Battery Separator Market Size - Analysis

The battery separator market is estimated to be valued at USD 13.98 Bn in 2025 and is expected to reach USD 36.51 Bn by 2032. It is projected to grow at a compound annual growth rate (CAGR) of 14.7% from 2025 to 2032. Increased adoption of electronic vehicles and need for high performance batteries to power these vehicles has been the major factor driving growth in the battery separator market.

The battery separator market is estimated to be valued at USD 13.98 Bn in 2025 and is expected to reach USD 36.51 Bn by 2032.

It is projected to grow at a compound annual growth rate (CAGR) of 14.7% from 2025 to 2032.

Increased adoption of electronic vehicles and need for high performance batteries to power these vehicles has been the major factor driving growth in the battery separator market.

Market Size in USD Bn

CAGR14.7%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 14.7% |

| Market Concentration | High |

| Major Players | Toray Battery Separator Film Korea Limited, Sumitomo Chemical Co., Ltd., Asahi Kasei Corporation, SK Innovation Co., Ltd., Freudenberg Performance Materials and Among Others |

please let us know !

Battery Separator Market Trends

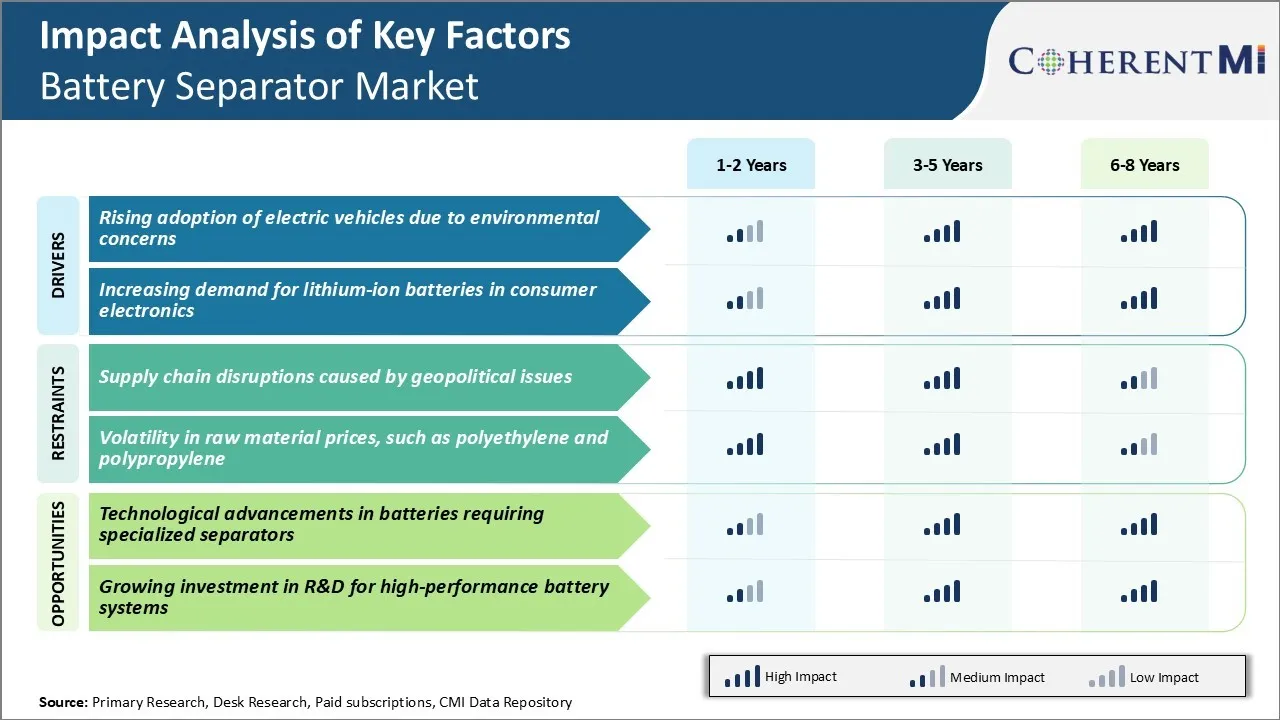

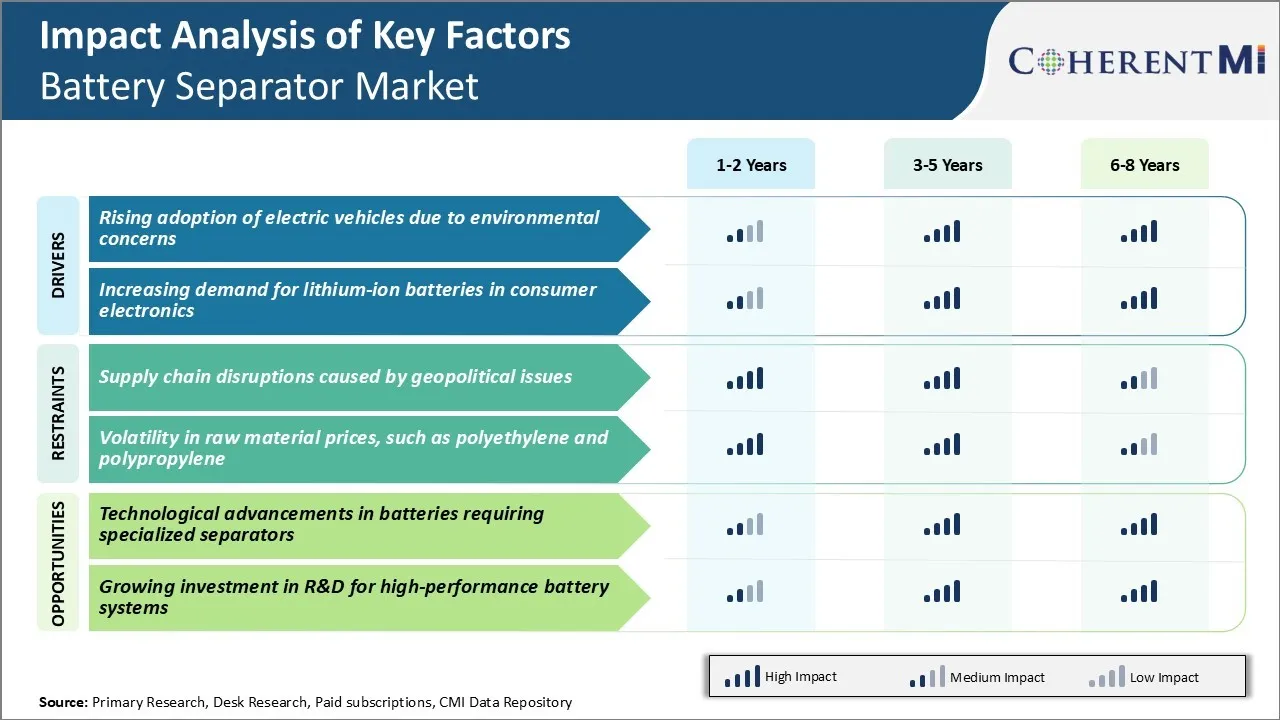

Market Driver - Rising Adoption of Electric Vehicles due to Environmental Concerns

As environmental issues have become a rising concern globally, consumers are inclining more towards sustainable transportation options. The sale of electric vehicles has picked up significantly in the recent past owing to the incentives and policies introduced by various governments to curb emission levels.

Lithium-ion batteries are most commonly used in EVs currently due to their high energy density and minimal self-discharge. Within the lithium-ion battery unit, battery separator plays a vital role as it keeps the cathode and anode plates apart during charging and discharging cycles.

