Australia Chlorine Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Australia Chlorine Market is Segmented By Derivative (PVC, Phosgene, Propylene Oxide & Epichlorohydr...

Australia Chlorine Market Size - Analysis

The Australia Chlorine Market is estimated to be valued USD 411.6 Mn in 2024 and is expected to reach USD 715.3 Mn by 2031, growing at a compound annual growth rate (CAGR) of 7.50% from 2024 to 2031.

The Australia chlorine market is expected to witness positive growth over the forecast period, owing to increasing demand from water treatment industries.

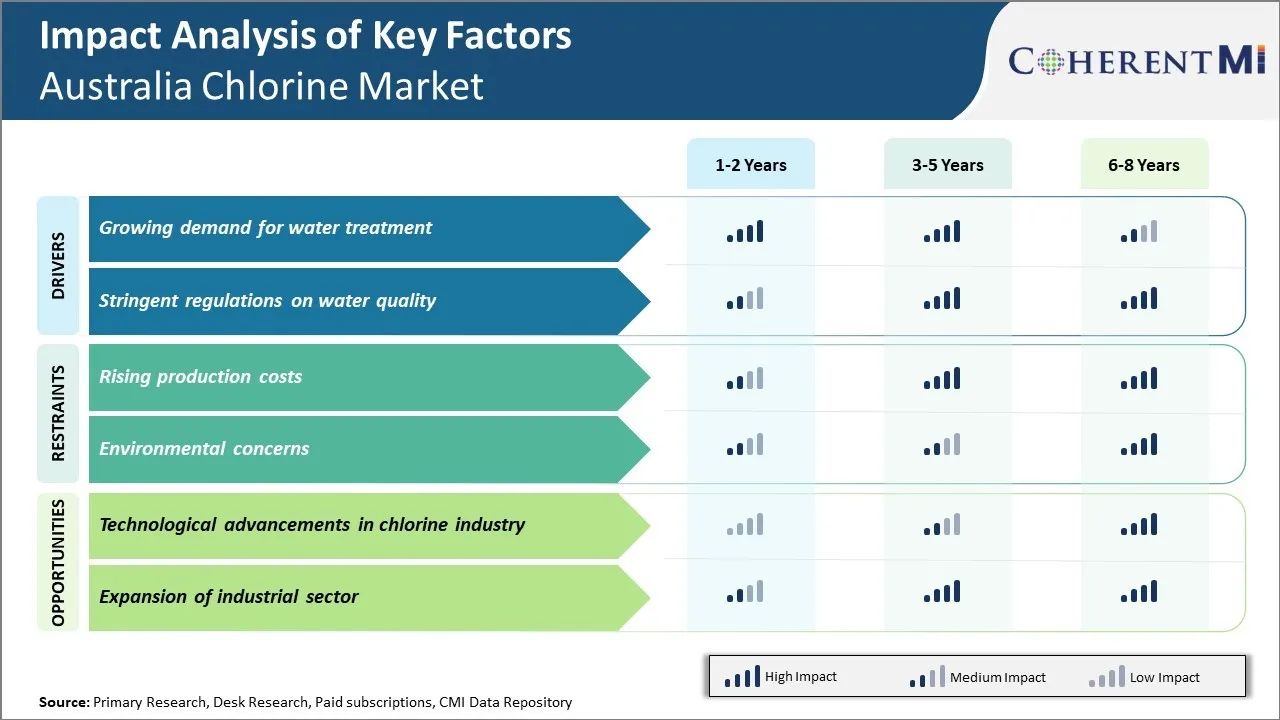

Growing Demand for Water Treatment

The growing demand for clean and safe water in Australia is one of the major factors driving the growth of the chlorine market in the country. With rising population and urbanization, the stress on existing water resources is increasing tremendously. According to the Australian Bureau of Statistics, Australia's population is projected to reach around 35 million by 2040 growing from the current level of around 25 million. This consistent rise in population coupled with rapid urbanization has resulted in increased water consumption in cities and towns.

At the same time, climate change is impacting water resources with less predictable rainfall and frequent droughts in many parts of Australia. For instance, as per Australia's State of the Climate 2020 report published by CSIRO and Bureau of Meteorology, south-eastern Australia received about 20% less rainfall in 2019 compared to the 1950-2019 average. Sustained water stress situations are straining conventional water supplies. As a result, desalination and water reuse/recycling have become important to address the demand-supply imbalance.

