Organic Feed Market Size - Analysis

Organic feed refers to agricultural animal feed that are composed of organic materials without any synthetic fertilizers or chemicals. It contains grains, oilseeds, forage, and supplements that are sourced from certified organic farms. Organic feed offers various benefits such as improved digestion, enhanced nutritional profile, and lower risk of diseases in animals. The market growth is driven by factors such as rising demand for organic meat products and stringent regulations regarding use of antibiotics and growth of organic food industry.

- Increasing demand for organic meat products: The demand for organic meat has been increasing steadily over the past few years, driven by rising health consciousness among consumers. People are becoming more aware of the health hazards that are caused by consumption of meat from traditionally raised animals fed with antibiotics and growth hormones. This has led to increasing consumer preference for organic meat from livestock raised on organic feed without any chemical additives. This creates a massive need for certified organic animal feed. Leading food brands are launching organic meat ranges and fast food chains like McDonald's are also adding organic burger options. This will boost production and further fuel the demand for organic feeds.

- Stringent regulations regarding antibiotic usage: Many governments across the world have implemented stringent regulations thus prohibiting or limiting the use of antibiotics in animal feed as overuse of antibiotics which leads to growing antimicrobial resistance. For instance, the European Union has banned the use of antibiotics as growth promoters in animal feed. The U.S. has regulations in place to phase out non-medical use of antibiotics in livestock feed. Such regulations are compelling livestock farms to switch to natural and organic feed additives. This has greatly supported the growth of antibiotic-free organic feeds.

- Growing popularity of organic dairy products: The organic dairy industry has witnessed substantial growth fueled by rising consumer awareness about the benefits of organic milk and dairy products. Consumers are willing to pay premium prices for organic dairy products that are produced ethically from cows fed organic feed are devoid of synthetic additives. Many dairy brands are launching organic product ranges. Large dairy farms are transitioning parts of their herd to organic farming practices. This requires certified organic feed as per organic farming standards. The growth of the organic dairy sector will result in massive demand for organic feed from dairy farms in the near future.

- Increased organic aquaculture practices: Organic aquaculture has been gaining prominence as an ethical way of fish farming. Consumers are demanding organic fish produced sustainably without harming marine ecosystems. Organic shrimp farming is becoming popular which is driven by high demand in export markets. Ensuring the feed is organic is a key part of organic aquaculture certification. Leading feed manufacturers are developing organic aquatic feed formulas containing oils, fish meals, and grains that are sourced from organic origin. With growth projected in organic aquaculture, the demand for associated organic feeds will see a sharp rise.

Organic Feed Market Opportunities

- Expanding organic livestock markets in developing regions: There is a vast untapped opportunity for organic feed manufacturers in developing regions. Countries like China, India, Brazil, and Argentina have large livestock populations but organic feed adoption is still at very nascent stages, due to lower awareness and high prices. However, with rising incomes, urbanization, and health consciousness, demand for organic meat and dairy products is expected to surge in these countries, thereby driving the need for certified organic feeds. Market players operating in organic feed can expand into these emerging markets through acquisitions of regional companies. This will open up enormous sales opportunities for organic feed producers.

- Growing demand from organic poultry sector: The organic poultry farming sector has gained increasing consumer interest which is driven by increasing health consciousness and food safety concerns related to conventionally raised chickens. Leading poultry companies are launching organic chicken products. Perdue Farms, Tyson Foods have identified the organic poultry market as a high sales opportunity and are making strategic investments to expand production. As organic poultry production scales up, demand for associated organic poultry feeds will witness exponential growth thus giving rise to lucrative opportunities for feed manufacturers.

- Surging preference for organic pet food: In recent years, there has been a marked rise in humanization of pets, with pet owners willing to spend more on organic and natural pet care products including feed. This has led to increasing demand for premium organic pet foods made from organic plant and meat ingredients to provide complete nutrition. Major pet food companies like Mars Petcare (American multinational manufacturer of confectionery, pet food, and other food products) and Nestle Purina are launching organic product lines. Small innovative startups like Nature's Logic are also gaining share. Rising humanization and pet health trends will massively drive organic pet food demand and open up new opportunities for organic feed ingredients.

- Growing adoption in organic dairy farming: Dairy farming is transitioning towards organic practices, driven by consumer demand for organic milk and recognition of higher profit potential by dairy farmers. Organic dairy allows for premium milk prices. Large cooperatives like Organic Valley (organic food brand and independent cooperative of organic farmers) are helping farmers adopt organic practices. Sourcing of organic feed is an important part of the organic certification process which opens up huge sales opportunities for feed producers. With more dairy farms switching to organic, the organic dairy feed segment is projected for exponential growth.

