Conductive Polymers Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Conductive Polymers Market is segmented By Product (Polyacytelene, Polyaniline, Polypyrrole, Polythiophene), By Application (Batteries, Polymer Capaci....

Conductive Polymers Market Size

Market Size in USD Bn

CAGR9.1%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 9.1% |

| Market Concentration | Medium |

| Major Players | 3M Company, Agfa-Gevaert Group, Celanese Corporation, Heraeus Holding, Hyperion Catalysis International, Lehmann & Voss & Co. and Among Others. |

please let us know !

Conductive Polymers Market Analysis

The Global Conductive Polymers Market is estimated to be valued at USD 5.9 Bn in 2024 and is expected to reach USD 13.1 Bn by 2031, growing at a compound annual growth rate (CAGR) of 9.1% from 2024 to 2031. Conductive polymers are primarily used in photovoltaic cells, organic solar cells, organic light-emitting diodes, organic field-effect transistors, and various other applications.

The global conductive polymers market is expected to witness a strong growth over the forecast period. The increasing demand from the automotive industry for applications such as batteries, sensors and conductive coatings is expected to drive the growth of the conductive polymers market. Also, the growing adoption of organic electronics owing to beneficial properties like lightweight, flexibility and low cost is further expected to propel the demand for conductive polymers.

Conductive Polymers Market Trends

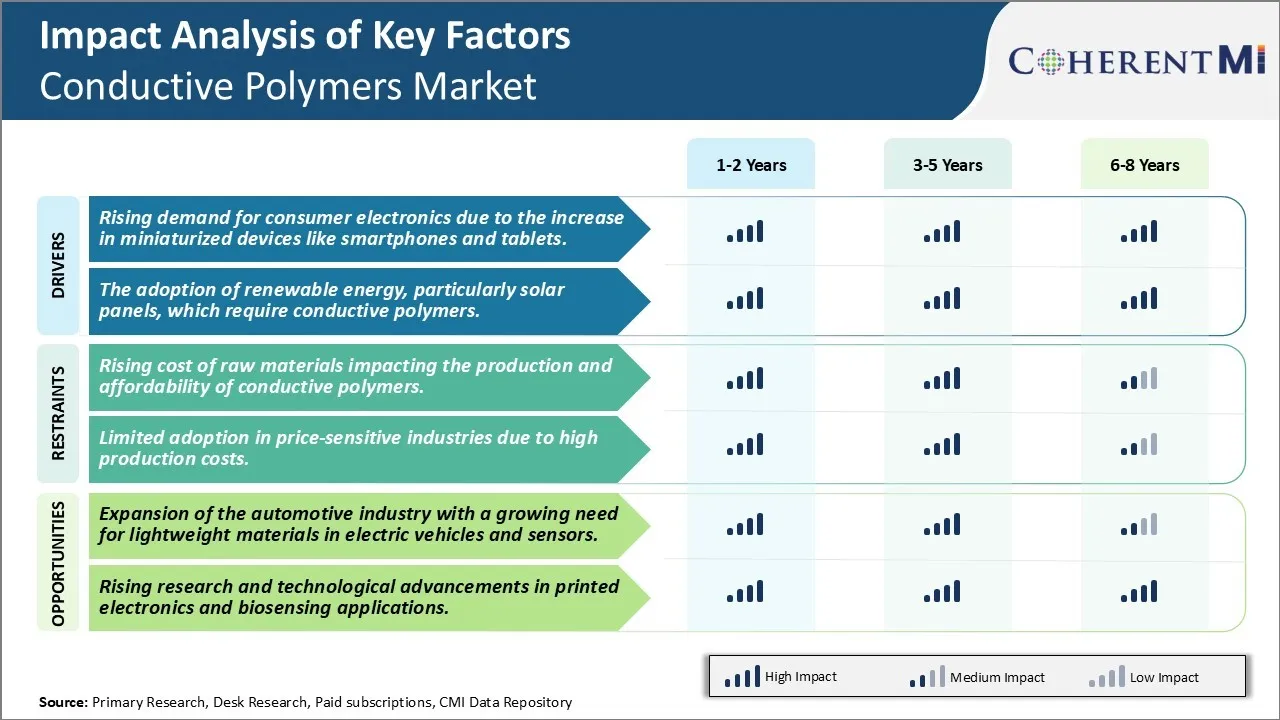

Market Driver - Rising Demand for Consumer Electronics due to the Increase in Miniaturized Devices like Smartphones and Tablets

The demand for consumer electronics like smartphones and tablets has witnessed exponential growth over the past decade due to constant innovation in technology as well as digitalization across industries. Miniaturized devices with advanced features have become commonplace. Conductive polymers play a vital role in enabling key components and functionalities in such devices. Their ability to conduct electricity flexibly makes them irreplaceable for applications involving touchscreens, circuit boards, and other internal connections.