Market Size in USD Mn

CAGR7.50%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 7.50% |

| Market Concentration | High |

| Major Players | 3M Company, Reckitt Benckiser, Procter and Gamble, Clorox Company, Incitec Pivot Limited and Among Others |

please let us know !

Australia Chlorine Market Trends

Market Driver – Stringent Regulations on Water Quality

Stringent regulations on water quality are one of the major factors contributing to the growth of Australia's chlorine market. The Australian government has implemented strict norms and guidelines to ensure access to clean and safe drinking water for all citizens. As per the Australian Drinking Water Guidelines put forth by the National Health and Medical Research Council, the disinfectant residual concentration in water is mandated to be a minimum of 0.2 mg/L. Chlorine is widely used as the primary disinfectant by water treatment facilities to effectively kill microorganisms and meet this standard.

With a growing population and rising demand, the water treatment infrastructure across the country is undergoing modernization and expansion. Many utilities are upgrading their systems with advanced technologies for filtration, purification and distribution. This requires continuous supply of disinfectants like chlorine gas and liquid bleach to sanitize large volumes of water on a daily basis as per regulations. According to statistics from the Australian Bureau of Statistics, annual investment in water infrastructure projects has risen over 20% between 2020-2022 driven mainly by stricter norms around source water protection, wastewater reuse and wastewater discharge quality.

Market Challenge – Rising Production Costs

Rising production costs are significantly restraining the growth of Australia's chlorine market. The key input costs required for chlorine production such as electricity, renewable energy, and labor have witnessed a substantial increase in the recent past. Electricity is one of the most critical utilities required during the chlorine production process. However, electricity prices in Australia have risen sharply over the last few years mainly due to supply-side constraints and rising costs of generation. As per the Australian Energy Market Operator, the average annual wholesale electricity prices increased by around 40% from 2020 to 2022 across the National Electricity Market regions of Australia. This surge in power tariffs has exponentially boosted the operating costs for chlorine producers.

Similarly, the transition towards renewable and clean energy sources for power generation in line with the country's decarbonization commitments has also pushed the electricity costs higher. The switch to renewable energy involves substantial infrastructure investments and continues to face intermittency challenges which get reflected in power bills. Higher labor costs are another constraint area for the Australian chlorine industry. As per the Australian Bureau of Statistics, average weekly ordinary time earnings of full-time adults increased by almost 13% from 2020 to 2022.

Market Opportunity – Technological Advancements in Chlorine Industry

Technological advancements have opened up huge opportunities for growth in Australia's chlorine industry. As new processes harness the power of digitization and automation more efficiently and sustainably produce chlorine, the industry is well positioned for gains.

Advanced membrane technologies now allow for more selective separation and purification of chlorine from salt. Membranes have increased in efficiency and lifetimes, reducing costs. Data analytics further optimize flows and pressures. This boosts output while lowering energy usage per ton. For example, the latest polymeric membranes from global suppliers can yield over 99% chlorine from salt at half the power of older methods according to the International Desalination Association.

Additive manufacturing too is yielding benefits. 3D printing custom parts on-site cuts lead times and inventories. Faulty components can be replaced faster, limiting downtime. A large Australia chlorine plant improved asset reliability over 20% using 3D printed parts, as cited in a case study by Australia's Commonwealth Scientific and Industrial Research Organization.

Segmental Analysis of Australia Chlorine Market

Insights, By Derivative: PVC Demand Drives the Chlorine Derivatives Market in Australia

The PVC segment contributes the largest share of 36.4% in the Australia chlorine market owing to strong demand from the construction industry. PVC finds widespread application in the construction of pipes, windows, doors and sidings for residential and commercial buildings. Australia has witnessed substantial growth in infrastructure development and construction activities over the past decade.

The government's investment in public infrastructure such as roads, bridges and utilities has increased markedly. Recent projects under development include the Melbourne Metro Rail Project, West Gate Tunnel in Victoria and Northconnex in New South Wales. Rising expenditure on transportation and social infrastructure is driving the need for durable construction materials like PVC. Its corrosion resistance, flexibility and affordability make it preferable to metals for applications such as piping.

Demand for PVC from the housing sector has also risen steadily with population growth. More residential projects are coming up across major cities to accommodate the increasing number of households. PVC competes effectively with traditional building materials and is replacing wood and aluminum in some applications owing to its weatherproof nature and robustness.

The chemicals industry consumes PVC primarily in the manufacture of more complex organic chemicals and pharmaceutical intermediates.