- High prices of organic feed: A massive roadblock to wider adoption of organic animal feed is the high prices, often ranging to 40-100% higher than regular feed. Organic grains, oilseeds, and forage sourced from farms carrying organic certification tend to be far costlier due to lower yields and higher production costs. Companies also pass on the higher costs related to specialize organic sourcing, processing, transportation, and storage. The high prices make organic feed adoption challenging, especially for small-scale livestock producers and farmers in developing countries with lower profit margins.

- Shorter shelf-life: Organic feed usually has a shorter shelf life as compared to conventional feed due to the absence of artificial preservatives. The feeds are more prone to quality deterioration through oxidation, microbial growth, and others which can affect palatability, nutrition content, and safety. Companies need specialized storage and packaging to prevent spoilage. The short shelf life poses inventory and logistics challenges for feed manufacturers, distributors, and farmers, thereby hampering growth.

- Ambiguity in organic regulations: While many countries have regulations governing organic crop production, standards related to organic livestock feeds are still evolving. There is ambiguity around allowed ingredients, supplements, and lack of harmonization across countries. Varying certification requirements pose challenges for feed producers supplying across multiple export countries. Lack of clarity deters new entrants who are unsure of the approved organic ingredients. Cohesive and well-defined regulatory standards will provide a vital push to the organic feed market.

Market Size in USD Bn

CAGR8.9%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 8.9% |

| Fastest Growing Market | Europe |

| Larget Market | North America |

| Market Concentration | High |

| Major Players | Cargill, Archer Daniels Midland, ForFarmers N.V., SunOpta, Country Heritage Feeds and Among Others |

please let us know !

Organic Feed Market Trends

- Focus on enhancing palatability: Organic feeds usually have lower palatability than conventional feeds, due to the absence of added flavors and supplements. This results in lower feed intake and productivity. Leading organic feed companies are extensively investing in R&D to develop innovative natural supplements like essential oils, yeast extracts, microalgae to enhance the smell, taste, and texture of organic feed without compromising on nutrition. The focus on palatability is expected to continue shaping product innovation in the organic feed market.

- Adoption of precision nutrition techniques: Feed manufacturers are leveraging advanced techniques like precision nutrition to create organic feed formulations that are tailored to the nutritional requirements of specific animal categories, based on breed, age, weight, lactation cycled, and others. Precision nutrition accounting for inter-animal variations can help improve feed efficiency. Companies like Cargill and Adisseo (A worldwide leader in nutritional solution and additives for animal feed) have precision nutrition platforms to design optimal organic feed formulas. The application of such techniques will enable development of highly customized and nutrient-rich organic feeds.

- Creating nutritionally balanced feed formulas: The key technical challenge in organic feeds is balancing the nutritional composition in absence of synthetic amino acids, vitamins, and minerals that are used in conventional feeds. Companies are mitigating this through extensive R&D to identify organic sources of essential nutrients like proteins, omega fatty acids, and strategically combining multiple organic ingredients to develop innovative, wholesome and nutritionally balanced feed products without any deficiencies. Such initiatives will allow increasing nutritional value in organic feeds.

- Investments in developing natural feed additives: Feed additives like vitamins, amino acids, and phytogenic is largely synthesized chemically in conventional feeds. Creating effective natural alternatives has been a big R&D focus area for organic feed producers. Companies are collaborating with research institutes to identify and develop plant-based additives with antimicrobial, anti-oxidant, and gut health benefits. Investments by leading firms in discovering new natural additives will lead to introduction of more diverse and beneficial organic feed ingredients.