As devices get smaller yet more powerful, the demand for sophisticated interconnected solutions within limited internal spaces increases. Conductive polymers address this need superbly through their processability into thin films or application as coatings or inks. Manufacturers rely on them for applications requiring conformability, like curved or foldable screens. Their use allows seamless bonding between different components without compromising on performance or space utilization. Conductors made of conventional metals simply cannot deliver the desired miniaturization while preserving functionality.

Further, consumer demand for superior features drives innovations that push technological boundaries. Devices with curved edges or foldable displays have emerged as the new frontier. However, achieving this increased complexity within tight form factors demands new generation materials. Conductive polymers have demonstrated ability to enable revolutionary designs through their flexibility and application versatility. Stakeholders foresee considerable ongoing requirement for such polymers from consumer gadget manufacturers aiming to sustain product refreshes aligning with evolving consumer preferences.

Market Driver - The Adoption of Renewable Energy Technologies is Expected to Boost the Market Growth

Harnessing renewable sources of energy like sunlight is the need of the hour from economic as well as environmental perspectives. Photovoltaic panels that directly convert solar energy into electricity have shown huge potential in this regard. However, large-scale integration of such panels requires continual efforts to enhance efficiency and reduce costs. Conductive polymers play a pivotal role by serving as key materials in modern solar cell technology.

Solar cells make use of a photoactive materials and transparent conducting electrodes on top and bottom to facilitate current flow. Conventionally used electrodes comprising inorganic compounds like tin-doped indium oxide impose certain limitations. In contrast, conducting polymers can be utilized as low-cost organic transparent conductors. They deliver high conductivity matching that of conventional compounds while enabling fabrication using simple Printing techniques. This allows mass production of flexible solar panels at lower prices.

Furthermore, novel polymers with improved properties stimulate higher solar cell performance. Research aims at developing customized formulations with balanced attributes of transparency, conductivity, flexibility, along with capability to interface effectively with photoactive layers. Success in these endeavors could yield polymer-based electrodes approaching the efficiency of conventional ones. Their use promises to augment power conversion efficiency as well reducing manufacturing expenses considerably.

Solar energy addresses both environmental need as well as energy security issues on a large scale. Widespread deployment depends on making the technology competitive against traditional sources. Conductive polymers as cost-effective substitutes to existing electrode materials assume huge importance in making photovoltaics commercially viable and driving solar power adoption. Their ongoing innovations thus encourage renewable integration to meet global energy demands sustainably.

Market Challenge - Rising Cost of Raw Materials Impacting the Production and Affordability of Conductive Polymers

The rising cost of raw materials used in the production of conductive polymers poses a significant challenge for the market. Important raw materials required such as graphene, carbon nanotubes and polyacetylene have seen substantial price increases in recent years. For example, the price of graphene has nearly doubled over the past five years due to low production volumes and high manufacturing costs. Similarly, polyacetylene production requires costly organic synthesis methods which add to operating expenses. With raw materials accounting for 30-40% of the total manufacturing costs, the rising input prices are squeezing the margins of players. It is becoming difficult for companies to price their conductive polymer products competitively without compromising on profitability. The surging material costs threaten to raise the price levels in the market and reduce affordability for the price-sensitive consumers. Market players need to find ways to drive down costs through innovations in synthesis techniques, improved material yields and developing lower-cost substitutes. However, this remains a challenge providing headwinds for volume growth if the affordability issue is not addressed.