Major automakers are focusing on developing competitive EV lineups with advanced connectivity and superior driving range to attract customers. This, in turn, is boosting investments by separator suppliers in ramping up production and developing new materials with enhanced properties. As the shift towards electric mobility further gathers steam driven by climate action plans, the need for high-performance batteries and battery separators will continue to surge.

Market Driver - Increasing Demand for Lithium-ion Batteries in Consumer Electronics

From smartphones to laptops to wearables, lithium-ion batteries have become integral to a wide array of consumer electronic devices used in daily life. With technological advances, these devices are becoming more powerful yet compact in design while offering interactive features and connectivity. As a result, the demand for high-capacity, long-lasting and fast-charging lithium-ion batteries has skyrocketed from manufacturers.

Consumer preference for slim and lightweight devices has necessitated compact battery designs with multiple cell layers separated by thin and durable membranes. Battery separator market players are developing innovative materials and coating techniques to manufacture microporous, shrunk, and functionalized separators.

Additionally, rapid battery recharging capabilities expected by users pose safety risks, increasing the onus on separators to prevent potential fire hazards. Suppliers are actively working on new separator grades with enhanced shutdown properties. Looking at continuous technology cycles and growing product categories, the demand from this end-use is expected to remain robust.

Market Challenge - Supply Chain Disruptions Caused by Geopolitical Issues

The battery separator market is facing significant supply chain challenges caused by ongoing geopolitical issues. Many key materials used in separator manufacturing such as polypropylene, polyethylene and coatings are highly dependent on imports from regions like China and the Middle East.

