Canada Carbon Credit Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Canada Carbon Credit Market is Segmented By Sector (Energy, Transportation, Residential and Commercial Buildings, Industrial, Agriculture, Forestry, W....

Canada Carbon Credit Market Size

Market Size in USD Bn

CAGR11.2%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 11.2% |

| Market Concentration | Medium |

| Major Players | WGL Holdings, Inc., Enking International, Green Mountain Energy, Native Energy, Cool Effect, Inc. and Among Others |

please let us know !

Canada Carbon Credit Market Analysis

The Canada Carbon Credit Market is estimated to be valued at USD 1.8 Bn in 2024 and is expected to reach USD 3.37 Bn by 2031, growing at a compound annual growth rate (CAGR) of 11.2% from 2024 to 2031.

The market is driven by the Canada's commitment to reduce greenhouse gas emissions and meet its Paris Agreement targets through carbon pricing schemes and emissions trading systems.

Canada Carbon Credit Market Trends

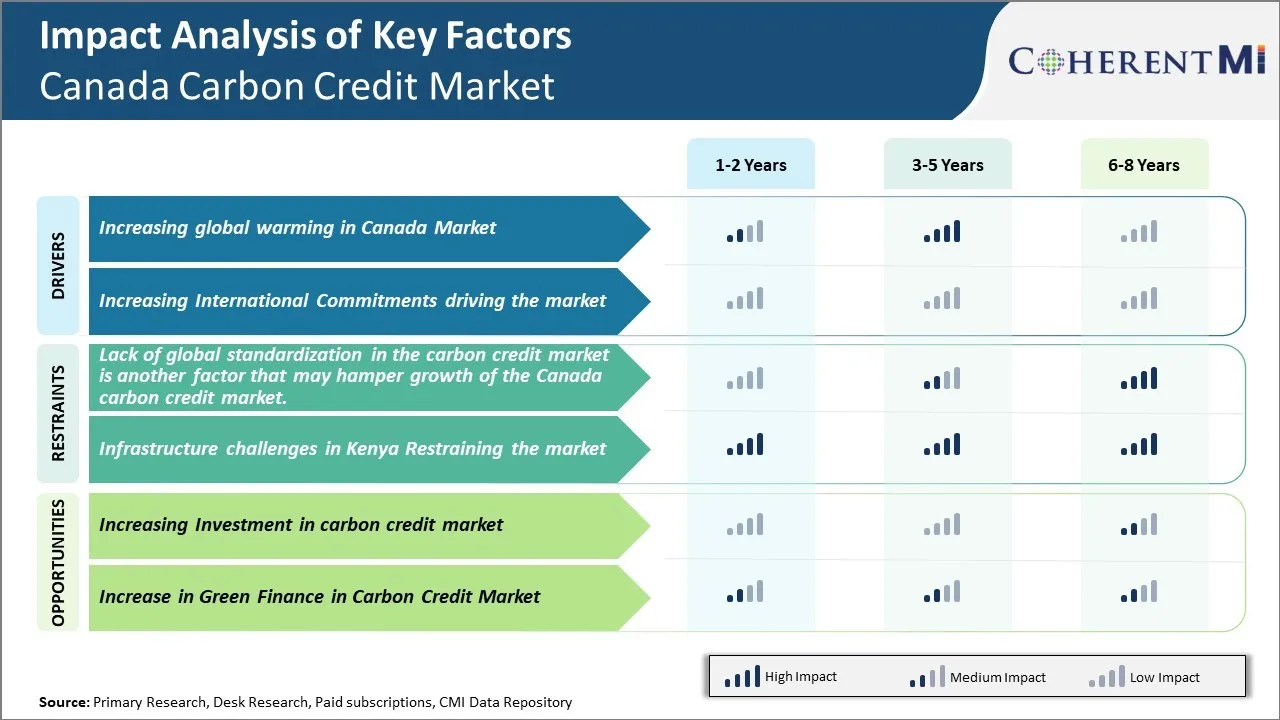

Market Driver - Increasing Global Warming in Canada Market

The increasing concerns about global warming across Canada has fueled the growth of the carbon credit market in the country. With rising temperatures causing hazards like wildfires and floods, the Canadian government has been actively pushing initiatives to lower carbon emissions through regulations and carbon pricing programs. This is driving more organizations to explore options to offset their carbon footprint and become neutralized. Carbon credits have emerged as an effective way to not just compensate for greenhouse gas emissions but also support green technology projects.

Many large Canadian corporations have committed to net-zero emission targets over the next couple of decades in line with the national goal of reducing emissions by 40–45% below 2005 levels by 2030. This is increasing the demand for credible carbon offsets. As per Natural Resources Canada, between 2018–2019, over 30 million tons of carbon offsets were purchased through provincial programs like the Alberta Emissions Offset System and Quebec Cap-and-Trade system. This trend is anticipated to continue rising strong given the climate targets.

