Machining Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Machining Market is segmented By Type (Lathe Machines, Laser Machines, Milling Machines, Grinding Machines, Winding Machines, Welding Machines), By En....

Machining Market Size

Market Size in USD Bn

CAGR6.5%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6.5% |

| Market Concentration | High |

| Major Players | FANUC Corp., DMG MORI Co Ltd., AMADA Co. Ltd., Atlas Copco AB., Bystronic Laser AG. and Among Others. |

please let us know !

Machining Market Analysis

The machining market is estimated to be valued at USD 402.56 Bn in 2024 and is expected to reach USD 625.55 Bn by 2031, growing at a compound annual growth rate (CAGR) of 6.5% from 2024 to 2031. The machining market is witnessing few key trends such as growing adoption of computer numerical controlled (CNC) machines, rising demand for multi-tasking machines, and growing popularity of hybrid machining processes.

Machining Market Trends

Market Driver - Rising Penetration of Automation and Integration through CNC Technologies

The machining industry has witnessed significant technological advancements in recent years. Computer Numerical Control (CNC) technologies have enabled higher levels of automation and integration in manufacturing workflows.

Automakers in particular are increasing their adoption of CNC machining as they focus on lightweight vehicle designs to boost fuel efficiency. Aerospace OEMs also favor CNC for its ability to machine advanced alloys and exotic materials used in aircraft engines and structures. Medical device manufacturers similarly rely on CNC for its precision in crafting tiny implantable components.

Another key trend in the machining market is the integration of CNC machines with other technologies like robotics, 3D printing, IoT sensors, and digital twins. This results in fully automated flexible manufacturing cells with faster changeovers and multi-process capabilities on a single machine. Such digitally connected machining hubs support lean manufacturing approaches like single-minute exchange of dies (SMED). They optimize production runs for low volume, high variety product lines, and enable on-demand production models, resulting in growing demand in the machining market.

Market Driver - Demand for Lightweight and Precise Machining in Industries like Automotive and Aerospace

Rising focus on lightweight designs across industries is a significant driver for advanced machining technologies. In the automotive space, auto OEMs and their suppliers are pursuing an average 15-20% weight reduction through new material selection and optimized component engineering.

Aerospace is another heavyweight industry pushing machining capabilities. Plane makers are utilizing ever more composites like carbon fiber along with super-engineered alloys in jet engines and airframes. These require innovative machining solutions that can work modern exotic metals and composite laminates with utmost precision. Even minute deviations from design specs could jeopardize safety.

With original equipment manufacturers (OEMs) and regulators imposing tighter deadlines, the machining market is rapidly deploying lean manufacturing systems like single minute exchange of dies (SMED). This calls for smart machinery applications that combine multiple processes with plug-and-produce quick changeovers. All these needs are fueling technological innovations from machinery vendors, driving continued growth prospects in this strategic industry.

Market Challenge - Size limitations affecting the machining of large parts

One of the key challenges faced by the machining market is size limitations when it comes to machining large parts. Traditional machining centers have standard working envelopes that limit the maximum size of parts that can be machined. This poses difficulties for sectors like aerospace, shipbuilding and construction equipment manufacturing where large composite or metal structures are integral.

Machining aircraft fuselages, ship hulls or wind turbine blades in one piece requires machines with extra-large working volumes and high payload capacities. However, such large five-axis machining centers require huge capital investments and large factory footprints. They also have engineering complexities related to rigidity and thermal stability at enlarged scales.

As a result, large parts often need to be machined as assemblies or sub-assemblies and later joined together using welding or fastening. The size constraints of current machining technology is a hindrance for the manufacturing of large monolithic components needed in certain industries.

Market Opportunity - Adoption of Alternative Materials like Composites and Polymers

One significant opportunity for the machining market lies in the increasing adoption of advanced composite and polymer materials. Lightweighting has become imperative across many industry sectors aiming to improve energy efficiency and performance. Composite materials allow creative freedom in design while providing comparable or better strength-to-weight ratios than metal alloys. Their adoption is growing in aerospace, automotive, marine and renewable energy products.

Machining of fiber reinforced plastics and engineering thermoplastics poses different challenges compared to metals but also opens up markets. As composites manufacturing grows, the need for machining of composite components will rise significantly. Specialized machining centers are being developed that can handle these materials using techniques like abrasive waterjet cutting and high-pressure fluid jet erosion.

