Cocktail Syrup Market Size - Analysis

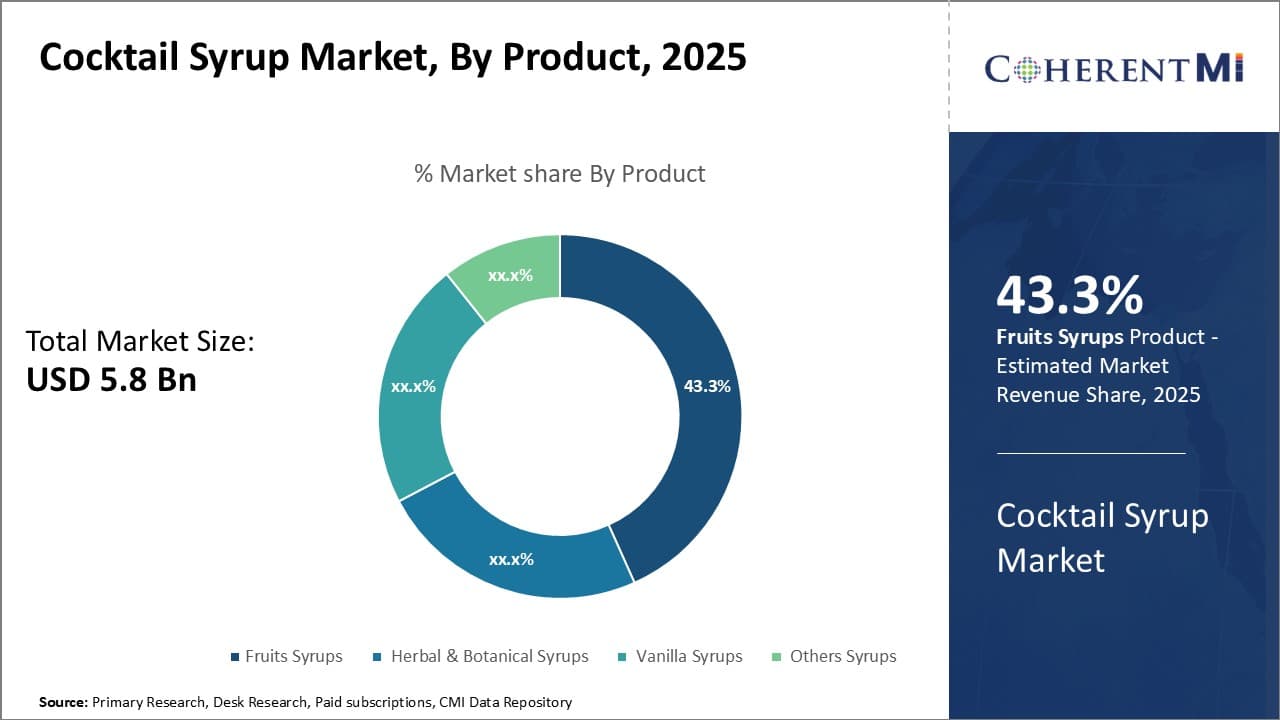

The cocktail syrup market is estimated to be valued at USD 5.80 Bn in 2025 and is expected to reach USD 7.58 Bn by 2032. It is projected to grow at a compound annual growth rate (CAGR) of 3.9% from 2025 to 2032. The cocktail syrup market is witnessing a positive trend of growing experimentation with cocktail recipes at home led by rise of cocktail culture.

Market Size in USD Bn

CAGR3.9%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 3.9% |

| Market Concentration | High |

| Major Players | Monin Inc., Torani, LLC, The Coca-Cola Company, Royal Dutch Distillers BV, Singing Dog Vanilla and Among Others |

please let us know !

