Botanicals Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Botanicals Market is By Product Type (Herbs, Spices, Essential Oils, Others (Plant Extracts, Medicinal Plants)), By Application (Food and Beverage, Ph....

Botanicals Market Size

Market Size in USD Bn

CAGR6.5%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6.5% |

| Market Concentration | High |

| Major Players | DSM, AmbePhytoextracts, Berje, Indesso, Lipoid Kosmetic and Among Others. |

please let us know !

Botanicals Market Analysis

The Global Botanicals Market is estimated to be valued at USD 112.31 Billion in 2024 and is expected to reach USD 174.10 Billion by 2031, growing at a compound annual growth rate (CAGR) of 6.5% from 2024 to 2031. Increasing awareness about the medicinal properties and various health benefits of botanicals is driving more consumers to use botanical products. There is rising demand for botanical supplements and ingredients that support immunity, gut health, memory and heart health. Many major personal care and food & beverage brands are focusing on introducing novel product lines containing botanical extracts.

The market is witnessing positive trends like increased R&D activities focused on identifying new botanicals and their properties. Many startups are entering the space and developing innovative products containing natural botanical extracts. The COVID-19 pandemic has further boosted the market as consumers are looking to boost their immunity through botanical products.

Botanicals Market Trends

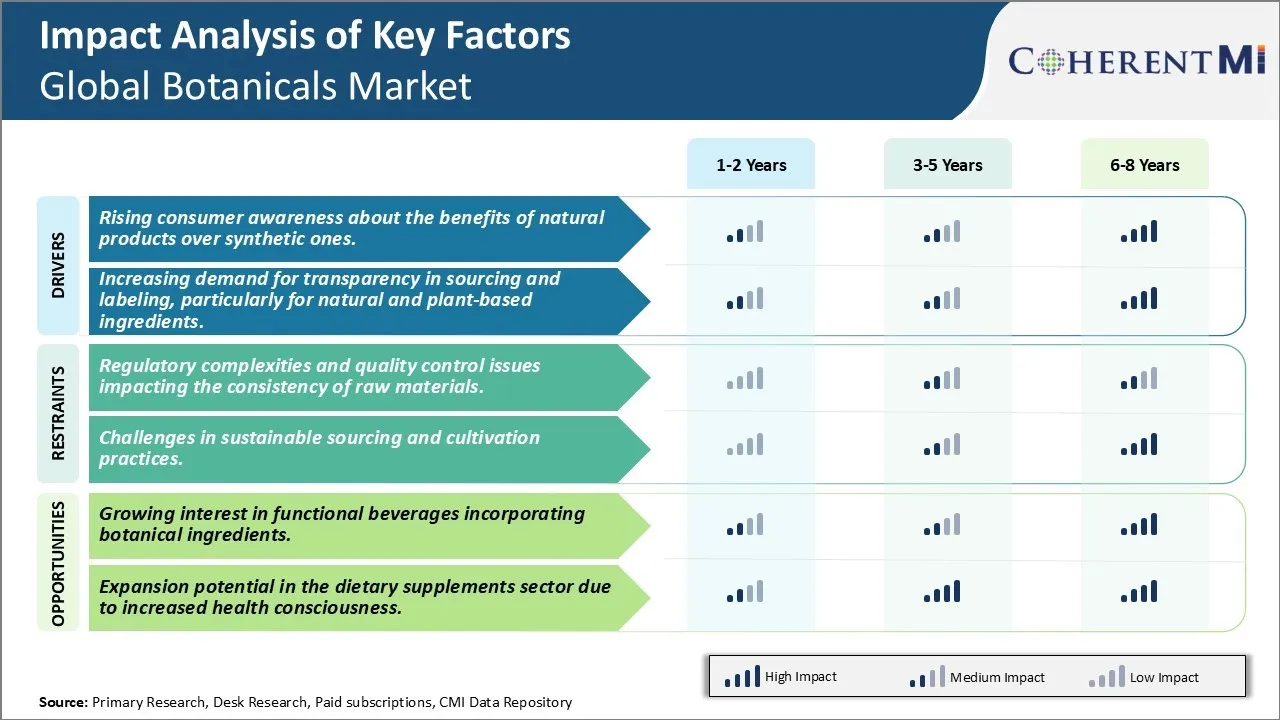

Market Driver - Rising consumer awareness about the benefits of natural products over synthetic ones.