The availability of advanced polymer composites from tier 1 suppliers also improves their machining prospects. As alternative materials gain acceptability, the machining market has a huge opportunity to develop related technologies and processes to capitalize on this trend.

Key winning strategies adopted by key players of Machining Market

Investment in advanced manufacturing technologies: Companies like DMG Mori, Haas Automation, and Doosan Machine Tools have invested heavily in advanced technologies like CNC machines, computer-aided manufacturing (CAM) software, and additive manufacturing to improve productivity and quality.

Focus on customized solutions: Players like Hardinge and Jinan North Machinery Co. have focused on providing customized, flexible machining solutions to their customers rather than just selling machines. This involves understanding customer processes and proposals involving the right machines, tooling, automation, and integration.

Strategic acquisitions: Machining companies have acquired other players to enhance their offerings and expand globally. For example, in 2021, Hurco acquired Indian CNC router manufacturer Akhuria CNC to establish a production base in India. This enabled Hurco to directly serve the growing Indian market.

Focus on aftermarket sales and servicing: Major players in machining market like Komatsu and Okuma earn over 50% of their revenue through aftermarket parts, servicing, and consumables sales rather than new machinery.

Segmental Analysis of Machining Market

Insights, By Type: Lathe Machines Highlight their Precision Engineering Capabilities

Lathe machines account for 35.3% share of the machining market in 2024, due to their versatile nature and precision engineering capabilities. A key factor driving the demand for lathe machines is their suitability for mass production applications needing consistency and uniformity. Industries like automobile and electronics rely heavily on lathe machines to churn out thousands of identical component pieces with minimal tolerances on a daily basis.

Another key demand driver is the rise of complex machining needs across industries. Lathe machines uniquely enable precision machining of such geometric forms through multi-axis computer numerical control systems and advanced tooling capabilities.

Manufacturers in these sectors rely on lathe machines to produce small batches of highly customized parts by programming in tight tolerances and complex cutting patterns as per drawings. This ability to swiftly adapt to non-standard parts requirements without setup changes keeps lathe machines relevant.

Insights, By End Use: Automotive Applications Dominate with Large-scale Machining Volumes

The automotive industry accounts 40.2% share of the machining market in 2024. This is due to the immense machining volumes required to produce the thousands of component parts in a single vehicle. A major driver fueling automotive machining demand is the sheer scale of vehicle production worldwide each year, measured in the tens of millions. Achieving such massive output levels necessitates ultra-efficient machining technologies and production systems that can pump out a dizzying mix and match of automotive parts at high tolerances and volumes.

Moreover, the complexity and customization needs of the automotive manufacturing process places a premium on machining flexibility. This highly integrated approach is critical to achieving just-in-time production methods and build-to-order mass customization models that define modern automotive manufacturing.

The confluence of these factors concentrating immense and sophisticated machining workloads within the automotive environment has cemented its position as the largest end-user industry for machining technologies worldwide.

Additional Insights of Machining Market

- Rising use of CNC machines in industrial automation is boosting growth of the machining market.

- Growth of CNC lathe machines due to demand in precise component manufacturing is the rising trend in the machining market.

- Asia-Pacific dominates the machining market due to cost-effective operations and the availability of raw materials. However, Europe is also expected to grow significantly, led by Germany, France, and Italy.

Competitive overview of Machining Market

The major players operating in the machining market include FANUC Corp., DMG MORI Co Ltd., AMADA Co. Ltd., Atlas Copco AB., Bystronic Laser AG., TRUMPF GmbH Co. KG., Okuma Corp., Sandvik AB., Yamazaki Mazak Corp., and IPG Photonics Corp.

Machining Market Leaders

- FANUC Corp.

- DMG MORI Co Ltd.

- AMADA Co. Ltd.

- Atlas Copco AB.

- Bystronic Laser AG.

Machining Market - Competitive Rivalry, 2024

Machining Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Machining Market

- In February 2023, HireCNC, a job board dedicated to connecting CNC machinists with employers, was launched. The platform focuses on CNC-related jobs in the U.S. and Canadian markets, aiming to streamline the hiring process for both job seekers and employers in the CNC machining industry.

- In January 2023, Mitsubishi Electric India's CNC division unveiled "Teach-T," a prototype training machine designed to enhance CNC technology education for students. This initiative aligns with the company's strategy to enter the education sector through government tenders and projects, targeting institutions such as ITIs, diploma courses, and private engineering training centers.

