Shore Power Market Size - Analysis

The shore power market is estimated to be valued at USD 2.49 Bn in 2025 and is expected to reach USD 5.04 Bn by 2032. It is projected to grow at a compound annual growth rate (CAGR) of 10.6% from 2025 to 2032. The trend underway in the shore power market is increasingly sophisticated and automated systems that make ship-to-shore power transfer simpler and easier for both port authorities and vessel crews.

The shore power market is estimated to be valued at USD 2.49 Bn in 2025 and is expected to reach USD 5.04 Bn by 2032.

It is projected to grow at a compound annual growth rate (CAGR) of 10.6% from 2025 to 2032.

The trend underway in the shore power market is increasingly sophisticated and automated systems that make ship-to-shore power transfer simpler and easier for both port authorities and vessel crews.

Market Size in USD Bn

CAGR10.6%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 10.6% |

| Market Concentration | Medium |

| Major Players | General Electric, Siemens AG, Schneider Electric SE, ABB Ltd., Eaton Corporation plc and Among Others |

please let us know !

Shore Power Market Trends

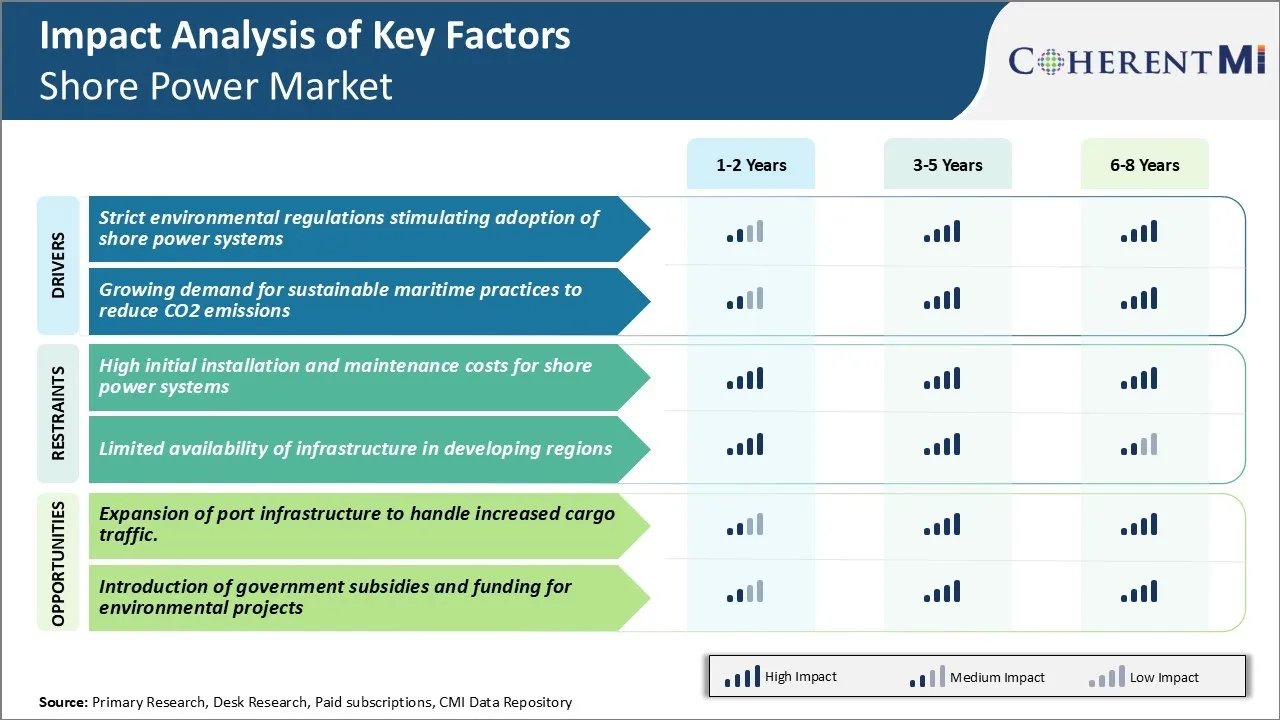

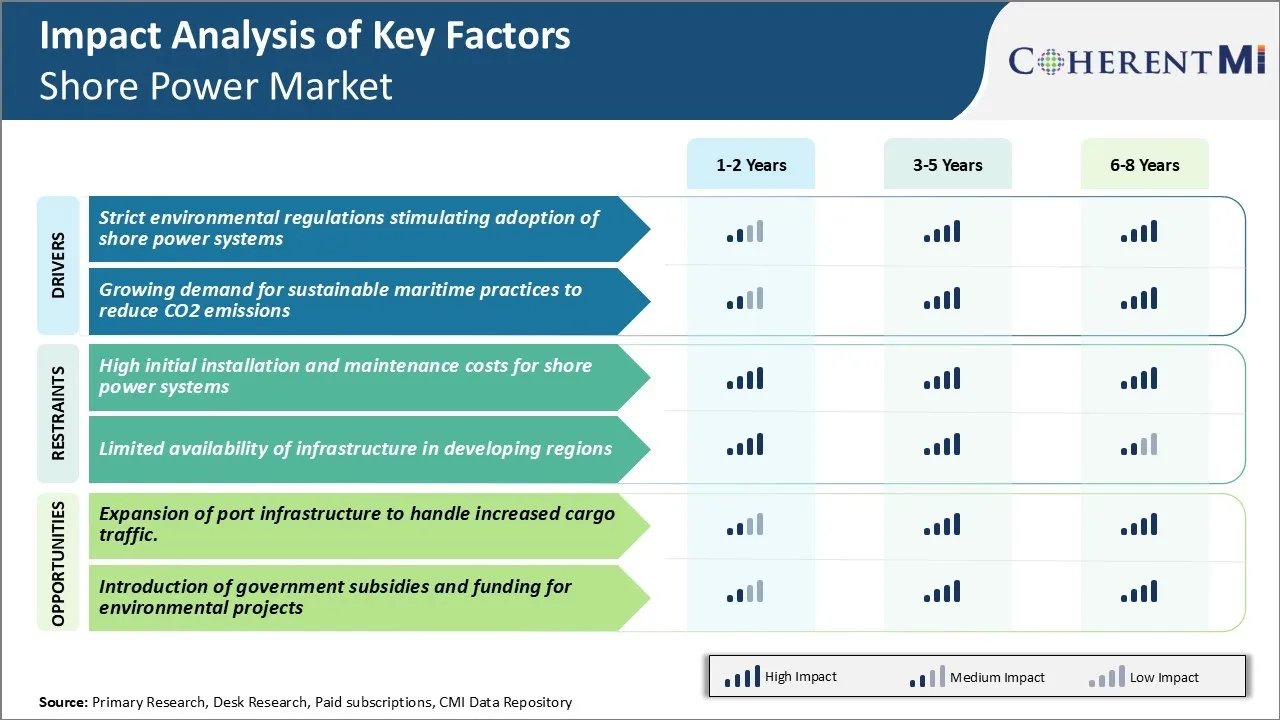

Market Driver - Strict Environmental Regulations Stimulating Adoption of Shore Power Systems

Focus on reducing emissions and promoting sustainable practices has increased. Consequently, various maritime authorities across the globe have introduced stringent regulations regarding air pollutants released by ships during their berthing periods. Particularly, emissions of NOx, Sox, and particulate matter have come under intense scrutiny due to their adverse health impacts. This influences important trends in the shore power market.

Ports are also investing in upgrades to provide sufficient power capacities and install distribution networks within terminal areas. Technology vendors are leveraging the growing demand to develop advanced shore power management systems and components specially designed for maritime applications. The International Maritime Organization has played a pivotal role in setting emissions standards that numerous countries have aligned their domestic policies with.

