and Among Others. |

please let us know !

Industrial Air Filtration Market Analysis

The industrial air filtration market is estimated to be valued at USD 7.95 Bn in 2024 and is expected to reach USD 12.64 Bn by 2031, growing at a compound annual growth rate (CAGR) of 6.85% from 2024 to 2031. Factors such as stringent regulations regarding industrial emission control and increasing awareness about workplace health and safety are expected to drive the industrial air filtration market.

Industrial Air Filtration Market Trends

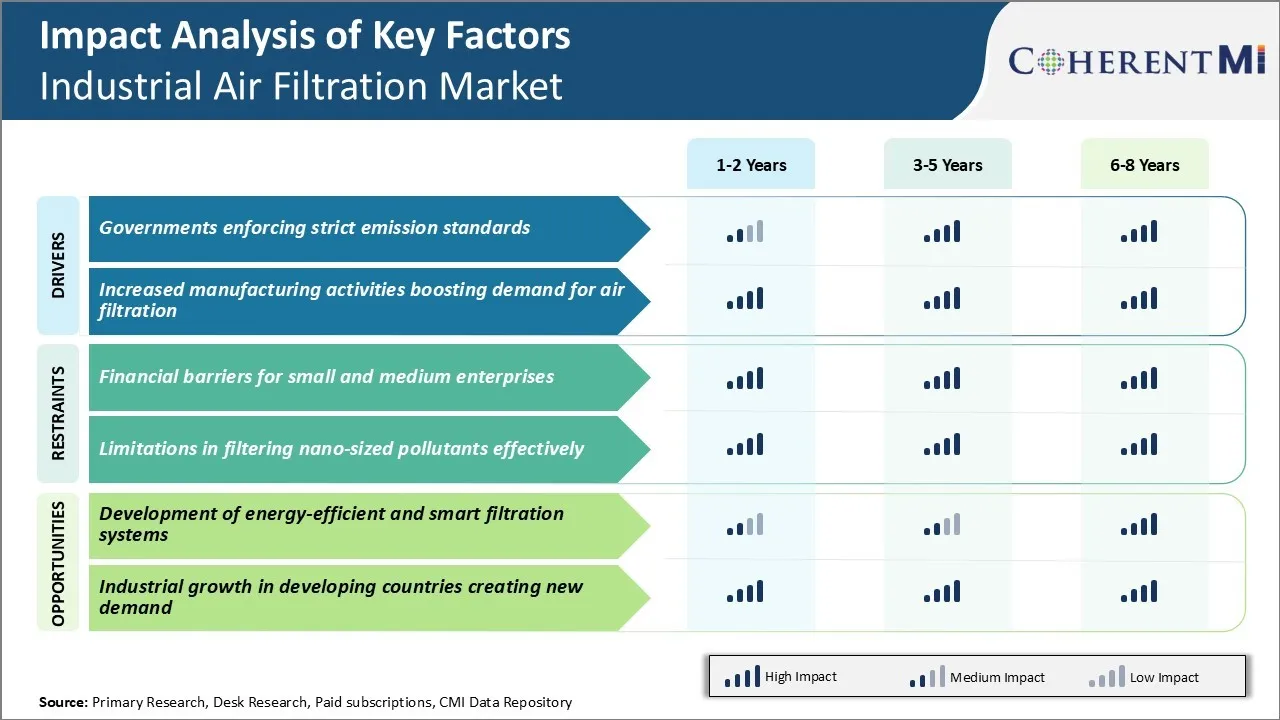

Market Driver - Governments Enforcing Strict Emission Standards

With rising pollution levels across major industrial hubs, governments worldwide have started recognizing the grave risks posed by deteriorating air quality. Stricter norms and regulations around industrial emissions have been introduced to curb air and water pollution.

In North America, the Environmental Protection Agency has significantly lowered acceptable emission levels for a variety of pollutants. Strict compliance is being ensured through periodic audits and surprise inspections at factory premises. The penalties for non-compliance have also been ramped up.

The Euro emission standards for vehicles and industrial operations have become a lot more stringent with each iteration. The impending switch to Euro 7 regulations is keeping the automotive ancillary sector on its toes. The compliance burden along with looming fines for violation have boosted demand for relevant air filtration products and services.

Other major economies like China and India have also rolled out tighter ambient air quality standards in their industrial areas and special economic zones. This is an attempt to arrest the alarming levels of PM2.5 and PM10 that have severely affected public health. This bodes well for the industrial air filtration market.

Market Driver - Increased Manufacturing Activities Boosting Demand for Air Filtration

As industrialization picks up pace globally on the back of growing manufacturing capacities, the need for process air filtration rises substantially. Modern factories deploy sophisticated, automated machineries and equipment that generate fine particulates, mists, fumes, and other pollutants within closed work spaces. Unfiltered, these can seriously impact both industrial operations and occupational safety.

