Singapore Carbon Credit Market Size - Analysis

Carbon credits are tradable permits that allow organizations to emit a certain amount of carbon emissions. They are used by corporations and governments to offset their carbon footprints and meet sustainability goals. The growth in Singapore's carbon market is driven by increasing climate change awareness, government regulations, and corporate sustainability commitments

- Government Regulations to Reduce Emissions: The Singapore government has implemented various regulations and policies to reduce the country's greenhouse gas (GHG) emissions and meet its climate targets. Key regulations include the carbon tax implemented in 2020 on large emitters to incentivize reductions. Singapore also has a mandatory energy efficiency program and emissions reporting requirements. Such policies are expected to be a major driver for carbon credit demand as companies seek offsets to meet compliance obligations. The government aims to halve emissions from its 2032 peak by 2050 and achieve net zero emissions as soon as viable in the second half of the century.

- Corporate Sustainability and Decarbonization Goals: An increasing number of corporations and organizations in Singapore have set carbon neutral or net zero emissions targets. Major companies across sectors like banking, technology, manufacturing and transport have made public commitments to drastically reduce their carbon footprints. For instance, DBS Bank aims to be net zero by 2050, Microsoft by 2032 and Sembcorp Industries by 2050. To meet these goals, companies would need to buy high quality carbon credits to offset hard-to-abate emissions. Renewable energy purchase and energy efficiency measures may not be enough. Voluntary offsetting through credits will thus drive market growth.

Market Size in USD Mn

CAGR21.2%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 21.2% |

| Market Concentration | High |

| Major Players | Climate Impact X, Carbon Credit Capital, Carbonbay, Southpole, Triple Oxygen and Among Others |

please let us know !

Singapore Carbon Credit Market Trends

- Mainstreaming of Carbon Credits and Trading: Carbon credits and emissions trading are moving into the mainstream business conversation globally, evidenced by announcements from tech giants like Microsoft and Meta establishing net zero targets. Singapore's carbon exchange, government backing and high trading environment make it well placed to drive mainstream adoption in Asia. Climate Impact X's marketplace model connects buyers and sellers in one place, providing an accessible platform for small businesses new to carbon markets. In 2020, it launched the Singapore Green Plan 2030, which aims to reduce the country's emissions intensity by 36% from 2005 levels by 2030, and to achieve net-zero emissions as soon as viable in the second half of the century. These instances indicate a growing trend towards the mainstreaming of carbon credits and trading in Singapore

- Live Streaming Taking Off: Live streaming is gaining substantial traction both for entertainment and conversations. Gaming live streams attract huge young audiences. Instagram lives enable direct creator-fan interactions. Conversational live audio apps like Clubhouse are ideal for knowledge sharing. Live shopping featuring product demos is also an emerging format. The raw, unfiltered nature of live content and the ability to directly interact with audiences adds to its appeal. Big tech platforms as well as startups are prioritizing live broadcasts. For instance, the Carbon Pricing Leadership Coalition (CPLC) often hosts webinars on carbon pricing and trading.

Segmental Analysis of Singapore Carbon Credit Market

Competitive overview of Singapore Carbon Credit Market

Singapore carbon credit market is a relatively new and evolving market, with a number of players vying for a share of the growing pie.

Singapore Carbon Credit Market Leaders

- Climate Impact X

- Carbon Credit Capital

- Carbonbay

- Southpole

- Triple Oxygen

Singapore Carbon Credit Market - Competitive Rivalry

Singapore Carbon Credit Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Singapore Carbon Credit Market

Numerous factors influence the carbon credit market in Singapore. One metric ton of carbon dioxide is represented by one carbon credit, which can be exchanged, retired, or sold. An organization is probably allotted a certain number of credits to apply toward its cap if it is subject to a cap-and-trade system (such as the California Cap and Trade Program). The organization can trade, sell, or store the remaining carbon credits if it emits fewer tons of carbon dioxide than is allotted. The buyer buys the seller's allotment of emissions when a credit is sold. A very real reduction in emissions—which comes from an action you might not be aware of—makes a credit tradeable.

- In September 2022, Carbonbay announced the launch of its carbon trading and offsetting platform tailored for Asia Pacific markets. The platform enables organizations to buy carbon credits and helps develop regional offset projects.

- In November 2020, Carbon Credit Capital launched the world's first regulated tokenized carbon credits called Carbon Tokens. Each token represents one carbon credit and can be traded on digital exchanges.