Overall, the tightening environmental mandates at major ports present a compelling argument for shippers and port operators to strongly consider shore power systems, especially for vessels making regular visits. The regulations have almost certainly accelerated market expansion over the past decade despite the high initial costs involved.

Market Driver - Growing Demand for Sustainable Maritime Practices to Reduce CO2 Emissions

With climate change emerging as the most pressing issue of our times, global commitments to reduce carbon footprints across all industries have heightened considerably. It is estimated that ships account for nearly 3% of the total annual carbon dioxide released worldwide. This has spurred a concerted push from leading organizations, charterers, and environmental groups towards decarbonizing maritime logistics operations.

Adopting shore power while at berth is one of the strategies gaining widespread acceptability within the shipping community looking to demonstrate meaningful progress on sustainability. Use of land-based electric grids eliminates the need to run auxiliary diesel engines and boilers during port stays. This has brought increasing commercial advantages for shore power market players in the form of favorable PR and marketing mileage emphasizing their green credentials.

Forward thinking owners are retrofitting new buildings and existing tonnage with shore power compatibility to gain competitive differentiators. All these factors indicate a structural long-term increase in shore power installations propelled by the worldwide decarbonization drive within the shore power market.

Market Challenge - High Initial Installation and Maintenance Costs for Shore Power Systems

One of the major challenges facing the shore power market is the high upfront costs associated with installing shore power systems onboard vessels as well as at ports and terminals. Installing the necessary transformers and switch gear to facilitate the transfer of shore power from land to ship can cost millions of US dollars.

