Life Plan Communities Market Size - Analysis

Life plan communities, also known as continuing care retirement communities (CCRCs), are retirement housing establishments that provide a continuum of accommodations and healthcare services. It includes independent living, assisted living, and skilled nursing care, allowing seniors to age in place. The growing elderly population and the rise in chronic diseases are the key factors driving the life plan communities market.

- Increasing Elderly Population: The global population of individuals aged 65 and above is growing rapidly. According to the United Nations, the number of persons aged 65 or over is projected to grow from an estimated 727 million in 2020 to 1.5 billion in 2050. The share of the population aged 65 years or over increased from 9.1% in 2019 to 9.3% in 2020 globally. This exponential rise in the aging population is creating strong demand for continuing care retirement communities as seniors look for living options that can provide a continuum of care as they age. With life expectancy increasing worldwide, many seniors are looking to move into CCRCs that allow them to lead an independent life initially, while transitioning to higher levels of care seamlessly as per their health needs.

- Growing Prevalence of Chronic Diseases: The rising prevalence of chronic conditions such as cardiovascular diseases, diabetes, neurological disorders, cancer, and respiratory diseases among the elderly is boosting the demand for CCRCs. Per the CDC, 6 in 10 adults in the US have a chronic disease and 4 in 10 adults have two or more chronic diseases. Chronic diseases are a leading driver of long-term care needs, creating the requirement for constant care and monitoring. CCRCs are equipped to provide regular skilled nursing, therapies, and medical care to seniors with chronic conditions, making them an ideal housing solution. The staff at CCRCs can coordinate care between different health providers and ensure medication adherence.

- Focus on Providing Value-Added Services and Amenities: Modern CCRCs are focused on providing unique amenities, engaging activities, home-like environment, and top-notch hospitality services to seniors along with healthcare. Communities are investing in improving amenities like fitness centers, pools, restaurants, salons, movie theaters, libraries, golf courses, walking trails etc. to attract seniors looking for an active lifestyle. Providing transportation, housekeeping, technologies, luxury accommodation, and maintenance services enables CCRCs to differentiate themselves. The value-added services and amenities make these communities more appealing than other long-term care options.

- Advancements in Medical Technologies: Advancements in medical technologies and healthcare services are making CCRCs more capable of providing high-quality care onsite to seniors. Improved diagnostics, remote patient monitoring, telehealth, mHealth tools, and point-of-care testing capabilities allow CCRCs to deliver better care. Electronic health records enable seamless care coordination. Robotics, AI, analytics help improve operational efficiencies. Medical advancements allow CCRCs to keep residents healthier and minimize hospital transfers, appealing to prospective residents.

Life Plan Communities Market Opportunities:

- Expansion into Developing Countries: There is significant potential for life plan communities to expand into developing countries across Asia Pacific, Latin America, and the Middle East. These countries have relatively lower penetration of CCRCs currently but are witnessing rapid growth in their senior populations. For instance, China’s 60+ population is expected to reach 362 million by 2032. The improving economic conditions and healthcare infrastructure in these countries provide major expansion opportunities for CCRC providers. Players can customize their offerings as per local culture and preferences. Strong marketing efforts raising awareness can aid penetration.

- Adoption of Telehealth and mHealth Solutions: Incorporating telehealth and mHealth technologies can help enhance care delivery while reducing costs for CCRCs. Telehealth solutions enable residents to virtually consult doctors, specialists without going to hospitals. mHealth apps and wearable allow remote monitoring of health parameters. These technologies can maximize convenience for residents, improve access to care, reduce hospital transfers, lower staffing requirements, and enable proactive health management. Their integration can be a competitive differentiator.

- Offering Home Healthcare Services: CCRCs can leverage their infrastructure and clinical workforce to provide home healthcare services to seniors living independently in the community. Services like in-home nursing care, physical therapy, telehealth, medical equipment delivery, medication management etc. can be offered. For CCRCs, this presents an excellent opportunity to generate additional revenues while also building deeper engagement with independent seniors who may become future residents.

