Rotator Cuff Injuries Treatment Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Rotator Cuff Injuries Treatment Market is segmented By Treatment (Surgical Repair, Non-Surgical Therapy), By Injury (Full-thickness Tears, Partial-thickness Tears), By Device (Implants, Orthobiologics), By Geography (North America, Latin America, Asia Pacific, Europe, Middle East, and Africa). The report offers the value (in USD Billion) for the above-mentioned segments.

Rotator Cuff Injuries Treatment Market Size

Market Size in USD Bn

CAGR6.2%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6.2% |

| Market Concentration | High |

| Major Players | Smith+Nephew, Arthrex, Medtronic, Integra LifeSciences, Zimmer Biomet and Among Others. |

please let us know !

Rotator Cuff Injuries Treatment Market Analysis

The rotator cuff injuries treatment market is estimated to be valued at USD 2.23 Bn in 2024 and is expected to reach USD 3.4 Bn by 2031, growing at a compound annual growth rate (CAGR) of 6.2% from 2024 to 2031. Key factors such as rising geriatric population, increasing incidence of sports injuries and road accidents, growth in medical tourism, and technological advancements in the field of shoulder joint repair procedures are expected to drive the demand for effective treatment options for rotator cuff injuries.

Rotator Cuff Injuries Treatment Market Trends

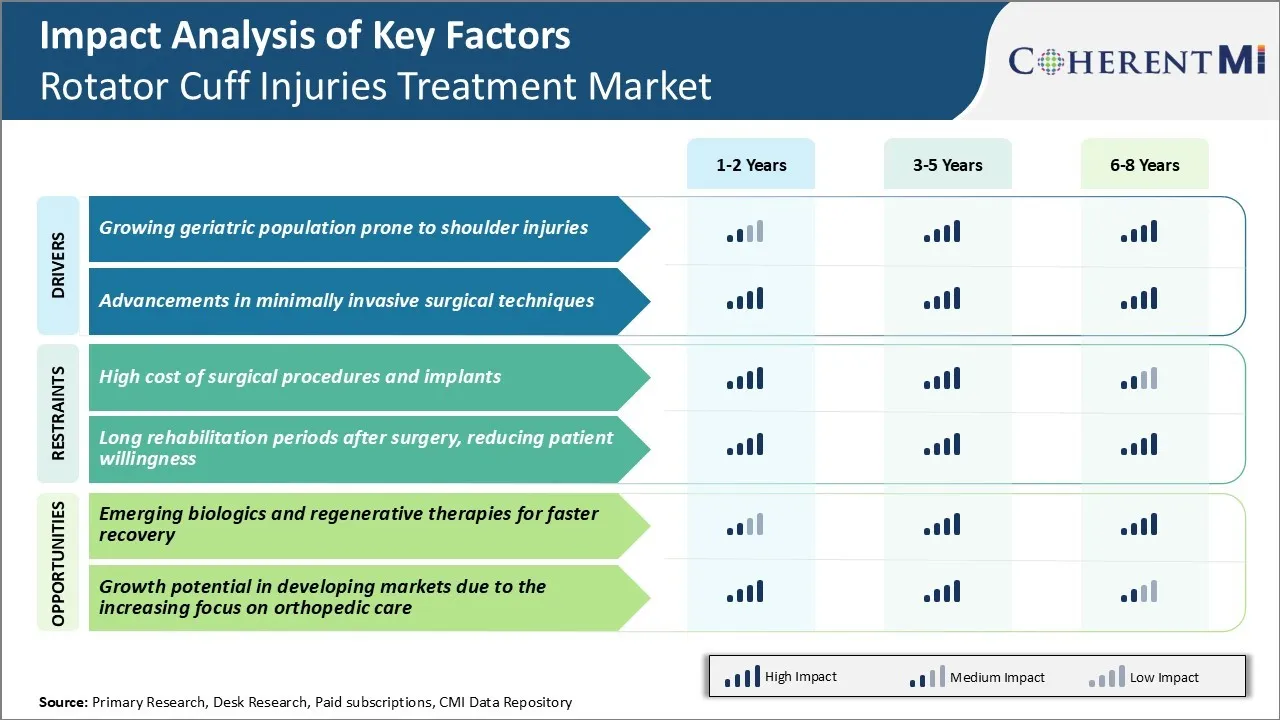

Market Driver - Growing Geriatric Population Prone to Shoulder Injuries

Statistics show that rotator cuff problems become far more prevalent in people over 60 years old compared to younger populations. Put plainly, shoulders were not designed to last decades of wear and tear without some consequences. Those in their 70s and 80s are at especially high risk as shoulders experience decades of stress from activities of daily living like getting dressed, lifting items, and other overhead movements. Some daily tasks that were once effortless can slowly develop into strains as one ages. Additionally, falls later in life can lead to sudden injuries that tear an already weakened rotator cuff.

