Hydrogen Technology Testing, Inspection, and Certification Market Size - Analysis

Market Size in USD Bn

CAGR18.1%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 18.1% |

| Market Concentration | High |

| Major Players | SGS SA, Bureau Veritas SA, Intertek Group plc, DEKRA SE, TÜV SÜD and Among Others |

please let us know !

Hydrogen Technology Testing, Inspection, and Certification Market Trends

With growing concerns over climate change and global efforts to reduce carbon emissions, transitioning to clean and renewable sources of energy has become a top priority for governments and industries across the world. One such promising clean technology that is gaining significant attention is hydrogen. As one of the most abundant elements on earth, hydrogen has the potential to help countries and organizations lower their carbon footprint in a sustainable way. It can be used as an alternative to fossil fuels in multiple hard-to-abate sectors like heavy-duty transportation, steel and chemical industries where direct electrification or use of battery-based solutions is not feasible.

Strict quality control and compliance with technical specifications would be critical for building customer confidence and trust in emerging hydrogen technologies. It would also help address potential risks and prompt remedial action wherever needed to advance the development of hydrogen applications in a responsible manner. As more companies proactively work on integrating clean hydrogen into their processes and transitioning their plants to run on hydrogen, the demand for third-party certification services by experts is expected to steadily rise in the coming years. This indicates promising prospects for hydrogen TIC providers to play an active role in enabling a smooth shift to hydrogen-based systems.

Market Driver - Increasing Investments by Governments and Industries in Hydrogen Technologies, Especially in Transportation and Power Generation

This rising tide of investments is a clear sign that hydrogen is increasingly being viewed as a key pillar of long-term zero-emission strategies, especially in hard-to-abate domains of transportation and power generation. In transportation, countries worldwide are targeting commercial roll-out of fuel cell vehicles and scaling up of hydrogen refueling infrastructure to provide a cleaner alternative to conventional vehicles. Moreover, leveraging hydrogen's ability to store and transport energy is seen as an important way to boost flexible renewable power generation capacity and enhance grid reliability. With billons of dollars committed towards deploying innovative hydrogen projects across diverse applications and geographies, demand for experienced technical experts is expected to accelerate.

Market Challenge - High Cost and Complexity of Infrastructure Development for Hydrogen Storage and Transport Challenges Large-Scale Deployment

The rising focus on generating hydrogen through renewable energy sources like electrolysis is a major opportunity for growth in the hydrogen technology testing, inspection, and certification market. Many countries are investing heavily in green hydrogen projects as part of their climate action plans and energy transition goals. The proliferation of large green hydrogen plants and ammonia facilities worldwide will lead to a surge in demand for testing and certification services during the construction, commissioning and operating phases of these facilities. Additionally, the expansion of wind and solar power capacity also provides opportunities for integrated green hydrogen production using surplus renewable energy. The increasing need to ensure reliability, efficiency and safety standards in green hydrogen value chains can drive significant future revenues for testing, inspection and certification providers. This represents a promising avenue for market expansion.

Key winning strategies adopted by key players of Hydrogen Technology Testing, Inspection, and Certification Market

- In 2021, German certification company TÜV SÜD acquired the hydrogen certification business of Element Materials Technology, strengthening its global hydrogen certification capabilities. This expanded TUV Sud's hydrogen testing network and expertise in certification of equipment across the hydrogen value chain.

- Intertek has partnerships with national standards bodies in countries actively pursuing hydrogen strategies like Korea, Japan and Germany. This enables it to leverage local expertise and standards while expanding its international hydrogen inspection services.

Investing in Specialized Test Facilities to Certify New Hydrogen Technologies

- TUV Rheinland unveiled a new hydrogen testing laboratory in Korea in 2021, with capabilities for materials testing, component certification and safety verification. This positioned it at the frontline of certifying new hydrogen fuel cell and storage technologies emerging from Korean companies.

- Bureau Veritas hired dozens of hydrogen specialists through 2020-21 and launched the Hydrogen Certification Academy to upskill inspectors and auditors. Over 300 inspectors have been certified through this program so far.