- Focus on Post-Retirement Engagement Model: CCRCs can enhance their value proposition by not just providing housing and care to seniors but also engaging residents in meaningful pursuits post-retirement through volunteering, skill-building, social impact programs. Research shows continued lifelong learning and social connections are vital for seniors’ wellbeing. CCRCs can design programs keeping residents’ skills and interests in mind to help them remain active and lead a purposeful life. This can further boost satisfaction levels.

- High Membership and Monthly Costs: While CCRCs provide valuable services, the membership fees and monthly costs are often high, making affordability a challenge for many seniors. The entrance fees can range from $100,000 to $1,000,000 for couples looking for extensive contracts. Ongoing monthly fees also range in thousands based on unit size and services. The high costs often lead seniors to choose more affordable options like assisted living facilities or in-home care. Providers need to improve the perceived value for money to attract more middle-income seniors.

- COVID-19 Pandemic Impact: The COVID-19 pandemic has created inhibitions in the minds of seniors regarding communal senior living due to heightened concerns about infection transmission risks. Occupancy rates were impacted in 2020-2021. While vaccination campaigns have helped restore confidence, the pandemic impact has remained a restraining factor. Providers are conducting robust infection control programs to reassure residents. But rebuilding occupancy levels will take concerted efforts and time.

- Staffing Challenges: CCRCs require extensive clinical and non-medical workforce across different operations like nursing, therapy, foodservice, maintenance etc. However, staffing shortages, lack of training, high turnover due to burnout are key challenges. Staffing issues can compromise care quality. The tight labor market adds to the issues. Attracting and retaining skilled staff through training programs, career growth opportunities, incentives etc. remains an area of focus.

Market Size in USD Bn

CAGR10.4%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 10.4% |

| Fastest Growing Market | Asia Pacific |

| Larget Market | North America |

| Market Concentration | High |

| Major Players | Erickson Living, ACTS Retirement Life Communities, Brookdale Senior Living, Life Care Services, Lutheran Senior Services and Among Others |

please let us know !

Life Plan Communities Market Trends

- Integration of Smart Technology and Sustainability Features: CCRCs are increasingly integrating smart home technologies and sustainability features in the design of their communities to provide convenience, safety, comfort, and energy efficiency for residents. Motion sensors, home automation, voice assistants, remote monitoring systems, electronic access controls are being incorporated along with features like solar panels, EV charging stations, recycling, stormwater conservation etc. Tech-enabled sustainability features help in building operations while also providing comfort to eco-conscious seniors.

- Partnerships between Providers for Development: Developing CCRCs requires significant investments. More providers are entering partnerships with real estate investment firms, private equity firms, and other healthcare companies to jointly develop communities and share risks and resources. Partnerships allow leveraging each other’s expertise. For example, Discovery Senior Living partnered with real estate firm Batson-Cook Development Co. to develop a CCRC in Georgia in 2022. Such partnerships are enabling faster expansion.

- On-Demand Services and Personalized Amenities: On-demand services and personalized amenities tailored as per individual resident preferences are a top trend in CCRCs currently. On-demand transportation, housekeeping, dining, maintenance allow maximum flexibility. Personalized fitness plans, dietician-curated meals, preferred social/recreational activities are being facilitated leveraging technology. Customizable spaces with modular layouts are being designed. The personalized model of service delivery enhances satisfaction.

- Integration of Sophisticated Health Technologies: Advanced health technologies are being integrated by CCRCs to deliver top-quality care onsite and attract seniors looking for access to the latest medical services. For example, The Buckner Retirement Services' Robison Retirement Community based in Texas provides remote patient monitoring, online medical consultations and an onsite clinic with advanced diagnostic tools. Cutting-edge medical devices and services enable CCRCs to minimize resident hospital transfers and trips.