In the last two years, trade restrictions, border closures and shipping delays due to the pandemic have disrupted the stable flow of these imports. This has put tremendous pressure on separator suppliers' production schedules and ability to fulfill customer orders. Suppliers in the battery separator market are struggling to secure reliable alternatives for these imported materials in the short term.

Rising logistics and procurement costs are also eroding the thin profit margins of suppliers. The supply uncertainty is compromising their commitments to battery cell manufacturers. Any delay in separator supply can severely affect the production planning of EV and energy storage system companies as well. This causes significant challenges in the battery separator market.

Market Opportunity - Technological Advancements in Batteries Requiring Specialized Separators

The rapid evolution of battery technologies towards higher capacities, faster charging and greater safety is opening new opportunities for separator manufacturers. Advanced next-gen separators need to have enhanced qualities like higher porosity, mechanical strength, ion conductivity and heat resistance. They also need sophisticated coating technologies.

The development of such specialized separators tailored for new battery chemistries offers a major growth avenue for separator suppliers. Those who make timely investments in research and production facilities for new separator products stand to gain from the upcoming transition towards advanced batteries in key areas like EVs, consumer electronics, and grid energy storage.

Capturing a share of the new battery separator markets for disruptive batteries will be instrumental in driving future revenues for suppliers.

As environmental issues have become a rising concern globally, consumers are inclining more towards sustainable transportation options.

The sale of electric vehicles has picked up significantly in the recent past owing to the incentives and policies introduced by various governments to curb emission levels.

Lithium-ion batteries are most commonly used in EVs currently due to their high energy density and minimal self-discharge.

Within the lithium-ion battery unit, battery separator plays a vital role as it keeps the cathode and anode plates apart during charging and discharging cycles.

Major automakers are focusing on developing competitive EV lineups with advanced connectivity and superior driving range to attract customers.

This, in turn, is boosting investments by separator suppliers in ramping up production and developing new materials with enhanced properties.

As the shift towards electric mobility further gathers steam driven by climate action plans, the need for high-performance batteries and battery separators will continue to surge.

From smartphones to laptops to wearables, lithium-ion batteries have become integral to a wide array of consumer electronic devices used in daily life.

With technological advances, these devices are becoming more powerful yet compact in design while offering interactive features and connectivity.

As a result, the demand for high-capacity, long-lasting and fast-charging lithium-ion batteries has skyrocketed from manufacturers.

Consumer preference for slim and lightweight devices has necessitated compact battery designs with multiple cell layers separated by thin and durable membranes.

Battery separator market players are developing innovative materials and coating techniques to manufacture microporous, shrunk, and functionalized separators.

Additionally, rapid battery recharging capabilities expected by users pose safety risks, increasing the onus on separators to prevent potential fire hazards.

Suppliers are actively working on new separator grades with enhanced shutdown properties.

Looking at continuous technology cycles and growing product categories, the demand from this end-use is expected to remain robust.

The battery separator market is facing significant supply chain challenges caused by ongoing geopolitical issues.

Many key materials used in separator manufacturing such as polypropylene, polyethylene and coatings are highly dependent on imports from regions like China and the Middle East.

In the last two years, trade restrictions, border closures and shipping delays due to the pandemic have disrupted the stable flow of these imports.

This has put tremendous pressure on separator suppliers' production schedules and ability to fulfill customer orders.

Suppliers in the battery separator market are struggling to secure reliable alternatives for these imported materials in the short term.

Rising logistics and procurement costs are also eroding the thin profit margins of suppliers.

The supply uncertainty is compromising their commitments to battery cell manufacturers.

Any delay in separator supply can severely affect the production planning of EV and energy storage system companies as well.

This causes significant challenges in the battery separator market.

The rapid evolution of battery technologies towards higher capacities, faster charging and greater safety is opening new opportunities for separator manufacturers.

Advanced next-gen separators need to have enhanced qualities like higher porosity, mechanical strength, ion conductivity and heat resistance.

They also need sophisticated coating technologies.

The development of such specialized separators tailored for new battery chemistries offers a major growth avenue for separator suppliers.

Those who make timely investments in research and production facilities for new separator products stand to gain from the upcoming transition towards advanced batteries in key areas like EVs, consumer electronics, and grid energy storage.

Key winning strategies adopted by key players of Battery Separator Market

Strategies focused on new product development and innovation:

- Dreyer's adopted a similar strategy and launched UltreX battery separators in 2018 made using a proprietary blend of raw materials like polyolefin and glass fiber. These separators offered enhanced thermal and electrical performance. They were widely adopted and helped Dreyer's emerge as a formidable player.