Similarly, ports are required to invest in high voltage electrical infrastructure right at the berths to deliver shore-side power. The payback period for such investments tend to be longer given current utilization rates remain low. Further, maintaining such specialized electrical systems involves additional operating expenses for facilities.

The costs are discouraging some ship owners and port authorities from making investments in shore power unless incentivized through regulatory measures or financial subsidies. This high barrier to entry can potentially slow down the widespread adoption of shore power globally.

Market Opportunity - Expansion of Port Infrastructure to Handle Increased Cargo Traffic

The continuous growth in global seaborne trade and cargo traffic handled at ports presents a major opportunity for the increased uptake of shore power technology. Most major ports worldwide are expanding and enhancing their infrastructure and facilities to cater to larger vessels calling on their ports. This involves adding greater berthing and cargo handling capacity through investments in new quay walls and yards, installation of more gantry and rubber-tired gantries cranes as well as warehouses and stockyards.

As part of such large infrastructure projects, ports now have an opportunity to 'future proof' their facilities by investing in higher power distribution grids and shore power supply points to enable green port operations. This will allow them to provide shore power as a value-added service to shipping lines and help attract more trans-shipment business to their ports. Over time, these ports can establish themselves as sustainable ports with the capability and reputation to optimize operations through shore power.

Focus on reducing emissions and promoting sustainable practices has increased.

Consequently, various maritime authorities across the globe have introduced stringent regulations regarding air pollutants released by ships during their berthing periods.

Particularly, emissions of NOx, Sox, and particulate matter have come under intense scrutiny due to their adverse health impacts.

This influences important trends in the shore power market.

Ports are also investing in upgrades to provide sufficient power capacities and install distribution networks within terminal areas.

Technology vendors are leveraging the growing demand to develop advanced shore power management systems and components specially designed for maritime applications.

The International Maritime Organization has played a pivotal role in setting emissions standards that numerous countries have aligned their domestic policies with.

Overall, the tightening environmental mandates at major ports present a compelling argument for shippers and port operators to strongly consider shore power systems, especially for vessels making regular visits.

The regulations have almost certainly accelerated market expansion over the past decade despite the high initial costs involved.

With climate change emerging as the most pressing issue of our times, global commitments to reduce carbon footprints across all industries have heightened considerably.

It is estimated that ships account for nearly 3% of the total annual carbon dioxide released worldwide.

This has spurred a concerted push from leading organizations, charterers, and environmental groups towards decarbonizing maritime logistics operations.

Adopting shore power while at berth is one of the strategies gaining widespread acceptability within the shipping community looking to demonstrate meaningful progress on sustainability.

Use of land-based electric grids eliminates the need to run auxiliary diesel engines and boilers during port stays.

This has brought increasing commercial advantages for shore power market players in the form of favorable PR and marketing mileage emphasizing their green credentials.

Forward thinking owners are retrofitting new buildings and existing tonnage with shore power compatibility to gain competitive differentiators.

All these factors indicate a structural long-term increase in shore power installations propelled by the worldwide decarbonization drive within the shore power market.

One of the major challenges facing the shore power market is the high upfront costs associated with installing shore power systems onboard vessels as well as at ports and terminals.

Installing the necessary transformers and switch gear to facilitate the transfer of shore power from land to ship can cost millions of US dollars.

Similarly, ports are required to invest in high voltage electrical infrastructure right at the berths to deliver shore-side power.

The payback period for such investments tend to be longer given current utilization rates remain low.

Further, maintaining such specialized electrical systems involves additional operating expenses for facilities.

The costs are discouraging some ship owners and port authorities from making investments in shore power unless incentivized through regulatory measures or financial subsidies.

This high barrier to entry can potentially slow down the widespread adoption of shore power globally.

The continuous growth in global seaborne trade and cargo traffic handled at ports presents a major opportunity for the increased uptake of shore power technology.

Most major ports worldwide are expanding and enhancing their infrastructure and facilities to cater to larger vessels calling on their ports.

This involves adding greater berthing and cargo handling capacity through investments in new quay walls and yards, installation of more gantry and rubber-tired gantries cranes as well as warehouses and stockyards.

As part of such large infrastructure projects, ports now have an opportunity to 'future proof' their facilities by investing in higher power distribution grids and shore power supply points to enable green port operations.

This will allow them to provide shore power as a value-added service to shipping lines and help attract more trans-shipment business to their ports.

Over time, these ports can establish themselves as sustainable ports with the capability and reputation to optimize operations through shore power.