Market Driver – Increasing International Commitments

The increasing international commitments by Canada to reduce greenhouse gas emissions is a major driving factor behind the growth of carbon credit market in the country. Canada has pledged to reduce its emissions by 40-45% by 2030 from the 2005 levels under the Paris Agreement. It has also joined collaborative initiatives like Powering Past Coal Alliance and Net Zero Electricity Alliance to transition away from fossil fuels. In order to meet these ambitious climate targets, carbon pricing and cap-and-trade programs have been introduced that are incentivizing Canadian companies to lower their carbon footprint. This has led to a rise in demand for carbon credits as they provide a flexible and cost-effective way to offset hard-to-abate emissions.

As per the data from Environment and Climate Change Canada, the overall carbon pricing in Canada is expected to increase from $50 per ton of CO2e in 2022 to $170 per ton by 2030. This significant rise in carbon prices is attracting many large emitters to invest in offset projects for crediting greenhouse gas reductions or removals.

Market Challenge – Lack of Global Standardization in the Carbon Credit Market

Lack of global standardization in the carbon credit market is a major factor restraining the growth of Canada's carbon credit market. With different countries having divergent rules and methodologies for generating, trading and accounting of carbon credits, it has become increasingly complex for Canadian companies and market participants.

Canada currently adheres to compliance protocols established by the Kyoto Protocol and Paris Agreement for generating credits from initiatives such as forestry projects, renewable energy installations etc. However, other large emitter nations such as USA, China and India have established their own domestic carbon trading platforms which follow unique rules and guidelines. For example, the compliance carbon market in China operates quite differently from the Canadian system in terms of eligible project types, credit vintage rules, accounting and more.

This lack of uniformity has made carbon credits generated in one region incompatible and non-tradable in other compliance regimes. Canadian companies now have to navigate a maze of different infrastructure and compliance norms before engaging in international trade of credits. This increases transaction costs and administrative hurdles, discouraging larger companies from fully participating in the carbon market.

Market Opportunity – Increasing Investment in Carbon Credit Market

Investing more in carbon credit markets in Canada has the potential to provide significant environmental and economic benefits. As climate change threatens the country, investing in projects and technologies that reduce greenhouse gas emissions is crucial. The carbon credit market allows companies and governments to finance emission-reduction projects via the sale and purchase of credits representing tons of carbon dioxide removed from the atmosphere. When more funds are put into this market, it enables larger scales of projects that remove or offset greater amounts of emissions.

More investment will support more projects across many sectors. For example, increased financing could lead to expansion of forest conservation and reforestation initiatives. According to data from Environment and Climate Change Canada, forests currently sequester over 8% of Canada's annual emissions. Larger projects protecting and expanding forest cover will therefore offset a substantial portion of Canada's climate pollution. Renewable energy is another sector that can grow with more carbon credit funding. Transitioning away from fossil fuels and investing in wind, solar and other clean power reduces long-term emissions.