Considering global demographics, the rise in the aging population creates a situation where rotator cuff issues are practically guaranteed to become more frequenthealth issues. With improved healthcare and standards of living around the world, life expectancies continue extending to new heights. The vast numbers of baby boomers are also entering their senior years in many nations.

As both developing and developed countries see their average ages creep upward, so too will shoulder problems that predominantly impact the elderly. This translates to steadily mounting demand for rotator cuff injury treatments across all healthcare systems globally.

Market Driver - Advancements in Minimally Invasive Surgical Techniques

Technology has revolutionized how rotator cuff repairs are performed in recent years. While open surgery requiring large incisions was once standard practice, minimally invasive approaches have since gained widespread acceptance. These less traumatic surgical techniques offer patients advantages of reduced pain, scarring, recovery times, and costs. They allow orthopedic surgeons to better target and reconstruct torn rotator cuff tendons through much smaller entry points.

Specifically, arthroscopic surgery utilizing tiny incisions and specialized cameras and instruments has emerged as the treatment of choice. Surgeons they can clearly visualize potential areas of damage within the joint and precisely repair tears using miniature surgical tools and sutures or anchors inserted through portals only millimeters in size.

The development of all-arthroscopic double-row repair techniques that approximate the footprint and compressive strength of the native rotator cuff further optimize clinical outcomes. Such technical progress drives both physician adoption of minimally invasive approaches and expands the pool of eligible patients willing to undergo treatment. Lower risks and burdens associated with minimally invasive options ensure they will remain the market standard. Their widespread acceptance also serves to boost overall rotator cuff injuries treatment demand.

Market Challenge - High Cost of Surgical Procedures and Implants

One of the major challenges currently impacting the rotator cuff injuries treatment market is the high cost of surgical procedures and implants. Rotator cuff surgery is expensive and costs thousands of dollars depending on the extent of damage and type of procedure required. The average cost of arthroscopic rotator cuff repair surgery in the US ranges from $15,000 to $30,000, while open surgery costs even more between USD 25,000 to USD 50,000.

Implants like suture anchors that are used to reattach the torn tendon also add to the total cost of surgery. In many cases, patients require multiple surgical procedures due to failed repairs or re-tears, further escalating treatment costs. The financial burden of high medical bills often discourages patients from opting for surgical treatment and compels them to try more conservative treatment options first.

This significantly impacts the demand for surgical procedures and associated products in the market. High costs create barriers for providers to adopt newer and advanced treatment solutions as well.

Market Opportunity - Emerging Biologics and Regenerative Therapies for Faster Recovery

The rotator cuff injuries treatment market has great potential opportunity in the emerging biologics and regenerative therapies segment. These therapies are focused on enhancing healing through the use of growth factors, stem cells, platelet rich plasma (PRP) and scaffolds. They aim to facilitate faster tendon-to-bone healing and better integrity of repair compared to traditional surgical techniques.

Biologics help reduce pain and swelling, accelerate rehabilitation and enable patients to return to daily activities sooner. The growing research in the field is expected to yield innovative cell-based solutions and tissue engineered grafts that could resolve size and chronic tears without surgery. Their ability to improve clinical outcomes in a cost-effective manner has the capability to transform the treatment landscape.

As data demonstrates their efficacy and safety, adoption of biologics is likely to increase noticeably in the coming years. This emerging category presents attractive opportunities for companies to introduce novel biomaterial-based solutions and gain a competitive edge in the market.

Prescribers preferences of Rotator Cuff Injuries Treatment Market

Rotator cuff injuries are generally treated through a staged approach depending on the severity of the tear. For mild cases, prescribers typically recommend over-the-counter medications like acetaminophen (Tylenol) and topical analgesics like diclofenac gel (Voltaren) to help manage pain in the initial weeks. Some may also suggest physical therapy exercises to maintain range of motion.

For moderate tears where pain persists, prescribers may prescribe oral NSAIDs like ibuprofen (Advil) or naproxen (Aleve) for a short term. Corticosteroid injections containing medications like triamcinolone acetonide (Kenalog) are also commonly used at this stage. Their anti-inflammatory effects help reduce pain and swelling.