Cocktail Syrup Market Trends

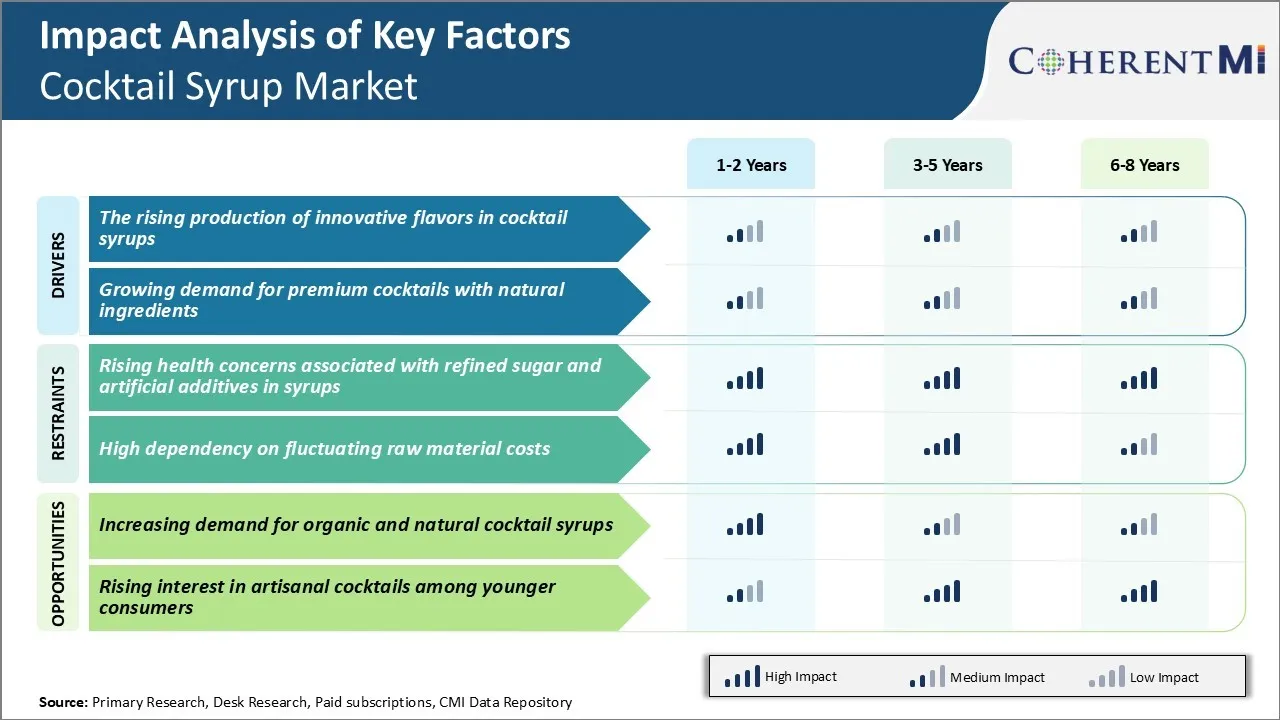

Market Driver - Rising Trend of Innovative Flavors in Cocktail Syrups

The cocktail syrup market has been witnessing a noticeable rise in the number of product launches featuring unique and exotic flavor profiles. Beverage companies are leveraging the trends of experimental mixology and global flavors to introduce cocktail syrups in interesting taste combinations.

The rich flavors give bartenders the scope to concoct novel drinks and milkshakes. Similarly, other brands are focusing on tropical fruit flavors mixed with herbs, spices, or chilies. A recent entrant offered a coffee plum balsamic cocktail syrup that brings an unusual savory twist.

Brands are also exploring regional cuisines for new flavor innovations. Ethnic flavors allow home bartenders and restaurants to experiment beyond the usual cocktail recipes. Such unique flavors satisfy the evolving tastes of millennial drinkers and appeal to their enthusiasm for culinary adventures and global experiences. The innovative flavors drive curiosity and sales as consumers want to try out these novelty cocktail syrups.

Market Driver - Growing Demand for Premium Cocktails with Natural Ingredients

There is a rising preference among consumers to opt for high-quality ingredients in the prepared beverages they consume. This sentiment extends to the syrups and mixers used in crafting cocktails as well. People want cocktails that not only taste exceptional but are also perceived as natural and healthy. This aspect is addressed by a new breed of premium cocktail syrups prepared using organic herbs, fruits, and sweeteners.