Strategies targeting emerging markets and applications:

- Celgard focused on the growing EV market and signed multi-year supply agreements with multiple EV manufacturers like Tesla in 2015 to cater to increasing demand. This pre-emptive move helped capture a large untapped segment of the battery separator market.

Mergers and acquisitions to gain capabilities:

- In 2017, W-Scope acquired Japan Viledon, a leading glass-fiber separator maker to expand its portfolio and technology base. This expanded W-Scope's offerings to include glass-fiber technology apart from existing polyolefin membranes.

- Dreyer's adopted a similar strategy and launched UltreX battery separators in 2018 made using a proprietary blend of raw materials like polyolefin and glass fiber.

These separators offered enhanced thermal and electrical performance. They were widely adopted and helped Dreyer's emerge as a formidable player.

- Celgard focused on the growing EV market and signed multi-year supply agreements with multiple EV manufacturers like Tesla in 2015 to cater to increasing demand.

This pre-emptive move helped capture a large untapped segment of the battery separator market.

- In 2017, W-Scope acquired Japan Viledon, a leading glass-fiber separator maker to expand its portfolio and technology base.

This expanded W-Scope's offerings to include glass-fiber technology apart from existing polyolefin membranes.

Segmental Analysis of Battery Separator Market

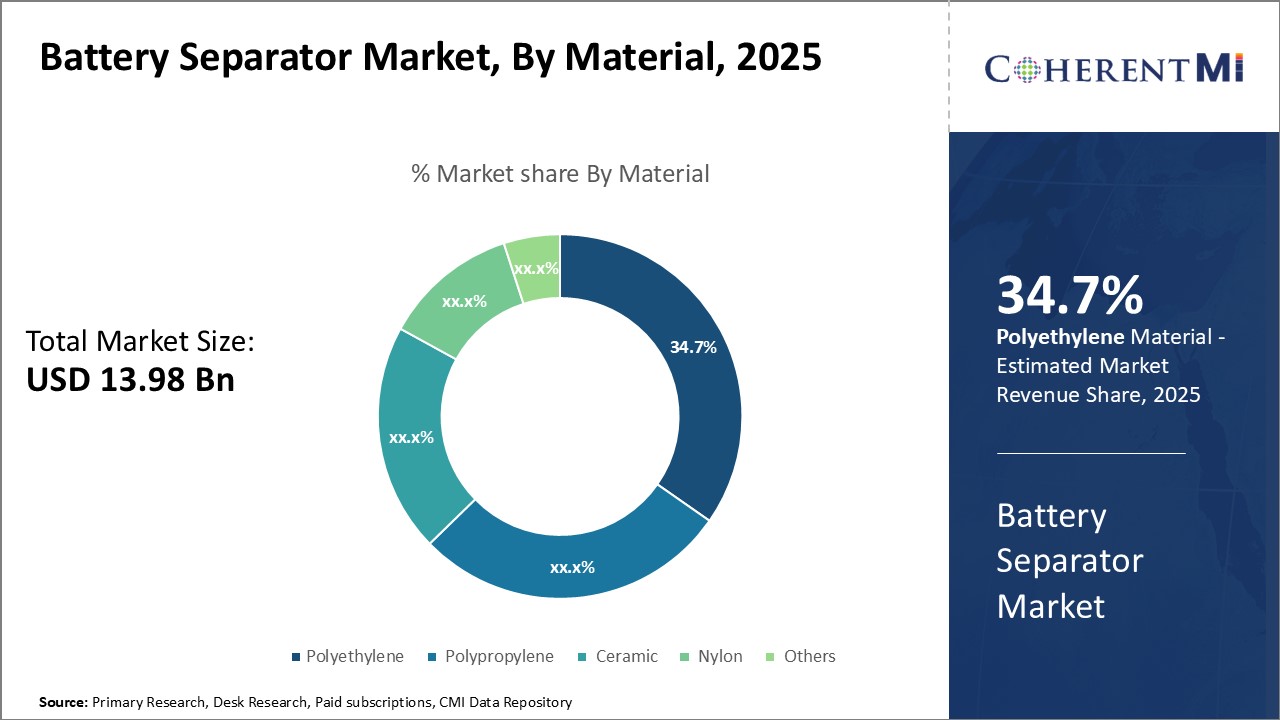

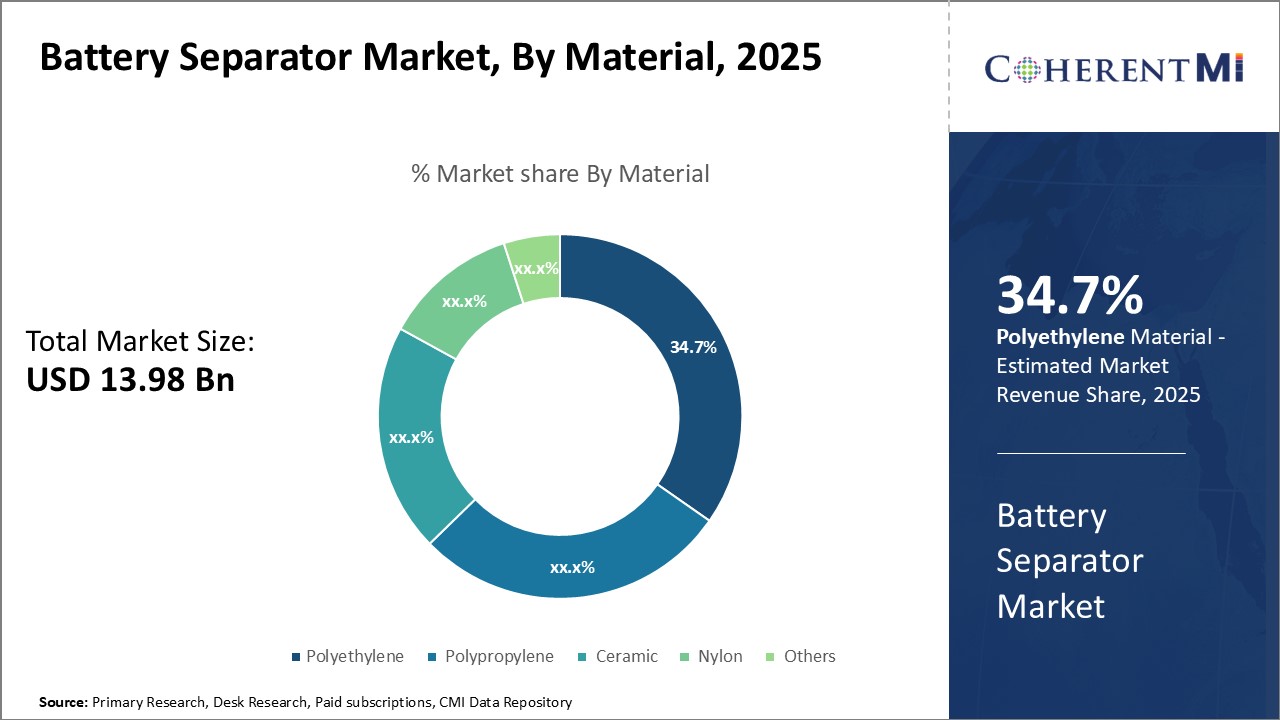

Insights, By Material: Low Cost and Superior Corrosion Resistance Drives Polyethylene Adoption

In terms of material, polyethylene contributes 34.7% share of the battery separator market in 2025. This is owning to its low manufacturing cost and superior corrosion resistance properties. Polyethylene offers an optimal balance of porosity, mechanical strength and shutdown behavior, making it ideal for a wide range of battery applications. Its low density nature allows for thinner and lighter separators, enhancing the energy density of batteries.

Moreover, being highly inert in nature, polyethylene separators prevent unwanted reactions between the anode and cathode. This preserves the integrity and prolongs the life of the battery. Polyethylene continues to gain more acceptance due to recent material innovations that have improved its wettability, thermal shrinkage, and pinhole resistance.