Insights, By Application: Organic Sub-segment Drives the Market Growth

The organic chemicals sub-segment accounts for the largest share of 43.1% chlorine consumption in Australia. Chlorine derivatives like ethylene dichloride, vinyl chloride monomer and ethylene amines are key intermediates employed extensively in the production of a vast array of organic products.

Strong demand for polyvinyl chloride (PVC), ethylene glycol, methanol and other chlorinated solvents from domestic industries translates to substantial chlorine intake. Australia has a sizable plastics processing industry that depends on chlorinated hydrocarbons for manufacturing objects ranging from pipes and fittings to furniture, automotive and electric components.

Agrochemical manufacturers as well are major consumers of chlorinated solvents to produce pesticides, herbicides and fungicides for the agricultural sector. As demand for food rises in line with population growth, agrochemical sales are set to climb higher. This will drive incremental requirements for chlorine-based intermediates.

Chlorine also plays a vital role in water treatment and disinfection. Most municipal water supply networks rely on chlorine gas or sodium hypochlorite to purify water and eradicate pathogens before distribution. Urbanization trends that require setting up of new water treatment facilities augur well for chlorine demand over the coming years.

Competitive overview of Australia Chlorine Market

The major players operating in the Australia Chlorine Market include 3M Company, Reckitt Benckiser, Procter and Gamble, Clorox Company, Incitec Pivot Limited, Solvay S.A., Nouryon, Tata Chemicals Limited, BASF SE, and Zychem Technologies.

Australia Chlorine Market Leaders

- 3M Company

- Reckitt Benckiser

- Procter and Gamble

- Clorox Company

- Incitec Pivot Limited

Australia Chlorine Market - Competitive Rivalry

Australia Chlorine Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Australia Chlorine Market

- In March 2024, BCI Minerals and Chandra Asri signed a Binding salt offtake agreement with three-year tenure. with the option to extend for a further three years. The offtake agreement is for the supply of annual contract quantity of 300,000 tons which will increase up to 600,000 tons of salt per annum.

- In December 2023, Australian chemical manufacturer coogee, expanded its chlor alkali Kemerton Plant with addition of 60 ton per day capacity addition. The additional capacity shall bring chlorine product availability to cater demand from wide range of end use industries.

- In January 2023, ERCO Worldwide a Greater Toronto Area Company and its wholly owned subsidiary International Dioxcide (IDI), today announced the opening of a new PurDOX production plant located in Shah Alam (Selangor), Malaysia in partnership with KC Chemicals (Manufacturing) Sdn Bhd. PurDOX is a blend of sodium chlorate and hydrogen peroxide to generate chlorine dioxide for water treatment application and the plant will be serving Asia Pacific region.

- In August 2022, a Sunshine Coast clean technology company launched an Australian first technology empowering chlorine-using industries to secure supply by creating it on site.

Australia Chlorine Market Segmentation

- By Derivative

- PVC

- Phosgene

- Propylene Oxide & Epichlorohydrin

- C1 Derivatives

- Others (HCl, TiO2, etc.)

- By Application

- Organic Chemicals

- Inorganic Chemicals

- Bleaching

- Disinfection

- Metal Separation

- By End Use Industry

- Water Treatment

- Plastic

- Paper & Pulp

- Chemical

- Mining

- Others (Pharmaceuticals, etc.)

Would you like to explore the option of buyingindividual sections of this report?

Yash Doshi is a Senior Management Consultant. He has 12+ years of experience in conducting research and handling consulting projects across verticals in APAC, EMEA, and the Americas.

He brings strong acumen in helping chemical companies navigate complex challenges and identify growth opportunities. He has deep expertise across the chemicals value chain, including commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals. Yash is a sought-after speaker at industry conferences and contributes to various publications on topics related commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals.

Frequently Asked Questions :

What are the key factors hampering the growth of the Australia Chlorine Market?

The rising production costs and environmental concerns are the major factors hampering the growth of the Australia Chlorine Market.

What are the major factors driving the Australia Chlorine Market growth?

The growing demand for water treatment and stringent regulations on water quality are the major factors driving the Australia Chlorine Market growth.

Which is the leading Derivative in the Australia Chlorine Market?

The leading Derivative segment is PVC.

Which are the major players operating in the Australia Chlorine Market?

3M Company, Reckitt Benckiser, Procter and Gamble, Clorox Company, Incitec Pivot Limited, Solvay S.A., Nouryon, Tata Chemicals Limited, BASF SE, and Zychem Technologies are the major players.

What will be the CAGR of the Australia Chlorine Market?

The CAGR of the Australia Chlorine Market is projected to be 7.50% from 2024-2031.