United States Infant Formula Market Size - Analysis

The United States Infant Formula Market is estimated to be valued at USD 7.53 Bn in 2025 and is expected to reach USD 10.32 Bn by 2032, growing at a CAGR of 4.6% from 2025 to 2032.

Market Size in USD Bn

CAGR4.6%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 4.6% |

| Market Concentration | Medium |

| Major Players | Abbott Laboratories, Arla Foods amba, Nestlé S.A., Bobbie Baby, Inc., Danone S.A. and Among Others |

please let us know !

United States Infant Formula Market Trends

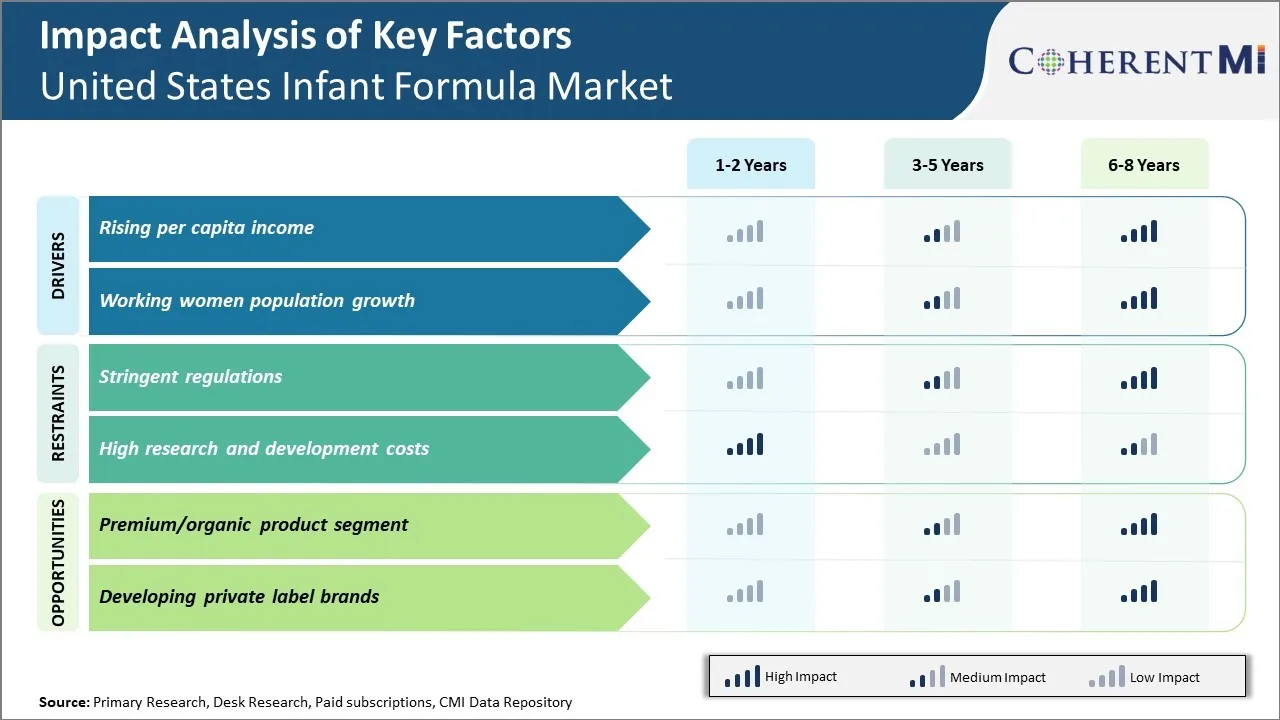

Rising per capita income has been one of the key drivers of growth in the United States infant formula market. As average incomes grow, American families have more discretionary funds to spend on quality nutrition and care for their infants. Many parents see infant formula as offering balanced, complete nutrition to support baby's growth and development.

As incomes rise across income brackets, overall demand grows as more households can participate in the infant formula category. This allows companies to achieve more scale and reinvest in innovation. Looking ahead, if economic expansion continues post-pandemic and unemployment remains low, disposable incomes are poised to grow further.

Market Driver – Working Women Population Growth

According to data from the United States Bureau of Labor Statistics, in 2021 around 57% of married mothers with children under the age of 3 were employed. This is a significant increase from 25 years ago in 1996 when the employment level was only 47%. Working women need convenient options to feed their babies when they are away from home for long hours at their jobs. This is where infant formula becomes indispensable as it allows new mothers to ensure their babies are adequately fed irrespective of their work schedules and locations.

Market Challenge – Stringent Regulations

The extensive pre-market approval process also slows time to market for new formulations. On average, it takes 1-2 years for the FDA to review a new infant formula submission before granting approval. By the time products reach shelves, market trends and consumer demands may have shifted. Lengthy reviews constrain the nimbleness required to adapt to changing consumer profiles and remain competitive.