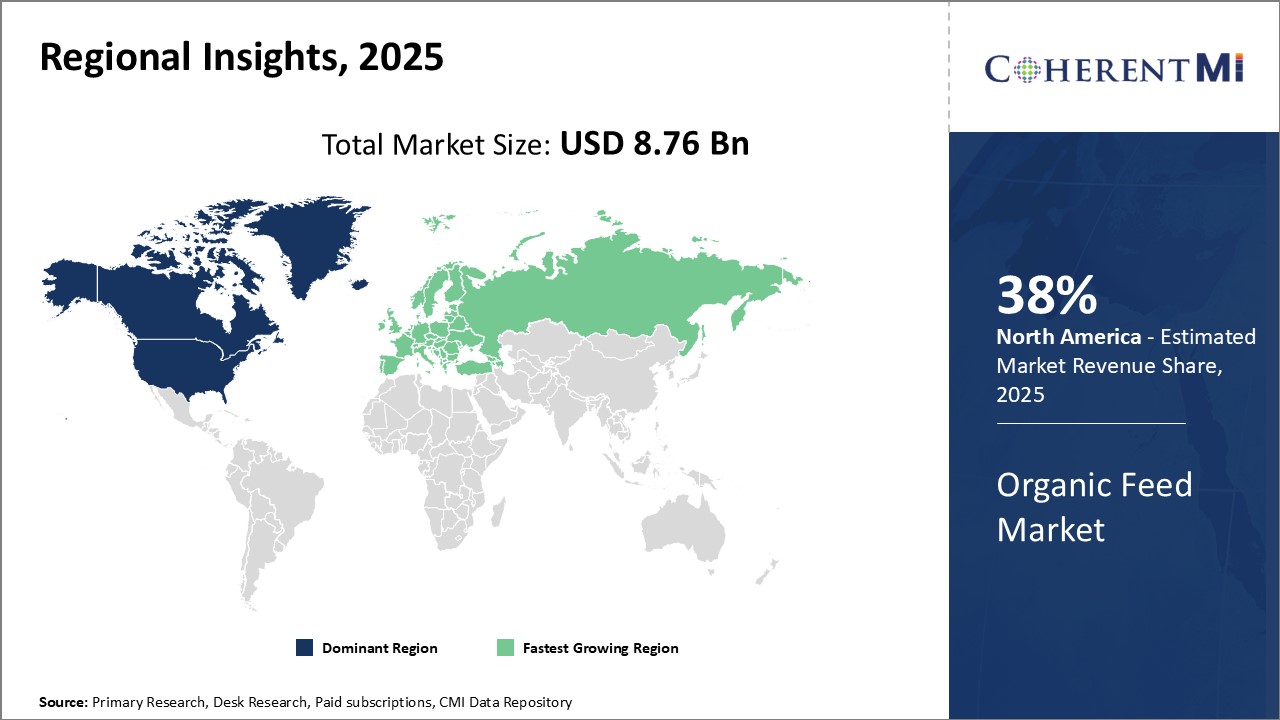

Organic Feed Market Regional Insights

- North America is expected to be the largest market for organic feed market during the forecast period, accounting for over 38% of the market share in 2025. The growth of the market in North America is due to the rising awareness regarding benefits of organic feeds, presence of major manufacturers, and increasing organic meat consumption.

- The Asia Pacific market is expected to be the second-largest market for organic feed market, accounting for over 28% of the market share in 2025. The growth of the market in is due to growing organic agriculture, government promotion of organic products, and increasing demand from livestock industry.

- The Europe market is expected to be the fastest-growing market for organic feed market, with a CAGR of over 14% during the forecast period. The growth of the market in Europe is due to stringent regulations on antibiotic use in feed, consumer preference for organic products and investments in research and developments (R&D).

