Carbon Capture and Sequestration Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Carbon Capture and Sequestration Market is segmented By Technology (Post-Combustion Capture, Pre-Combustion Capture, Oxy-Fuel Combustion Capture), By ....

Carbon Capture and Sequestration Market Size

Market Size in USD Bn

CAGR19.5%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 19.5% |

| Market Concentration | High |

| Major Players | ExxonMobil Corporation, Royal Dutch Shell plc, Mitsubishi Heavy Industries, Ltd., General Electric Company, Siemens Energy AG and Among Others. |

please let us know !

Carbon Capture and Sequestration Market Analysis

The carbon capture and sequestration market is estimated to be valued at USD 3.25 Bn in 2024 and is expected to reach USD 11.3 Bn by 2031, growing at a compound annual growth rate (CAGR) of 19.5% from 2024 to 2031. The carbon capture and sequestration market is expected to grow significantly with growing impetus on reducing greenhouse gas emissions and carbon footprints globally.

Carbon Capture and Sequestration Market Trends

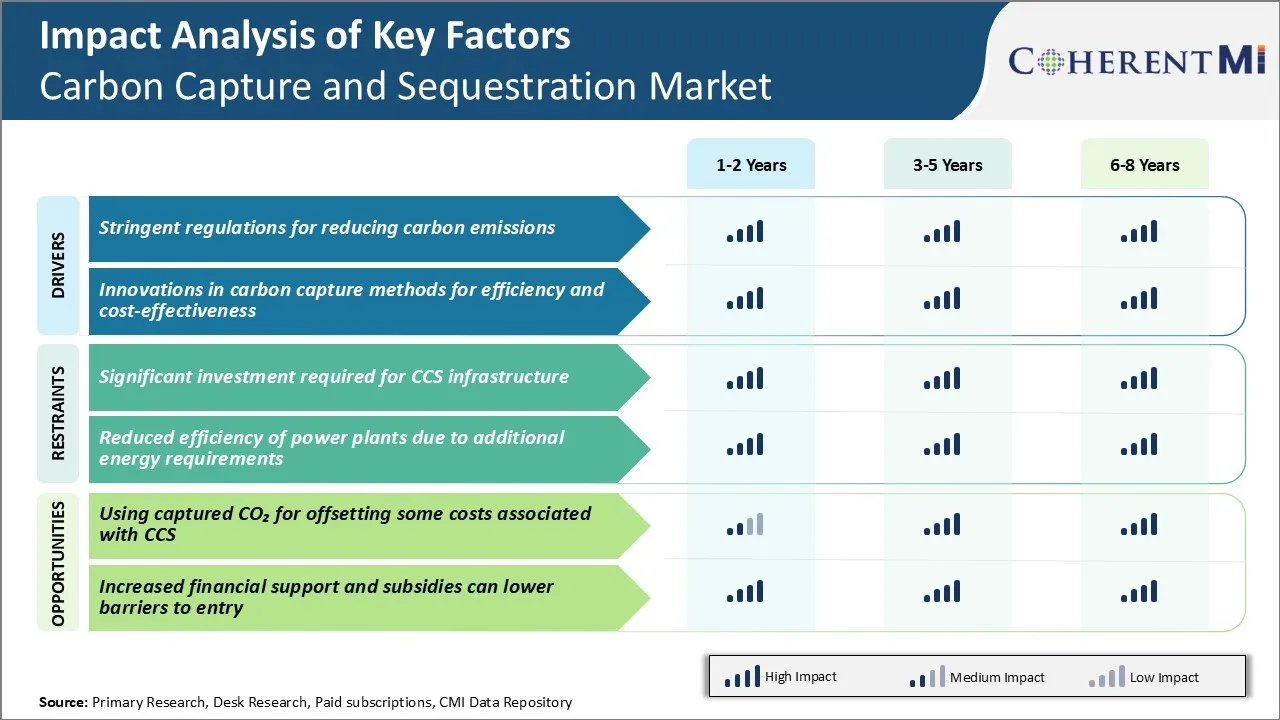

Market Driver - Stringent Regulations for Reducing Carbon Emissions

Power generation has been a major focus area due to high dependency on fossil fuels. Countries like China, India, and many European nations have announced plans to be carbon neutral in coming decades. This has put pressure on power companies to explore low carbon alternatives and technologies to meet the new emission standards.

Manufacturing is another sector seeing increased regulatory scrutiny over emissions. Recent studies have indicated industrial operations contribute over 20% of global carbon emissions. Cement, steel, and chemical factories are exploring use of carbon capture and sequestration to meet new emission caps.

This regulatory driver is one of the key factors prompting organizations to seek carbon capture and sequestration solutions for curbing emissions effectively from their operations.