In severe cases where conservative options provide little relief, surgery is often recommended. Prior to surgery, prescribers may prescribe gabapentin (Neurontin) or pregabalin (Lyrica) to help manage neuropathic pain components. After surgery, prescribers focus on restoring function through a rigorous post-op physical therapy regimen. Oral pain relievers may be needed occasionally in initial postoperative weeks.

The stage and size of tear, concurrent patient conditions, insurance approvals, side effect profiles, and cost of medications all factor into prescribers' preferences.

Treatment Option Analysis of Rotator Cuff Injuries Treatment Market

Rotator cuff injuries can range from mild strains to complete tears.

For mild strains without a tear, initial treatment involves rest, ice, and over-the-counter anti-inflammatory medications like ibuprofen. Physical therapy focused on stretching and strengthening may also help. If symptoms do not improve within a few weeks, further examination is needed.

Moderate tears may be treated with a corticosteroid injection to reduce pain and inflammation. This allows many patients to avoid or delay surgery. Physical therapy is also prescribed to maintain range of motion. If the injection provides no relief after 6 months, surgery may be considered.

For full-thickness or larger tears, especially in active patients, arthroscopic surgery is usually recommended. This allows diagnosis and repair of the torn tendon through small incisions. Common procedures are debridement, acromioplasty to treat bone spurs, and rotator cuff repair. The torn tendon is reattached to the bone using sutures or biologic patches. Post-surgery, a sling and physical therapy are used for rehabilitation.

For patients who cannot undergo surgery or whose tendon cannot be repaired, another option is a shoulder arthroscopy combined with subacromial decompression to relieve pressure, followed by prolonged physical therapy.

Key winning strategies adopted by key players of Rotator Cuff Injuries Treatment Market

Strategy 1: Focus on advanced treatment procedures

Many major players have focused on developing and offering advanced treatment procedures to effectively treat rotator cuff injuries. For example, in 2015, Arthrex launched its SwiveLock anchoring system which uses suture tape technology for rotator cuff repair. Clinical studies showed the system provided improved healing rates and patient outcomes compared to traditional suture anchors. This helped Arthrex gain a significant share of the rotator cuff repair market.

Strategy 2: Strategic acquisitions and partnerships

Companies have acquired or partnered with other players to expand their product portfolio and surgical solutions for rotator cuff injuries. For instance, in 2018, Smith & Nephew acquired Rotation Medical to add the CrossFix Extreme knotless anchor to its sports medicine product range. This allowed it to provide a wider range of anchor options to orthopedic surgeons. Such strategic deals helped companies strengthen their market position.

Strategy 3: Focus on developing all-arthroscopic repair solutions

Players like DePuy Synthes launched all-arthroscopic rotator cuff repair systems that provided a minimally invasive treatment option compared to traditional open surgeries. Clinical research demonstrated benefits like less pain, faster recovery and higher patient satisfaction.

Segmental Analysis of Rotator Cuff Injuries Treatment Market

Insights, By Treatment: Clinical Efficacy of Surgical Procedures Drives the Surgical Repair Segment

In terms of treatment, surgical repair segment is expected to account for 58.9% share of the market in 2024, owing to its clinical efficacy in addressing full-thickness rotator cuff tears. Surgical procedures such as arthroscopic repair and open repair have been shown to be more effective in restoring the anatomical structure and biomechanical function of completely torn rotator cuff muscles as compared to non-surgical therapies.

Advances in surgical techniques such as mini-open repairs and arthroscopic surgeries have further increased the uptake of surgical repair by enabling less invasive procedures and quicker recovery times for patients.

Additionally, factors like the rising number of sports injuries and traumatic accidents which often result in complete tears have contributed to the growth of surgical volume. While non-surgical options are considered for partial tears or early-stage injuries, surgical repair remains the standard of care for treating higher-grade full-thickness tears, thereby supporting its market leadership.

Insights, By Injury: Demand for Addressing Aging Population's Full-thickness Tears Aids Segment

In terms of injury, full-thickness tears segment is estimated to account for 54.3% share of the market in 2024, owing to the rising incidence of such severe tears, especially in the aging population group. As rotator cuff muscles weaken with age, the risk of tendons tearing completely rises significantly.

Injuries resulting in full-thickness tears often require surgical intervention to re-attach the torn muscles back to the bone, unlike milder partial tears. This has augmented the demand for effective solutions targeting such injuries.

Additionally, lifestyle-related risk factors such as repetitive overhead activities common in occupations have contributed to increasing incidence rates of full-thickness tears. The growing elderly population demographic and reliance on surgical repair further propels the volume growth of this injury segment.

