Alkaline Battery Market Size - Analysis

Market Size in USD Bn

CAGR5.5%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 5.5% |

| Market Concentration | High |

| Major Players | Duracell Inc., Energizer Holdings, Gold Peak Industries Limited, Camelion Batterien GmbH, Panasonic Corporation and Among Others |

please let us know !

Alkaline Battery Market Trends

Households today, own more gadgets and devices than ever before which require consistent power source to function. Alkaline batteries have emerged as one of the most convenient options to power array of products ranging from remote controls, toys, flashlight, keyboards etc. Rising affordability of electronics has put alkaline batteries in greater spotlight.

Looking at surging local demand, manufacturers in the alkaline battery market have augmented both capacity and distribution network across tier-2 and tier-3 towns. Where previously consumers had to depend on nearby cities for regular battery replenishment, extended retail footprint has provided ease, and convenience.

Continuous R&D by battery manufacturers have enabled remarkable technology leap over last decade. Recent innovations in advancing electrolytes, enhancing energy density, and implementing nano-coating are distinctly improving performance of alkaline batteries. New optimized formulations now provide longer run-times of up to 50% compared to conventional variants. This directly enhances overall value proposition for consumers.

Collaborations with scientific institutions are continuously advancing electrochemical reactions inside battery case. Customized product variants targeted at specific appliance categories will optimize performance-cost balance. This is expected to drive growth for the alkaline battery market in the coming years.