Market Driver - Innovations in Carbon Capture Methods for Efficiency and Cost-effectiveness

Carbon capture and sequestration faces economic challenge of additional capital and operating costs involved for implementation on power plants or industrial facilities. This has limited wider commercial deployment so far. However, growing R&D in the field is helping address the cost issues through technology innovations that can improve efficiency and reduce costs associated with carbon capture and sequestration systems.

Major efforts are being made to enhance post combustion and pre combustion capture systems which are more suitable for retrofitting on existing plants. New solvents with nearly 30% improvement in capture rates compared to earlier versions are in testing stages. Membrane based separation techniques offer promise of lower energy requirement which can lower operating expenses significantly.

Novel sorbent materials able to capture carbon at lower temperatures further boost efficiency. Similarly, developments in cryogenic and chemical looping technologies aim to achieve carbon capture at costs approaching that of conventional processes without carbon capture and sequestration in long term.

Market Challenge - Significant Investment Required for CCS Infrastructure

One of the major challenges facing the growth of the carbon capture and sequestration market is the significant upfront investment required to build the necessary infrastructure. Developing the pipelines, storage facilities, and other infrastructure components requires massive capital outlays.

According to industry estimates, a large-scale integrated carbon capture and sequestration project capturing emissions from a coal-fired power plant could cost over $1 billion. The high costs associated with building new carbon capture and sequestration infrastructure deters many businesses and utilities.

The significant capital expenditures still pose challenges for widespread commercial deployment of carbon capture and sequestration. Wider adoption of carbon capture and sequestration will depend on lowering costs through technological advances, economies of scale with increased deployment, and more government and private sector financing support for building the necessary infrastructure networks.

Market Opportunity - Using Captured CO2 for Offsetting Some Costs Associated with Carbon Capture and Sequestration

One opportunity for reducing the costs challenges facing the carbon capture and sequestration market is utilizing the captured carbon dioxide for purposes that can offset expenses. CO2 gathered through capture processes retains value and can be sold for applications such as enhanced oil recovery (EOR).

By selling the captured CO2 to oil producers, carbon capture and sequestration project developers are able to generate revenue that helps defray the expenses of building transportation and sequestration infrastructure. As EOR demands grow along with the need to curb emissions, the carbon capture and sequestration market shows potential to scale up over time.

Additional offsetting opportunities may emerge through innovations in converting CO2 into useful products and materials. This would strengthen the business case in carbon capture and sequestration market by generating recurring revenue streams from stored carbon.

Key winning strategies adopted by key players of Carbon Capture and Sequestration Market

Strategic Partnerships and Collaborations: An important strategy adopted by major players in carbon capture and sequestration market is entering into strategic partnerships with other industry players. Such partnerships help companies gain access to new markets, technical expertise, and share risks, and costs of developing carbon capture and sequestration technologies.

Business Expansions: Leading players in carbon capture and sequestration market have expanded their carbon capture business globally through mergers and acquisitions as well as organically. In 2021, Schlumberger acquired Condor Energy Services to grow its production chemical business focused on improved oil recovery using carbon capture and sequestration.

Focus on Innovation: Tenaska's efforts since 2000 in innovation led to its Sierra Energy Project coming online in 2021 as one of the largest carbon capture facilities in the US.

Public-Private Partnerships: Canada's Boundary Dam Carbon Capture and Sequestration Project operated by SaskPower received $240 million from the provincial government, giving it a cost advantage. Similarly, the Department of Energy in the US has selectively provided funding support to large-scale carbon capture and sequestration projects under the 45Q tax credit program.

