United States Distilled Spirits Market Size - Analysis

The market is expected to witness steady growth during the forecast period driven by rising population of millennials and generation Z.

Market Size in USD Bn

CAGR3.6%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 3.6% |

| Larget Market | U.S. |

| Market Concentration | Medium |

| Major Players | Diageo plc, Pernod-Ricard SA, Constellation Brands Inc, Brown-Forman Corporation, Remy Cointreau SA and Among Others |

please let us know !

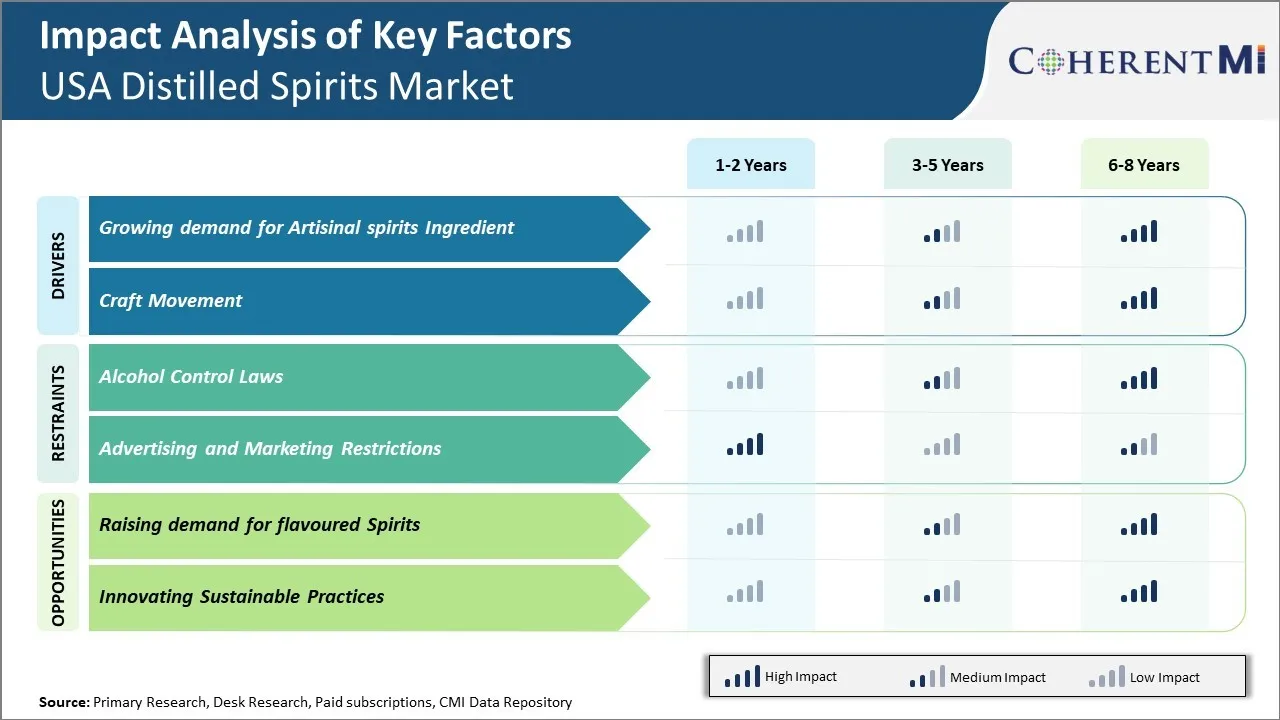

United States Distilled Spirits Market Trends

The demand for artisanal spirits made with unique ingredients is driving significant growth in the United States distilled spirits market. Consumers are increasingly interested in premium and craft spirits that have more distinctive flavors derived from locally sourced botanicals. They are eager to support smaller American distilleries that produce limited batches using unconventional ingredients grown or foraged in specific regions.

Distillers based in California, Oregon and Washington have been notable early adopters of using Pacific Northwest berries, nuts and roots such as huckleberries, hazelnuts and licorice root. Those in the Northeast also incorporate ingredients like cranberries, sassafras and fir tips indigenous to Appalachian forests.