Furthermore, some new market entrants showcased their commitment to sustainability and environment by producing cocktail syrups with minimal or no added refined sugars. They deploy low glycemic sweeteners and fruits high in fructose to achieve the right balance of sweetness.

Such natural and low sugar options appeal to health-conscious drinkers. Additionally, with rising bartending at home, people want cocktail ingredients as premium as those used in fine dining restaurants and bars. The craft cocktail culture and emphasis on utilizing organic and natural produce thus drives significant demand for these artisanal, premium quality cocktail syrups. This will drive upcoming trends in the cocktail syrup market in the coming years.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - Rising health concerns associated with refined sugar and artificial additives in syrups

One of the major challenges facing the cocktail syrup market is the rising health concerns associated with refined sugar and artificial additives in syrups. There is a growing awareness among consumers about the ill-effects of synthetic food colors, flavors, and preservatives that are commonly used in commercially produced syrups. This has triggered a shift towards more natural and wholesome ingredients.

Many consumers are actively seeking out product labels to check for artificial additives and refined sugars. They prefer syrups that use natural sweeteners like honey, maple syrup or agave instead. The industry will need to address these health apprehensions and formulate syrups with cleaner labels and less sugar content to attract the increasingly health-conscious consumer base. Companies not adapting to this change may lose their position in the cocktail syrup market to brands offering natural or low sugar options.

Market Opportunity - Increasing Demand for Organic and Natural Cocktail Syrups

One opportunity area for the cocktail syrup market is the increasing demand for organic and natural syrups. Consumers are showing growing preference for products made from real, locally sourced fruits and organic sweeteners rather than refined sugars or chemical additives.

Many view syrups labeled as organic or natural as healthier options that are minimally processed. This change in taste and priorities presents a major opportunity for brands dealing in natural or organic cocktail syrups. They can attract consumers seeking an alternative to mainstream commercial syrups high in sugar or synthetic ingredients.

By focusing on real fruit flavors derived from organic sources and sweeteners like honey or maple syrup, such brands can cater to this rising consumer segment. This niche market for cleaner, greener syrups produced in a sustainable manner is set for significant growth in the coming years. Companies expanding their range of organic and natural syrups have an excellent opportunity to capture this demand from increasingly health and environment conscious customers.

Key winning strategies adopted by key players of Cocktail Syrup Market

Product innovation and expanding flavors - Introducing new and unique flavors has been a hugely successful strategy for syrup manufacturers. In 2018, Monin launched over 20 new flavors including hibiscus rose, blood orange ginger and strawberry balsamic. Their extensive range of over 100 unique flavors helped them capture a significant market share.

Focus on premiumization - Several players like Rich's focused on premium natural ingredients to position their syrups as high-quality products worth a higher price point. In 2020, Rich's introduced syrups made with cane sugar instead of high fructose corn syrup.

Strategic packaging - Standout packaging that highlights flavors and potential usages has boosted impulse buys. In 2017, Monin redesigned bottles with large graphic labels highlighting recipes. This strategic packaging made their syrups shelf-stable and enhanced visibility.

Aggressive marketing and promotions - Leaders heavily promote via social media, influencer partnerships, in-store demos and tastings. Rogers has an active social media presence cooking up new recipes. In 2019, Stirr partnered with celebrity chef Carla Hall to promote their brand.

Segmental Analysis of Cocktail Syrup Market

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Insights, By Product: Growing Popularity of Exotic Fruit Flavors Boosts Fruits Syrups

In terms of product, fruits syrups contributes 43.3% share of the cocktail syrup market owing to consumers' increasing preferences for unique fruit flavors in their cocktails. Tropical fruits in particular have gained immense popularity in recent years as customers seek more exciting flavor profiles beyond the common citrus options. Syrups made from mangoes, passion fruits, and pineapples allow bartenders to infuse tropical notes into many mixed drinks.