Market Opportunity – Premium/Organic Product Segment

According to the USDA, sales of organic food products grew by over 14% year-over-year in 2021. Parents feel organic infant formulas provide considerable advantages over traditional formulas when it comes to avoidance of potentially harmful additives, chemicals or GMOs. Some of the popular organic infant formulas contain probiotics and prebiotics for gut and immune health as well as DHA and ARA for brain and eye development.

Segmental Analysis of United States Infant Formula Market

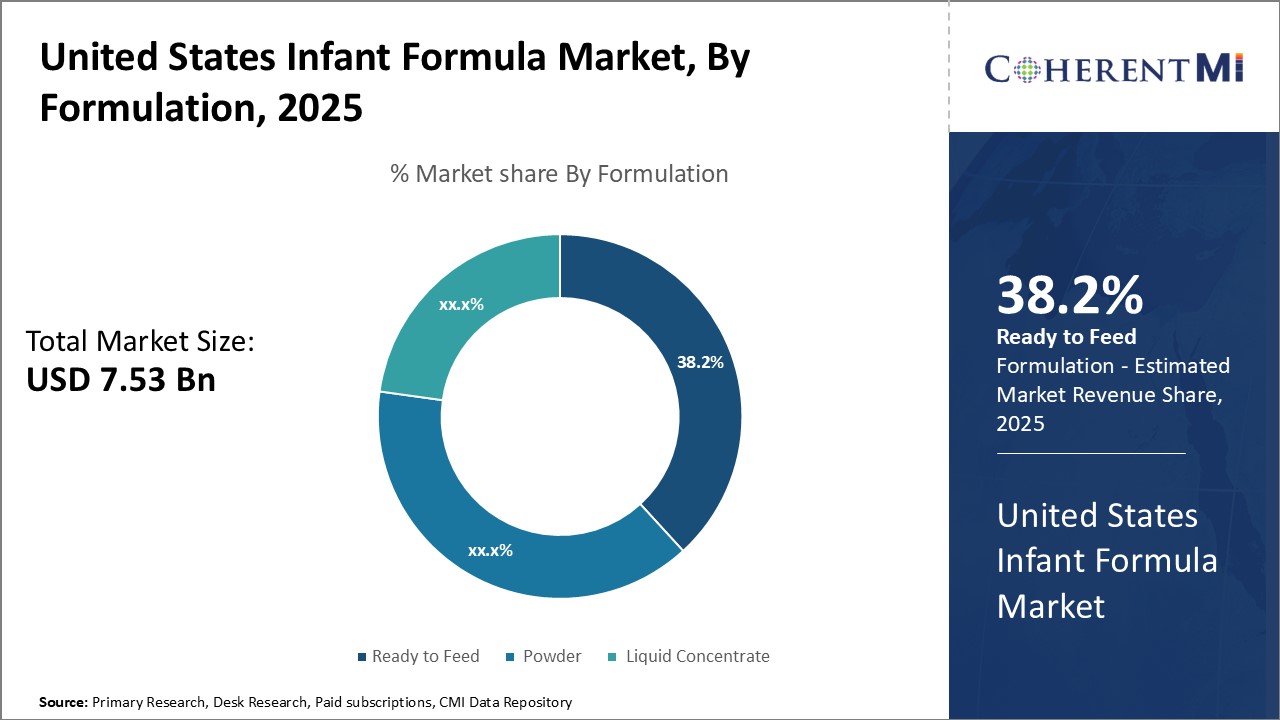

Insights, By Formulation: Consumer Preference for Flexibility

Insights, By Formulation: Consumer Preference for FlexibilityIn terms of formulation, powder sub-segment contributes the highest share of 38.2% in the market owning to consumer preference for flexibility

The do-it-yourself aspect of powder is seen as more natural by some parents compared to the pre-made options. Many find satisfaction in being able to custom-mix formula for their baby with complete control over ingredients. Additionally, powder tends to have a longer shelf life when unopened which provides peace of mind for storage. With its portable packaging, powder formula is also well-suited for travel which adds to its demand. While it requires more preparation time, overall powder remains the preferred choice due to the independence, freshness and value it brings to caregivers in their daily routines.