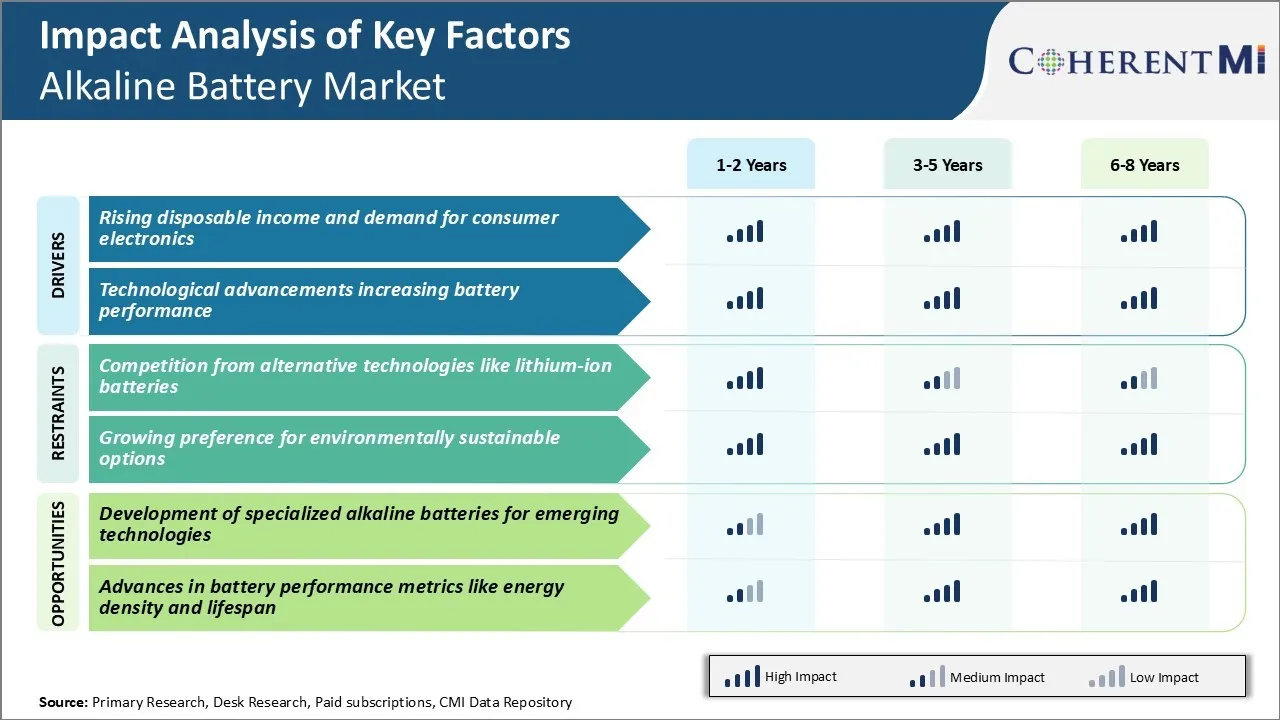

One of the major challenges faced by the alkaline battery market is the rising competition from alternative battery technologies like lithium-ion batteries. Lithium-ion batteries have significantly higher energy density compared to alkaline batteries, which allows devices to operate longer on a single charge. This makes lithium batteries an attractive proposition for many common applications that currently use alkaline batteries such as smartphones, tablets, cameras etc.

Moreover, lithium batteries can be recharged hundreds of times during its lifespan, while alkaline batteries are single-use in nature. All these factors have started to negatively impact the growth of the alkaline battery market in recent years.

Market Opportunity - Development of Specialized Alkaline Batteries for Emerging Technologies

Alkaline battery’s versatility in chemical composition gives manufacturers an advantage to formulate new variants of alkaline batteries that can address the demanding power needs of novel technologies. Successful development of such application-specific alkaline batteries can help players gain a first-mover advantage in the evolving markets. It can also help alkaline batteries sustain their relevance against alternatives as new sectors expand in the coming years.

Key winning strategies adopted by key players of Alkaline Battery Market

One of the most successful strategies adopted by Duracell, a leader in the alkaline battery market, was new product development and innovation. In 2010, Duracell launched Coppertop batteries which provided 25% longer lasting power compared to traditional alkaline batteries.

Moreover, private label players like Rayovac adopted a strategy of competitive pricing without compromising on quality. For example, in 2018, Rayovac launched a range of alkaline batteries at 10-15% lower prices than Duracell and Energizer. Within a year, Rayovac captured 10% more market share in the US and Europe.