Another driver is the focus on natural and "clean label" products in daily diets. Fruits syrups allow customers enjoy sweetened cocktails without artificial flavors or colors. Moreover, fruits are seen as a healthy ingredient choice that fits well with current wellness trends.

The growing exotic fruits market also benefits the fruits syrups segment, as more exotic fruit varieties become available for syrup production. Overall, fruit syrups' ability to lend unique flavors and natural sweetness to cocktails in exciting and healthy ways fuel their dominance in the cocktail syrup market.

To learn more about this report, Download Free Sample Copy

Insights, By Flavor: Health Perceptions Boost Sour Syrups' Popularity

To learn more about this report, Download Free Sample Copy

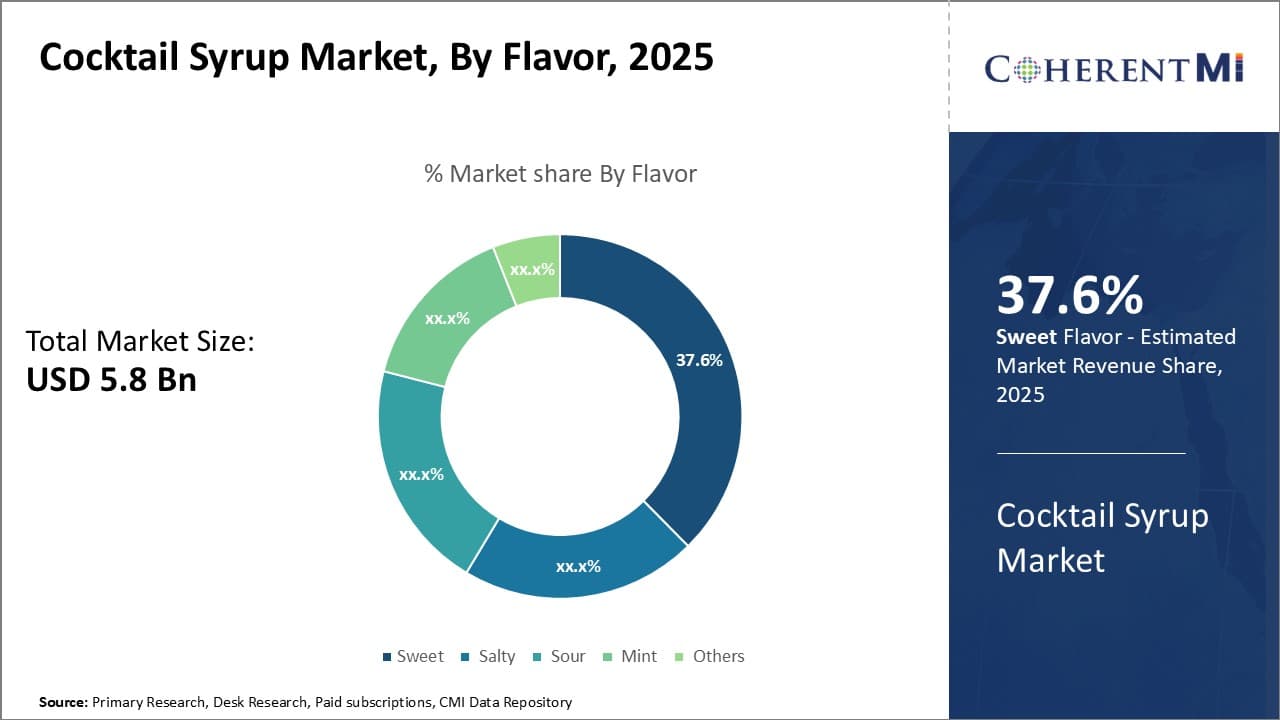

Insights, By Flavor: Health Perceptions Boost Sour Syrups' Popularity

In terms of flavor, sweet flavors currently have 37.6% share of the cocktail syrup market in 2025 due to universal appeal. Sour flavors are also gaining popularity due to perceptions of balancing out high sugar contents in cocktails. With growing obesity and diabetes rates, consumers are seeking options with lower sugar and calorie levels. Sour cocktail syrups allow bartenders to achieve the perfect balance of sweet and tart without overloading drinks with sugar. The natural acidity from ingredients like lime, lemon, and tamarind help cut the sweetness of other mixers.