Market Opportunity- Expansion of the Automotive Industry to Create Novel Opportunities for Market Developments

The automotive industry is undergoing a massive transformation with the rise of electric vehicles and autonomous driving technologies. Conductive polymers are increasingly finding numerous applications that leverage their properties of electrical conductivity and lightweight characteristics. For instance, conductive polymers are being widely adopted as electrode materials in lithium-ion batteries to power electric vehicles. Their conductivity and flexibility make them suitable for developing advanced battery materials. Furthermore, conductive polymers play a key role in manufacturing sensors and touchscreens that are crucial for driver-assist and self-driving systems. The surging investment toward next-gen vehicles is driving tremendous demand for lightweight, cost-effective and high-performance materials like conductive polymers. It is estimated that conductive polymer consumption will increase 3-fold in the automotive sector over the next five years. As automakers aggressively ramp up EV production targets, conductive polymers are primed to benefit significantly from this secular growth opportunity in the coming years.

Key winning strategies adopted by key players of Conductive Polymers Market

Focus on Innovation - Conductive polymers are an evolving technology, so continuous innovation is important to stay ahead.

Partnerships and Collaborations – The industry is set to witness robust growth driven by partnerships and collaborations. For example, in 2019 DuPont partnered with Danish company Xintela to collaborate on advances in conductive polymers for printed electronics and biomedical uses.

Target Emerging Applications - Markets like 3D printing, robotics, smart textiles and bioelectronics are growing rapidly. Players are focusing R&D on these domains.

Acquisitions for Technology and Market Access - Buying complementary tech strengthens portfolios and expands reach.

Aggressive Marketing - Successful promotion is key to educating customers and driving demand. For example, at trade shows, Parker Hannifin highlighted how its carbon fiber composite and anisotropic conductive film help smartphone makers make folding devices. This highlighted new opportunities.

The above examples show that innovation, partnerships, targeting emerging domains, strategic M&A and marketing have helped major players strengthen conductive polymer product lines and global presence, giving them leadership positions in growing application markets. Continuous adaptation of such strategies will be critical for players to boost market share going forward.

Segmental Analysis of Conductive Polymers Market

Insights, By Product, Polyacytelene is Projected to Lead with a Remarkable Share in the Coming Years

By Product, Polyacytelene contributes the highest share of the market owing to its unique conductivity properties. Polyacetylene is one of the earliest discovered conductive polymers, having been developed in the 1970s. It shows very high electrical conductivity when doped with halogens or metal salts. This property has allowed it to capture a leading market share compared to other conductive polymer products.

Polyacetylene's conductivity results from its linear conjugated carbon chain structure. The carbon atoms along the backbone alternately form single and double bonds, leaving delocalized pi-electrons that are free to transport charge. When subjected to doping, which involves adding or removing electrons, the pi-electrons become charge carriers responsible for conductivity.

The precise molecular ordering and conjugation provided by polyacetylene's simple structure promote robust electron delocalization and mobilities far surpassing other polymers. This gives it conductivity approaching that of copper at higher dopant levels. No other conductive polymer can match polyacetylene's intrinsic electrical properties.

Its linear-conjugated molecular framework also makes polyacetylene more stable and processable than earlier conductive materials like polypyrrole or polyaniline. It can be melt-processed into strong, conductive films without degradation. This superior stability and compatibility with manufacturing methods have accelerated polyacetylene's adoption in industries.

The outstanding electrical characteristics and material properties derived from polyacetylene's unique molecular structure have cemented its leadership position among conductive polymer products. Continued technical advances are expanding its applications in areas like antistatic coatings, sensors, rechargeable batteries and organic electronic devices.

Insights, By Application, Batteries Are Expected to Grow Remarkably in the Forecast Period

Batteries contributes the highest share of the conductive polymers market owing to its versatile application. Batteries have emerged as the dominant end use sector for conductive polymers due to their growing use in a variety of battery types. Conductive polymers are increasingly employed as electrode materials, improving battery performance and lifetime.

In lithium-ion batteries, polyaniline and polythiophene coated LiCoO2 or LiMn2O4 cathode materials enhance electrical conductivity, improving charge transfer and capacity. Meanwhile, polyacetylene and polypyrrole coatings on silicon or graphite anodes enable them to expand and contract without fracturing during charge/discharge cycles. This extends cycle life significantly.

Conductive polymers also find widespread use in lithium polymer batteries as an integral component of the electrodes. Their high conductivity allows for thinner electrodes and batteries with improved energy densities. Additionally, they alleviate safety issues by regulating ion diffusion and preventing dendrite growth.

