Wiederkehrender Verpackungsmarkt GRÖSSEN- UND MARKTANTEILSANALYSE - WACHSTUMSTRENDS UND PROGNOSEN (2024 - 2031)

Returnable Packaging Market ist segmentiert von Material (Plastic, Metal, Wood), By Product (Pallets, Crates, IBCs, Drums & Barrels, Dunnage), By End-....

Wiederkehrender Verpackungsmarkt Trends

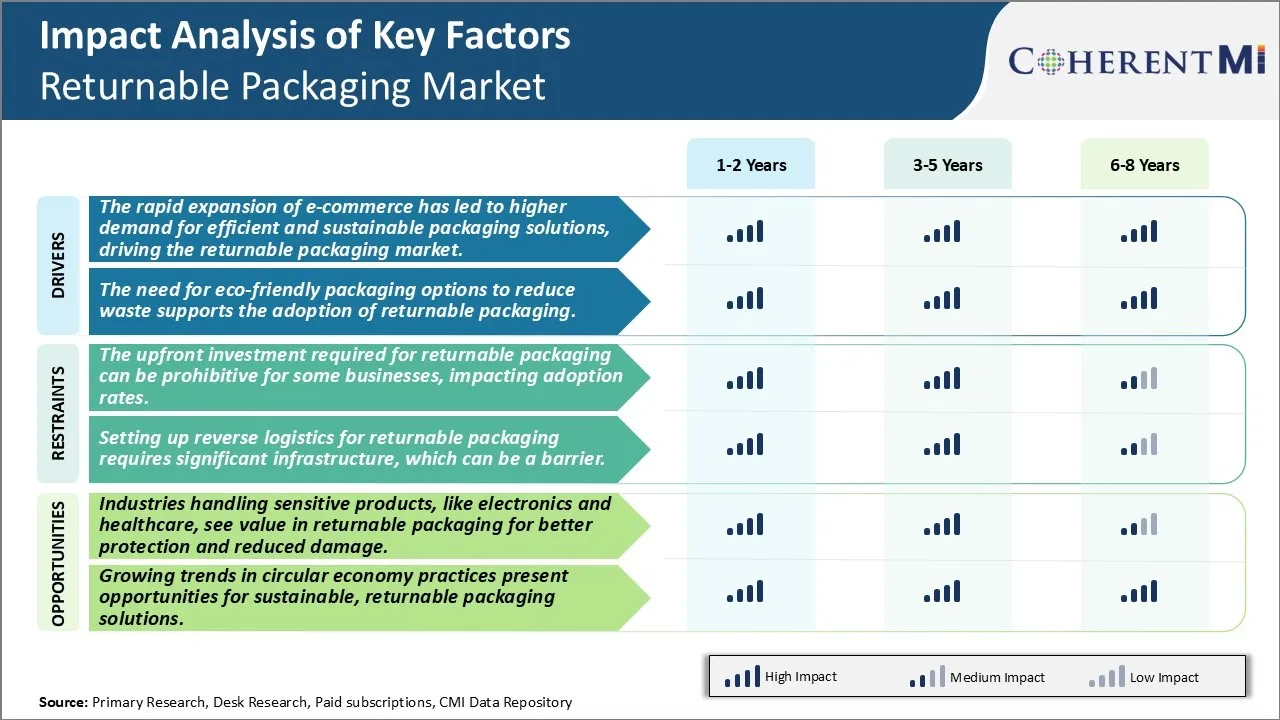

Markttreiber - Die rasche Expansion von E-Commerce hat auf eine höhere Nachfrage nach effizienten und nachhaltigen Verpackungslösungen geachtet

Das explosive Wachstum des E-Commerce und des Online-Shoppings in den letzten Jahren hat die Nachfragetrends der Verpackungen weltweit deutlich beeinflusst. Immer mehr Verbraucher entscheiden sich für den Kauf von Waren über Online-Shopping-Plattformen aufgrund der Bequemlichkeit, die es bietet. Dies hat enormen Druck auf Marken und Händler zu den wachsenden Online-Bestellungen durch verstärkte Supply Chain-Netzwerke. Die Verpackung spielt eine zentrale Rolle im gesamten Auftragserfüllungsprozess für E-Commerce-Unternehmen. Einwegverpackungsprodukte sind für die von e-tailers täglich bearbeiteten Massenmengen ungeeignet. Sie führen zu übermäßigen Materialverschwendungen und aufgeblasenen Logistikkosten aufgrund von zusätzlichen Schüttgut aus Entsorgungsverpackungen in Sendungen.

Wiederverwendbare Transportartikel und wiederverwendbare Verpackungsformate haben sich als attraktive Wahl für E-Commerce-Unternehmen entwickelt, die ihren Verpackungsbetrieb optimieren möchten. Wiederverwendbare Verpackungen wie Kunststoffkisten, Paletten, Stauraum und Container sind für mehrere Wiederverwertungsfahrten mit denselben oder verschiedenen Kunden ausgelegt. Sie verbessern die Verpackungsauslastung im Vergleich zu Einmalprodukten. Wiederverwendbare Verpackung hilft, das Abfallvolumen an Kundenlieferstellen zu reduzieren. Für E-Commerce-Geschäfte, die sich mit saisonalen Schwankungen in Auftragsvolumina befassen, bietet die wiederverwendbare Verpackung die Flexibilität, die Bestandsauf- und -abmessungen leicht nach Bedarfsmustern zu skaliert. Sie dienen als Asset, wenn nicht in Gebrauch und müssen nicht wieder für jede Bestellung gekauft werden.