- In September 2022, Mitsubishi Electric India introduced the M800V and M80V series of CNCs, aiming to enhance efficiency and technological innovation in manufacturing. These CNCs feature the industry's first built-in wireless LAN, enabling remote access and control, which is particularly beneficial in the post-pandemic era.

Machining Market Segmentation

- By Type

- Lathe Machines

- Laser Machines

- Milling Machines

- Grinding Machines

- Winding Machines

- Welding Machines

- By End Use

- Automotive

- Aerospace & Defense

- Construction Equipment

- Power & Energy

- Industrial

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the machining market?

The machining market is estimated to be valued at USD 402.56 Bn in 2024 and is expected to reach USD 625.55 Bn by 2031.

What are the key factors hampering the growth of the machining market?

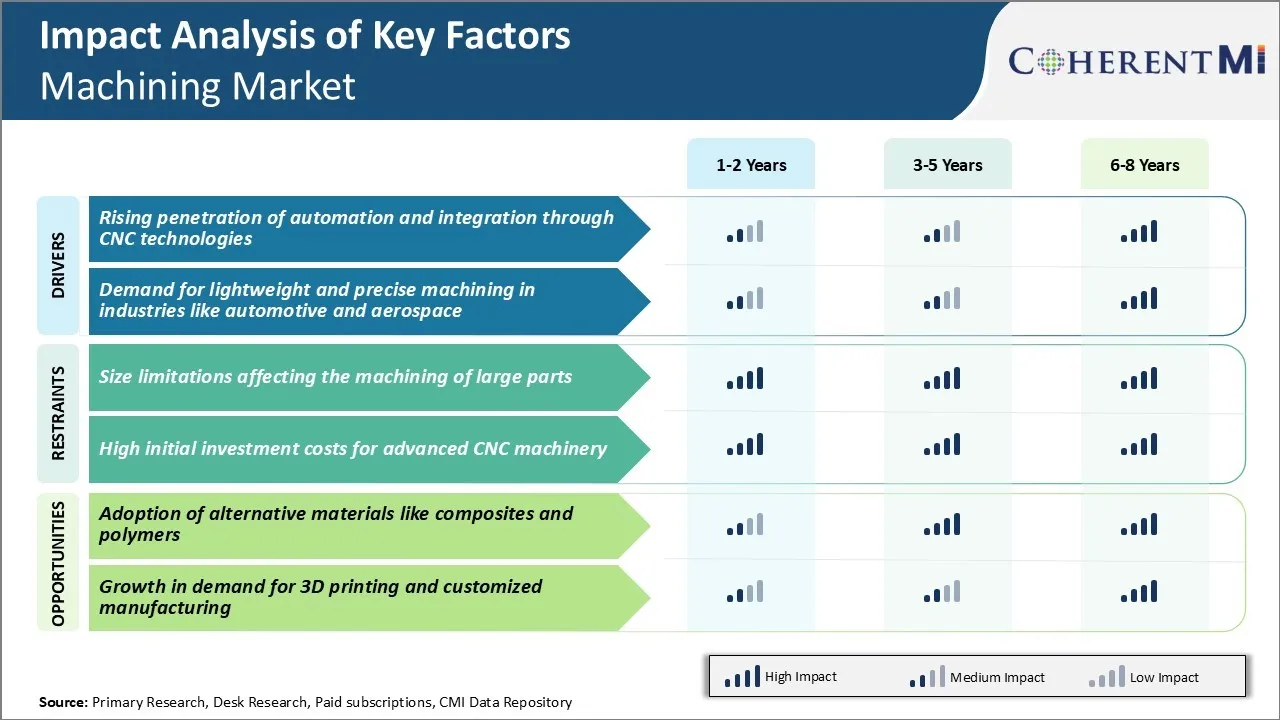

Size limitations affecting the machining of large parts and high initial investment costs for advanced CNC machinery are the major factors hampering the growth of the machining market.

What are the major factors driving the machining market growth?

Rising penetration of automation and integration through CNC technologies and demand for lightweight and precise machining in industries like automotive and aerospace are the major factors driving the machining market.

Which is the leading type in the machining market?

The leading type segment is Lathe Machines.

Which are the major players operating in the machining market?

FANUC Corp., DMG MORI Co Ltd., AMADA Co. Ltd., Atlas Copco AB., Bystronic Laser AG., TRUMPF GmbH Co. KG., Okuma Corp., Sandvik AB., Yamazaki Mazak Corp., IPG Photonics Corp. are the major players.

What will be the CAGR of the machining market?

The CAGR of the machining market is projected to be 6.5% from 2024-2031.