AI In Networks Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

AI In Networks Market is segmented By Component (Hardware, Software, Services), By Deployment (Cloud, On-premises), By Technology (Machine Learning, N....

AI In Networks Market Size

Market Size in USD Bn

CAGR15.7%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 15.7% |

| Market Concentration | Medium |

| Major Players | Arista Networks, Inc., Broadcom, Cisco Systems, Inc., Huawei Technologies Co., Ltd., Nokia and Among Others. |

please let us know !

AI In Networks Market Analysis

The Global AI In Networks Market is estimated to be valued at USD 11.5 Bn in 2024 and is expected to reach USD 24.3 Bn by 2031, growing at a compound annual growth rate (CAGR) of 15.7% from 2024 to 2031.

The market is expected to witness significant growth during the forecast period. The growth of this market can be attributed to various factors such as rising adoption of AI-enabled network devices across different industry verticals to enhance network operations and optimize network resources. Enterprises are increasingly implementing AI-powered networking solutions to monitor and analyze network traffic patterns, predict network failures, and automate network operations. The increasing need to enhance customer experience while reducing operation costs is also driving the demand for AI solutions in networking domain. Moreover, increasing investments by networking giants to develop human-like cognitive capabilities in networks is anticipated to boost innovation and fuel adoption of advanced AI networking technologies during the forecast period.

AI In Networks Market Trends

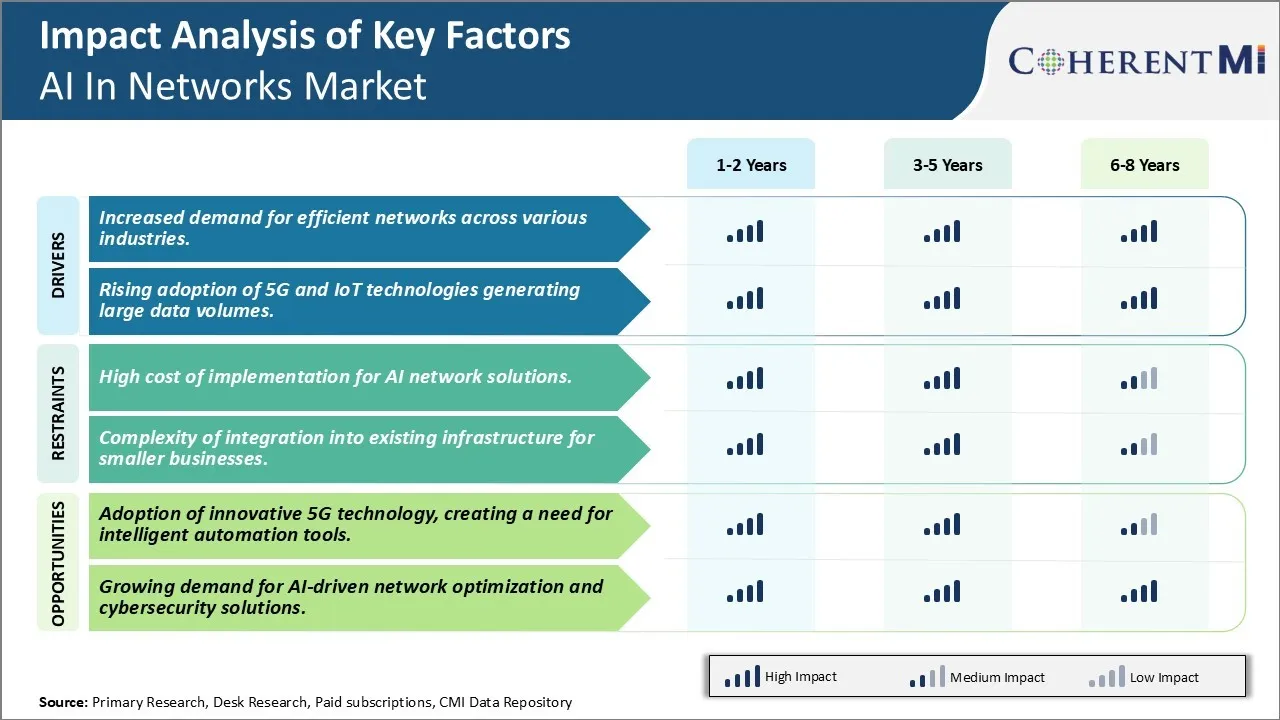

Market Driver - Increased Demand for Efficient Networks Across Various Industries

