Canada Carbon Credit Market Trends

Market Driver - Increasing Global Warming in Canada Market

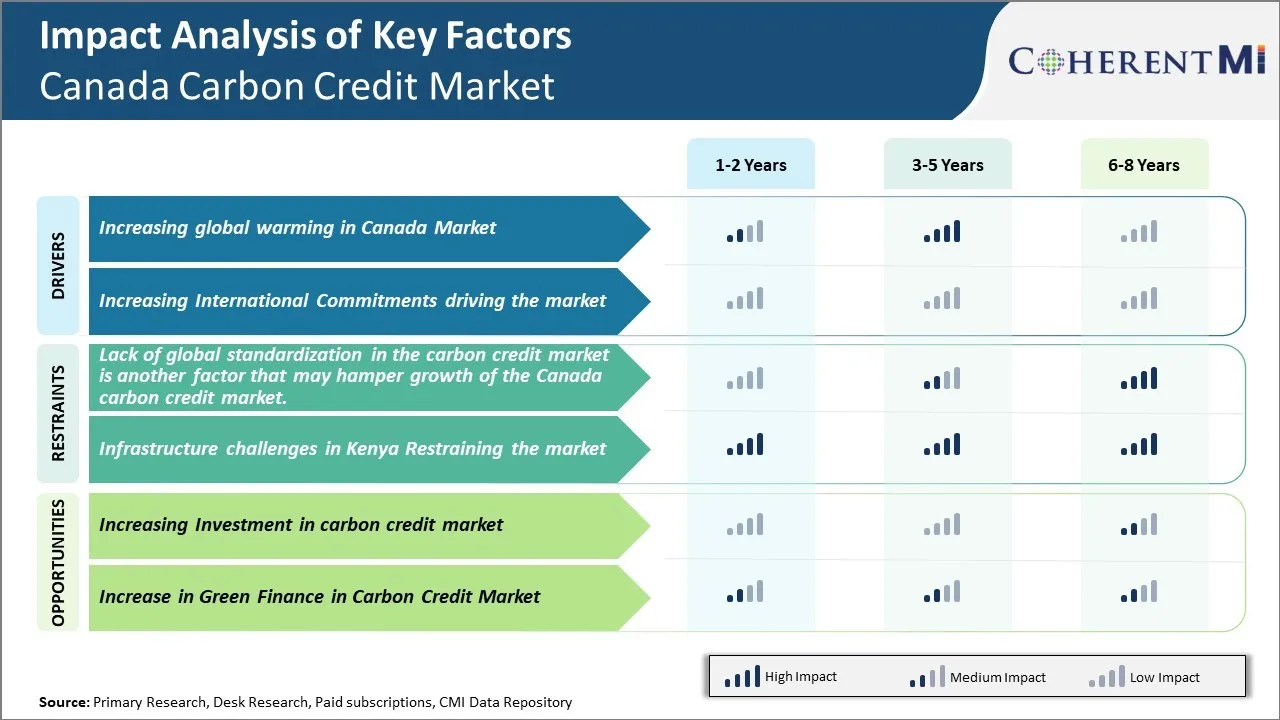

The increasing concerns about global warming across Canada has fueled the growth of the carbon credit market in the country. With rising temperatures causing hazards like wildfires and floods, the Canadian government has been actively pushing initiatives to lower carbon emissions through regulations and carbon pricing programs. This is driving more organizations to explore options to offset their carbon footprint and become neutralized. Carbon credits have emerged as an effective way to not just compensate for greenhouse gas emissions but also support green technology projects.

Many large Canadian corporations have committed to net-zero emission targets over the next couple of decades in line with the national goal of reducing emissions by 40–45% below 2005 levels by 2030. This is increasing the demand for credible carbon offsets. As per Natural Resources Canada, between 2018–2019, over 30 million tons of carbon offsets were purchased through provincial programs like the Alberta Emissions Offset System and Quebec Cap-and-Trade system. This trend is anticipated to continue rising strong given the climate targets.

Market Driver – Increasing International Commitments

The increasing international commitments by Canada to reduce greenhouse gas emissions is a major driving factor behind the growth of carbon credit market in the country. Canada has pledged to reduce its emissions by 40-45% by 2030 from the 2005 levels under the Paris Agreement. It has also joined collaborative initiatives like Powering Past Coal Alliance and Net Zero Electricity Alliance to transition away from fossil fuels. In order to meet these ambitious climate targets, carbon pricing and cap-and-trade programs have been introduced that are incentivizing Canadian companies to lower their carbon footprint. This has led to a rise in demand for carbon credits as they provide a flexible and cost-effective way to offset hard-to-abate emissions.

As per the data from Environment and Climate Change Canada, the overall carbon pricing in Canada is expected to increase from $50 per ton of CO2e in 2022 to $170 per ton by 2030. This significant rise in carbon prices is attracting many large emitters to invest in offset projects for crediting greenhouse gas reductions or removals.

Market Challenge – Lack of Global Standardization in the Carbon Credit Market

Lack of global standardization in the carbon credit market is a major factor restraining the growth of Canada's carbon credit market. With different countries having divergent rules and methodologies for generating, trading and accounting of carbon credits, it has become increasingly complex for Canadian companies and market participants.

Canada currently adheres to compliance protocols established by the Kyoto Protocol and Paris Agreement for generating credits from initiatives such as forestry projects, renewable energy installations etc. However, other large emitter nations such as USA, China and India have established their own domestic carbon trading platforms which follow unique rules and guidelines. For example, the compliance carbon market in China operates quite differently from the Canadian system in terms of eligible project types, credit vintage rules, accounting and more.

This lack of uniformity has made carbon credits generated in one region incompatible and non-tradable in other compliance regimes. Canadian companies now have to navigate a maze of different infrastructure and compliance norms before engaging in international trade of credits. This increases transaction costs and administrative hurdles, discouraging larger companies from fully participating in the carbon market.

Market Opportunity – Increasing Investment in Carbon Credit Market

Investing more in carbon credit markets in Canada has the potential to provide significant environmental and economic benefits. As climate change threatens the country, investing in projects and technologies that reduce greenhouse gas emissions is crucial. The carbon credit market allows companies and governments to finance emission-reduction projects via the sale and purchase of credits representing tons of carbon dioxide removed from the atmosphere. When more funds are put into this market, it enables larger scales of projects that remove or offset greater amounts of emissions.

More investment will support more projects across many sectors. For example, increased financing could lead to expansion of forest conservation and reforestation initiatives. According to data from Environment and Climate Change Canada, forests currently sequester over 8% of Canada's annual emissions. Larger projects protecting and expanding forest cover will therefore offset a substantial portion of Canada's climate pollution. Renewable energy is another sector that can grow with more carbon credit funding. Transitioning away from fossil fuels and investing in wind, solar and other clean power reduces long-term emissions.