Due to the fast-paced modern lifestyle and rampant pollution, many consumers have become highly conscious about the ingredients they consume on a daily basis. There is a growing realization that synthetic and chemically processed products may have some adverse effects on health in the long run when compared to natural botanical ingredients. This is prompting many buyers to opt for natural alternatives which are perceived as safer and have more nourishing properties. Consumers are increasingly turning to ancient medicinal systems like Ayurveda and Traditional Chinese Medicine as a means to improve overall well-being in a mild yet effective manner using herbs, plants and plant extracts. Products based on botanicals are seen as an extension of such natural healing approaches and are believed to work in synergy with the human body instead of disrupting its internal balance.

Also, in the current social media driven world, consumers diligently research each ingredient before making a purchase decision. This has enhanced awareness about the potential dangers of artificial preservatives, colors and flavors. Many are alarmed by scientific studies highlighting links between certain synthetic additives and increased risk of conditions such as cancer, liver or kidney damage and hormonal imbalances. In contrast, active phytochemicals derived from botanical sources are considered gentler and possess antioxidants that could boost immunity. Several herbs are also proven to manage stress, anxiety and promote relaxation. This has translated into strong demand for botanical infused functional foods, supplements and beauty products with identifiable natural contents.

Increasing demand for transparency in sourcing and labeling, particularly for natural and plant-based ingredients

There is growing disillusionment with brands that indulge in misleading marketing practices when it comes to natural claims. Many companies are under scrutiny for highlighting a single botanical ingredient but not clearly specifying other synthetics that may be present. This duplicity is even more unappreciated in premium end products aimed at health conscious audiences. Today's shoppers want full visibility into what exactly they are purchasing and do not wish any ambiguity regarding the sourcing and processing of different components. They track supply chains closely to confirm authenticity and minimize potential environmental or social exploitation throughout value chains.

To fulfill this expectation of transparency, businesses must scientifically substantiate natural content percentage on pack and educate buyers about permissible lab enhancements if any, versus actual plant derivation. Organic and fair trade certifications help build trust but credibility also depends on direct traceability to farms. Companies serious about sourcing responsibilities respond proactively instead of reactively to sustainability issues. Some form collaborative alliances with sourcing partners to establish quality standards and monitoring protocols for consistent supply of natural botanimals. By going beyond basic compliance, they influence consumer loyalty and can demand a premium in the long run for truly green, ethically produced botanical ingredients.

In this era of conscious spending, transparency drives satisfaction more than any marketing campaign. It empowers discerning customers to choose products aligned with their values of health, ecology and social welfare.

Market Challenge - Regulatory complexities and quality control issues impacting the consistency of raw materials.

The global botanicals market faces significant regulatory complexities and quality control issues that impact the consistency of raw materials. Different regions and countries have varying approval processes and standards for new botanical ingredients and products. This leads to delay in getting clearances and launching products uniformly across geographies. Further, botanicals are sourced from nature and their composition can fluctuate depending on growing conditions, geography and time of harvest. Maintaining consistent quality of raw materials from varied sources spread across locations poses a major challenge. Any quality issues detected during regulatory checks can impact production and supply. Strict import rules also affect seamless global movement of botanicals. The market players have to invest heavily to meet diverse regulatory norms. Quality control and supply chain management further increases cost of operations. Overall, navigating the regulatory landscape and ensuring quality standards add to research and development costs for new products.

Market Opportunity- Growing Interest in Functional Beverages Incorporating Botanical Ingredients

There is a growing interest among consumers in functional beverages that provide additional health and wellness benefits other than basic refreshment. Botanical ingredients are increasingly being explored for their various nutritional and medicinal properties. Beverages incorporating botanicals like turmeric, ginger, guarana, aloe vera etc. that support immune health, metabolism, energy and other functions are in demand. As people focus more on preventive healthcare and lifestyle, beverages with herbal extracts have emerged as a convenient way to get daily dosage of benefits. Various startups are innovating in this segment and mainstream brands are also introducing such offerings. The Millennial and Gen Z consumers, in particular, are keen to try products with natural ingredients. As awareness increases about health-supporting properties of botanicals, opportunities will arise for market players to develop new beverage concepts, formulations and marketing strategies to tap into this trend. Functional beverages are expected to be one of the fastest growing categories globally.

Key winning strategies adopted by key players of Botanicals Market

Strategic Acquisitions & Partnerships: Acquisitions and partnerships have allowed companies to expand their product portfolio and geographic footprint. For example, in 2017, International Flavors & Fragrances (IFF) acquired Frutarom for US$7.1 billion, creating a global leader in natural ingredients. This gave IFF access to Frutarom's botanical extracts portfolio. Similarly, in 2018, DuPont acquired FMC's health and nutrition business for $1.6 billion, adding botanical extracts to its product range. Such deals strengthen distribution networks and R&D capabilities.