With rising production targets, the scale and output of industrial facilities has increased manifold. Greater amounts of pollutants are being released within industrial premises that necessitate strong air purification measures. Both new plants and existing factories are allocating larger CAPEX towards air filter retrofits and overhauls.

New-age sectors like renewable energy equipment, electric vehicles, aerospace and defense components require cleanroom environments to manufacture products. Only top-quality air scrubbing systems can sustain such pollution-sensitive operations on a large scale over the long-term. Therefore, the industrial air filtration market holds outstanding opportunities.

In summary, the global manufacturing sector is expanding at a fervent pace. This invariably increases the load of industrial pollutants that must be removed from circulating air through robust filtration arrangements. Such trends lay the foundation for continued growth of the industrial air filtration market.

Market Challenge - Financial Barriers for Small and Medium Enterprises

One of the key challenges for the industrial air filtration market is the financial barriers faced by small and medium enterprises (SMEs) for adoption of advanced air filtration systems. The initial capital costs associated with purchasing, installing, and commissioning industrial air filtration equipment can be quite high, ranging anywhere between $50,000 to $500,000. This significant upfront investment poses a major hurdle for SMEs who have limited capital budgets and restricted access to financing.

Unlike large enterprises, SMEs find it difficult to secure large loans or lines of credit from financing institutions. High interest rates on business loans in many countries additionally increase the costs. With thin profit margins, most SMEs are unable to justify such large capital expenditure on air filtration unless there is a compliance requirement. This financial challenge restricts their ability to invest in the latest industrial air filtration technologies meant for improving workplace air quality, reducing environmental emissions, and enhancing productivity.

Market Opportunity - Development of Energy-efficient and Smart Filtration Systems

One major opportunity for the industrial air filtration market lies in the development of sophisticated yet energy-efficient and smart filtration systems. The focus on reducing energy consumption and carbon footprint of industrial operations is growing, So, there is a growing need for filtration technologies that minimize operational costs while fulfilling stringent performance requirements.

Technologies such as energy recovery systems, variable speed fans, smart sensors, and IoT connectivity can help create a new generation of intelligent air filters optimized for low energy use. Integrating robotics, automation, predictive analytics and advanced materials can further boost the efficiency and lifespan of industrial air filtration systems.

The integration of renewable energy sources can make such systems self-sustaining with near-zero emissions. The development of user-friendly monitoring and reporting platforms can also unlock opportunities for advanced remote asset management. Energy-efficient, smart filters with predictive maintenance capabilities present enormous opportunities for industrial air filtration market players to be in line with the global move towards industry 4.0.

Key winning strategies adopted by key players of Industrial Air Filtration Market

Strategy #1: Emphasis on high-efficiency filtration solutions

Donaldson launched its Ultra-Web membrane filter technology in 2005 that is capable of capturing 99.99% of particles 0.3 microns or larger. This helped them gain a strong foothold in markets like power generation that require extremely high filtration efficiency.

Strategy #2: Broadening product portfolio through acquisitions

In 2017, Parker Hannifin acquired CLARCOR Inc., a leading manufacturer of filtration products. This strengthened Parker's industrial filtration business by adding CLARCOR's portfolio of engine and industrial-grade filter elements.

Strategy #3: Leveraging global sales and distribution networks

In Asia, Donaldson captured large contracts from semiconductor manufacturers and power utilities in South Korea and Taiwan during 2018-20 through its extensive regional sales team. Companies with wide-reaching networks have gained significant competitive advantage in the moderately fragmented industrial air filtration market.

Segmental Analysis of Industrial Air Filtration Market

Insights, By Product Type: HEPA Filters Drive Product Type Segment

Within the product type segment, HEPA filters account for 29.9% share in the industrial air filtration market in 2024. This is due to their unique capabilities in filtering ultra-fine particles. Ultra-fine filtration ability makes HEPA filters especially critical for industries that deal with hazardous airborne contaminants at a micron level. The stringent air purity standards of these sectors rely on HEPA filters to prevent environmental and occupational health issues from air pollutants.

HEPA filters are also widely used because they offer longevity and cost-effectiveness compared to alternatives. Their densely-packed fiber material structure can withstand high airflow volumes for extended filter life, lowering operating costs over time.

HEPA filters are also reusable through a cleaning process, further improving their value proposition. Some facilities will utilize HEPA filters as a permanent installation given their powerful and long-lasting filtration. Collectively, these performance advantages mean HEPA filters capture the greatest market share for product types designed to remove sub-micron particles from industrial environments.

Insights, By End Use: Cement Drives End Use Segment

Within the end use segment, cement production accounts for 25.6% share in the industrial air filtration market in 2024. This is due to its intensive air quality management needs. If uncontrolled, cement dust emissions pose serious health issues for workers and surrounding communities through respiratory illnesses. At the same time, stringent environmental regulations increasingly mandate lower permissible emission limits from cement facilities.

As a result, the cement industry relies heavily on robust industrial air filtration equipment like baghouse filters, wet scrubbers, electrostatic precipitators and others to meet stringent emission control standards. The large capital investments that cement companies make into air pollution control align with the industry's massive production scale worldwide.