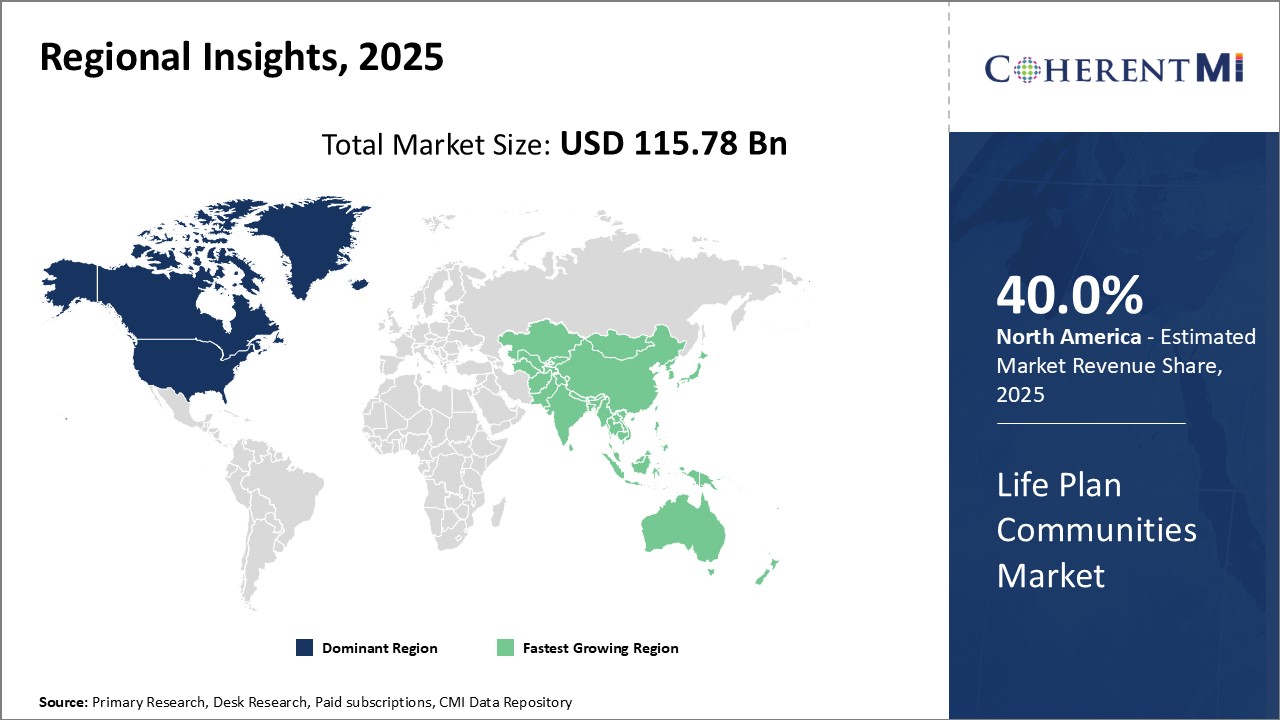

Life Plan Communities Market Regional Insights:

- North America is expected to be the largest market for Life Plan Communities Market during the forecast period, accounting for over 40% of the market share in 2025. The growth of the market in North America is attributed to the rising aging population and increasing prevalence of chronic diseases in the region.

- The Europe market is expected to be the second-largest market for Life Plan Communities Market, accounting for over 28% of the market share in 2025. The growth of the market in is attributed to the growing demand for assisted living and long-term care services for the elderly in European countries.

- The Asia Pacific market is expected to be the fastest-growing market for Life Plan Communities Market. The growth of the market in Asia Pacific is attributed to the improving healthcare infrastructure and increasing healthcare expenditure in the region.