- In March 2021, Carbon Capital acquired a minority stake in project developer ClimateCare to joint develop carbon reduction projects globally

Singapore Carbon Credit Market Segmentation

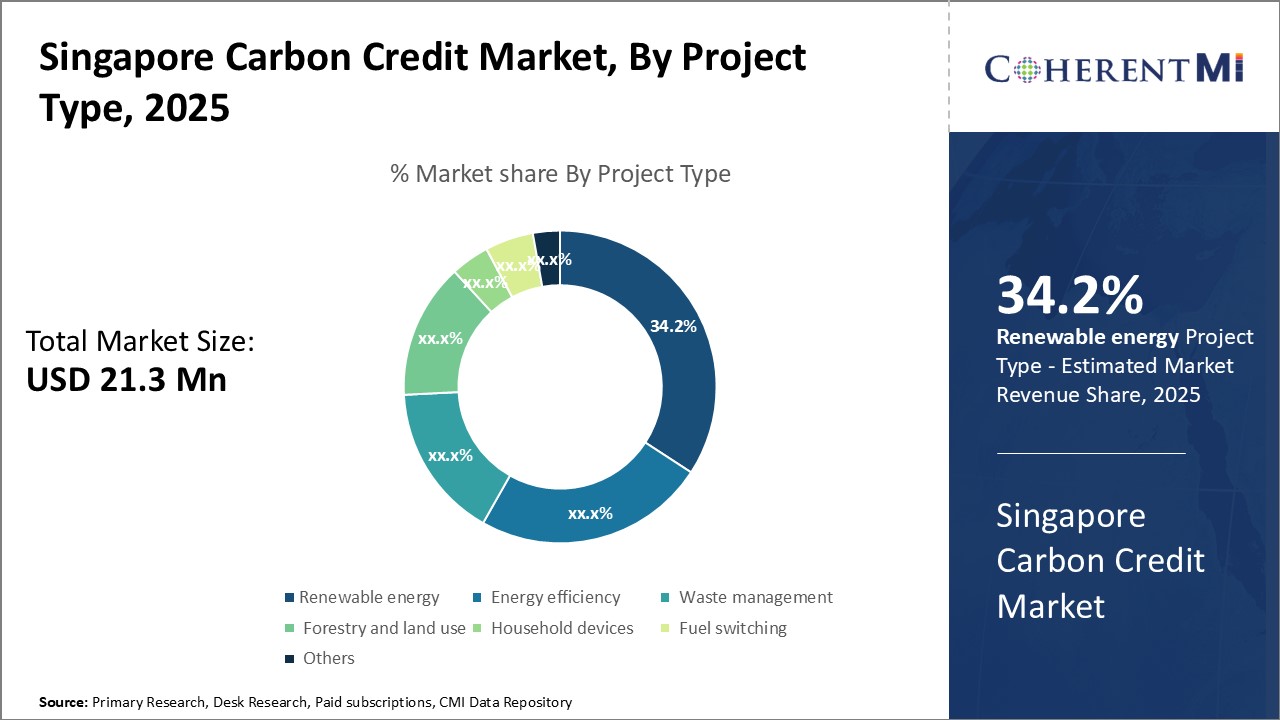

- By Project Type

- Renewable energy

- Energy efficiency

- Waste management

- Forestry and land use

- Household devices

- Fuel switching

- Others

- By Trading Type

- Over the counter

- Exchange Traded

- Merchandise

- Project Based

- Others (futures, options etc)

- By End User

- Corporations

- Governments

- Broker & Exchange

- Project Developers

- Individuals

- Others (NGOs, public sector agencies etc.)

Would you like to explore the option of buying individual sections of this report?

Suraj Bhanudas Jagtap is a seasoned Senior Management Consultant with over 7 years of experience. He has served Fortune 500 companies and startups, helping clients with cross broader expansion and market entry access strategies. He has played significant role in offering strategic viewpoints and actionable insights for various client’s projects including demand analysis, and competitive analysis, identifying right channel partner among others.

Frequently Asked Questions :

How big is the Singapore Carbon Credit Market?

The Singapore Carbon Credit Market is estimated to be valued at USD 21.30 in 2025 and is expected to reach USD 81.80 Million by 2032.

What are the major factors driving the Singapore Carbon Credit Market growth?

Government regulations, corporate sustainability goals, investor pressure, and increasing climate change awareness are driving the market growth.

Which is the leading component segment in the Singapore Carbon Credit Market?

The renewable energy project segment leads the Singapore Carbon Credit Market.

Which are the major players operating in the Singapore Carbon Credit Market?

Climate Impact X, Carbon Credit Capital, Carbonbay, South Pole, Triple Oxygen are the major players.

What will be the CAGR of Singapore Carbon Credit Market?

The CAGR of Singapore Carbon Credit Market is projected to be 21.2% from 2025 to 2032.

What are the drivers of the Singapore Carbon Credit Market?

The key drivers are government regulations, corporate sustainability goals, investor pressure, and increasing awareness of climate change.