In primary batteries like alkaline and zinc-carbon cells, additives like polyaniline improve conductivity between the active materials and current collectors. This boosts power levels and lowers internal resistances. Even emerging battery chemistries leverage conductive polymers. Polypyrrole has shown promise in improving sodium-ion batteries, while PEDOT facilitates ion transport in lithium-sulfur batteries. Due to their versatility in enhancing rechargeable and primary battery technologies, conductive polymers are becoming indispensable battery materials. Their rapid adoption in batteries will ensure this application area drives further market expansion.

Additional Insights of Conductive Polymers Market

The conductive polymers market is experiencing significant growth due to the rising demand for consumer electronics and renewable energy applications. These polymers offer a lightweight, flexible, and cost-effective alternative to metals. Asia Pacific dominates the market, particularly in the production of electronic components and renewable energy adoption, driven by countries like China and India. The automotive industry is also shifting towards lightweight materials for electric vehicles, and conductive polymers are playing a key role in this transition. The market is expected to grow further due to the increasing use of conductive polymers in smart textiles, sensors, and other advanced technologies. However, challenges remain, such as high raw material costs, which could slow adoption in cost-sensitive sectors. The market's future lies in the development of more efficient and environmentally friendly materials, coupled with strong government support for renewable energy and electronic innovation.

Competitive overview of Conductive Polymers Market

The major players operating in the Conductive Polymers Market include 3M Company, Agfa-Gevaert Group, Celanese Corporation, Heraeus Holding, Hyperion Catalysis International, Lehmann & Voss & Co., Parker Hannifin Corp., PolyOne Corporation, Premix Group, RTP Company, The Lubrizol Corporation, Kemet Corporation, Heraeus Holding GmbH, American Dyes Inc. and Rieke Metals.

Conductive Polymers Market Leaders

- 3M Company

- Agfa-Gevaert Group

- Celanese Corporation

- Heraeus Holding

- Hyperion Catalysis International

- Lehmann & Voss & Co.

Conductive Polymers Market - Competitive Rivalry, 2024

Conductive Polymers Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Conductive Polymers Market

The conductive polymers market is experiencing significant growth due to the rising demand for consumer electronics and renewable energy applications. These polymers offer a lightweight, flexible, and cost-effective alternative to metals. Asia Pacific dominates the market, particularly in the production of electronic components and renewable energy adoption, driven by countries like China and India. The automotive industry is also shifting towards lightweight materials for electric vehicles, and conductive polymers are playing a key role in this transition. The market is expected to grow further due to the increasing use of conductive polymers in smart textiles, sensors, and other advanced technologies. However, challenges remain, such as high raw material costs, which could slow adoption in cost-sensitive sectors. The market's future lies in the development of more efficient and environmentally friendly materials, coupled with strong government support for renewable energy and electronic innovation.

Conductive Polymers Market Segmentation

- By Product

- Polyacytelene

- Polyaniline

- Polypyrrole

- Polythiophene

- By Application

- Batteries

- Polymer Capacitor

- Actuators and Sensors

- Solar Energy

- LED Lights

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Conductive Polymers Market?

The Global Conductive Polymers Market is estimated to be valued at USD 5.9 Bn in 2024 and is expected to reach USD 13.1 Bn by 2031.

What will be the CAGR of the Conductive Polymers Market?

The CAGR of the Conductive Polymers Market is projected to be 9.1% from 2024 to 2031.

What are the key factors hampering the growth of the Conductive Polymers Market?

The rising cost of raw materials impacting the production and affordability of conductive polymers and limited adoption in price-sensitive industries due to high production costs are the major factors hampering the growth of the Conductive Polymers Market.

What are the major factors driving the Conductive Polymers Market growth?

The rising demand for consumer electronics due to the increase in miniaturized devices like smartphones and tablets and the adoption of renewable energy, particularly solar panels, which require conductive polymers are the major factors driving the Conductive Polymers Market.

Which is the leading Product in the Conductive Polymers Market?

Polyacytelene is the leading Product segment.

Which are the major players operating in the Conductive Polymers Market?

3M Company, Agfa-Gevaert Group, Celanese Corporation, Heraeus Holding, Hyperion Catalysis International, Lehmann & Voss & Co., Parker Hannifin Corp., PolyOne Corporation, Premix Group, RTP Company, The Lubrizol Corporation, Kemet Corporation, Heraeus Holding GmbH, American Dyes Inc., Rieke Metals are the major players.