Key winning strategies adopted by key players of Shore Power Market

Strategy #1 - Expanding shore power infrastructure:

Siemens adopted this strategy in 2014 when it won contracts to provide shore power systems to multiple ports across Europe and Asia. It helped expand shoreside infrastructure which allowed more vessels to plug into the local grid versus running diesel generators while docked.

Strategy #2 - Offering turnkey shore power solutions:

In 2015, ABB introduced complete turnkey shore power systems to clients which included everything needed from grid connection to installation and commissioning. This one-stop-shop approach removed complexities for ports and made the adoption process seamless.

Strategy #3 - Partnering with port authorities and terminals:

In 2017, Cavotec partnered with major ports in Northern Europe to deploy shore power across ferry and cargo terminals on a large scale through joint-funding models. This public-private partnership approach reduced costs for ports while allowing Cavotec preferential supply rights.

Siemens adopted this strategy in 2014 when it won contracts to provide shore power systems to multiple ports across Europe and Asia.

It helped expand shoreside infrastructure which allowed more vessels to plug into the local grid versus running diesel generators while docked.

In 2015, ABB introduced complete turnkey shore power systems to clients which included everything needed from grid connection to installation and commissioning.

This one-stop-shop approach removed complexities for ports and made the adoption process seamless.

In 2017, Cavotec partnered with major ports in Northern Europe to deploy shore power across ferry and cargo terminals on a large scale through joint-funding models.

This public-private partnership approach reduced costs for ports while allowing Cavotec preferential supply rights.