Segmental Analysis of Hydrogen Technology Testing, Inspection, and Certification Market

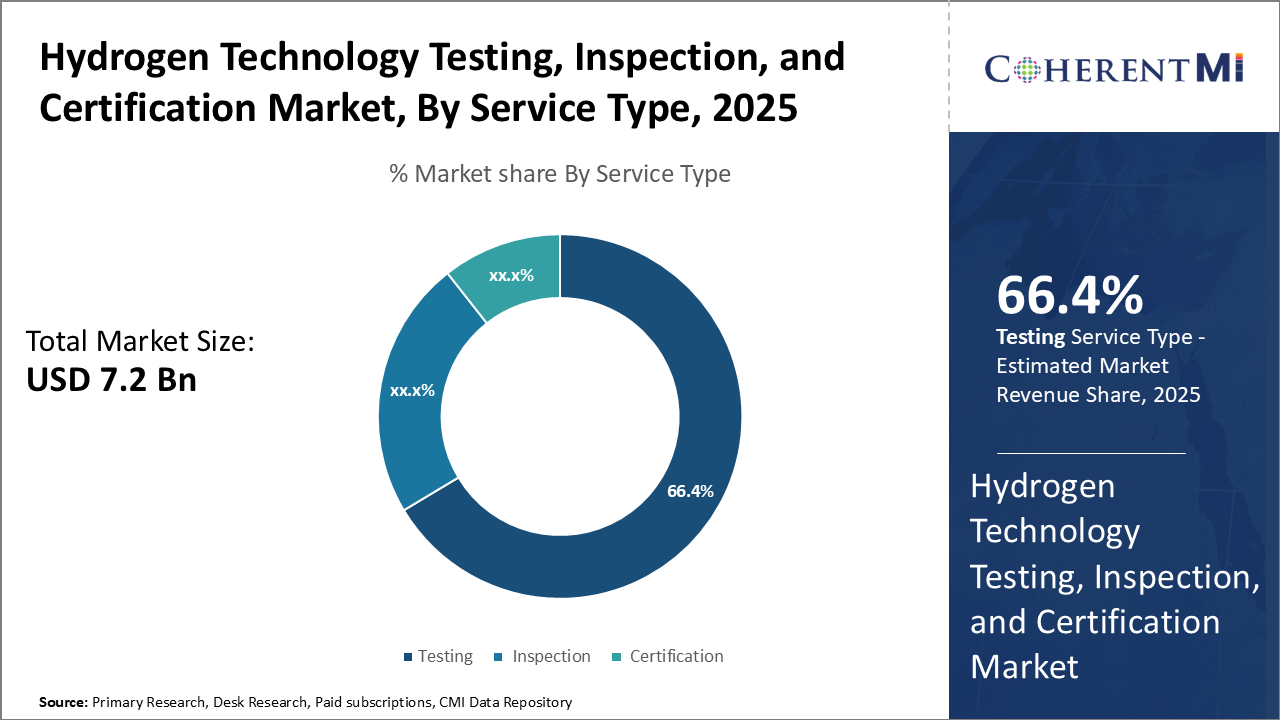

Insights, By Service Type, Testing Remains the Backbone of Hydrogen Technology Industry Owing to Safety Concerns

Insights, By Service Type, Testing Remains the Backbone of Hydrogen Technology Industry Owing to Safety ConcernsBy Service Type, Testing services are expected to contribute 66.4% market share in 2025 owing to paramount safety concerns regarding hydrogen technologies. Hydrogen, being an intensely volatile and flammable gas, demands stringent testing protocols to prevent accidents and ensure personnel safety. Unlike other industries, a single oversight in testing hydrogen systems, cylinders or equipment can instantly lead to devastation. Therefore, stakeholders leave nothing to chance and prioritize periodic as well as surprise testing to rule out any defects or vulnerabilities at design/production stages as well as during operation. This risk-averse attitude translates to massive budgets and resources designated for testing new as well as existing hydrogen technologies, infrastructure and applications on a continual basis. Additionally, with hydrogen finding increasing applications across transport, energy and industrial sectors, the testing demand volumes continue to surge thereby keeping this segment dominant in the service type landscape.