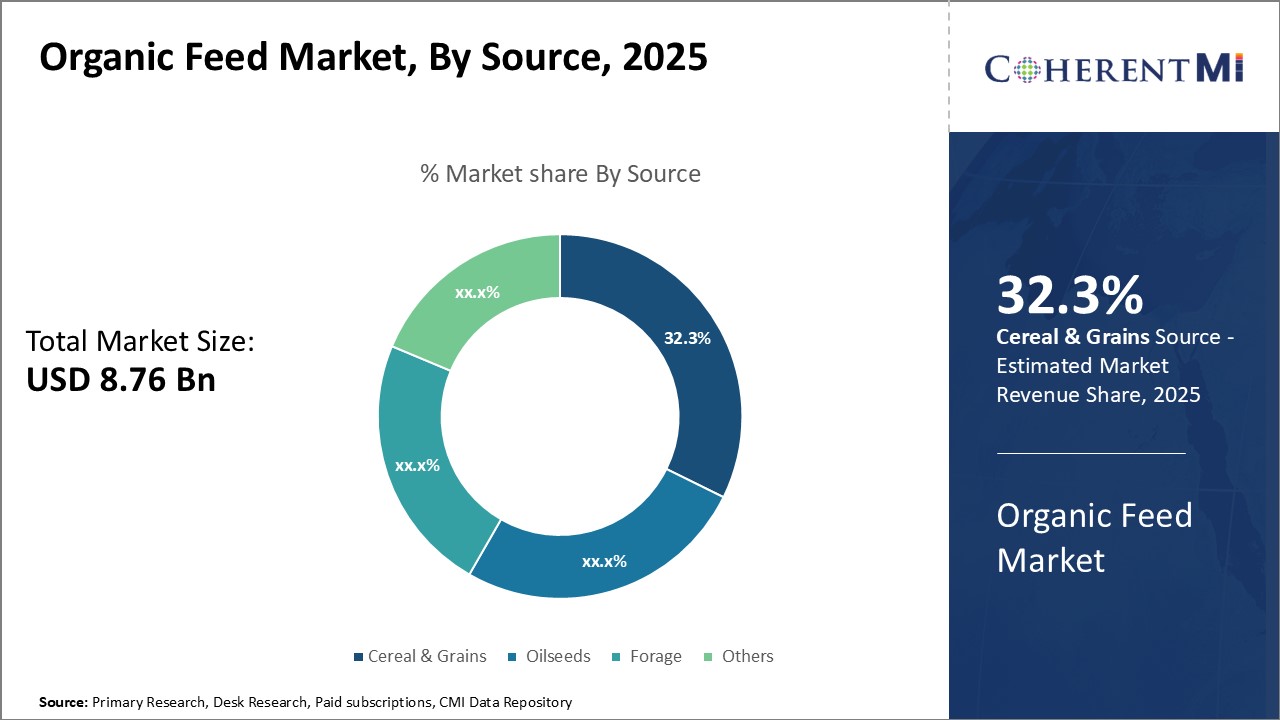

Segmental Analysis of Organic Feed Market

Competitive overview of Organic Feed Market

The Organic Feed Market is competitive and consist some players in the market which are expanding organic livestock markets in developing regions and key players are Cargill, Archer Daniels Midland, ForFarmers N.V., SunOpta, Country Heritage Feeds, Feedex Companies, Kreamer Feed Inc., Aller Aqua A/S, B&W Feeds, Country Junction Feeds, Agro Feed Ltd., Unique Organics, Hi Peak Feeds, Yorktown Organics, LLC, Land O'Lakes, Inc., Alltech Inc., and Purina Animal Nutrition LLC

Organic Feed Market Leaders

- Cargill

- Archer Daniels Midland

- ForFarmers N.V.

- SunOpta

- Country Heritage Feeds

Organic Feed Market - Competitive Rivalry

Organic Feed Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Organic Feed Market

New product launches

- In March 2022, Cargill (American global food corporation) launched ChickXM, an organic poultry feed supporting gut health and immunity in broiler chickens. It contains beta mannan, essential oils, and probiotics.

- In January 2021, ForFarmers (international organisation that provides complete innovative feed solutions for conventional and organic livestock) introduced Reudink Organic, an organic feed range for dairy cattle in the Netherlands. It is offered in roughage and compound feed variants.

- In October 2020, Liquid Feeds Synegis launched ActiBeet, a molasses-based feed supplement containing bioactive compounds from sugar beets. It improves gut health in pigs and poultry.

Acquisition and partnerships

- In December 2021, Cargill (American global food corporation) acquired Delacon, an Austria-based pioneer in phytogenic feed additives. This strengthened Cargill's animal nutrition capabilities.

- In May 2020, ForFarmers (international organisation that provides complete innovative feed solutions for conventional and organic livestock) acquired De Hoop Mengvoeders, a Netherlands-based company, providing conventional and organic poultry feeds. This expanded ForFarmers organic feed portfolio.

- In January 2020, Cargill (American global food corporation) partnered with Heuvelland, a Belgium organic grains group, to expand its organic feed ingredients supply. This ensures a traceable, responsible supply chain

Organic Feed Market Segmentation

- By Source

- Cereal & Grains

- Oilseeds

- Forage

- Others (pulses, fruits etc.)

- By Application

- Poultry

- Swine

- Ruminant

- Aquatic Animals

- Others (Equine, Pets etc.)

- By Form

- Pellets

- Crumbles

- Mashes

- Others (cakes, bales etc.)

- By Additives

- Amino Acids

- Enzymes

- Vitamins

- Antibiotics

- Antioxidants

- Acidifiers

- Others (probiotics, prebiotics etc.)

- By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

Frequently Asked Questions :

How big is the Organic Feed Market?

The Organic Feed Market is estimated to be valued at USD 8.8 in 2025 and is expected to reach USD 15.9 Billion by 2032.

What are the major factors driving the market growth?

Increasing demand for organic meat, stringent regulations regarding antibiotics usage, growing organic of organic dairy products, increased organic aquaculture practices are the major factors driving the market growth.

Which is the leading source segment in the market?

The cereal & grains segments the leading source segment in the market.

Which are the major players operating in the market?

The major players operating in the market are Cargill, Archer Daniels Midland, For Farmers N.V., SunOpta, Country Heritage Feeds, Aller Aqua A/S, B&W Feeds, Country Junction Feeds, Agro Feed Ltd., Unique Organics, Hi Peak Feeds, Yorktown Organics, LLC, Land O'Lakes, Inc., Alltech Inc., and Purina Animal Nutrition LLC.

Which region will lead the market?

The North America region leads the market.

What will be the CAGR of market?

The CAGR of the market is 8.9%.