Segmental Analysis of Alkaline Battery Market

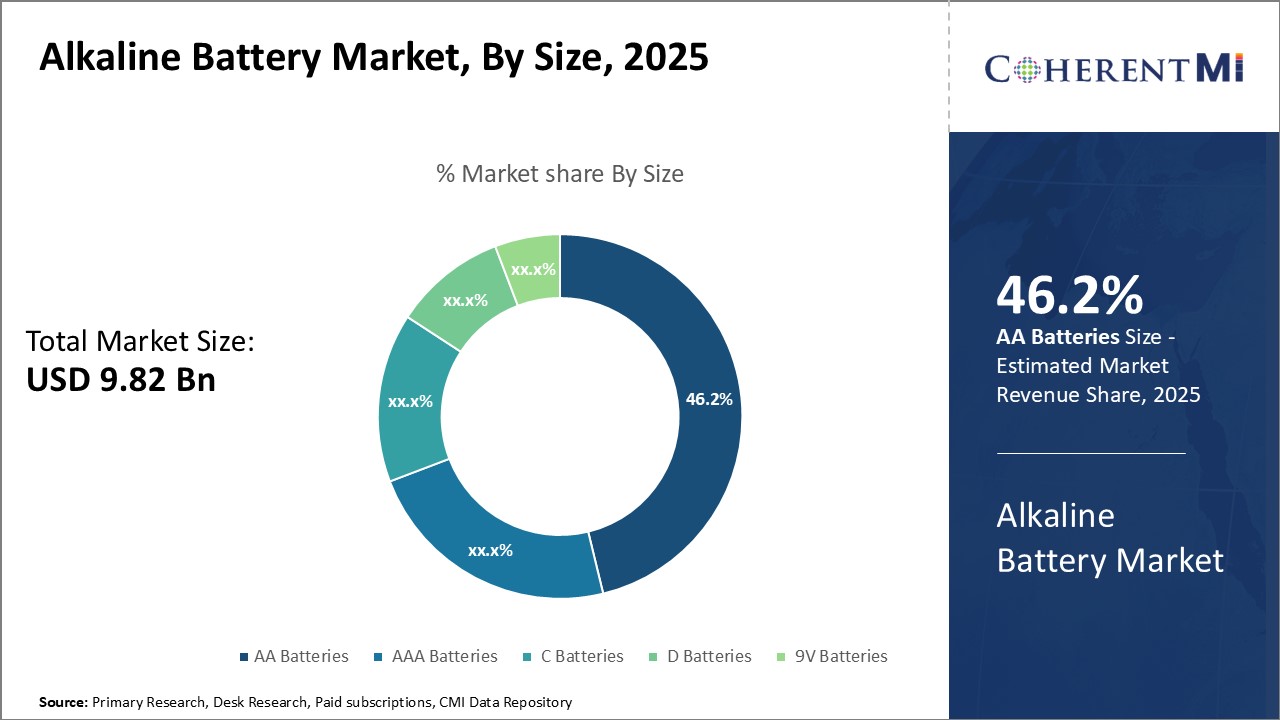

Insights, By Size: AA Batteries Show Wide Applicability and Demand

AA batteries have the right balance of capacity and size that meet the power needs of many common consumer products. Their cylindrical shape with moderate capacity fits well in the battery slots of a wide range of household and portable devices. The widespread adoption of AA batteries in both consumer and commercial segments has made them a volume driver for the overall alkaline battery market. Device manufacturers prefer to use AA batteries knowing well their market dominance and readily available replacement options.

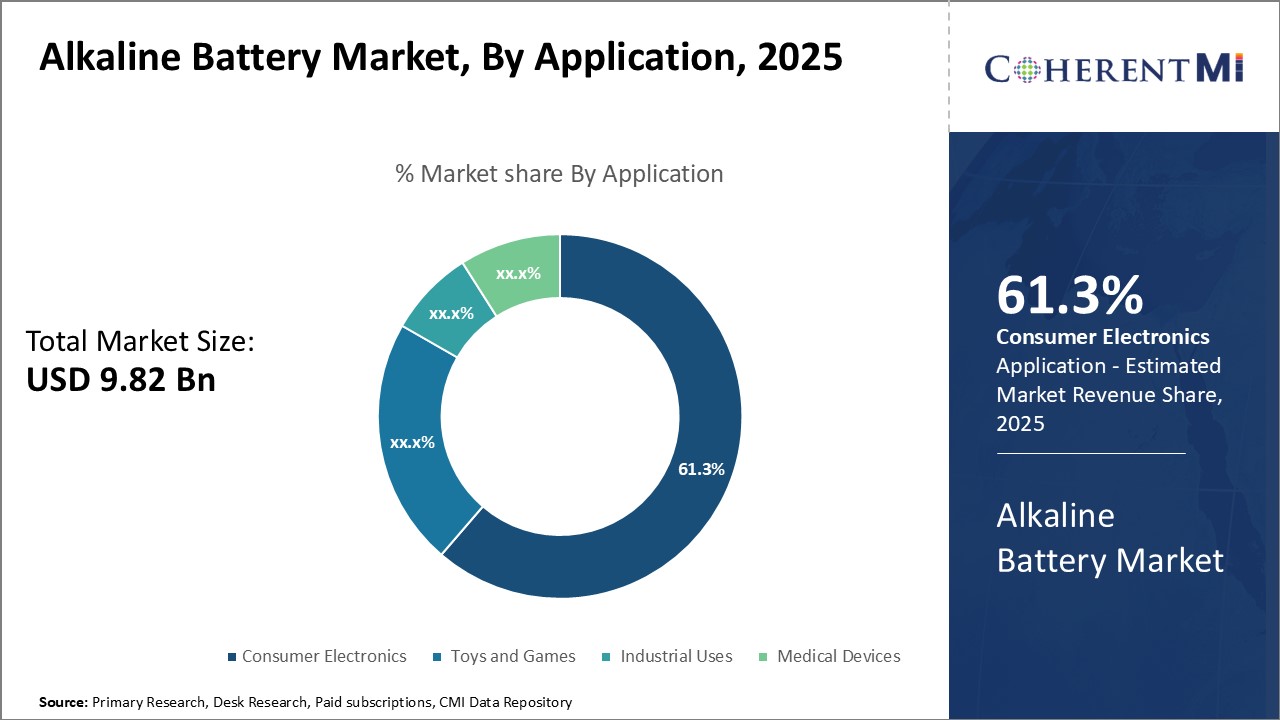

Insights, By Application: Consumer Electronics Witness Growing Device Usage

Insights, By Application: Consumer Electronics Witness Growing Device Usage

Young consumers fuel the demand with new gaming, wearable and interactive toys hitting the alkaline battery market regularly. Even developing regions are witnessing higher disposable income and living standards, increasing device affordability and battery sales.