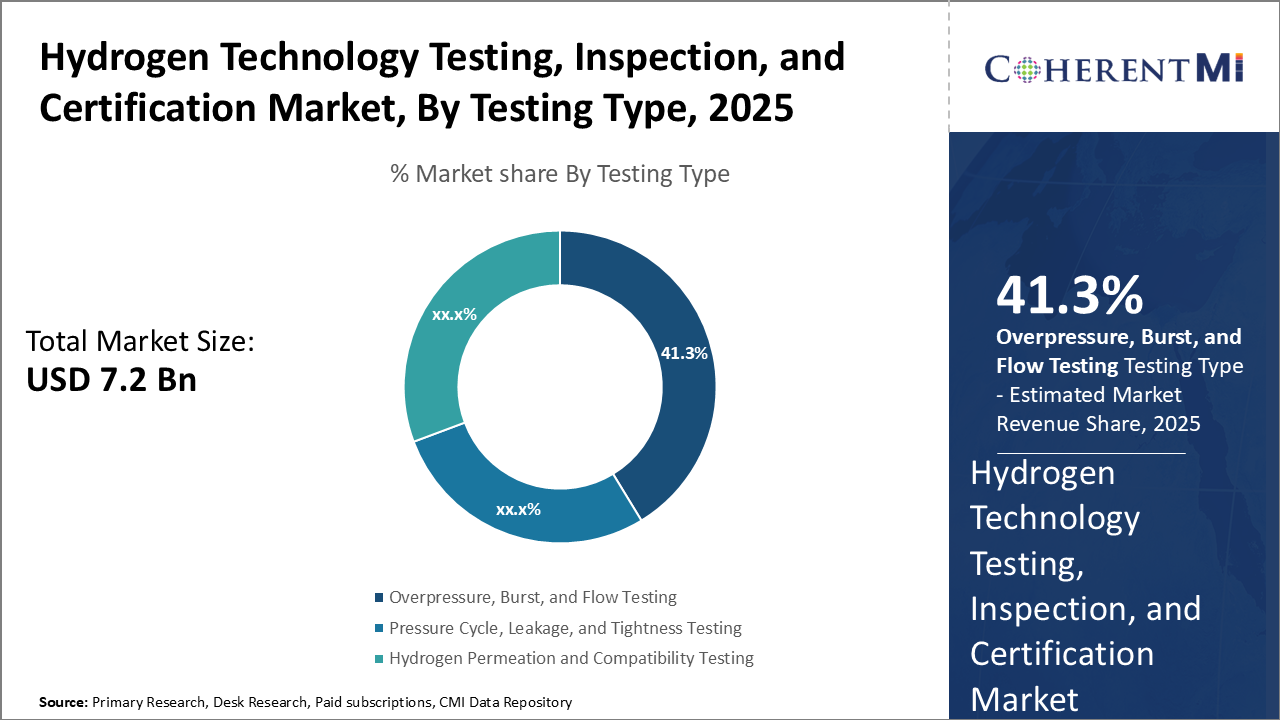

By Testing Type, Overpressure, Burst, and Flow Testing type is expected to contribute 41.3% market share in 2025 owing to prime focus on confirming equipment strength and integrity. As hydrogen systems operate at high pressures, it is critical to verify that vessels, cylinders, tubing and connectors can withstand pressures significantly above their rated capacity without showing signs of weakness or potential failure. Overpressure testing evaluates factors like stress margins, safety factor evaluation and response to surges. Burst testing determines the exact pressure at which equipment will fail to avoid operating them close to burst points. Flow testing looks at pressure drop, flow constraints and dynamic responses under varied flow conditions. Given hydrogen's ubiquitous use across pressure intensive operations and transportation, this testing segment assumes immense importance to rule out risks of rupture. With new applications emerging, there is a robust demand for such testing.