Focus on Premium & Organic Products: With rising health consciousness, players have focused on premium organic botanical extract offerings. For example, Sensient launched organic rose extracts in 2021 after seeing growing demand for natural and sustainable products. Approximately 25% of Firmenich's botanical extracts are now certified organic. This shift has helped companies capture a larger share of the high-growth organic segment.

Innovation through R&D: Industry leaders spend significantly on R&D to develop novel botanical extracts and delivery systems. For instance, Givaudan invested CHF 520 million (12.7% of sales) in R&D in 2020, resulting in innovative solutions like its Tasteprint botanical flavor capsules. Similarly, BASF has a dedicated botanical research facility in Germany developing high-value botanical extracts using biotechnological methods, benefiting customer industries. Such investments in science-driven innovation give early movers a competitive edge.

Emerging Markets Expansion: Companies have found success through investments in high-growth regions like Asia Pacific, Latin America, and Africa. For example, exports of Indian botanical extracts have grown over 15% annually since 2015, driven by demand from China, USA, and Europe.

Segmental Analysis of Botanicals Market

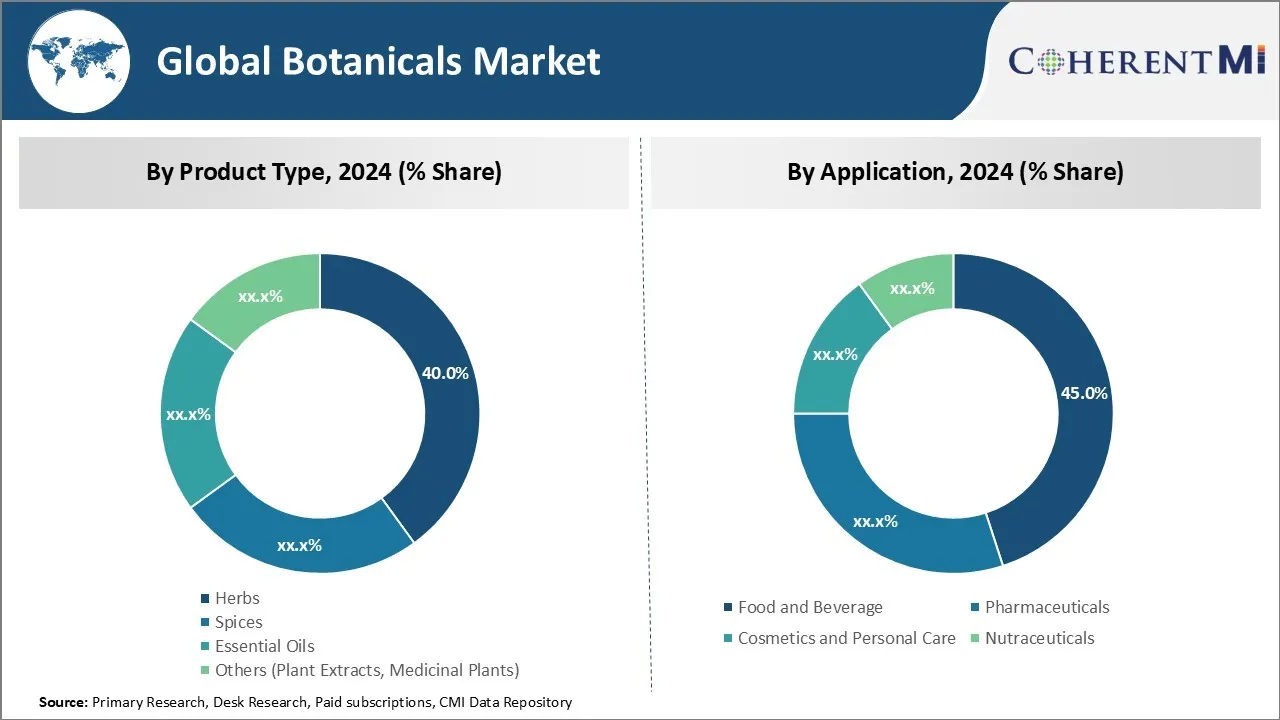

By Product Type - Culinary delights and traditional medicine

In terms of By Product Type, Herbs contributes the highest share of the market with 40% in 2024 owning to their widespread use in culinary applications and traditional medicine. Herbs have been an integral part of human civilization for centuries, with a variety of species like basil, oregano, thyme and mint being commonly used globally to enhance the flavor and aromas of diverse cuisines. Many herbs also hold valuable medicinal properties, with garlic, ginger and turmeric having strong anti-inflammatory and antioxidant effects. Turmeric in particular is a core component of Ayurveda and traditional Chinese medicine, while garlic has a long history of therapeutic use in cold, cough and digestive issues. Their easy availability and affordability have further strengthened the popularity of herbs amongst consumers and manufacturers alike.