The digital transformation across various industries has significantly increased the demand for highly efficient and scalable networks. As industries move towards advanced technologies like cloud, analytics and automation, the volume as well as complexity of data being generated has increased exponentially. This has exposed the limitations of traditional network infrastructures which are unable to support the bandwidth and response time requirements of emerging applications. There is an urgent need amongst organizations to modernize their networks to derive true value from digital investments and stay ahead of the curve.

Industries like manufacturing are adopting Industry 4.0 technologies like IoT, robotics, and 3D printing on a large scale to optimize production processes and enhance productivity. This has increased the need for low latency, high throughput networks within factory premises to support machine to machine communication and real time analytics. Similarly, healthcare sector is investing heavily in telemedicine, remote patient monitoring and digital health records which generate massive amounts of sensitive data on a daily basis. This calls for secure, reliable networks that can seamlessly integrate different systems and locations. Even sectors like transportation and logistics are looking to transform using technologies like autonomous vehicles, drone deliveries and supply chain optimization. However, the current network architectures lack capabilities like edge computing to support applications with strict latency constraints.

The growing complexity of networks across domains has increased dependency on AI enabled solutions that can help intelligently manage network resources, traffic flows, security policies and performance benchmarks. AI in networks provides capabilities like predictive analytics, anomaly detection and automated remediation which help enterprises achieve continuous network monitoring and optimization. Advanced technologies like SDN and NFV also require integration with AI/ML frameworks to enable capabilities like automated provisioning, self-healing and proactive capacity management. With industries progressively moving towards a connected future driven by advanced technologies, the demand for AI powered self-driving networks is expected to rise exponentially in the coming years.

Market Driver - Rising Adoption of 5G and IoT Technologies Generating Large Data Volumes

The widespread rollout of 5G cellular networks and proliferation of IoT devices are two prominent trends that are significantly influencing the growth of AI in networks market. 5G promises ultra-high speeds, low latency and massive connectivity which will transform the way we interact with technologies as well as each other. It is expected to power a diverse array of applications ranging from augmented/virtual reality to autonomous vehicles to smart cities. While 5G will deliver the necessary bandwidth to support these innovations, managing the scale and complexity of next generation infrastructures requires modern solutions like AI/ML and analytics. As the number of connected 5G devices grow exponentially in the coming years, the resultant flood of data from diverse sources will put immense pressure on core and edge networks.

IoT is another mega trend that is connecting everything from manufacturing equipment to home appliances to wearables to infrastructure through embedded sensors and internet connectivity. The number of IoT devices being installed across sectors is growing at an unprecedented rate generating huge volumes of data on a daily basis. By 2025, there will be over 25 billion actively connected IoT devices generating close to 80 zettabytes of data annually. However, traditional network architectures lack the scalability and intelligence to cost-effectively manage such volumes of streaming data from scattered sources. This is where AI driven capabilities like traffic engineering, anomaly detection, predictive maintenance and automated provisioning become indispensable for IoT networks.

In summary, advanced technologies like 5G and IoT are dramatically changing the networking landscape by enabling new use cases but also producing massive amounts of complex data. This shift necessitates adoption of AI in networks to autonomously manage traffic flows, security policies, performance monitoring across expanding scales. Without cognitive networks that can self-optimize on the fly, it will be extremely difficult for enterprises to extract true value from 5G and IoT investments.