Segmental Analysis of Shore Power Market

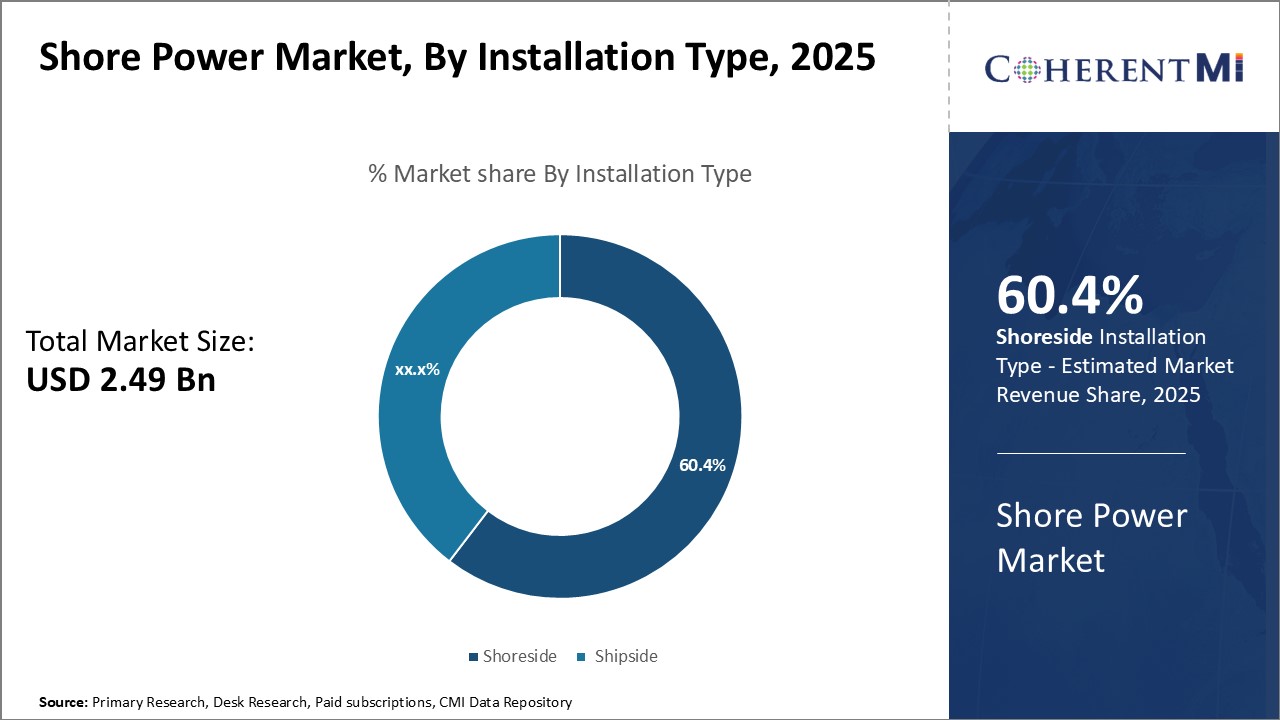

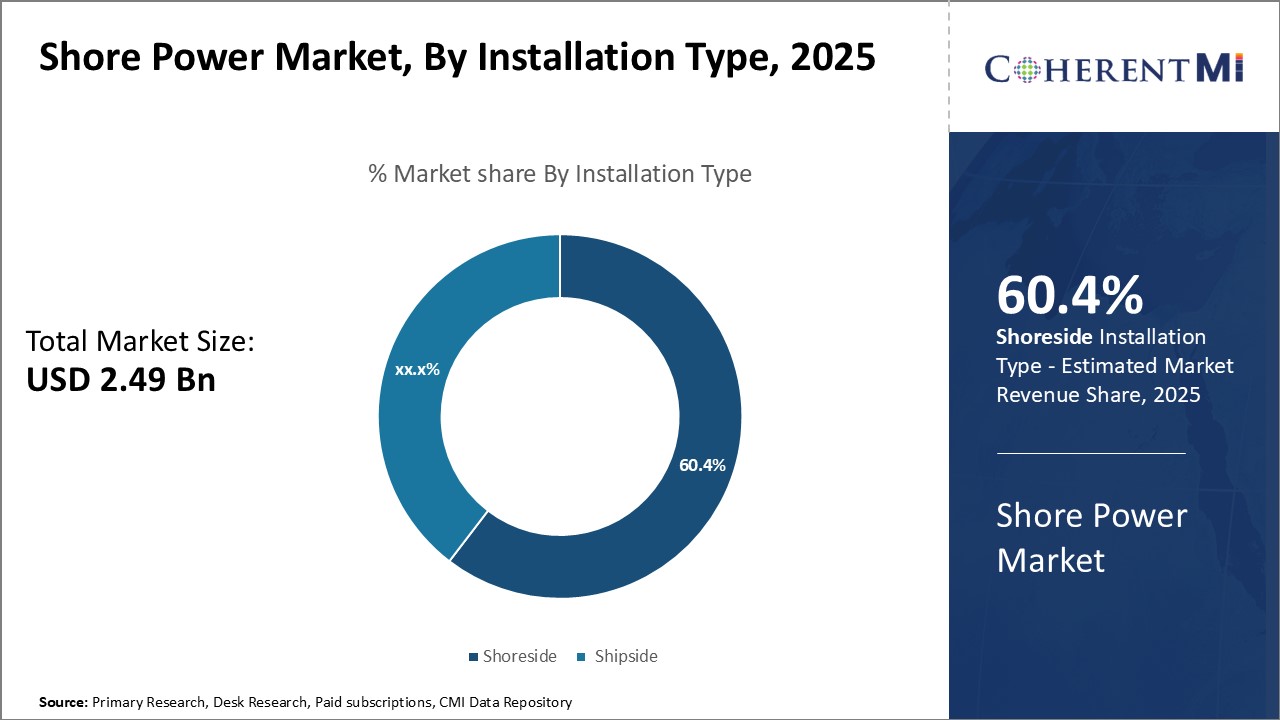

Insights, By Installation Type: Capital Investments Drive Shoreside Segment Growth

In terms of installation type, shoreside contributes 60.4% share of the shore power market in 2025. This is due to the substantial capital investments required to install shore power infrastructure. Shoreside infrastructure allows vessels to shut down diesel engines and plug into electric power supplied from the shore. This reduces emissions and noise pollution during port stays.

Developing robust shoreside systems necessitates large investments in high voltage transformers, switchgear, distribution networks, and cables on the dock. Major ports have been allocating sizable capital to upgrade shoreside facilities to support growing shore power adoption. For example, the Port of Los Angeles invested over $50 million to enable shore power use at two major terminals. These activities encourage more vessel operators to outfit their fleets with compatible onboard shore power systems.

