U.S. Artificial Sweeteners Market Size - Analysis

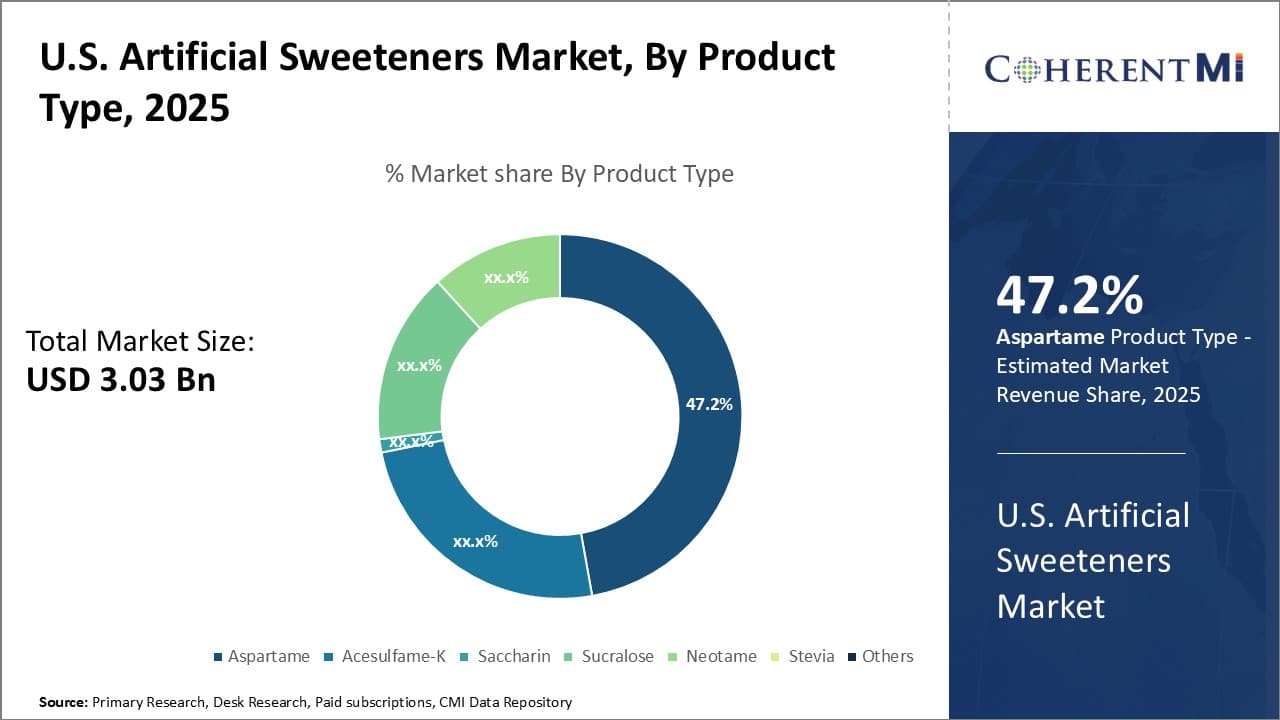

U.S. artificial sweeteners market is expected to be valued at US$ 3.03 Bn in 2025, and is expected to reach US$ 4.77 Bn by 2032, exhibiting a compound annual growth rate (CAGR) of 6.7% from 2025 to 2032.

Artificial sweeteners, also known as non-nutritive sweeteners or intense sweeteners, are substitutes for sugar with low or no calories. These are synthesized in laboratories, and are sweeter than table sugar. The major types of artificial sweeteners include aspartame, acesulfame K, saccharin, neotame, and sucralose. Artificial sweeteners provide the sweetness of sugar without the high amount of calories, thus, making them attractive alternatives for weight management, diabetes control, and dental health.

U.S. artificial sweeteners market growth is driven by rising health consciousness among consumers, growing prevalence of obesity and diabetes, and surging demand for low-calorie food and beverages. The market is segmented into by product type, application, form, and distribution channel. By product type, the aspartame segment held the largest share in 2025, owing to its widespread use in beverages and convenience foods.

U.S. Artificial Sweeteners Market- Drivers

- Increasing health consciousness and demand for sugar alternatives: Rising health consciousness among consumers is a major factor boosting demand for low-calorie artificial sweeteners. Consumers are becoming more aware of issues like obesity, diabetes, heart diseases, and others, and seek to limit sugar intake. This leads to higher demand for artificial sweeteners as these provide the sweet taste without the calories and carbs of sugar. Brands are launching low-sugar and sugar-free products made with non-nutritive sweeteners to cater to this growing demand. The growing fitness culture and popularity of diets like Keto are further propelling the need for sugar substitutes and alternative sweeteners.