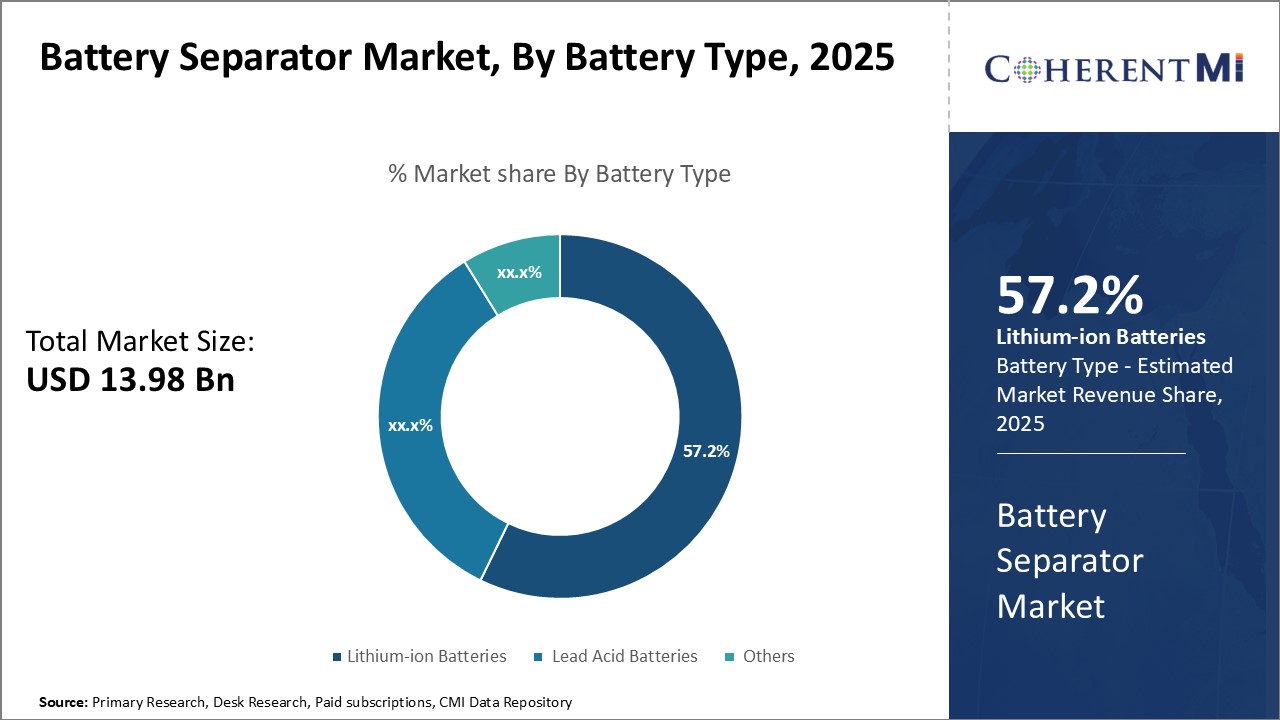

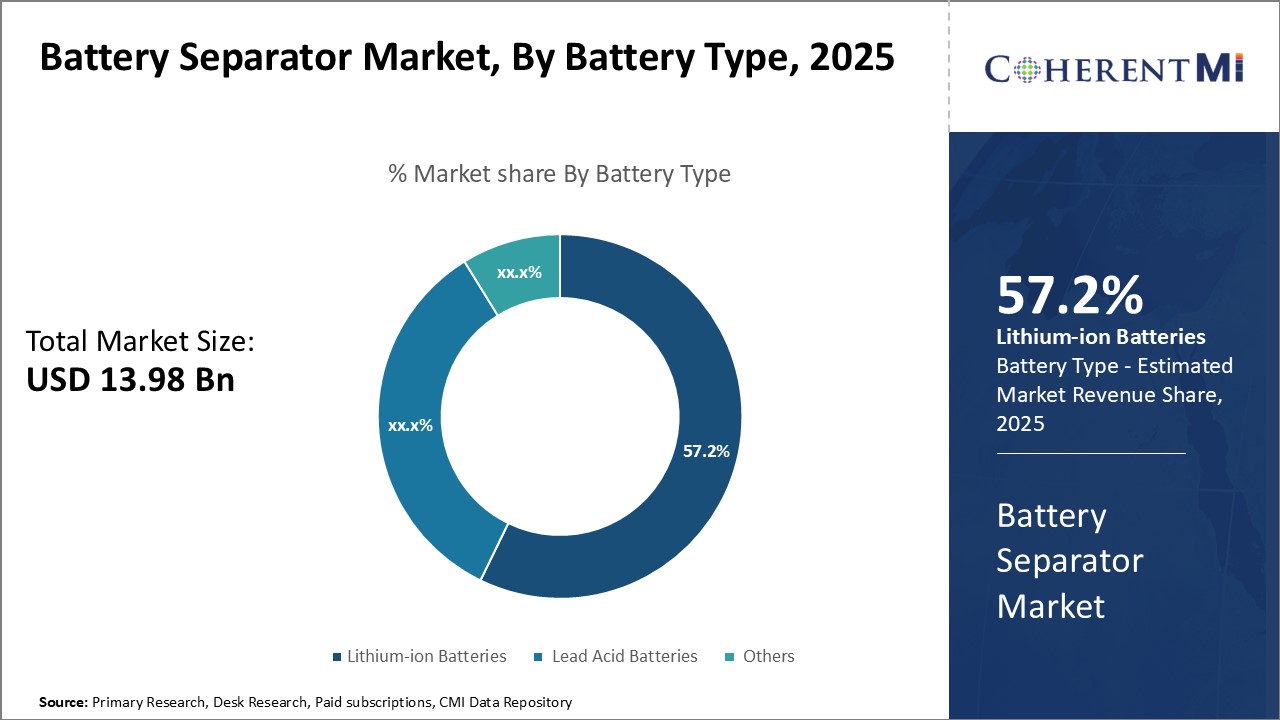

Insights, By Battery Type: Rising Popularity of Portable Electronics Fuels Lithium-ion Battery Adoption

