Cell Cytometry Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Cell Cytometry Market is segmented By Type of Cytometer (High Throughput Flow Cytometers, Image Cytometers), By Company Size (Very Small, Small, Mid-s....

Cell Cytometry Market Size

Market Size in USD Bn

CAGR9.9%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 9.9% |

| Market Concentration | High |

| Major Players | Agilent, Beckton Dickinson, Beckman Coulter Life Sciences, Bio-Rad, ThermoFisher Scientific and Among Others. |

please let us know !

Cell Cytometry Market Analysis

The cell cytometry market is estimated to be valued at USD 1.5 Bn in 2024 and is expected to reach USD 3.5 Bn by 2031, growing at a compound annual growth rate (CAGR) of 9.9% from 2024 to 2031. The market is expected to show strong growth over the forecast period due to increasing application of cell cytometry techniques in medical research and clinical diagnosis. Advances in technology are also fueling the growth of cell cytometry techniques globally.

The cell cytometry market is expected to witness positive trends over the next few years. There is continued uptake of novel cell analysis techniques across various end-use industries like hospitals, research institutes, pharmaceutical and biotechnology companies. Also, rising healthcare expenditure in emerging nations and growing public-private investments to expedite drug development process will further drive the adoption of cell cytometry solutions.

Cell Cytometry Market Trends

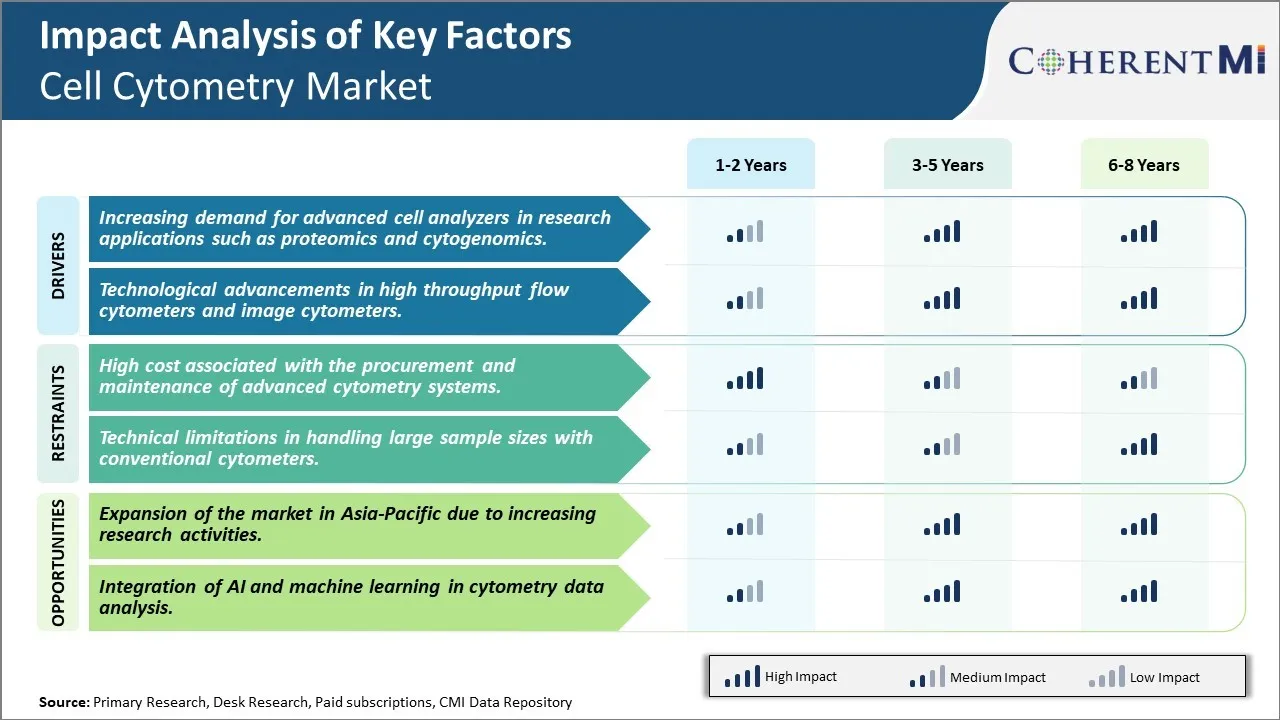

Market Driver - Increasing demand for advanced cell analyzers in research applications such as proteomics and cytogenomics

The cell cytometry market has been witnessing significant rise in demand for advanced cell analyzers across various research applications such as proteomics and cytogenomics. Researchers are exploring deeper into cell structure and functions using latest cytometry technologies to gain critical insights.

Cell analyzers help in precision studies of cell populations and their characteristics at a large scale. They enable identifying abnormal cells and various sub-populations based on proteins expressed on cell surface and within cells. This capability has made cell analyzers highly useful for proteomics research focused on understanding complex protein interaction networks. Many ongoing research projects involve characterization of large number of different cell types derived from various sources such as stem cells, cancer cells etc. Advanced analyzers with high sample throughput are fueling such studies by allowing researchers to analyze thousands of cells within short duration.