- Growing prevalence of obesity and diabetes: Increasing incidence of obesity and diabetes, especially in the U.S., is a key factor boosting adoption of low-calorie sweeteners. According to Centers for Disease Control and Prevention reports, over 40% of the adult population in the U.S. is obese. Over 34 million Americans have diabetes. These trends are prompting health professionals and organizations to promote artificial sweeteners as these contain negligible calories and carbohydrates. Stevia and sucralose are gaining traction among diabetics as these help in controlling blood sugar levels. The use of sweeteners is surging in food applications targeting diabetic and obese populations.

- Favorable regulations and government policies: The regulatory landscape is turning favorable for artificial sweeteners in the U.S. with authorities like U.S. FDA issuing approvals for new sweeteners and variants. Implementation of sugar taxes by cities like Philadelphia is making sweeteners more cost-competitive than sugar. Government guidelines promoting low-sugar foods is further aiding adoption of these sweeteners. Such favorable regulations and policies are expected to accelerate the U.S. artificial sweeteners market growth.

- Product innovations and advancements in taste profiles: Manufacturers are continuously carrying out R&D activities to improve the taste profile and sweetness intensity of synthetic sweeteners. The emergence of novel sweeteners like stevia and tagatose that mimic the taste and sweetness of sugar is aiding adoption of these sweeteners. Companies are using techniques like masking agents and synergistic sweetener blends to overcome bitter aftertastes. Advancements like delayed-release encapsulations are also enhancing taste. Such product innovations are focused on improving taste, texture and solubility are supporting the market growth.

U.S. Artificial Sweeteners Market- Opportunities

- Rising demand from emerging food and beverage applications: Increasing adoption of artificial sweeteners in a range of food and beverage categories beyond just carbonated soft drinks is expected to offer opportunities to the market. The usage is rising in juices, flavored water, energy drinks, coffee, tea, yogurt, ice creams, candies, chewing gum, and others due to strong demand for low-calorie formulations. This presents significant opportunities for manufacturers to expand into new application areas. For instance, stevia is being widely used in snacks, cereals and bakery items. Sucralose and aspartame usage in protein powders and nutrition bars is also rising.

- Growing demand from pharmaceutical applications: The use of strong sweeteners in pharmaceutical products is increasing to mask the chewy, bitter taste of active ingredients such as cough syrups. Multivitamins, electrolyte solutions, and others. Sweeteners improve patient compliance as these provide sweetness along with solubility. For instance, sucralose is increasingly being used in children's medicines. Similarly, saccharin sodium has applications as a tablet binder and coating agent. Such growing adoption of sweeteners by pharmaceutical companies to develop palatable formulations offers lucrative opportunities.

- Rising demand for natural sweeteners: With growing consumer inclination towards natural products, stevia and other natural high-intensity sweeteners are gaining significant traction over artificial sweeteners. Stevia sales have witnessed exponential growth in recent years. The growing adoption of sweeteners derived from natural sources like fruits, vegetables and plants provides opportunities for manufacturers to develop innovative natural sweetening solutions. Investments in expanding stevia and monk fruit sweetener portfolios will enable companies to leverage this trend.

- Surging demand from emerging economies: Emerging economies like China, India, Mexico and Brazil offer untapped growth potential for artificial sweetener manufacturers. With rising disposable incomes, increasing urbanization and changing lifestyle habits, demand for low-calorie foods and beverages is increasing in these markets. As obesity and diabetes levels rise, sweeteners are gaining adoption to limit sugar intake. Companies are establishing manufacturing facilities and distribution networks in these regions to tap the huge growth opportunities.

U.S. Artificial Sweeteners Market- Restraints

- Bitter aftertaste issues: Certain high-intensity sweeteners like saccharin, sucralose and natural sweeteners like stevia are associated with bitter and metallic aftertastes which limit their adoption. While advancements have improved taste profiles, the strong lingering aftertaste remains a challenge. This deters adoption across food and beverage applications where taste is a priority. Manufacturers often require flavor masking agents to counteract the bitterness, which adds to costs. Therefore, the bitter taste issues of certain sweeteners restrain market growth.

- Controversies and negative perception: Despite FDA approvals, there are conflicting research reports and controversies regarding the long-term safety of sweeteners for human health. For instance, aspartame is considered carcinogenic by some studies. Although not definitive, such reports spread consumer skepticism and negative perceptions of artificial sweeteners. This leads to the customer segment avoiding or reducing the use of products containing synthetic sweeteners, hampering adoption rates and market growth.

- Higher costs compared to sugar: While highly sweet, most high-intensity sweeteners are costlier than plain sugar. For example, acesulfame potassium costs around US$ 24 per kg as compared to sugar which costs under US$ 1 per kg. Similarly, sucralose is over 20-30 times costlier than sugar. Such high costs make integration challenging, especially for small food manufacturers. Therefore, the higher prices of synthetic sweeteners compared to conventional sugar restrain market growth to some extent.

Market Size in USD Bn

CAGR6.7%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 6.7% |

| Larget Market | U.S. |

| Market Concentration | High |

| Major Players | Cargill, Archer Daniels Midland, Tate & Lyle, Ajinomoto Co. Inc., Celanese Corporation and Among Others |

please let us know !