Insights, By Battery Type: Rising Popularity of Portable Electronics Fuels Lithium-ion Battery Adoption

In terms of battery type, lithium-ion batteries contributes 57.2% share of the battery separator market in 2025. This is owing to the increasing application in portable consumer electronics. Lithium-ion batteries have revolutionized portable electronics due to their high energy density, lack of memory effect and low self-discharge. Devices such as smartphones, laptops, tablets have seen widespread adoption fueled by advancements in lithium-ion battery technology.

The demand from electric vehicles is further driving the need for higher capacity and more durable lithium-ion batteries. Battery separators tailored for lithium-ion batteries need to withstand higher operating voltages while preventing potential dendrite growth and short-circuiting. The rapid proliferation of portable electronics and EVs will continue spurring the demand for lithium-ion battery separators in the coming years.

Insights, By Type: Superior Insulation and Durability Boosts Coated Separator Acceptance

In terms of type, coated separator contributes the highest share of the battery separator market owing to its advanced insulating and durability properties. Coated battery separators address the limitations of conventional non-coated variants through the use of polymeric coatings. The ultra-thin coatings create a protective layer that improves insulation between the electrodes even at high voltages. This suppresses internal short circuits and prevents potential dendrite growth.

Additionally, coated separators are highly resistant to mechanical breakdown and offer better puncture resistance compared to non-coated versions. Their longer operating lifetime aligns well with the growing needs of EVs and industrial applications that require batteries to work for extended duty cycles. Advanced coating technologies will further support the ongoing replacement of conventional separators by superior coated variants.

In terms of material, polyethylene contributes 34.7% share of the battery separator market in 2025.

This is owning to its low manufacturing cost and superior corrosion resistance properties.

Polyethylene offers an optimal balance of porosity, mechanical strength and shutdown behavior, making it ideal for a wide range of battery applications.

Its low density nature allows for thinner and lighter separators, enhancing the energy density of batteries.

Moreover, being highly inert in nature, polyethylene separators prevent unwanted reactions between the anode and cathode.

This preserves the integrity and prolongs the life of the battery.

Polyethylene continues to gain more acceptance due to recent material innovations that have improved its wettability, thermal shrinkage, and pinhole resistance.

Insights, By Battery Type: Rising Popularity of Portable Electronics Fuels Lithium-ion Battery Adoption

Insights, By Battery Type: Rising Popularity of Portable Electronics Fuels Lithium-ion Battery AdoptionIn terms of battery type, lithium-ion batteries contributes 57.2% share of the battery separator market in 2025.

This is owing to the increasing application in portable consumer electronics.

Lithium-ion batteries have revolutionized portable electronics due to their high energy density, lack of memory effect and low self-discharge.

Devices such as smartphones, laptops, tablets have seen widespread adoption fueled by advancements in lithium-ion battery technology.

The demand from electric vehicles is further driving the need for higher capacity and more durable lithium-ion batteries.

Battery separators tailored for lithium-ion batteries need to withstand higher operating voltages while preventing potential dendrite growth and short-circuiting.

The rapid proliferation of portable electronics and EVs will continue spurring the demand for lithium-ion battery separators in the coming years.

In terms of type, coated separator contributes the highest share of the battery separator market owing to its advanced insulating and durability properties.

Coated battery separators address the limitations of conventional non-coated variants through the use of polymeric coatings.

The ultra-thin coatings create a protective layer that improves insulation between the electrodes even at high voltages.

This suppresses internal short circuits and prevents potential dendrite growth.

Additionally, coated separators are highly resistant to mechanical breakdown and offer better puncture resistance compared to non-coated versions.

Their longer operating lifetime aligns well with the growing needs of EVs and industrial applications that require batteries to work for extended duty cycles.

Advanced coating technologies will further support the ongoing replacement of conventional separators by superior coated variants.

Additional Insights of Battery Separator Market

- Asia Pacific accounts for the largest market share (56% in 2023) and is expected to lead due to industrialization and technological advances.

- North America is projected to witness the fastest growth in the global battery separator market driven by demand for electric vehicles.

- The lithium-ion battery segment dominated with a 57% share of the battery separator market in 2023.

- The coated separator type accounted for over 63% share of the battery separator market in 2023.