Insights, By Process, Generation Dominates Owing to Scale of Hydrogen Production and Inherent Safety Risks

Additional Insights of Hydrogen Technology Testing, Inspection, and Certification Market

The global hydrogen technology testing, inspection, and certification market is set for substantial growth as countries and industries pivot toward clean energy solutions like hydrogen. The push for decarbonization across sectors such as transportation, refining, and energy is creating significant demand for testing and certification services to ensure safety, regulatory compliance, and system performance. Hydrogen permeation, leakage testing, and pressure testing are key areas within the industry. The expansion of green hydrogen production facilities, particularly in Asia Pacific, is accelerating the adoption of TIC services, with governments supporting the transition to clean energy. As industries scale hydrogen production and storage solutions, specialized TIC services will be increasingly critical to ensure safety and efficiency.

Competitive overview of Hydrogen Technology Testing, Inspection, and Certification Market

The major players operating in the Hydrogen Technology Testing, Inspection, and Certification Market include SGS SA, Bureau Veritas SA, Intertek Group plc, DEKRA SE, TÜV SÜD, DNV GL, TÜV Rhineland, Applus+, TÜV NORD GROUP and UL LLC.

Hydrogen Technology Testing, Inspection, and Certification Market Leaders

- SGS SA

- Bureau Veritas SA

- Intertek Group plc

- DEKRA SE

- TÜV SÜD

Hydrogen Technology Testing, Inspection, and Certification Market - Competitive Rivalry

Hydrogen Technology Testing, Inspection, and Certification Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Hydrogen Technology Testing, Inspection, and Certification Market

- In January 2024, Baker Hughes launched a new Hydrogen Testing Facility to validate its NovaLT industrial turbines for operation with hydrogen blends of up to 100%. This facility offers flexible pressure testing up to 300 bars and a large storage capacity of 2,450 kg.

- In November 2023, Element Materials Technology initiated a USD 10 million investment program to acquire hydrogen testing equipment and expand its global team dedicated to hydrogen technologies.

- In September 2023, Intertek Group plc launched the Hydrogen Assurance platform to support the hydrogen value chain with advisory and assurance services, emphasizing quality and sustainability.

Hydrogen Technology Testing, Inspection, and Certification Market Segmentation

- By Service Type

- Testing

- Inspection

- Certification

- By Testing Type

- Overpressure, Burst, and Flow Testing

- Pressure Cycle, Leakage, and Tightness Testing

- Hydrogen Permeation and Compatibility Testing

- By Process

- Generation

- Storage

- Transportation

- By Application

- Mobility

- Refining and Chemical

- Energy

- Others

Would you like to explore the option of buying individual sections of this report?

Ankur Rai is a Research Consultant with over 5 years of experience in handling consulting and syndicated reports across diverse sectors. He manages consulting and market research projects centered on go-to-market strategy, opportunity analysis, competitive landscape, and market size estimation and forecasting. He also advises clients on identifying and targeting absolute opportunities to penetrate untapped markets.

Frequently Asked Questions :

How Big is the Hydrogen Technology Testing, Inspection, and Certification Market?

The Global Hydrogen Technology Testing, Inspection, and Certification Market is estimated to be valued at USD 7.20 Bn in 2025 and is expected to reach USD 24.4 Bn by 2032.

What will be the CAGR of the Hydrogen Technology Testing, Inspection, and Certification Market?

The CAGR of the Hydrogen Technology Testing, Inspection, and Certification Market is projected to be 17.9% from 2024 to 2031.