Market Challenge - High Cost of Implementation For AI Network Solutions

One of the major challenges in the AI in Networks market is the high cost of implementation for AI network solutions. Developing and deploying advanced AI capabilities to power network functions requires significant capital expenditure on new hardware, software licenses, specialized skills and training. Telecom operators have traditionally focused on optimizing legacy 2G, 3G and 4G networks and it requires large upfront investments to virtualize, automate and infuse intelligence into modern 5G infrastructure and edge computing platforms. Additionally, rolling out AI technologies at scale across multiple network domains and geographic regions poses integration challenges that drive up implementation and operations costs. Cost-effective solutions are needed to migrate legacy network components, extract value from existing infrastructure investments and offer pay-as-you-grow pricing models to reduce short-term financial burden on network operators. Addressing the high costs of implementation will be a key factor to faster adoption of AI-driven automation and optimization within carrier networks.

Market Opportunity: Adoption of Innovative 5G Technology, Creating a Need for Intelligent Automation Tools

The maturation of 5G technology standards and increasing deployments of 5G networks worldwide present lucrative opportunities for AI vendors in this market. Next-generation 5G networks rely on dynamic infrastructure to support technologies like network slicing, edge computing and low-latency applications. This creates an urgent need for intelligent automation tools that can self-optimize networks, autonomously configure virtualized resources and assist operators in managing the complexity of highly distributed 5G architectures. AI-driven solutions are well-positioned to help smooth provisioning of services across fragmented domains, predict capacity demands, optimize spectrum usage and ensure stringent quality of experience requirements for diverse 5G use cases. As 5G adoption accelerates, the demand is expected to surge for AI network platforms that support autonomous operations, predictive maintenance and self-healing capabilities essential for managing sophisticated 5G networks. This represents a major opportunity for AI solution providers to offer innovative products tailored for the unique demands of intelligent 5G infrastructure.

Key winning strategies adopted by key players of AI In Networks Market

Heavy Investment in R&D to Develop Advanced AI Solutions: Companies like Cisco, Huawei, IBM have invested heavily in R&D to develop cutting-edge AI solutions for networks. Cisco invested USD One billion in AI R&D in 2018 and launched new capabilities in its Intent-Based Networking portfolio. Huawei established seven joint innovation centers with universities globally in 2017 focused on AI and networks. Such heavy investments have helped these companies build strong AI capabilities and launch innovative solutions before competitors.

Partnerships for go-to-market Strength: Leading players partnered with other technology providers as well as telecom operators for wider market coverage. For example, Huawei partnered with carriers like China Mobile to deploy its AI-enabled Self-Driving Network solutions in 2017 across 100+ cities in China, significantly boosting its scale in a short time. Cisco also collaborates with service providers globally to deploy its AI-based networking solutions. Such strategic partnerships accelerated commercial deployment of AI-driven solutions.

Establishing Open Partner Ecosystems: Companies are building open partner ecosystems to crowdsource innovation. For example, IBM established the Open Grid Alliance in 2020 bringing together partners applying AI/ML to manage 5G networks smarter. Such ecosystems facilitate collaborative development of standards-based, interoperable solutions unlocking new market potential.