U.S. Artificial Sweeteners Market Trends

Increasing adoption in confectionery, bakery and dairy items: Historically, the usage of high-intensity sweeteners was limited to beverages and tabletop sweeteners. However, their application is rising across confectionery, bakery and dairy products. Manufacturers are using sweeteners in chocolate, ice cream, yogurt, cakes, muffins, frosting, and others to develop low-sugar alternatives. For instance, brands like Halo Top have gained popularity for their low-calorie artificial sweetener-based ice creams. Rising demand for sweetener-based desserts and bakery items among diabetics and weight watchers is a trend that boosts product adoption.

Demand for sweetener blends over single sweeteners: Food and beverage manufacturers are increasingly using combinations of artificial sweeteners rather than single sweeteners to achieve well-rounded taste profiles. Blends provide synergistic effects resulting in enhanced sweetness potency and sensory experience. For instance, stevia is often blended with aspartame, sucralose or monk fruit extracts. The use of combinations of sweeteners also makes it possible to reduce the dosage of individual sweeteners, which promotes this development. Companies like ADM, Cargill and Tate & Lyle offer blended sweetener solutions.

Clean label and natural sweetener solutions: With rising consumer demand for clean label and natural products, manufacturers are offering ingredients like stevia and monk fruit to replace artificial sweeteners like aspartame or acesulfame K. Consumers are increasingly scrutinizing product labels and seeking recognizable and natural ingredients. Stevia and monk fruit provide the sweetness of sugar without artificial additives. Brands across categories like beverages, dairy, snacks, and others are reformulating products with these natural sweetening solutions, thus, fueling their adoption.

Surging popularity of stevia sweeteners: Among high-intensity sweeteners, stevia has witnessed exponential growth in demand and adoption rates owing to its natural origin. According to Innova Market Insights Data in 2021, stevia was used in over 35% of food and beverage launched in 2021. Consumers perceive it as a healthy, plant-based alternative with no calories and glycemic impact. Manufacturers are using premium quality stevia extracts like reb M and reb D optimized for taste. The rising consumer preference for stevia as a sugar substitute is a noteworthy trend in the industry.

Segmental Analysis of U.S. Artificial Sweeteners Market

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample CopyCompetitive overview of U.S. Artificial Sweeteners Market

Imperial Sugar Company, Cumberland Packing Corp., NOW Foods, Ajinomoto Co. Inc., Celanese Corporation, JK Sucralose Inc., Hermes Sweeteners Ltd., Merisant Company, DuPont, Niutang Chemical Ltd., SweetLeaf, Pyure Brands, Cargill, Archer Daniels Midland, Tate & Lyle, PureCircle, Stevia First Corporation, Wisdom Natural Brands, Xinghua Green Biological Engineering Co. Ltd., GLG Life Tech Corporation

U.S. Artificial Sweeteners Market Leaders

- Cargill

- Archer Daniels Midland

- Tate & Lyle

- Ajinomoto Co. Inc.

- Celanese Corporation

Recent Developments in U.S. Artificial Sweeteners Market

New Product Launches

- In March 2022, Tate & Lyle (supplier of food and beverage products to food and industrial markets) launched its new monk fruit sweetener, TASTEVA M Stevia Sweetener, to meet the rising demand for natural, plant-based sweeteners. It provides a high-quality sweet taste without any bitter aftertaste.

- In January 2021, ADM launched its new sweetener product, VerySweet, which combines fructose, Reb M and Reb D to provide improved sweetness and taste compared to sucrose. It can be used across various food and beverage applications.

- In November 2020, PureCircle (producer and innovator in the area of stevia sweeteners for the food and beverage industry) launched its next generation stevia leaf sweetener, Reb M, which has a clean, sugar-like taste and can reduce bitterness and licorice aftertaste.

Acquisition and partnerships

- In December 2021, Sweegen acquired SweetGredients, a France-based company that develops natural sweetener solutions. This expanded Sweegen's portfolio and presence in Europe.

- In November 2020, PureCircle and WILD Flavors and Specialty Ingredients announced an exclusive partnership to launch next generation stevia solutions like Reb M for the global beverage industry

- In October 2020, Food Chem International was acquired by Sweegen to enhance its technology leadership through Food Chem's strong portfolio of natural sweetener patents

U.S. Artificial Sweeteners Market Segmentation

- By Product Type

-

- Aspartame

- Acesulfame-K

- Saccharin

- Sucralose

- Neotame

- Stevia

- Others (Luo Han Guo, Cyclamate etc.)

- By Application

-

- Beverages

- Food

- Pharmaceuticals

- Personal Care

- Tabletop Sweeteners

- Others (tobacco, animal feed etc.)

- By Form

-

- Powder

- Liquid

- Granular

- By Distribution Channel

-

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Stores

- Others

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.