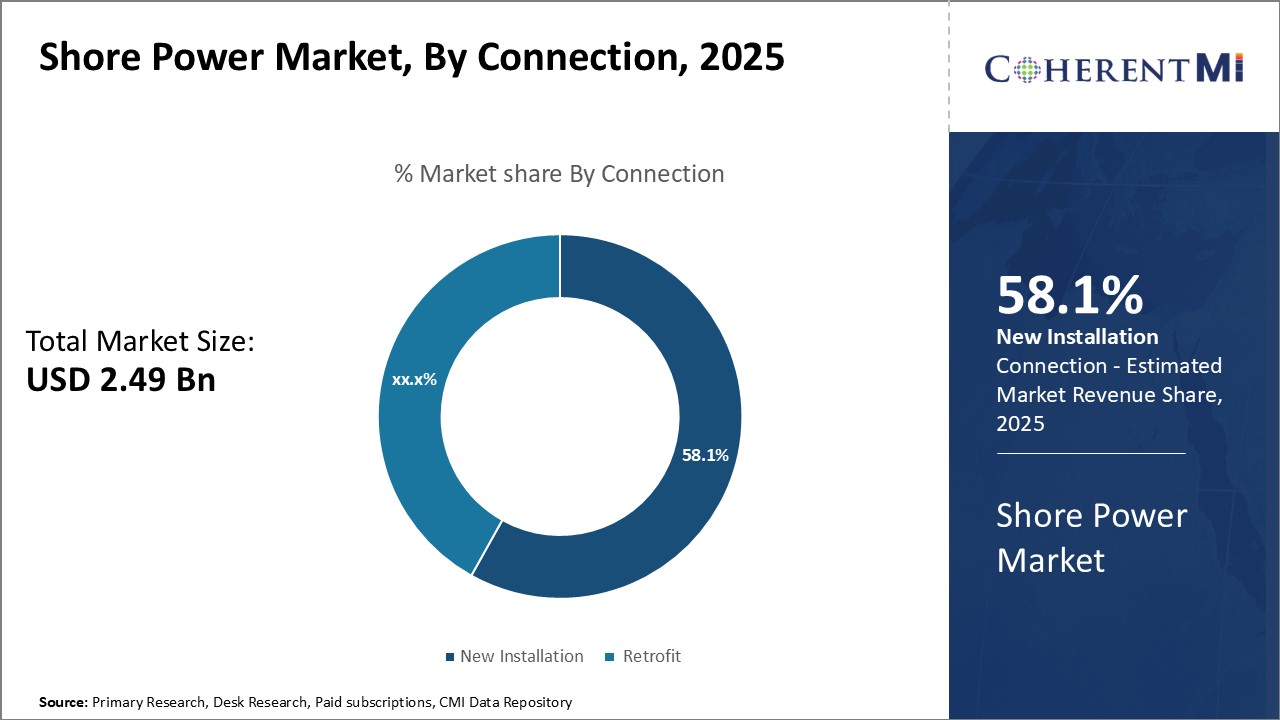

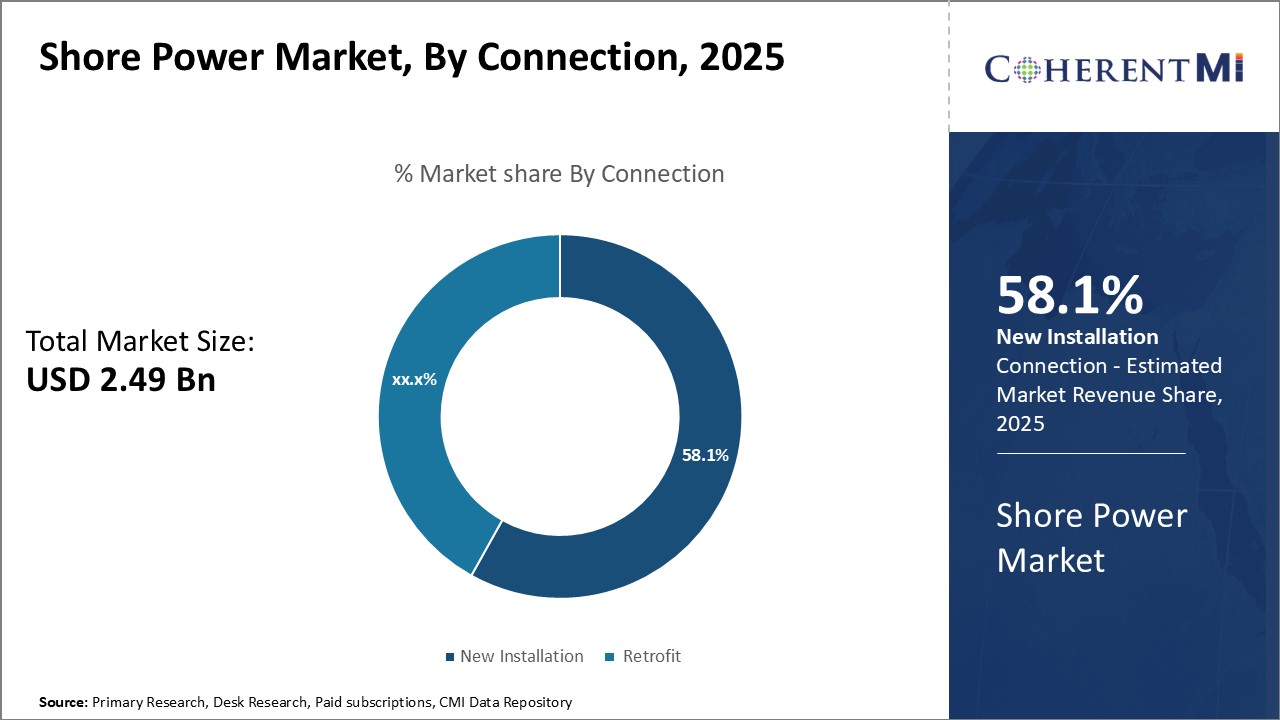

Insights, By Connection: New Environmental Regulations Spur New Installation Segment