Segmental Analysis of Carbon Capture and Sequestration Market

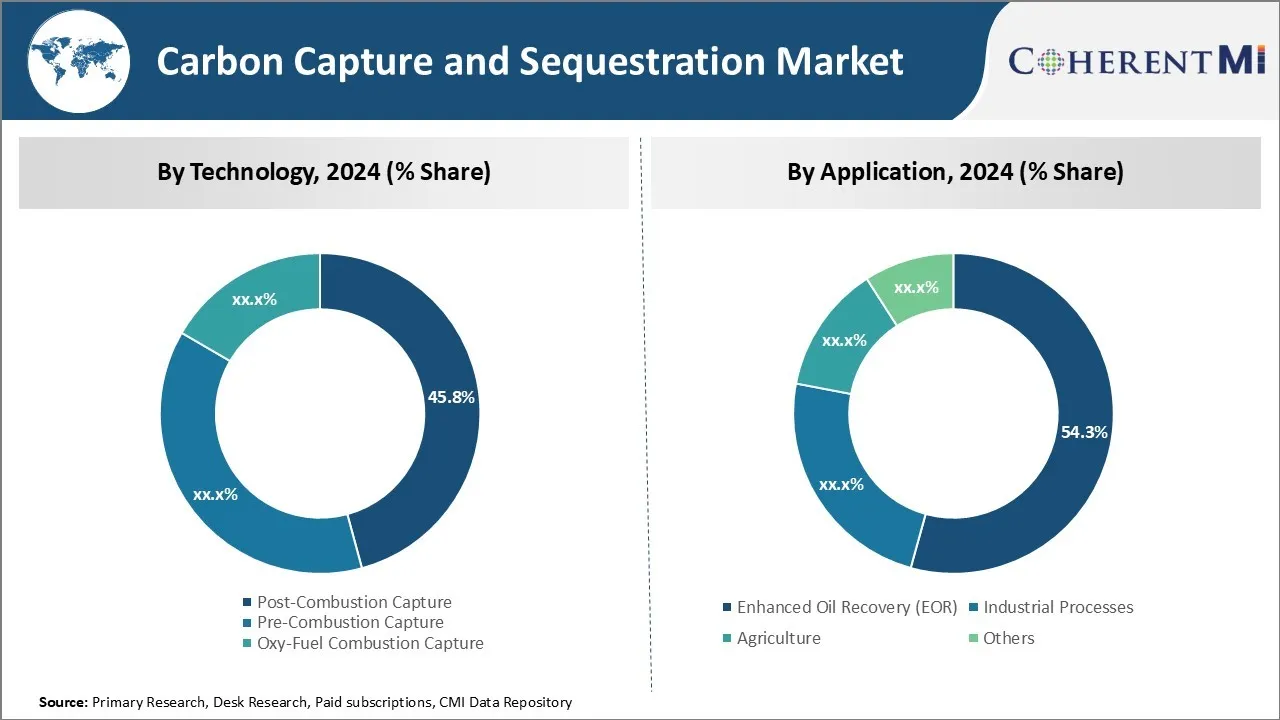

Insights, By Technology: Rise of Cost-effective Carbon Capture Technologies Favors Post-Combustion Capture

In terms of technology, post-combustion capture contributes 45.8% share of the carbon capture and sequestration market in 2024. This is due to the continuous technological advancement in post-combustion capture systems. Post-combustion capture technology has attracted significant interest from industries as it can be easily retrofitted with the existing fossil fuel-based power plants and industrial facilities. Some of the factors driving the growth of post-combustion carbon capture segment in carbon capture and sequestration market include the introduction of new solvent-based solutions.

Further, adoption of membrane-based carbon capture technologies is also gaining prominence due to benefits like reduced footprint, energy requirements, and ease of operation. Ongoing research and development activities aimed at improving the efficiency and reducing the costs through innovations are expected to accelerate carbon capture and sequestration market.

Insights, By Application: Higher CO2 Storage Capacities Fuels EOR Driven Adoption

In terms of application, enhanced oil recovery (EOR) contributes 54.3% share of the carbon capture and sequestration market. EOR has emerged as one of the most viable options for long-term CO2 storage and reuse due to rising demand for oil and declining reserves from conventional oil fields.

EOR involves injection of supercritical CO2 into depleting or depleted oil fields to extract additional oil left behind that cannot be produced through conventional production methods. It offers a win-win solution by not only sequestering CO2 safely in underground geological formations but also generating revenues from incremental oil produced.

Infrastructure already in place for EOR like pipelines, injection wells provides lower capital and operating expenditures for early CCUS projects. Stringent emission regulations and financial incentives are compelling oil producers to adopt carbon capture to meet GHG goals and benefit from higher crude oil recovery rates through EOR activities.

Insights, By End-use Industry: Regulatory Push Drives Adoption in Oil & Gas Sector

In terms of end-use industry, oil and gas contributes the highest share of the carbon capture and sequestration market. Within the oil & gas sector, the upstream segment accounts for a major chunk of demand. This is primarily attributed to stringent emission compliance for oil and gas facilities across various regions worldwide. Mandates like the 45Q US federal tax credit and upcoming performance standards for new/modified oil & gas sources under EPA are major driving factors.

Oil and gas companies are actively pursuing CCUS to reduce the carbon footprint of production facilities and ensure regulatory compliance in the long run. Favorable policies are also encouraging EOR deployment through carbon capture to boost fuel extraction from mature oil fields.

Additionally, growing focus on decarbonizing natural gas value chain and making Gas-to-Liquids/Gas-to-Chemicals processes cleaner further aids adoption. Partnerships with CCUS technology providers and research funding paves way for commercialization in carbon capture and sequestration market.

Additional Insights of Carbon Capture and Sequestration Market

- The Norwegian Government's investment in the Northern Lights project, Europe's first full-scale carbon capture and sequestration operation, signifies a substantial commitment to reducing carbon emissions and sets a precedent for other nations.