Market Driver – Craft Movement

Many Americans have developed an interest in learning about the artisanal processes involved in crafting small-batch spirits. They are drawn to supporting small, independent distilleries in their local communities. Craft spirits allow consumers to directly engage with the producers and locations where their purchases are made. This interaction has made craft distilling an experiential industry that encourages travel and tourism. Distilleries offer tours and tastings experiences that have become a novelty cultural activity. According to the Distilled Spirits Council of the United States, visits to craft distilleries grew by over 15% per year between 2018-2021.

Market Challenge – Alcohol Control Laws

Market Challenge – Alcohol Control LawsThe stringent alcohol control laws enforced by various states and the federal government present significant bottlenecks for the growth of the United States distilled spirits market. These regulations govern multiple aspects of production, distribution, sales, and marketing of distilled liquor products.

Another challenge comes from the control states model followed by 17 states where state agencies have monopoly over wholesale and retail sales of distilled spirits. While the intention is to regulate alcohol consumption, it lacks free market competition. This discourages innovations as private businesses have little incentive to introduce new brands or tailor products according to changing customer preferences.

Market Opportunity – Rising Demand for Flavored Spirits

Flavored spirits allow for greater experimentation and variety in drinks. Popular flavors include lemon, lime, orange, apple, cherry, cinnamon, vanilla and more. Ready-to-drink cocktails are also on the rise, combining spirits with mixers and flavors in convenient cans or bottles. For example, sales of spiked seltzers grew over 50% in 2021 according to data from IWSR Drinks Market Analysis (not a market research firm).

Segmental Analysis of United States Distilled Spirits Market

Insights, By Product Type: Consumer Preference Whiskey for Its Rich Flavors

Insights, By Product Type: Consumer Preference Whiskey for Its Rich FlavorsIn terms of product type, whiskey sub-segment contributes the highest market share of 34.3% owing to consumer preference for its rich flavors.

Bourbon whiskey in particular has exploded in popularity in recent years. Its signature sweet vanilla and oak aromas from aging in charred oak barrels resonate well with modern tastes. American pride in bourbon as a homegrown product has also boosted sales. Several small-batch and artisanal bourbon distillers have emerged to cater to connoisseurs seeking unique flavor profiles. Meanwhile, Tennessee whiskey maintains a loyal following for its smoother character compared to other bourbons.