With cement production projected to further increase to meet global infrastructure growth, its dependence on industrial air filters will also rise proportionately. This will drive important trends in the industrial air filtration market.

Additional Insights of Industrial Air Filtration Market

- The North American industrial air filtration market accounted for USD 3.20 billion in 2023, with a projected value of USD 5.90 billion by 2033.

- Asia-Pacific’s industrial air filtration market was valued at USD 1.71 billion in 2023 and is expected to reach USD 3.23 billion by 2033, fueled by rapid industrial growth in China and India.

- The Food & Drug Administration (FDA) mandates strict air purity standards in the pharmaceutical industry, making filtration essential to prevent contamination.

- MoEF&CC launched India’s National Clean Air Program (NCAP), aiming to standardize and improve ambient air quality annually across the country.

- Energy Consumption: Advanced air filtration systems can reduce energy consumption by up to 20%, contributing to lower operational costs. Companies are integrating IoT technology for real-time monitoring and predictive maintenance of industrial air filtration systems.

Competitive overview of Industrial Air Filtration Market

The major players operating in the industrial air filtration market include Honeywell International, Inc., MANN+HUMMEL, Daikin Industries, Ltd., Danaher Corporation, Donaldson Company Inc., SPX Corporation, Lydall Inc., AAF International, Industrial Air Filtration, Inc., Parker Hannifin Corporation, Camfil Group, Freudenberg & Co. Kg., Filtration Group, Testori SpA, and Eaton Corporation Plc.

Industrial Air Filtration Market Leaders

- Honeywell International, Inc.

- MANN+HUMMEL

- Daikin Industries, Ltd.

- Danaher Corporation

- Donaldson Company Inc.

Industrial Air Filtration Market - Competitive Rivalry, 2024

Industrial Air Filtration Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Industrial Air Filtration Market

- In September 2023, Clean Air America rebranded as Clean Air Industries, reflecting its growth and the acquisition of Amtech LC, a manufacturer of industrial air filtration equipment. This strategic move expanded their product offerings in educational and industrial air filtration, enhancing their ability to provide comprehensive air quality solutions.

- In October 2023, Toray Industries, Inc. commenced production of air filters at its new facility in Sri City, Andhra Pradesh, India. These filters, designed for air purifiers and air conditioning systems in both automotive and building applications, are crafted from nonwoven fabrics.

- In September 2023, Camfil AB partnered with a leading automotive manufacturer to install advanced filtration systems in their new production facility, aiming to reduce emissions by 30%.

- In June 2023, Donaldson Company, Inc. launched a new line of high-efficiency filters designed for pharmaceutical manufacturing, enhancing contaminant capture and ensuring product purity.

- In March 2024, Hengst Filtration inaugurated a new facility in Yelahanka, Bengaluru, India. This 36,000-square-foot plant focuses on producing filtration solutions for the automotive sector, hydraulic applications, medical technology, and various industrial sectors, primarily serving the Indian industrial air filtration market.

Industrial Air Filtration Market Segmentation

- By Product Type

- HEPA Filters

- True HEPA Filters

- ULPA Filters

- Dust Collectors

- Baghouse Filters

- Cyclone Separators

- Electrostatic Precipitators

- Mist Collectors

- Centrifugal Collectors

- Coalescing Filters

- Cartridge Collectors & Filters

- Pleated Filters

- Specialty Filters

- Baghouse Filters

- Shaker

- Reverse Air

- Pulse Jet

- Fume Collectors

- HEPA Filters

- By End Use

- Cement

- Food & beverages

- Metal

- Power

- Pharmaceutical

- Chemical & petrochemical

- Paper & wood processing

- Agriculture

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the industrial air filtration market?

The industrial air filtration market is estimated to be valued at USD 7.95 Bn in 2024 and is expected to reach USD 12.64 Bn by 2031.

What are the key factors hampering the growth of the industrial air filtration market?

Financial barriers for small and medium enterprises and limitations in filtering nano-sized pollutants effectively are the major factors hampering the growth of the industrial air filtration market.

What are the major factors driving the industrial air filtration market growth?

Governments enforcing strict emission standards and increased manufacturing activities boosting demand for air filtration are the major factors driving the industrial air filtration market.

Which is the leading product type in the industrial air filtration market?

The leading product type segment is HEPA filters.

Which are the major players operating in the industrial air filtration market?

Honeywell International, Inc., MANN+HUMMEL, Daikin Industries, Ltd., Danaher Corporation, Donaldson Company Inc., SPX Corporation, Lydall Inc., AAF International, Industrial Air Filtration, Inc., Parker Hannifin Corporation, Camfil Group, Freudenberg & Co. Kg., Filtration Group, Testori SpA, and Eaton Corporation Plc. are the major players.

What will be the CAGR of the industrial air filtration market?

The CAGR of the industrial air filtration market is projected to be 6.85% from 2024-2031.