- TotalEnergies SE implemented carbon capture and sequestration technology in its gas processing plant in Lacq, France, successfully reducing emissions by capturing and storing 100,000 tons of CO₂ annually.

- According to the International Energy Agency (IEA), carbon capture and sequestration could mitigate up to 19% of global CO₂ emissions by 2050, highlighting its critical role in achieving climate goals.

- The deployment of carbon capture and sequestration technology could protect up to 40 million jobs in industries that are difficult to decarbonize, such as cement and steel manufacturing.

Competitive overview of Carbon Capture and Sequestration Market

The major players operating in the carbon capture and sequestration market include ExxonMobil Corporation, Royal Dutch Shell plc, Mitsubishi Heavy Industries, Ltd., General Electric Company, Siemens Energy AG, Honeywell International Inc., Schlumberger Limited, Linde plc, TotalEnergies SE, Equinor ASA, Fluor Corporation, Linde AG, and Shell CANSOLV.

Carbon Capture and Sequestration Market Leaders

- ExxonMobil Corporation

- Royal Dutch Shell plc

- Mitsubishi Heavy Industries, Ltd.

- General Electric Company

- Siemens Energy AG

Carbon Capture and Sequestration Market - Competitive Rivalry, 2024

Carbon Capture and Sequestration Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Carbon Capture and Sequestration Market

- In June 2024, a joint venture between SLB and Aker Carbon Capture (ACC) aims to deploy carbon capture and sequestration technologies for power and industrial sectors. This partnership facilitates rapid adoption of carbon capture and sequestration for industrial decarbonization.

- In September 2023, Mitsubishi Heavy Industries, Ltd. partnered with Equinor ASA to develop a next-generation carbon capture and sequestration system in Norway. The collaboration aims to create a more efficient capture technology that reduces energy consumption by 20%, potentially lowering operational costs and encouraging broader adoption across industries.

- In June 2023, Royal Dutch Shell plc launched its Quest Carbon Capture and Storage project in Alberta, Canada. The facility successfully captured and stored over 5 million tons of CO₂ since its inception, demonstrating the viability of large-scale carbon capture and sequestration projects. This advancement enhances Shell's commitment to achieving net-zero emissions by 2050.

- In March 2023, ExxonMobil Corporation announced the expansion of its carbon capture and sequestration facilities in the Gulf Coast region. The company plans to invest over USD 3 billion to increase its carbon capture capacity by 50 million metric tons per year by 2030. This development positions ExxonMobil as a leader in carbon capture and sequestration technology and is expected to significantly reduce industrial CO₂ emissions in the area.

Carbon Capture and Sequestration Market Segmentation

- By Technology

- Post-Combustion Capture

- Pre-Combustion Capture

- Oxy-Fuel Combustion Capture

- By Application

- Enhanced Oil Recovery (EOR)

- Industrial Processes

- Agriculture

- Others

- By End-use Industry

- Oil and Gas

- Upstream

- Downstream

- Power Generation

- Coal-Fired Plants

- Natural Gas Plants

- Chemicals and Petrochemicals

- Petrochemical Plants

- Chemical Manufacturing

- Iron and Steel

- Blast Furnace Operations

- Direct Reduction Iron Plants

- Cement

- Clinker Production

- Kiln Operations

- Others

- Pulp and Paper

- Textile Industry

- Oil and Gas

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the carbon capture and sequestration market?

The carbon capture and sequestration market is estimated to be valued at USD 3.25 Bn in 2024 and is expected to reach USD 11.3 Bn by 2031.

What are the key factors hampering the growth of the carbon capture and sequestration market?

Significant investment required for infrastructure and reduced efficiency of power plants due to additional energy requirements are the major factors hampering the growth of the carbon capture and sequestration market.

What are the major factors driving the carbon capture and sequestration market growth?

Stringent regulations for reducing carbon emissions and innovations in carbon capture methods for efficiency and cost-effectiveness are the major factors driving the carbon capture and sequestration market.

Which is the leading technology in the carbon capture and sequestration market?

The leading technology segment is post-combustion capture.

Which are the major players operating in the carbon capture and sequestration market?

ExxonMobil Corporation, Royal Dutch Shell plc, Mitsubishi Heavy Industries, Ltd., General Electric Company, Siemens Energy AG, Honeywell International Inc., Schlumberger Limited, Linde plc, TotalEnergies SE, Equinor ASA, Fluor Corporation, Linde AG, Shell CANSOLV are the major players.

What will be the CAGR of the carbon capture and sequestration market?

The CAGR of the carbon capture and sequestration market is projected to be 19.5% from 2024-2031.