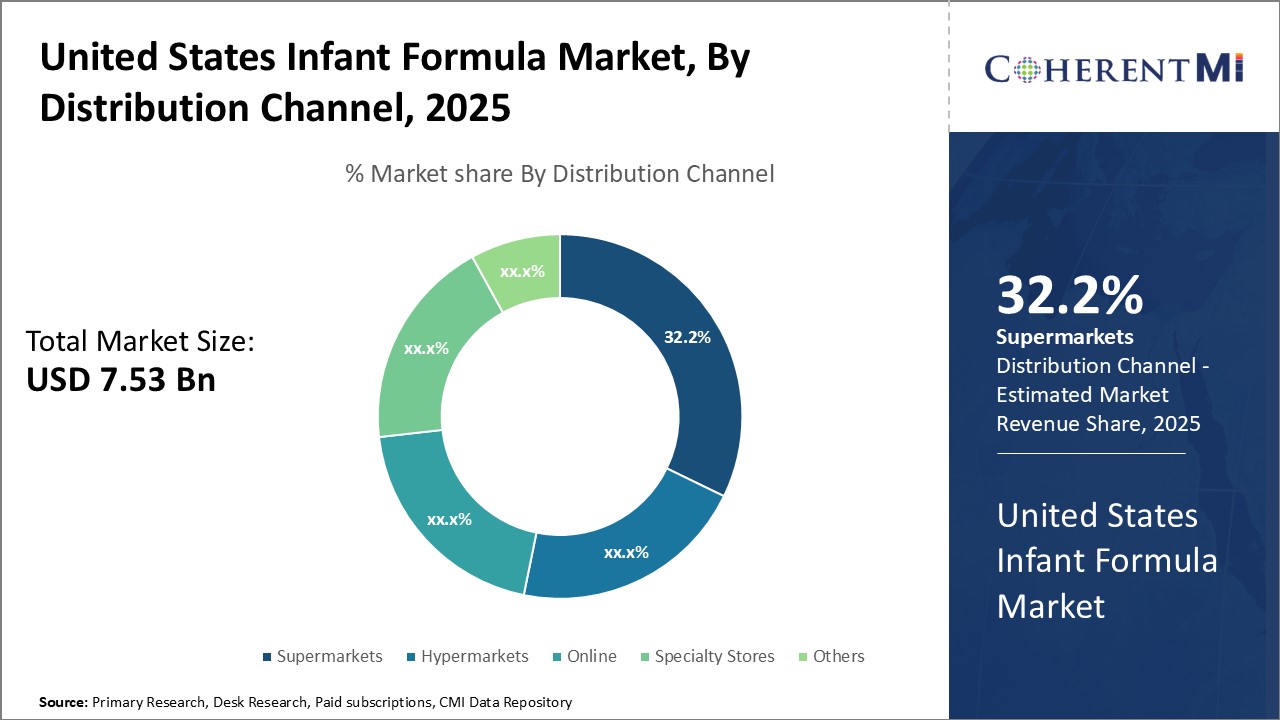

In terms of distribution channel, supermarkets sub-segment contributes the highest share of 32.2% in the market owning to widespread availability and discounts

Competitive overview of United States Infant Formula Market

The major players operating in the United States Infant Formula Market include Aussie Bubs, Inc., Else Nutrition Holdings Inc., Reckitt Benckiser Group PLC, Walmart Inc., Target Corporation, Abbott Laboratories, Arla Foods amba, Nestlé S.A., Bobbie Baby, Inc., and Danone S.A.

United States Infant Formula Market Leaders

- Abbott Laboratories

- Arla Foods amba

- Nestlé S.A.

- Bobbie Baby, Inc.

- Danone S.A.

United States Infant Formula Market - Competitive Rivalry

United States Infant Formula Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in United States Infant Formula Market

- In July 2023, Similac introduced a new line of organic formula, catering to the increasing demand for natural and clean-label products among parents.

- In June 2023, Enfamil launched a specialized formula designed to address specific dietary needs for infants with allergies, receiving positive feedback from the medical community

- In March 2023, Gerber announced a partnership with a renowned nutritionist to develop a comprehensive guide for parents on infant feeding practices and nutritional needs.

United States Infant Formula Market Segmentation

- By Formulation

- Ready to Feed

- Powder

- Liquid Concentrate

- By Distribution Channel

- Online

- Hypermarkets

- Supermarkets

- Specialty Stores

- Others

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

Frequently Asked Questions :

How big is the United States Infant Formula Market?

The United States Infant Formula Market is estimated to be valued at USD 7.53 in 2025 and is expected to reach USD 10.32 Billion by 2032.

What are the major factors driving the United States Infant Formula Market growth?

The rising per capita income and working women population growth are the major factors driving the United States Infant Formula Market growth.

Which is the leading Formulation in the United States Infant Formula Market?

The leading Formulation segment is Powder.

Which are the major players operating in the United States Infant Formula Market?

Aussie Bubs, Inc., Else Nutrition Holdings Inc., Reckitt Benckiser Group PLC, Walmart Inc., Target Corporation, Abbott Laboratories, Arla Foods amba, Nestlé S.A., Bobbie Baby, Inc., and Danone S.A. are the major players.

What will be the CAGR of the United States Infant Formula Market?

The CAGR of the United States Infant Formula Market is projected to be 4.6% from 2025-2032.