Insights, By Connection: New Environmental Regulations Spur New Installation Segment

In terms of connection, new installation contributes 58.1% share of the shore power market in 2025. Tighter environmental regulations are a key driver for this segment in shore power market. Many countries and states have enacted laws mandating shore power for certain vessel categories and sizes during berthing. This is aimed at improving local air quality around ports. To comply with these new regulations, maritime stakeholders have to invest in shore power systems for the first time, benefiting the new installation segment.

Japan, for example, made shore power usage compulsory for cruise ships and container vessels over a certain tonnage. Similarly, California regulations will require shore power for container ships and refrigerated cargo vessels. This regulatory push is set to substantially grow the demand for new, compliant shore power installations worldwide.

Insights, By Component: Advancing Network Capabilities Spur Transformer Segment Dominance

In terms of component, transformers contributes the highest share of the shore power market. Developments that allow for more advanced shore power network capabilities are driving growth for this segment in the shore power market. Transformers play an important role in matching vessel and shore voltages seamlessly. Newer generation transformers facilitate higher power transfer needed for megawatt size vessels. They also allow bi-directional power flow to aid grid services from vessel batteries.

Ongoing research on areas like grid-scale energy storage leverages shore power network interfaces. This offers opportunities to transform ports into testbeds for innovative smart grid technologies. The technological leaps in turn increase requirements for capable, high-spec transformers to tap their full potential. The need to keep upgrading shoreside network infrastructure thus sustains transformer segment growth in the shore power market.

In terms of installation type, shoreside contributes 60.4% share of the shore power market in 2025.

This is due to the substantial capital investments required to install shore power infrastructure.

Shoreside infrastructure allows vessels to shut down diesel engines and plug into electric power supplied from the shore.

This reduces emissions and noise pollution during port stays.

Developing robust shoreside systems necessitates large investments in high voltage transformers, switchgear, distribution networks, and cables on the dock.

Major ports have been allocating sizable capital to upgrade shoreside facilities to support growing shore power adoption.

For example, the Port of Los Angeles invested over $50 million to enable shore power use at two major terminals.

These activities encourage more vessel operators to outfit their fleets with compatible onboard shore power systems.

Insights, By Connection: New Environmental Regulations Spur New Installation Segment

Insights, By Connection: New Environmental Regulations Spur New Installation SegmentIn terms of connection, new installation contributes 58.1% share of the shore power market in 2025.

Tighter environmental regulations are a key driver for this segment in shore power market.

Many countries and states have enacted laws mandating shore power for certain vessel categories and sizes during berthing.

This is aimed at improving local air quality around ports.

To comply with these new regulations, maritime stakeholders have to invest in shore power systems for the first time, benefiting the new installation segment.

Japan, for example, made shore power usage compulsory for cruise ships and container vessels over a certain tonnage.

Similarly, California regulations will require shore power for container ships and refrigerated cargo vessels.

This regulatory push is set to substantially grow the demand for new, compliant shore power installations worldwide.

In terms of component, transformers contributes the highest share of the shore power market.

Developments that allow for more advanced shore power network capabilities are driving growth for this segment in the shore power market.

Transformers play an important role in matching vessel and shore voltages seamlessly.

Newer generation transformers facilitate higher power transfer needed for megawatt size vessels.

They also allow bi-directional power flow to aid grid services from vessel batteries.

Ongoing research on areas like grid-scale energy storage leverages shore power network interfaces.

This offers opportunities to transform ports into testbeds for innovative smart grid technologies.

The technological leaps in turn increase requirements for capable, high-spec transformers to tap their full potential.

The need to keep upgrading shoreside network infrastructure thus sustains transformer segment growth in the shore power market.

Additional Insights of Shore Power Market

- The North American region is highlighted as a dominant player in the global shore power market, accounting for a substantial portion of the overall revenue.

- The increasing global emphasis on reducing carbon footprints at maritime hubs is expected to boost the market penetration of shore power solutions.