Segmental Analysis of Life Plan Communities Market

Competitive overview of Life Plan Communities Market

Erickson Living, ACTS Retirement Life Communities, Brookdale Senior Living, Life Care Services, Lutheran Senior Services, Presbyterian Senior Living, United Methodist Retirement Communities, Wesley Woods Senior Living, Benchmark Senior Living, Senior Lifestyle Corporation, Five Star Senior Living, Sunrise Senior Living, Silverado Senior Living, Maplewood Senior Living, Oakmont Senior Living, Leisure Care, Holiday Retirement, Capital Senior Living, Welltower, and HCP Inc. are some of the major players in the global Life Plan Communities market.

Life Plan Communities Market Leaders

- Erickson Living

- ACTS Retirement Life Communities

- Brookdale Senior Living

- Life Care Services

- Lutheran Senior Services

Life Plan Communities Market - Competitive Rivalry

Life Plan Communities Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Life Plan Communities Market

New product launches:

- On May 17, 2023, Lutheran Senior Services released an article stating that they are leading the way in region by introducing Tovertafel to all Life Plan Communities. Tovertafel, or 'magic table' in Dutch, utilizes light projections on a table to offer an engaging and interactive experience. Through games designed to be enjoyable, it enhances participants' skills. With over 6,000 communities across 14 countries already adopting Tovertafel since its launch in 2015, its effectiveness in promoting movement and stimulation for individuals with dementia has been well-established.

- In June 2022, Lutheran Senior Services (LSS), St. Louis' biggest non-profit organization, has welcomed a new team member – a robot. This marks the first use of a robot in a senior living community in the St. Louis area. Named Servi and developed by Bear Robotics, this advanced robot helps with tasks like clearing tables, serving food, and delivering drinks. By automating these tasks, the robot allows human staff to focus more on engaging with residents, ensuring they enjoy exceptional dining experiences.

Acquisition and partnerships:

- On September 27, 2023, Orchard Valley at Wilbraham, a Benchmark assisted living and Mind & Memory Care community, has revealed their collaboration with local organizations and individuals dedicated to serving seniors. Together, they aim to enhance Wilbraham as a more accommodating place for those with Alzheimer’s and dementia. A series of events, starting with the first on September 27, is planned to achieve this goal. The project intends to improve the local community's understanding and connection with individuals facing dementia.

- In December 2022, Benchmark Senior Living, the senior housing provider in New England, has just revealed a partnership with Big Brothers Big Sisters of Rhode Island (BBBSRI). Together, they are launching a statewide fundraiser during this holiday giving season. The collaboration aims to support BBBSRI's mentorship program, which connects boys and girls across the state with adult role models