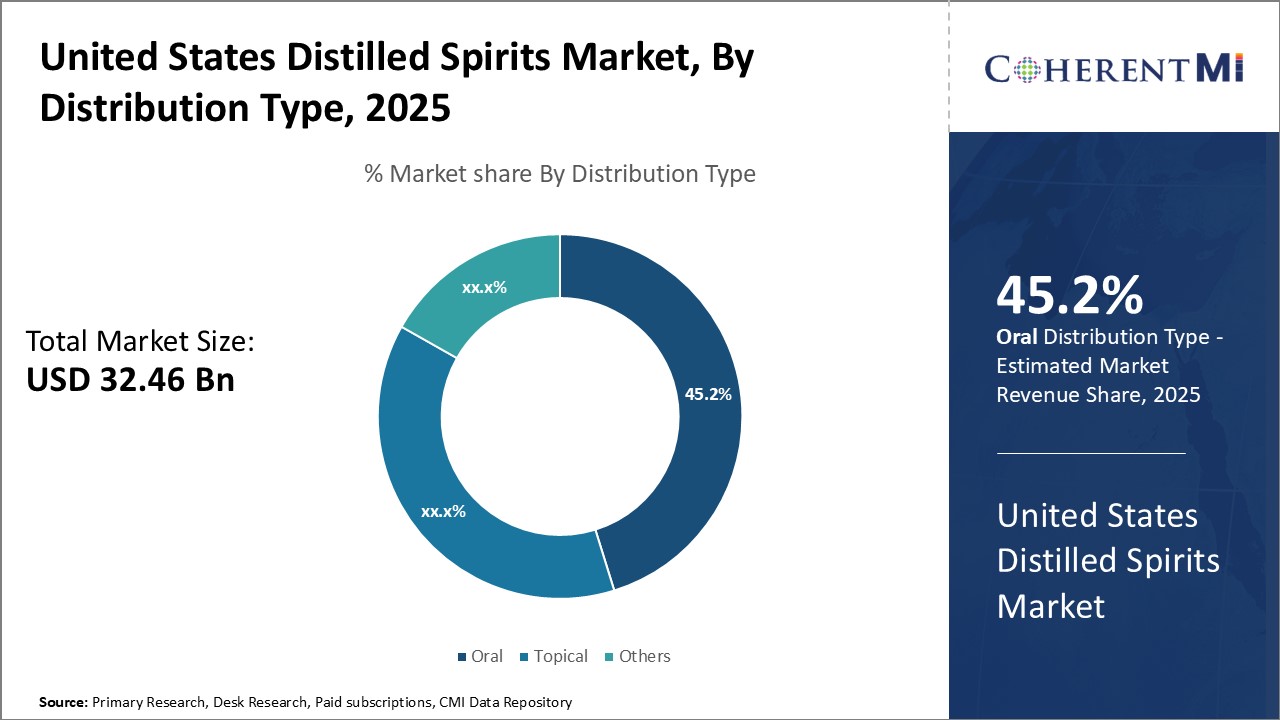

Insights, By Distribution Type: Social Drinking Culture Drives the Oral Sub-segment Growth

Insights, By Distribution Type: Social Drinking Culture Drives the Oral Sub-segment Growth

Bars and restaurants are epicenters of the country's thriving drinking culture. Craft cocktails designed by innovative bartenders attract customers looking to treat themselves on nights out. Meanwhile, at home parties and sports viewing gatherings frequently incorporate an array of whiskey, rum or vodka cocktails. Supermarkets and liquor stores also sell the majority of their spirits for oral consumption in drinks.

Competitive overview of United States Distilled Spirits Market

The major players operating in the United States Distilled Spirits market include Kweichow Moutai, Diageo plc, Anheuser-Busch Inbev, Heineken, Pernod Ricard SA, Brown-Forman Corporation, Marie Brizard Wine & Spirits, Constellation Brands Inc, Budweiser APAC, and Remy Cointreau SA.

United States Distilled Spirits Market Leaders

- Diageo plc

- Pernod-Ricard SA

- Constellation Brands Inc

- Brown-Forman Corporation

- Remy Cointreau SA

United States Distilled Spirits Market - Competitive Rivalry

United States Distilled Spirits Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in United States Distilled Spirits Market

- In June 2022, Brown-Forman and The Coca‑Cola Company collaborated together to launch iconic Jack & Coke cocktail branded as a RTD (Ready-To-Drink) pre mix. The partnership shall bring new taste for consumer in RTD format along with diversity in existing product offering.

- In December 2023, Metabev Korea secured a partnership with Rémy Cointreau as French business representative.

- In April 2024, Familia Torres, a producer of Spanish brandy and wine, entered the whisky category by launching blended Scotch brand Liathmor.

- In March 2023, Diageo, a global leader in beverage alcohol, announced the acquisition of Don Papa Rum, a super-premium, dark rum from the Philippines. This acquisition is the strategy of Diageo to acquire high growth brands with attractive margins that support premiumization.

- In February 2024, Mothers Against Drunk Driving (MADD) partnered with Diageo to tackle impaired driving in the U.S. for public awareness and education campions with an aim to end drunk driving.

United States Distilled Spirits Market Segmentation

- By Product Type

- Whiskey

- Vodka

- Rum

- Gin

- Tequila

- Brandy

- Others

- By Distribution Type

- Oral

- Topical

- Others

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

Frequently Asked Questions :

How big is the United States Distilled Spirits Market?

The United States Distilled Spirits Market is estimated to be valued at USD 32.46 in 2025 and is expected to reach USD 41.58 Billion by 2032.

What are the major factors driving the United States Distilled Spirits Market growth?

The growing demand for artisanal spirits ingredient and craft movement are the major factors driving the United States Distilled Spirits Market growth.

Which is the leading Product Type in the United States Distilled Spirits Market?

The leading Product Type segment is Whiskey.

Which are the major players operating in the United States Distilled Spirits Market?

Kweichow Moutai, Diageo plc, Anheuser-Busch Inbev, Heineken, Pernod Ricard SA, Brown-Forman Corporation, Marie Brizard Wine & Spirits, Constellation Brands Inc, Budweiser APAC, and Remy Cointreau SA are the major players.

What will be the CAGR of the United States Distilled Spirits Market?

The CAGR of the United States Distilled Spirits Market is projected to be 3.6% from 2025-2032.