Moreover, cell analyzers are indispensable tools for cytogenomic studies which require detailed analysis of chromosomal structure during cell cycle phases. They help in detecting abnormalities in chromosome number as well as structure. Several genetic disorders and cancer types have been linked to certain cytogenetic changes which are now possible to detect using modern cytometers. Research activities in fields like prenatal diagnosis, cancer diagnosis and treatment monitoring are propelling demand for high-resolution cytometers.

Research institutes and academia make up a major customer segment pushing this growth as they actively pursue proteomics and cytogenomics to address various health challenges. Government funding support for life science research especially in developed countries has created conducive environment for procurement of such high-end capital equipment.

Market Driver - Technological advancements in high throughput flow cytometers and image cytometers

Constant innovation in cytometry platform technologies has fueled the market growth remarkably. Major cytometer OEMs are focusing on introducing systems with advanced features addressing current research needs. Key technology upgrades seen recently include high throughput flow cytometry and high-resolution imaging cytometry solutions.

Flow cytometry is the most widely used cell analysis method due to ability to measure multiple parameters on thousands of cells per second. Newer high throughput flow cytometers boost sample analysis rates to millions of cells per hour. Combined with latest digital signal processing and fluidic technologies, they ensure accurate, reproducible results on large sample sets in very less time. This has become game changer for applications involving analysis of rare cell sub-populations.

Researchers can now evaluate comprehensive datasets within practical timelines even for big ongoing clinical trials and epidemiological studies.

On other hand, image cytometers are gaining prominence due to capability of microscopic visualization of cells along with multiparametric quantification. Technological innovations have enhanced image resolution, speed and ability to capture spatial expression of markers within intact cells and micro-environments like tissues. This provides critical intracellular details beyond flow cytometry. Vendors have integrated latest fluorescence imaging, microfluidic and computational image analysis into next-gen image cytometers.

Market Challenge - High cost associated with the procurement and maintenance of advanced cytometry systems

One of the key challenges faced by the cell cytometry market is the high cost associated with the procurement and maintenance of advanced cytometry systems. Cell cytometry instruments equipped with the latest technological advancements tend to be extremely expensive, with some high-end analyzers and sorters priced well over $100,000. Additionally, maintenance and repair of these sophisticated machines requires substantial investments. Regular service, calibration, preventive maintenance checks and replacement of consumables all contribute to high operating expenses. The need for special training of technicians to handle advanced instruments also drives up the maintenance costs. The prohibitive cost of instruments limits their adoption, especially in cost-sensitive and resource-constrained settings like academic research labs, hospitals and diagnostic centers in developing countries. Additionally, the high costs associated with consumables and reagents needed for sample preparation and analysis pose an obstacle for widespread application of cell cytometry techniques. To address this challenge, industry players need to develop more affordable instruments with simplified designs that require minimal maintenance and service interventions.

Market Opportunity - Expansion of the market in Asia-Pacific due to increasing research activities

The Asia-Pacific region presents significant growth opportunities for the global cell cytometry market. Factors such as rising healthcare expenditure, increasing biomedical research funding and rapidly growing biotechnology and pharmaceutical industries are fueling the demand for cell analysis instruments in the Asia-Pacific countries. There is a significant expansion of private and public research organizations as well as commercial clinical diagnostic laboratories in China, India, Japan, South Korea and other emerging nations. With greater recognition of the role of cytometry in various applications ranging from cancer research to stem cell therapy, more research projects involving cell analysis are being undertaken in these countries. This is translating to heightened procurement of flow cytometers, cell counters, high-content screening systems and other related equipment. Moreover, regional life science players are actively working on the development and commercialization of novel cytometry methods and assays. Thus, the Asia-Pacific region presents lucrative opportunities for market players to tap into the demands of research, academic and clinical end users through establishment of local manufacturing and distribution networks.

Key winning strategies adopted by key players of Cell Cytometry Market

Leading players like Becton Dickinson, Beckman Coulter, and Thermo Fisher Scientific have focused on niche segments within the overall cell cytometry market that have high growth potential. For example, BD focused on acquiring specialized cell analysis companies like Cytek Biosciences which focused on high-throughput cell analysis using novel technologies like mass cytometry. This helped BD expand its portfolio and capabilities in an emerging high-growth segment.

Players constantly up their technological capabilities by adopting the latest technologies to stay ahead of competition. For example, in 2018, Merck Millipore acquired Spatial Transcriptomics, a pioneer in the emerging field of spatial gene expression analysis. This positioned Merck as a leader in this novel technology which has significant applications in cell analysis.

Acquisitions are a key strategy to rapidly gain capabilities and market share. For instance, in 2015, Agilent acquired multi-photon microscopy firm DermaQuest which strengthened Agilent's position in advanced live-cell imaging. Similarly, Becton Dickinson acquired Cytomation in 2011 which made BD a global leader in high-end cell analysis platforms overnight.