By Application - Flavorfulness and functionality

In terms of By Application, Food and Beverage contributes the highest share of the market with 45% in 2024 due to botanicals' ability to impart delightful flavors and functional benefits. Whether fresh or dried, many botanicals make rich additions to snacks, soups, sauces and beverages of all kinds. From sage in stuffing to coriander in chutneys, botanical flavors bring dishes to life. Additionally, certain botanicals cater to evolving health and wellness needs, with ginger aiding digestion and turmeric supporting joint mobility. Their applications across cuisines of all palatability spectrums, from sweet to savory, has bolstered food and beverage's position as the dominant segment.

By Form - Versatility and convenience

In terms of By Form, Dry contributes the highest share of the market owing to its versatility and convenience advantages over other forms. Being lightweight and compact, dry botanicals are hassle-free to ship, store and handle. Without concerns over leakage or spoilage, dry variants maintain quality over long shelf lives. Furthermore, dry botanicals are extremely flexible in terms of rehydration- some simply require boiling water while others need steeping or infusions. This versatility allows dry botanicals to suit diverse preparation techniques across cuisines, medicines and other applications. Their ability to be effortlessly incorporated precisely as per requirements has made dry a preferred option amongst commercial Forms.

Competitive overview of Botanicals Market

The major players operating in the Global Botanicals Market include DSM, AmbePhytoextracts, Berje, Indesso, Lipoid Kosmetic, Prakruti Sources, Rutland Biodynamics, The Green Labs, The Herbarie at Stoney Hill Farm, Umalaxmi Organics, Integra Biosciences AG, Labconco Corporation, Flexicare (Group) Limited, Stryker Corporation and Smiths Medical.

Botanicals Market Leaders

- DSM

- AmbePhytoextracts

- Berje

- Indesso

- Lipoid Kosmetic

Botanicals Market - Competitive Rivalry, 2024

Botanicals Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Botanicals Market

- On April 2024, Evonik has launched a new Botanicals & Natural Actives business segment, consolidating its expertise in botanical extracts and natural actives. This segment, part of the Nutrition & Care division, enhances Evonik's ability to meet the rising demand for natural, claim-substantiated actives, supported by its Skin Institute.

- In October 2023 DSM-Firmenich formed a strategic partnership with Indena, an Italian botanicals supplier, to create innovative botanical solutions for human health.

- In March 2023: Nutri-tech startup Novella introduced proprietary technology to cultivate nutritious botanical ingredients without using the entire plant. This innovative platform aims to increase global access to high-value nutraceuticals.

- In May 2022 India-based startup Leaven Essentials launched its branded botanical extracts on the global market, focusing on providing scientifically-backed and effective herbal solutions tailored to customer needs.

- In January 2023 Green Mountain Biotech and MeNow initiated a project focusing on discovering new botanical combinations for skin conditions.

Botanicals Market Segmentation

- By Product Type

- Herbs

- Spices

- Essential Oils

- Others (Plant Extracts, Medicinal Plants)

- By Application

- Food and Beverage

- Pharmaceuticals

- Cosmetics and Personal Care

- Nutraceuticals

- By Form

- Dry

- Liquid

- Powder

- By Distribution Channel

- Direct Sales

- Online Retail

- Supermarkets/Hypermarkets

- Specialty Stores

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

What are the key factors hampering the growth of the Global Botanicals Market?

The regulatory complexities and quality control issues impacting the consistency of raw materials. and challenges in sustainable sourcing and cultivation practices. are the major factor hampering the growth of the Global Botanicals Market.

What are the major factors driving the Global Botanicals Market growth?

The rising consumer awareness about the benefits of natural products over synthetic ones. and increasing demand for transparency in sourcing and labeling, particularly for natural and plant-based ingredients. are the major factor driving the Global Botanicals Market.

Which is the leading Product Type in the Global Botanicals Market?

The leading Product Type segment is Herbs.

Which are the major players operating in the Global Botanicals Market?

DSM, AmbePhytoextracts, Berje, Indesso, Lipoid Kosmetic, Prakruti Sources, Rutland Biodynamics, The Green Labs, The Herbarie at Stoney Hill Farm, Umalaxmi Organics, Integra Biosciences AG, Labconco Corporation, Flexicare (Group) Limited, Stryker Corporation, Smiths Medical are the major players.

What will be the CAGR of the Global Botanicals Market?

The CAGR of the Global Botanicals Market is projected to be 6.5% from 2024-2031.