- Several large European cruise ports have successfully implemented shore power infrastructures allowing vessels to connect seamlessly to the local grid. This transition provides a tangible reduction in marine diesel usage, cutting greenhouse gas emissions drastically.

- The North American region is highlighted as a dominant player in the global shore power market, accounting for a substantial portion of the overall revenue.

- The increasing global emphasis on reducing carbon footprints at maritime hubs is expected to boost the market penetration of shore power solutions.

- Several large European cruise ports have successfully implemented shore power infrastructures allowing vessels to connect seamlessly to the local grid. This transition provides a tangible reduction in marine diesel usage, cutting greenhouse gas emissions drastically.

Competitive overview of Shore Power Market

The major players operating in the shore power market include General Electric, Siemens AG, Schneider Electric SE, ABB Ltd., Eaton Corporation plc, Conntek Integrated Solutions Inc., Piller Group GmbH, Power Systems International, Sydney Marine Electrical, Blueday Technology, Wartsila Oyj Abp, Cavotec SA, ESL Power Systems Inc., VINCI Energies, Danfoss A/S, Cochran Marine LLC, PowerCon, and Patton & Cooke Co.

The major players operating in the shore power market include General Electric, Siemens AG, Schneider Electric SE, ABB Ltd., Eaton Corporation plc, Conntek Integrated Solutions Inc., Piller Group GmbH, Power Systems International, Sydney Marine Electrical, Blueday Technology, Wartsila Oyj Abp, Cavotec SA, ESL Power Systems Inc., VINCI Energies, Danfoss A/S, Cochran Marine LLC, PowerCon, and Patton & Cooke Co.

Shore Power Market Leaders

- General Electric

- Siemens AG

- Schneider Electric SE

- ABB Ltd.

- Eaton Corporation plc

- General Electric

- Siemens AG

- Schneider Electric SE

- ABB Ltd.

- Eaton Corporation plc

Recent Developments in Shore Power Market

- In July 2024, the Port of Barcelona inaugurated its first Onshore Power Supply (OPS) system at the Hutchison Ports BEST container terminal. This installation enables ships to connect to 100% renewable electricity while docked, allowing them to turn off their engines and significantly reduce emissions.

- In June 2024, the Jawaharlal Nehru Port Authority (JNPA) announced plans to invest approximately ₹100 crore in India's first pilot project for shore electric power supply. This initiative aims to provide electricity from the national grid to ships docked at the port, thereby eliminating the use of diesel engines during their stay and reducing pollution.

- In September 2023, Wärtsilä announced it would supply such systems for two new hybrid RoRo vessels for Stena RoRo, enabling the vessels to operate on methanol fuel and connect to shore power while in port.

- In July 2023, Rotterdam Shortsea Terminals (RST) and Samskip launched the Green Shore Power initiative, aiming to reduce CO₂ emissions from docked vessels by providing clean shore-powered energy solutions. This initiative is the first of its kind for a container terminal in the Netherlands.

- In July 2024, the Port of Barcelona inaugurated its first Onshore Power Supply (OPS) system at the Hutchison Ports BEST container terminal. This installation enables ships to connect to 100% renewable electricity while docked, allowing them to turn off their engines and significantly reduce emissions.

- In June 2024, the Jawaharlal Nehru Port Authority (JNPA) announced plans to invest approximately ₹100 crore in India's first pilot project for shore electric power supply. This initiative aims to provide electricity from the national grid to ships docked at the port, thereby eliminating the use of diesel engines during their stay and reducing pollution.

- In September 2023, Wärtsilä announced it would supply such systems for two new hybrid RoRo vessels for Stena RoRo, enabling the vessels to operate on methanol fuel and connect to shore power while in port.

- In July 2023, Rotterdam Shortsea Terminals (RST) and Samskip launched the Green Shore Power initiative, aiming to reduce CO₂ emissions from docked vessels by providing clean shore-powered energy solutions. This initiative is the first of its kind for a container terminal in the Netherlands.

Shore Power Market Segmentation

- By Installation Type

- Shoreside

- Shipside

- By Connection

- New Installation

- Retrofit

- By Component

- Transformers

- Switchgear Devices

- Frequency Converters

- Cables and Accessories

- Others

- By Power Rating

- Up to 30 MVA

- 30 to 60 MVA

- Above 60 MVA

- By Installation Type

- Shoreside

- Shipside

- By Connection

- New Installation

- Retrofit

- By Component

- Transformers

- Switchgear Devices

- Frequency Converters

- Cables and Accessories

- Others

- By Power Rating

- Up to 30 MVA

- 30 to 60 MVA

- Above 60 MVA

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting.

She is proficient in market estimation, competitive analysis, and patent analysis.

Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making.

Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.