Major players are expanding sales and distribution networks aggressively into emerging Asia Pacific and Latin American markets which are expected to be the main future growth regions. For example, Thermo Fisher opened a new cell analysis Solutions Center in China in 2018 to tap into the fast growing Chinese cell analysis market.

Players also partner with biopharma companies, research institutions and other technology firms to co-develop integrated solutions. For instance, Merck Millipore partnered with biotech firm Horizon Discovery to integrate Horizon's gene editing technology with Merck's cell analysis platforms for more effective drug discovery research.

Segmental Analysis of Cell Cytometry Market

Insights, By Type of Cytometer: Advancements in flow cytometry technology drive growth of high throughput flow cytometers segment

High throughput flow cytometers segment contributes the highest share of 60.5% in the global cell cytometry market owing to continuous technological advancements. The constant evolution of flow cytometry technology from single-laser, single-color instruments to multi-laser, multi-parameter analytical capabilities has considerably increased the throughput and sensitivity of analysis. Modern high throughput flow cytometers provide faster analysis of large number of cells with enhanced resolution at single cell level.

The development of microfluidics-based sorting systems has enabled high throughput screening of rare cells from small sample volumes. Additionally, automation and digital signal processing has boosted workflow efficiency. Leading companies are focusing on integrating artificial intelligence and machine learning algorithms to simplify data analysis from high-dimensional datasets. This is anticipated to widen the applications of flow cytometry across diverse fields such as immunology and cancer research.

Insights, By Company Size: Very small company segment growth fueled by increased accessibility of cell cytometry tools

The very small sub-segment holds the highest share of 26.7% in the global cell cytometry market owing to greater accessibility of analytical platforms. Startups and small research laboratories have benefitted considerably from technological advancements that have miniaturized instrumentation and reduced the costs of reagents and consumables.

Compact flow cytometers designed for routine quality checks or specialized panels require less space and investment compared to conventional devices. Open-source and DIY kits provide affordable options to test preliminary experiments. Cloud-based cytometry data analysis software as a service removes the need for expensive licenses or dedicated workstations.

These factors have lowered the entry barriers, enabling more research groups and core facilities to perform multi-parametric immunophenotyping and cell sorting. This trend is positively impacting the growth of cell analysis applications across diverse areas including biomanufacturing, translational research and clinical testing.

Additional Insights of Cell Cytometry Market

- The global cell cytometry market is experiencing rapid growth driven by technological advancements in cytometry devices, particularly in high throughput flow cytometers and image cytometers. These tools are becoming increasingly important in various research applications, including oncology and proteomics, due to their ability to analyze large libraries of cells and multiple sample parameters simultaneously. The market is highly competitive, with major players continuously innovating and forming strategic alliances to maintain their market position.

Competitive overview of Cell Cytometry Market

The major players operating in the cell cytometry market include ThermoFisher Scientific, Beckton Dickinson, Beckman Coulter Life Sciences, Agilent, Bio-Rad, Sony Biotechnology, Sartorius, Chemometec, Milkotronic, Nexcelom Bioscience and Union Biometrica.

Cell Cytometry Market Leaders

- Agilent

- Beckton Dickinson

- Beckman Coulter Life Sciences

- Bio-Rad

- ThermoFisher Scientific

Cell Cytometry Market - Competitive Rivalry, 2024

Cell Cytometry Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Cell Cytometry Market

- In August 2023, LightForce Orthodontics secured USD 80 million in series D funding for its 3D printed braces system, indicating a growing investment in advanced medical devices and related technologies.

- In July 2023, Desktop Health partnered with Carbon to validate Flexcera Smile Ultra+ for use on the Carbon Digital Manufacturing Platform, expanding access to nanoceramic resin in high-volume dental labs globally.

- In May 2023, HP Multi Jet Fusion collaborated with Metal JET to expand their medical 3D printing potential, combining Jet Fusion 5420W and Metal Jet S100 systems to enhance the production of complex medical devices.

Cell Cytometry Market Segmentation

- By Type of Cytometer

- High Throughput Flow Cytometers

- Image Cytometers

- By Company Size

- Very Small

- Small

- Mid-sized

- Large

- Very Large

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

What are the key factors hampering the growth of the cell cytometry market?

The high cost associated with the procurement and maintenance of advanced cytometry systems and technical limitations in handling large sample sizes with conventional cytometers are the major factors hampering the growth of the cell cytometry market.

What are the major factors driving the cell cytometry market growth?

The increasing demand for advanced cell analyzers in research applications such as proteomics and cytogenomics and technological advancements in high throughput flow cytometers and image cytometers are the major factors driving the cell cytometry market.

Which is the leading type of cytometer in the cell cytometry market?

The leading type of cytometer segment is high throughput flow cytometers.

Which are the major players operating in the cell cytometry market?x

ThermoFisher Scientific, Beckton Dickinson, Beckman Coulter Life Sciences, Agilent, Bio-Rad, Sony Biotechnology, Sartorius, Chemometec, Milkotronic, Nexcelom Bioscience, and Union Biometrica are the major players.

What will be the CAGR of the cell cytometry market?

The CAGR of the cell cytometry market is projected to be 9.9% from 2024-2031.