Insights, By Device: Implants Popularity Increases as a Preferred Restoration Aid

In terms of device, implants contribute the highest share of the market driven by their increased popularity among surgeons and efficacy in aiding soft-tissue restoration. Conventionally, open or arthroscopic surgical procedures involved re-attachment of torn muscles without any supplemental devices.

However, the advent of advanced implants like biodegradable anchors, interference screws, and composite patches have provided surgeons arsenal to mechanically reinforce and augment soft-tissue repair during surgery. The superior structural support provided by such implants help accelerate post-operative healing of repaired muscles and improves clinical outcomes.

Additionally, implants allow for secure fixation during the early critical healing phases. Their ease of use and versatility in addressing various injury patterns have further increased preference for implant-assisted rotator cuff repairs among orthopedic surgeons. This growing acceptance and utilization of implants is a key factor supporting the segment's dominance.

Additional Insights of Rotator Cuff Injuries Treatment Market

- Rotator cuff tears are a leading cause of shoulder pain, especially in the elderly. In the U.S. alone, approximately 200,000 rotator cuff surgeries are performed each year, reflecting the rising demand for innovative treatments and better recovery options.

- Rotator cuff injuries are highly prevalent, particularly in older adults, with degenerative tears more common in this group. The increasing demand for non-invasive therapies is expected to drive market growth.

Competitive overview of Rotator Cuff Injuries Treatment Market

The major players operating in the rotator cuff injuries treatment market include Smith+Nephew, Arthrex, Medtronic, Integra LifeSciences, Zimmer Biomet, and Tego Science.

Rotator Cuff Injuries Treatment Market Leaders

- Smith+Nephew

- Arthrex

- Medtronic

- Integra LifeSciences

- Zimmer Biomet

Rotator Cuff Injuries Treatment Market - Competitive Rivalry, 2023

Rotator Cuff Injuries Treatment Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Rotator Cuff Injuries Treatment Market

- In June 2024, TPX 115 by Tego Science, advancing through Phase II/III trials, has shown promising results in regenerative treatment for rotator cuff injuries through fibroblast cell replacement therapy. It is currently in Phase 2b/3 trials, with an aim to assess the safety and efficacy of this therapy in treating patients with rotator cuff injuries. The trials are designed to test improvements in shoulder function and healing, particularly through the regeneration of damaged tissues using healthy fibroblast cells.

- In March 2024, Arthrex introduced a new suture technology that enhances healing post-surgery, providing better long-term outcomes for patients with full-thickness tears. Arthrex has been developing and introducing advanced suture technologies, including innovations like the FiberStitch™ RC implant and knotless suture technologies for rotator cuff and other repairs, as seen in previous years. Their advancements typically aim to enhance healing and improve outcomes for conditions such as full-thickness tears.

- In September 2022, Smith+Nephew reported that their REGENETEN Bioinductive Implant demonstrated an 86% reduction in rotator cuff re-tear rates in a randomized controlled trial. This study involved patients with full-thickness rotator cuff tears, comparing traditional repair methods with and without the REGENETEN implant. The implant group had significantly lower re-tear rates after one year, with only 3.5% experiencing re-tears compared to 25% in the non-implant group. This data suggests a substantial improvement in post-operative recovery and long-term outcomes for patients receiving the REGENETEN implant.

Rotator Cuff Injuries Treatment Market Segmentation

- By Treatment

- Surgical Repair

- Non-Surgical Therapy

- By Injury

- Full-thickness Tears

- Partial-thickness Tears

- By Device

- Implants

- Orthobiologics

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the rotator cuff injuries treatment market?

The rotator cuff injuries treatment market is estimated to be valued at USD 2.23 Bn in 2024 and is expected to reach USD 3.4 Bn by 2031.

What are the key factors hampering the growth of the rotator cuff injuries treatment market?

High cost of surgical procedures and implants and long rehabilitation periods after surgery, reducing patient willingness are the major factors hampering the growth of the rotator cuff injuries treatment market.

What are the major factors driving the rotator cuff injuries treatment market growth?

Growing geriatric population prone to shoulder injuries and advancements in minimally invasive surgical techniques are the major factors driving the rotator cuff injuries treatment market.

Which is the leading treatment in the rotator cuff injuries treatment market?

The leading treatment segment is surgical repair.

Which are the major players operating in the rotator cuff injuries treatment market?

Smith+Nephew, Arthrex, Medtronic, Integra LifeSciences, Zimmer Biomet, and Tego Science are the major players.

What will be the CAGR of the rotator cuff injuries treatment market?

The CAGR of the rotator cuff injuries treatment market is projected to be 6.2% from 2024-2031.