Segmental Analysis of Canada Carbon Credit Market

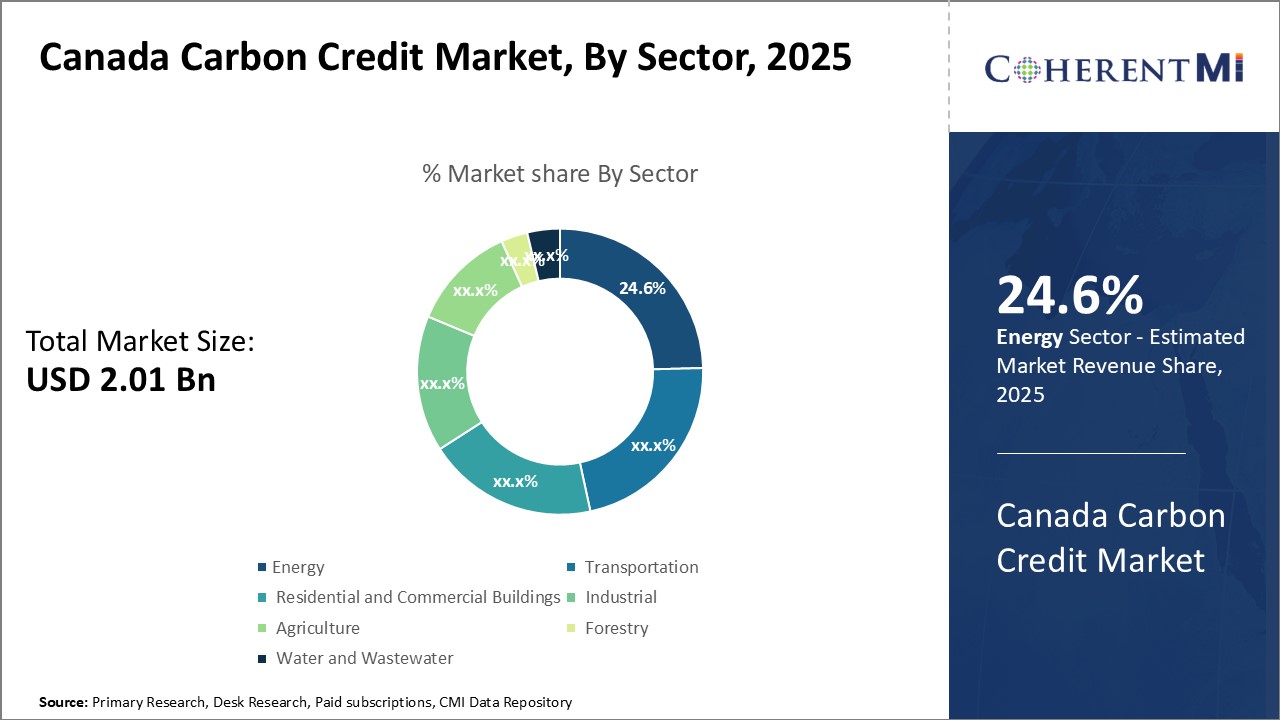

Insights, By Sector: Decarbonization Policies and Renewable Expansion

In terms of sector, energy sub-segment contributes the highest share of 24.6% in the market, owing to decarbonization policies and renewable expansion

Canada has committed to achieve net-zero greenhouse gas emissions by 2050, which has accelerated carbon reduction programs targeting the energy sector. Various policies including carbon tax, clean fuel standards, coal plant phase outs have been effective in curbing emissions from electricity generation and fuel consumption.

Moreover, provincial renewable portfolio standards requiring a certain percentage of electricity coming from green sources have boosted investments in wind and solar energy sources. Provinces like Ontario, Quebec and Alberta are world leaders in renewable capacity addition. This accelerated transition away from fossil fuels towards cleaner energy production is a key driver responsible for the energy sector's high demand for carbon credits. As utilities retire coal and natural gas plants ahead of schedule and scale up their renewable energy capacity, it leads to significant emission reductions qualifying for carbon credits.

Adoption of clean technologies like carbon capture and storage as well as nuclear power expansion have also helped the energy sector make substantive emission cuts eligible for carbon credits. Though carbon intensive in nature, oil and gas production remains a necessity for meeting Canada's energy needs.

Competitive overview of Canada Carbon Credit Market

The major players operating in the Canada Carbon Credit Market include WGL Holdings, Inc., Enking International, Green Mountain Energy, Native Energy, Cool Effect, Inc., Sustainable Travel International, 3 Degrees, Terrapass, and Sterling Planet, Inc.

Canada Carbon Credit Market Leaders

- WGL Holdings, Inc.

- Enking International

- Green Mountain Energy

- Native Energy

- Cool Effect, Inc.

Canada Carbon Credit Market - Competitive Rivalry

Canada Carbon Credit Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Canada Carbon Credit Market

- In March, EnKing International won a bid for selling Methane Credits to Pilot Auction Facility (PAF) of The World Bank Group.

- In November, EnKing International announced that the company is an approved Energy Service Company (ESCO) from Bureau of Energy Efficiency (BEE), India.

Canada Carbon Credit Market Segmentation

- By Sector

- Energy

- Transportation

- Residential and Commercial Buildings

- Industrial

- Agriculture

- Forestry

- Water and Wastewater

Would you like to explore the option of buyingindividual sections of this report?

Frequently Asked Questions :

What are the key factors hampering the growth of the Canada Carbon Credit Market?

The lack of global standardization in the carbon credit market is a major factor hampering the growth of the Canada Carbon Credit Market.

What are the major factors driving the Canada Carbon Credit Market growth?

The increasing global warming across Canada is a major factor driving the Canada Carbon Credit Market growth.

Which is the leading Sector in the Canada Carbon Credit Market?

The leading Sector segment is Energy.

Which are the major players operating in the Canada Carbon Credit Market?

WGL Holdings, Inc., Enking International, Green Mountain Energy, Native Energy, Cool Effect, Inc., Sustainable Travel International, 3 Degrees, Terrapass, and Sterling Planet, Inc. are the major players.

What will be the CAGR of the Canada Carbon Credit Market?

The CAGR of the Canada Carbon Credit Market is projected to be 11.2% from 2024-2031.