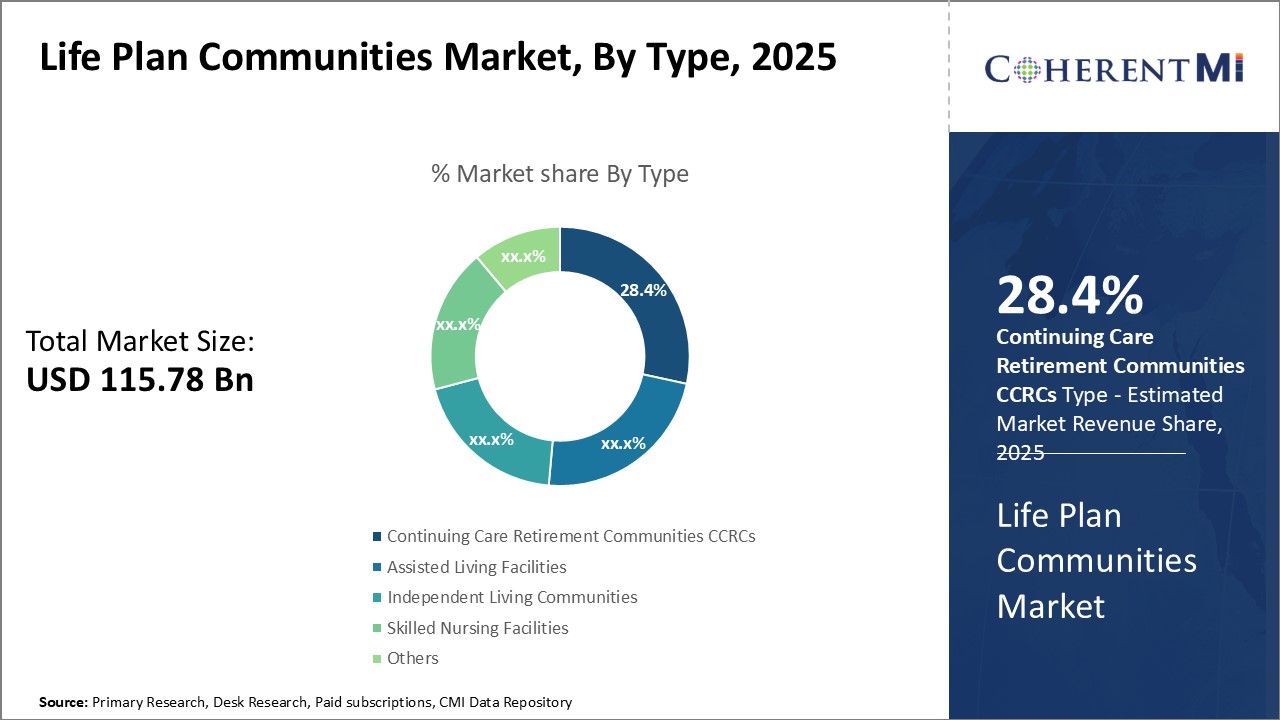

Life Plan Communities Market Segmentation

- By Type

- Continuing Care Retirement Communities (CCRCs)

- Assisted Living Facilities

- Independent Living Communities

- Skilled Nursing Facilities

- Others

- By Ownership Type

- For-profit

- Non-profit

- Government

- By Contract Type

- Extensive contracts

- Modified contracts

- Fee-for-service contracts

- Equity contracts

- Others

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Would you like to explore the option of buying individual sections of this report?

Suraj Bhanudas Jagtap is a seasoned Senior Management Consultant with over 7 years of experience. He has served Fortune 500 companies and startups, helping clients with cross broader expansion and market entry access strategies. He has played significant role in offering strategic viewpoints and actionable insights for various client’s projects including demand analysis, and competitive analysis, identifying right channel partner among others.

Frequently Asked Questions :

How big is the Life Plan Communities Market?

The Life Plan Communities Market is estimated to be valued at USD 115.8 in 2025 and is expected to reach USD 231.4 Billion by 2032.

What are the major factors driving the Life Plan Communities Market growth?

Aging population and increasing demand for long-term care are the major factors driving the Life Plan Communities Market growth.

Which is the leading component segment in the Life Plan Communities Market?

The independent living communities segment held the largest share of the Life Plan Communities Market in 2022. It allows seniors to lead an active lifestyle with some assistance available on-demand.

Which are the major players operating in the Life Plan Communities Market?

Erickson Living, ACTS Retirement Life Communities, Brookdale Senior Living, Life Care Services, Lutheran Senior Services, Presbyterian Senior Living, United Methodist Retirement Communities, Wesley Woods Senior Living, Benchmark Senior Living, Senior Lifestyle Corporation, Five Star Senior Living, Sunrise Senior Living, Silverado Senior Living, Maplewood Senior Living, Oakmont Senior Living, Leisure Care, Holiday Retirement, Capital Senior Living, Welltower, and HCP Inc. are some of the major players in the global Life Plan Communities market.

Which region will lead the Life Plan Communities Market?

North America is expected to continue dominating the Life Plan Communities market during the forecast period.

What will be the CAGR of Life Plan Communities Market?

The Life Plan Communities market is projected to grow at a CAGR of 10.4% from 2025 to 2032.