- In industrial-scale energy storage installations, advanced battery separators have demonstrated their importance by ensuring stable operation of large-format batteries, improving system durability, and enhancing the integration of renewable energy sources into the grid, thus contributing to a more resilient and sustainable energy infrastructure.

- Asia Pacific accounts for the largest market share (56% in 2023) and is expected to lead due to industrialization and technological advances.

- North America is projected to witness the fastest growth in the global battery separator market driven by demand for electric vehicles.

- The lithium-ion battery segment dominated with a 57% share of the battery separator market in 2023.

- The coated separator type accounted for over 63% share of the battery separator market in 2023.

- In industrial-scale energy storage installations, advanced battery separators have demonstrated their importance by ensuring stable operation of large-format batteries, improving system durability, and enhancing the integration of renewable energy sources into the grid, thus contributing to a more resilient and sustainable energy infrastructure.

Competitive overview of Battery Separator Market

The major players operating in the battery separator market include Toray Battery Separator Film Korea Limited, Sumitomo Chemical Co., Ltd., Asahi Kasei Corporation, SK Innovation Co., Ltd., Freudenberg Performance Materials, ENTEK International, LLC, W-Scope Corporation, UBE Corporation, Bernard Dumas, Dow, Inc., and Teijin Limited.

The major players operating in the battery separator market include Toray Battery Separator Film Korea Limited, Sumitomo Chemical Co., Ltd., Asahi Kasei Corporation, SK Innovation Co., Ltd., Freudenberg Performance Materials, ENTEK International, LLC, W-Scope Corporation, UBE Corporation, Bernard Dumas, Dow, Inc., and Teijin Limited.

Battery Separator Market Leaders

- Toray Battery Separator Film Korea Limited

- Sumitomo Chemical Co., Ltd.

- Asahi Kasei Corporation

- SK Innovation Co., Ltd.

- Freudenberg Performance Materials

- Toray Battery Separator Film Korea Limited

- Sumitomo Chemical Co., Ltd.

- Asahi Kasei Corporation

- SK Innovation Co., Ltd.

- Freudenberg Performance Materials

Recent Developments in Battery Separator Market

- In April 2024, Nissan showcased its under-construction all-solid-state battery pilot line at its Yokohama Plant in Kanagawa Prefecture, Japan. This initiative is part of Nissan's Ambition 2030 vision, aiming to launch electric vehicles equipped with these advanced batteries by fiscal year 2028.

- In April 2024, Bounce Infinity, in collaboration with Clean Electric, introduced India's first portable liquid-cooled battery for electric scooters. This innovation was integrated into the Bounce Infinity E1 model, enhancing its real-world range to over 100 kilometers on a single charge.

- In April 2024, Hyundai Motor Company and Kia Corporation entered into a strategic partnership with Exide Energy Solutions Ltd. to enhance their electric vehicle (EV) offerings in India. This collaboration focuses on localizing EV battery production, particularly lithium-iron-phosphate (LFP) cells, to equip future Hyundai and Kia EV models in the Indian market with domestically produced batteries.

- In April 2024, Nissan showcased its under-construction all-solid-state battery pilot line at its Yokohama Plant in Kanagawa Prefecture, Japan. This initiative is part of Nissan's Ambition 2030 vision, aiming to launch electric vehicles equipped with these advanced batteries by fiscal year 2028.

- In April 2024, Bounce Infinity, in collaboration with Clean Electric, introduced India's first portable liquid-cooled battery for electric scooters. This innovation was integrated into the Bounce Infinity E1 model, enhancing its real-world range to over 100 kilometers on a single charge.

- In April 2024, Hyundai Motor Company and Kia Corporation entered into a strategic partnership with Exide Energy Solutions Ltd. to enhance their electric vehicle (EV) offerings in India. This collaboration focuses on localizing EV battery production, particularly lithium-iron-phosphate (LFP) cells, to equip future Hyundai and Kia EV models in the Indian market with domestically produced batteries.

Battery Separator Market Segmentation

- By Material

- Polyethylene

- Polypropylene

- Ceramic

- Nylon

- Others

- By Battery Type

- Lithium-ion Batteries:

- Lead Acid Batteries

- Others

- By Type

- Coated Separator

- Non-coated Separator

- By End Use

- Automotive

- Consumer Electronics

- Industrial

- Others

- By Material

- Polyethylene

- Polypropylene

- Ceramic

- Nylon

- Others

- By Battery Type

- Lithium-ion Batteries:

- Lead Acid Batteries

- Others

- By Type

- Coated Separator

- Non-coated Separator

- By End Use

- Automotive

- Consumer Electronics

- Industrial

- Others

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting.

She is proficient in market estimation, competitive analysis, and patent analysis.

Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making.

Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.