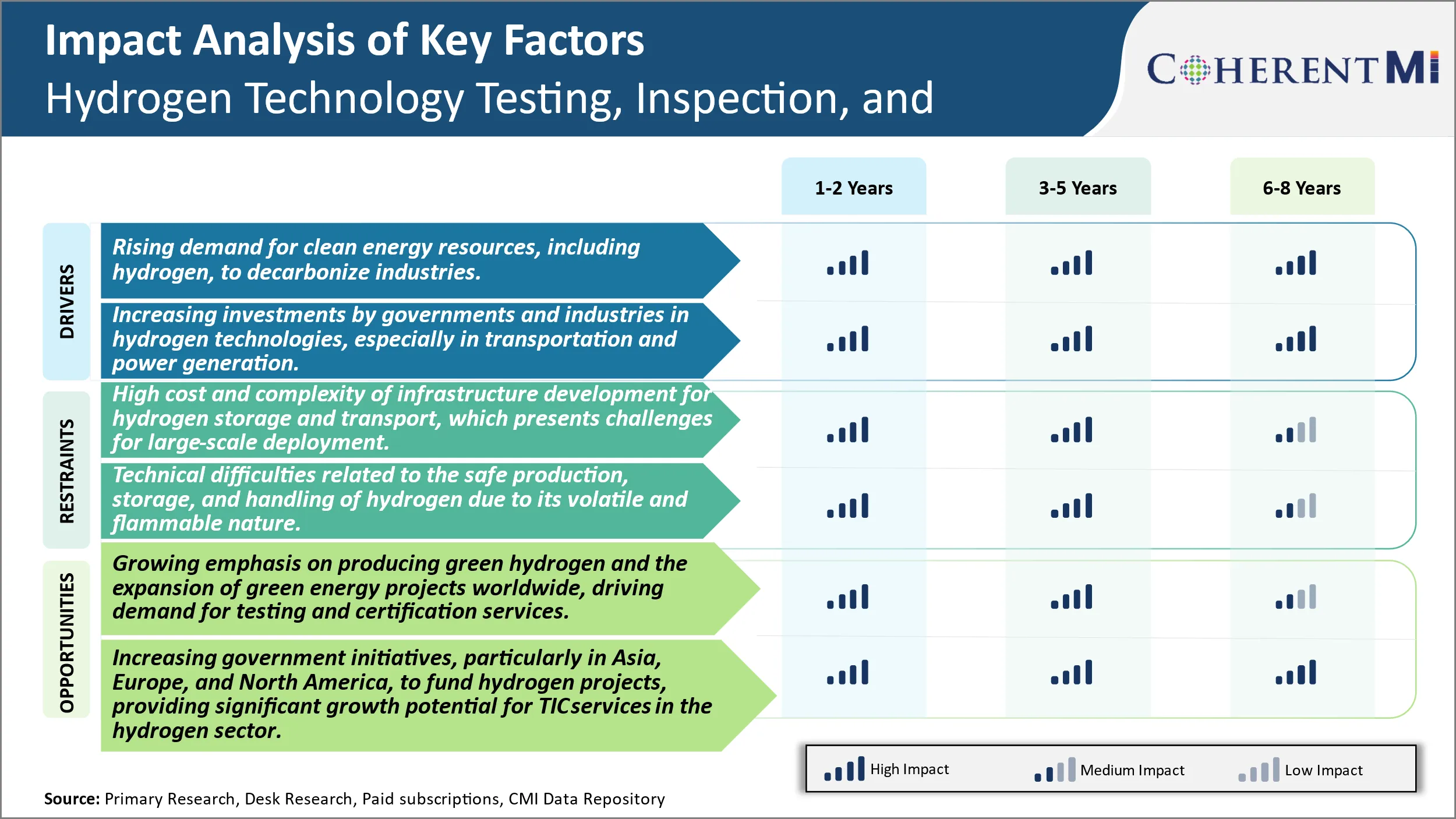

What are the major factors driving the Hydrogen Technology Testing, Inspection, and Certification Market growth?

The rising demand for clean energy resources, including hydrogen, to decarbonize industries. Increasing investments by governments and industries in hydrogen technologies, especially in transportation and power generation are the major factors driving the Hydrogen Technology Testing, Inspection, and Certification Market.

What are the key factors hampering the growth of the Hydrogen Technology Testing, Inspection, and Certification Market?

The high cost and complexity of infrastructure development for hydrogen storage and transport, which presents challenges for large-scale deployment. Technical difficulties related to the safe production, storage, and handling of hydrogen due to its volatile and flammable nature are the major factors hampering the growth of the Hydrogen Technology Testing, Inspection, and Certification Market.

Which is the leading Service Type in the Hydrogen Technology Testing, Inspection, and Certification Market?

Testing is the leading Service Type segment.

Which are the major players operating in the Hydrogen Technology Testing, Inspection, and Certification Market?

SGS SA, Bureau Veritas SA, Intertek Group plc, DEKRA SE, TÜV SÜD, DNV GL, TÜV Rhineland, Applus+, TÜV NORD GROUP, UL LLC are the major players.