Segmental Analysis of AI In Networks Market

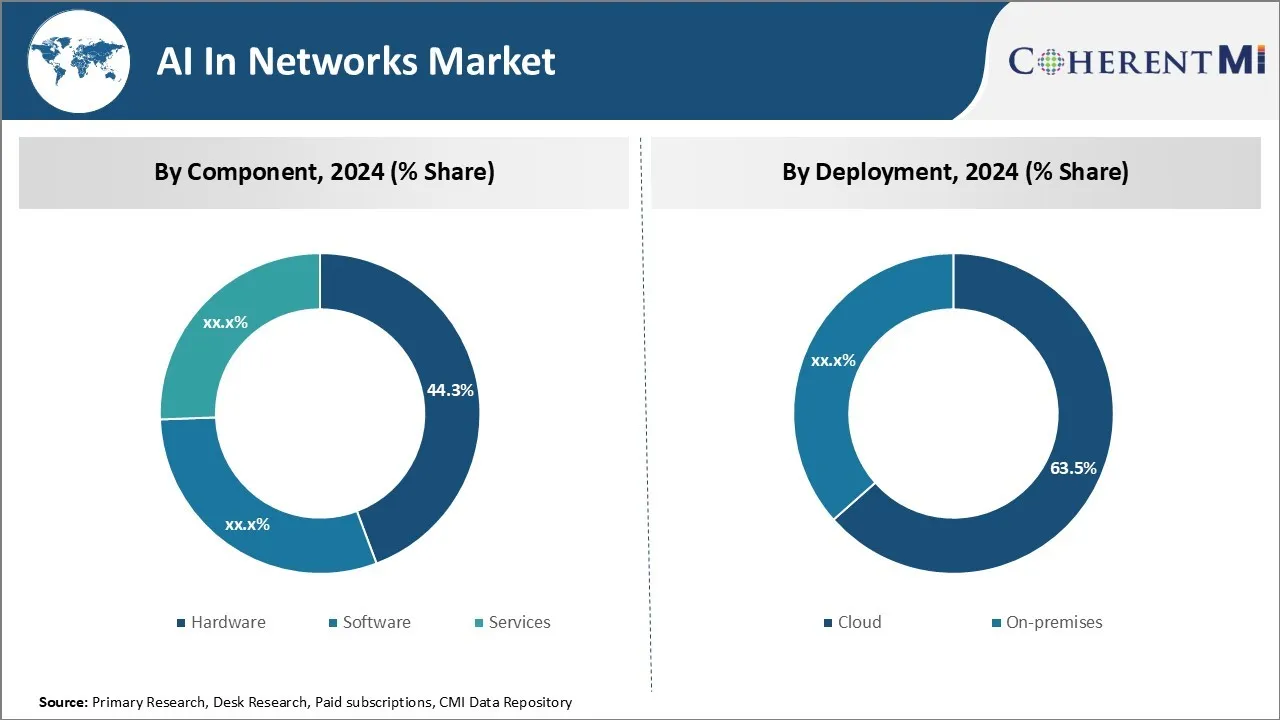

Insights, By Component, Hardware Dominance Driven by Crucial Computing Infrastructure Needs

By Component, Hardware is expected to contribute 44.3% in 2024 owing to its indispensable role in powering all AI applications. As AI algorithms become increasingly sophisticated, there is a growing need for computers with exponentially greater processing power and data storage capabilities. Hardware designed specifically for AI workloads, such as GPUs and customized chips, have become crucial for tackling complex tasks involving massive datasets and neural networks. Leading technology firms are racing to develop more powerful hardware optimized for machine learning to gain a competitive edge in the AI space. Furthermore, hardware upgrades are necessary to support the continuous improvements in software and new types of algorithms. The hardware segment benefits from regular innovation cycles and being at the core of the overall AI infrastructure. As networks become more intelligent, the demand for advanced hardware customized for computation-intensive AI processing can only continue to strengthen.

Insights, By Deployment, Cloud Migration Driven by Scalability, Accessibility and Costs Advantages

By Deployment, Cloud segment is expected to contribute 63.5% in 2024 for its compelling value proposition for AI workloads. Cloud services allow organizations to deploy robust AI models without massive up-front infrastructure investments. Using cloud AI platforms, businesses of all scales can easily access powerful GPUs and specialized hardware on a flexible, pay-per-use basis. For data scientists, the cloud streamlines collaboration and speeds up prototyping of new ideas through its scalable, standardized environment. It also offers invaluable data storage and services. As networks adopt more advanced AI, the ability to seamlessly scale computational resources up or down as required gives the cloud a significant advantage. Overall, the cloud approach leads to lower costs of ownership compared to installing on-premise hardware and managing data centers. These factors are driving many organizations to migrate their AI initiatives to the cloud.

Insights, Machine Learning at the Core of Contemporary AI Applications

By Technology, Machine Learning contributes the highest share of the market owing to its central role in tackling modern network challenges. Whether it is automating tasks, gaining insights from data, or powering intelligent virtual assistants, machine learning algorithms are at the heart of the majority of current AI applications. Complex networks generate vast volumes of diverse data on a daily basis, creating the need for self-learning systems that can detect useful patterns without explicit programming. As networks become more instrumented and interconnected, there is an increasing necessity for machines to continuously learn from new information being generated. Revolutionary machine learning techniques like deep learning have enabled building scalable AI systems capable of handling complex, unstructured data. Given its current prominence across industries, machine learning is expected to drive some of the most impactful innovations in intelligent networking in the coming years. Its prevalence is a key driver for growth across various AI technologies and services segments that are designed to support advanced machine learning applications.