E-Commerce-Unternehmen sind auch unter Druck, grünere Geschäftspraktiken zu übernehmen und ihre CO2-Fußabdrücke zu reduzieren. Dieses Ziel erfüllen wiederkehrende Transportgüter aus recycelten Kunststoffen, Holz oder anderen nachhaltigen Materialien. Sie senken die Umweltauswirkungsmetrie wie Wassernutzung, Treibhausgasemissionen und den nicht erneuerbaren Energieverbrauch über längere Lebenszyklen. Returnable Packaging ermöglicht E-Commerce-Unternehmen, ihre Nachhaltigkeitsverpflichtungen für immer umweltbewusste Online-Shopper zu präsentieren. Dies verbessert das Image des Unternehmens und hilft bei der besseren Verbindung mit den betroffenen Kunden, Abfall zu reduzieren.

Markttreiber - Die wachsende Nachfrage nach umweltfreundlichen Verpackungen unterstützt die Adoption von rückzahlbaren Optionen

Mit steigendem Umweltbewusstsein priorisieren mehr Unternehmen die Entwicklung nachhaltiger Verpackungslösungen. Kunden erwarten heute, dass Marken aufgrund ihrer Produkte die Verantwortung für Verpackungsabfälle übernehmen. Es gibt zunehmende Vorschriften sowie die Vervielfältigung des reduzierten Gebrauchs von Kunststoffen und die Annahme von wiederverwendbaren oder recycelbaren Verpackungsmaterialien. Returnable Verpackung hilft, diese Notwendigkeit für umweltfreundliche Verpackungsoptionen.

Wiederverwendbare Transportverpackungen wie Kunststoffkisten, Paletten und Behälter werden über mehrere Lebenszyklen eingesetzt, was die Materialnutzungseffizienz erheblich verbessert. Durch den Austausch von Einweg-Verpackungen reduziert sich die wiederverwendbare Verpackung auf den Verbrauch von nativen Materialien. Wenn nicht mehr nutzbar, hilft es, zu reduzieren, was in Deponien oder Abfallströmen endet. Wiederverwendbare Verpackung erfüllt die gleiche Schutzfunktion wie Einwegverpackungen, jedoch mit weniger Umwelteinflüssen über die längere Produktlebensdauer.

Verbundene wiederverwendbare Verpackungsmodelle, bei denen Einheiten zwischen Lieferkettenpartnern geteilt werden, maximieren das Wiederverwendungspotenzial weiter. Dieser Netzwerkansatz zur Verpackungsauslastung minimiert die Gesamtmenge der benötigten Verpackungen. Es senkt die Kosten für alle Parteien, während weniger Stress auf die Umwelt. Recycelter Inhalt wird häufig in der wiederverwendbaren Verpackungsherstellung verwendet, die Kunststoffe und andere Materialien aus Abfallströmen ableitet. Leichtigkeitsreformen und Neugestaltung fördern auch die Nachhaltigkeits-Berechtigungen von wiederverwendbaren Verpackungen.

Marktherausforderung - Die vorderste Investition erforderlich für wiederverwendbare Verpackung kann für einige Unternehmen, Auswirkungen Adoption Preise

Die für die erstattungsfähige Verpackung erforderlichen Investitionen können für einige Unternehmen untersagt werden, was die Adoptionsraten betrifft. Die Umstellung auf wiederverwendbare Verpackungssysteme beinhaltet den Kauf von dauerhaften und wiederverwendbaren Behältern, Kasten und Paletten anstelle von Einwegverpackungen. Dies erfordert erhebliche Investitionsausgaben. Unternehmen müssen in die richtige Implementierung Infrastruktur investieren, einschließlich Verpackung, Sortierung, Reinigungsanlagen und Technologie wie Barcode-Tracking. Die operativen Aufwendungen für die Verwaltung von wiederverwendbaren Verpackungen sind auch höher als die Einwegverpackung. Die Kosten für die Erfassung, den Transport, die Reinigung und Wartung im gesamten wiederverwendbaren Verpackungslebenszyklus erhöhen sich. Für kleine und mittlere Unternehmen mit engen Budgets stellen solche hohen Anfangskosten eine große Barriere für Investitionen in wiederverwendbare Verpackungsalternativen dar. Darüber hinaus gibt es Unsicherheit darüber, wie lange rückzahlbare Vermögenswerte dauern können, bevor sie Ersatz benötigen. Die Rückzahlungsfrist für rückzahlbare Verpackungsanlagen kann lang sein. Dieses wahrgenommene Risiko reduziert seine Attraktivität für Unternehmen.

Marktchance- Erhöhter Schutz für empfindliche Güter treibt den Marktbedarf an

Branchen, die sensible Produkte wie Elektronik und Gesundheitswesen behandeln, sehen Wert in wiederverwendbaren Verpackungen für besseren Schutz und reduzierte Schäden. Wiederverwendbare Verpackungen wie wiederverwendbare Kunststoffbehälter (RPCs), Paletten und Faltschachteln sind für Haltbarkeit und Wiederverwendung konzipiert. Sie bieten hervorragende Dämpfungs- und Schutzeigenschaften im Vergleich zu Einwegverpackungen. Dies führt zu weniger Produktschäden durch Bruch oder Produkteinwirkung beim Transport und Lagern. Weniger Produktrendite und Ansprüche im Zusammenhang mit In-Transit-Schäden können die gesamten Supply Chain Kosten für diese Branchen deutlich senken. Wiederverwendbare Verpackungslösungen ermöglichen auch die Anpassung der Behältergrößen in der Nähe der Montage für unregelmäßige Formen. Dies maximiert die Auslastung pro Sendung. Die Umweltvorteile der Wiederverwendung reizen Unternehmen, die Nachhaltigkeitsziele anstreben. Insgesamt bietet die wiederverwendbare Verpackung operative Effizienz und Marketingvorteile, die für Industrien mit fragilen und hochwertigen Produkten sehr attraktiv sind.