Additionally, sour flavors are associated with various health benefits. Citrus fruits contribute antioxidants and vitamin C, while tamarind and other exotic souring agents support digestive health. Consumers increasingly factor perceived wellness attributes into their cuisine and beverage choices. Overall, the combination of great flavor, lower perceived sugar levels, and inferred health advantages is giving the Sour flavors’ segment an edge over high-sugar options.

Insights, By End Users: Convenience and Socializing Drive Household Consumption

In terms of end users, households represent a fast-growing segment in the cocktail syrups market due to convenience factors and their supportive role in social activities. Busy lifestyles leave less time to craft homemade drinks from scratch on weeknights. Syrups offer effortless mixing when consumers want a fun cocktail without much preparation. Just a few squeezes liven up spirits for an impromptu get-together.

Furthermore, home cocktail sessions have become a trend as customers seek new hobbies and skills. Syrups are an easy entry point for aspiring at-home mixologists to practice techniques. Many now view alcohol consumption less as an indulgence and more as a creative outlet.

Overall, the segment's ability to facilitate socializing, skills development and convenient drinking drives steady expansion among households.

Additional Insights of Cocktail Syrup Market

- Rise of Premiumization: Consumers are willing to pay more for high-quality, artisanal syrups that offer unique flavors and superior ingredients.

- Customization Trend: Bars and restaurants are increasingly creating signature cocktails using bespoke syrups to differentiate their offerings.

- Increasing Online Sales: There has been a significant shift towards online purchasing, with a notable percentage of syrup sales now occurring through e-commerce platforms.

- Market Growth Rate: The cocktail syrup market has been experiencing steady growth, influenced by changing consumer lifestyles and preferences.

- North America captured 32% revenue share in the cocktail syrup market in 2023. Asia-Pacific is the fastest-growing region for cocktail syrups market due to demand from younger demographics.

Competitive overview of Cocktail Syrup Market

The major players operating in the cocktail syrup market include Monin Inc., Torani, LLC, The Coca-Cola Company, Royal Dutch Distillers BV, Singing Dog Vanilla, Maison Giffard, DaVinci Gourmet, Liber & Co., Fee Brothers, Small Hand Foods, Barmalade, The Perfect Purée of Napa Valley, and Re'al Cocktail Ingredients.

Cocktail Syrup Market Leaders

- Monin Inc.

- Torani, LLC

- The Coca-Cola Company

- Royal Dutch Distillers BV

- Singing Dog Vanilla

Recent Developments in Cocktail Syrup Market

- In April 2023, Monin, a renowned French producer of syrups, liqueurs, and fruit purées, identified key cocktail trends for the year, including the rise of slushies, Tequila and Mexican-inspired drinks, and clarified cocktails. These insights were part of Monin's 2022-2023 Summer Drinks Trends Report, which surveyed UK-based consumers and hospitality leaders.

- In March 2023, MONIN, a leading producer of syrups, liqueurs, and fruit purées, participated in the Northern Restaurant & Bar trade show held in Manchester. During this event, MONIN's UK team showcased new products and offered tasting samples to attendees.

Cocktail Syrup Market Segmentation

- By Product

- Fruits Syrups

- Citrus Fruits

- Berries

- Tropical Fruits

- Herbal & Botanical Syrups

- Mint

- Lavender

- Elderflower

- Vanilla Syrups

- Others Syrups

- Fruits Syrups

- By Flavor

- Sweet

- Salty

- Sour

- Mint

- Others

- By End User

- Bars & Pubs

- Restaurants & Hotels

- Households

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.