Additional Insights of Alkaline Battery Market

- North America, with a 46% share in alkaline battery market, leads due to consumer electronics advancements and high technological adoption. The U.S. alkaline battery market is forecasted to grow from USD 3.05 billion in 2023 to USD 5.01 billion by 2033, at a CAGR of 5.09%.

- AA batteries dominated the alkaline battery market due to their versatile applications and cost-effectiveness.

- Asia Pacific emerged as a manufacturing hub for alkaline battery-powered devices, driven by urbanization and technological adoption.

- Consumer Preferences: There's a noticeable trend towards purchasing bulk packs of alkaline batteries, indicating consumer demand for cost-effective solutions for their battery needs.

- Increased Adoption in Medical Devices: There's a growing reliance on alkaline batteries for portable medical equipment like blood pressure monitors and glucose meters, driven by the need for reliable and long-lasting power sources in healthcare.

Competitive overview of Alkaline Battery Market

The major players operating in the alkaline battery market include Duracell Inc., Energizer Holdings, Gold Peak Industries Limited, Camelion Batterien GmbH, Panasonic Corporation, Maxell Holdings Limited, Toshiba International Limited, Sony Group Corporation, FDK Corporation, GBP International Limited, and Rayovac Corporation.

Alkaline Battery Market Leaders

- Duracell Inc.

- Energizer Holdings

- Gold Peak Industries Limited

- Camelion Batterien GmbH

- Panasonic Corporation

Alkaline Battery Market - Competitive Rivalry

Alkaline Battery Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Alkaline Battery Market

- In February 2024, Xiaomi patented anti-peep wearable devices for hidden camera detection, impacting the tech-driven battery demand.

- In January 2024, Launch of UDropMore by Rishi Tandan, revolutionizing digital shopping and driving battery usage for connected devices.

- In September 2023, Energizer Holdings, Inc.: Energizer announced a partnership with a leading recycling company to introduce a battery recycling program. This initiative addresses environmental concerns and positions Energizer as a responsible and sustainable brand, potentially attracting eco-conscious consumers.

- In June 2023, Duracell launched its new Quantum line of alkaline batteries, featuring Hi-Density Core technology for longer-lasting power. This development strengthens Duracell's market position by catering to high-drain devices, enhancing consumer satisfaction and brand loyalty.

Alkaline Battery Market Segmentation

- By Size

- AA Batteries

- AAA Batteries

- C Batteries

- D Batteries

- 9V Batteries

- By Application

- Consumer Electronics

- Toys and Games

- Industrial Uses

- Medical Devices

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

Frequently Asked Questions :

How big is the alkaline battery market?

The alkaline battery market is estimated to be valued at USD 9.82 Bn in 2025 and is expected to reach USD 14.28 Bn by 2032.

What are the key factors hampering the growth of the alkaline battery market?

Competition from alternative technologies like lithium-ion batteries and growing preference for environmentally sustainable options are the major factors hampering the growth of the alkaline battery market.

What are the major factors driving the alkaline battery market growth?

Rising demand for consumer electronics and technological advancements increasing battery performance are the major factors driving the alkaline battery market.

Which is the leading size in the alkaline battery market?

The leading size segment is AA batteries.

Which are the major players operating in the alkaline battery market?

Duracell Inc., Energizer Holdings, Gold Peak Industries Limited, Camelion Batterien GmbH, Panasonic Corporation, Maxell Holdings Limited, Toshiba International Limited, Sony Group Corporation, FDK Corporation, GBP International Limited, Rayovac Corporation are the major players.

What will be the CAGR of the alkaline battery market?

The CAGR of the alkaline battery market is projected to be 5.5% from 2025-2032.