Additional Insights of AI In Networks Market

The AI in networks market is witnessing robust growth due to the increasing integration of AI into network management systems. This is primarily driven by the exponential rise in data generated by technologies like IoT, 5G, and cloud computing, which require sophisticated tools to manage, optimize, and secure networks effectively. AI provides automation and predictive capabilities that help reduce latency, improve bandwidth utilization, and enhance overall network performance. Telecom companies, in particular, are benefiting from AI-driven network optimization, as it reduces operational costs, prevents downtime, and enhances customer satisfaction. AI's role in network cybersecurity is also growing, with companies investing in AI to mitigate cyber risks and predict potential attacks. The market is further fueled by advancements in AI technologies like machine learning and deep learning, which are enabling more precise and scalable network management solutions. This creates significant growth opportunities for AI in network management, especially with the ongoing global adoption of 5G technology.

Competitive overview of AI In Networks Market

The major players operating in the AI In Networks Market include Arista Networks, Inc., Broadcom, Cisco Systems, Inc., Huawei Technologies Co., Ltd., Nokia, IBM Corporation, Extreme Networks, Juniper Networks, Inc., Telefonaktiebolaget LM Ericsson and ZTE Corporation.

AI In Networks Market Leaders

- Arista Networks, Inc.

- Broadcom

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Nokia

AI In Networks Market - Competitive Rivalry, 2024

AI In Networks Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in AI In Networks Market

The AI in networks market is witnessing robust growth due to the increasing integration of AI into network management systems. This is primarily driven by the exponential rise in data generated by technologies like IoT, 5G, and cloud computing, which require sophisticated tools to manage, optimize, and secure networks effectively. AI provides automation and predictive capabilities that help reduce latency, improve bandwidth utilization, and enhance overall network performance. Telecom companies, in particular, are benefiting from AI-driven network optimization, as it reduces operational costs, prevents downtime, and enhances customer satisfaction. AI's role in network cybersecurity is also growing, with companies investing in AI to mitigate cyber risks and predict potential attacks. The market is further fueled by advancements in AI technologies like machine learning and deep learning, which are enabling more precise and scalable network management solutions. This creates significant growth opportunities for AI in network management, especially with the ongoing global adoption of 5G technology.

AI In Networks Market Segmentation

- By Component

- Hardware

- Software

- Services

- By Deployment

- Cloud

- On-premises

- By Technology

- Machine Learning

- Natural Language Processing

- Computer Vision

- Deep Learning

- Others

- By Application

- Network Optimization

- Network Cybersecurity

- Network Predictive Maintenance

- Network Troubleshooting

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the AI in Networks Market?

The Global AI In Networks Market is estimated to be valued at USD 11.5 Bn in 2024 and is expected to reach USD 24.3 Bn by 2031.

What will be the CAGR of the AI In Networks Market?

The CAGR of the AI In Networks Market is projected to be 15.7% from 2024 to 2031.

What are the major factors driving the AI In Networks Market growth?

The increased demand for efficient networks across various industries, and rising adoption of 5G and IoT technologies generating large data volumes are the major factors driving the AI In Networks Market.

What are the key factors hampering the growth of the AI In Networks Market?

The high cost of implementation for AI network solutions and complexity of integration into existing infrastructure for smaller businesses are the major factors hampering the growth of the AI In Networks Market.

Which is the leading Component in the AI In Networks Market?

Hardware is the leading Component segment.

Which are the major players operating in the AI In Networks Market?

Arista Networks, Inc., Broadcom, Cisco Systems, Inc., Huawei Technologies Co., Ltd., Nokia, IBM Corporation, Extreme Networks, Juniper Networks, Inc., Telefonaktiebolaget LM Ericsson, ZTE Corporation are the major players.