Australia Chlorine Market Trends

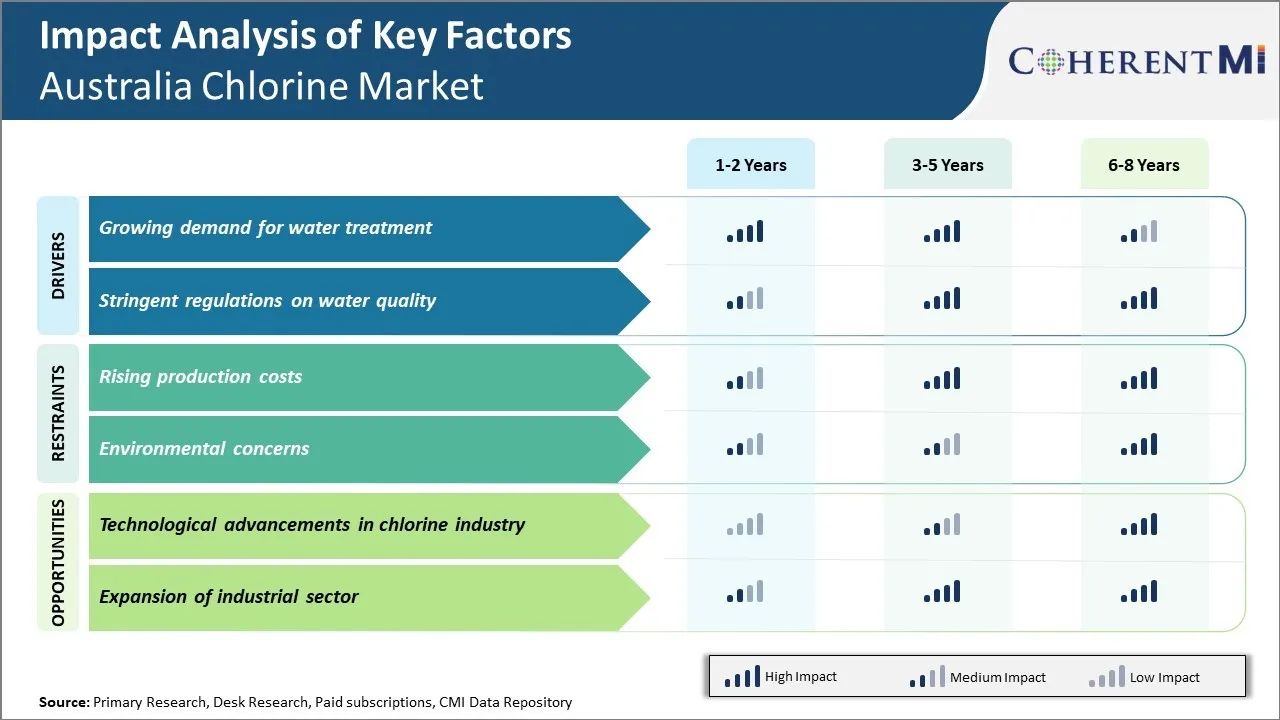

Market Driver – Stringent Regulations on Water Quality

Stringent regulations on water quality are one of the major factors contributing to the growth of Australia's chlorine market. The Australian government has implemented strict norms and guidelines to ensure access to clean and safe drinking water for all citizens. As per the Australian Drinking Water Guidelines put forth by the National Health and Medical Research Council, the disinfectant residual concentration in water is mandated to be a minimum of 0.2 mg/L. Chlorine is widely used as the primary disinfectant by water treatment facilities to effectively kill microorganisms and meet this standard.

With a growing population and rising demand, the water treatment infrastructure across the country is undergoing modernization and expansion. Many utilities are upgrading their systems with advanced technologies for filtration, purification and distribution. This requires continuous supply of disinfectants like chlorine gas and liquid bleach to sanitize large volumes of water on a daily basis as per regulations. According to statistics from the Australian Bureau of Statistics, annual investment in water infrastructure projects has risen over 20% between 2020-2022 driven mainly by stricter norms around source water protection, wastewater reuse and wastewater discharge quality.

Market Challenge – Rising Production Costs

Rising production costs are significantly restraining the growth of Australia's chlorine market. The key input costs required for chlorine production such as electricity, renewable energy, and labor have witnessed a substantial increase in the recent past. Electricity is one of the most critical utilities required during the chlorine production process. However, electricity prices in Australia have risen sharply over the last few years mainly due to supply-side constraints and rising costs of generation. As per the Australian Energy Market Operator, the average annual wholesale electricity prices increased by around 40% from 2020 to 2022 across the National Electricity Market regions of Australia. This surge in power tariffs has exponentially boosted the operating costs for chlorine producers.

Similarly, the transition towards renewable and clean energy sources for power generation in line with the country's decarbonization commitments has also pushed the electricity costs higher. The switch to renewable energy involves substantial infrastructure investments and continues to face intermittency challenges which get reflected in power bills. Higher labor costs are another constraint area for the Australian chlorine industry. As per the Australian Bureau of Statistics, average weekly ordinary time earnings of full-time adults increased by almost 13% from 2020 to 2022.

Market Opportunity – Technological Advancements in Chlorine Industry

Technological advancements have opened up huge opportunities for growth in Australia's chlorine industry. As new processes harness the power of digitization and automation more efficiently and sustainably produce chlorine, the industry is well positioned for gains.

Advanced membrane technologies now allow for more selective separation and purification of chlorine from salt. Membranes have increased in efficiency and lifetimes, reducing costs. Data analytics further optimize flows and pressures. This boosts output while lowering energy usage per ton. For example, the latest polymeric membranes from global suppliers can yield over 99% chlorine from salt at half the power of older methods according to the International Desalination Association.

Additive manufacturing too is yielding benefits. 3D printing custom parts on-site cuts lead times and inventories. Faulty components can be replaced faster, limiting downtime. A large Australia chlorine plant improved asset reliability over 20% using 3D printed parts, as cited in a case study by Australia's Commonwealth Scientific and Industrial Research Organization.