Construction Software Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Construction Software Market is segmented By Type (Project Management, Account Management, Quality and Safety, Field Productivity, Others), By Deploym....

Construction Software Market Size

Market Size in USD Bn

CAGR9.2%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 9.2% |

| Market Concentration | High |

| Major Players | Procore, Linarc, Builder Trend, Autodesk Construction Cloud, Raken and Among Others. |

please let us know !

Construction Software Market Analysis

The Global Construction Software Market is estimated to be valued at USD 4.9 Bn in 2024 and is expected to reach USD 9.1 Bn by 2031, growing at a compound annual growth rate (CAGR) of 9.2% from 2024 to 2031. Construction software helps streamline processes and improve collaboration throughout the project lifecycle, helping reduce costs and drive efficiency for contractors and owners.

The construction software market is expected to witness significant growth over the forecast period. This can be attributed to growing infrastructure development activities worldwide and the increasing adoption of cloud-based technologies and Building Information Modeling (BIM) solutions across the construction industry. Construction firms are using specialized software to automate workflows, gain real-time visibility, and simplify documentation and handovers. This is expected to drive continued demand for construction software.

Construction Software Market Trends

Market Driver - Rising Advancements in Smart Cities and Urbanization

As more and more people are moving to urban areas, the concept of smart cities has taken off rapidly in past few years. Smart cities utilize a variety of sensors, data collection tools and integrated technologies to maximize resource efficiency, reduce costs and enable better planning and management across various functions within a city. Construction sector plays a vital role in establishing smart infrastructure and building capabilities required for smart cities. With rising focus on initiatives like intelligent transport systems, smart energy grids, e-governance, environmental monitoring and adaptive infrastructure, construction companies are under increasing pressure to leverage latest construction technologies and software to cope up with the complex requirements of smart cities. Advanced technologies such as IoT, augmented reality, cloud computing and big data are being integrated into construction management and planning tools to improve productivity, coordination and quality control in large smart city projects.

Constructing smart buildings, transport hubs, utilities and public amenities involve handling enormous amount of project data from design to completion which requires robust and automated construction management systems. Therefore, software that helps streamline operations, oversee subcontractor coordination and enable real-time progress tracking across spatially distributed smart city projects have seen escalating demand from urban infrastructure developers. Intelligent software tools that facilitate multi-stakeholder collaboration, maintain design compliance and optimize resource allocation over the entire lifecycle of a smart city are strengthening the business case for construction companies investing in digital transformation of their processes. While still at a nascent stage, advancements in smart cities across major countries indicate strong potential for construction software market specifically engineered to deal with complexities introduced by intelligent urbanization initiatives globally.

Market Driver - Increased Demand for Better Construction Management Tools and Automation

Construction industry has always grappled with issues related to project delays, cost overruns, quality discrepancies and inefficient resource management attributing largely to fragmented nature of operations and lack of integrated systems. However, growing awareness about potential of latest digital technologies as well as client pressures to adopt advanced practices have compelled construction firms to seek innovative software driven solutions to enhance performance. In addition, shortage of skilled labor aggravated by aging workforce has accelerated adoption of tools enabling work automation, remote monitoring and augmented operations. Construction project management software equipped with features like 4D BIM integration, predictive analytics, damage detection, automated scheduling, cash flow forecasting and remote tracking are helping stakeholders achieve better outcomes. Meanwhile, construction firms are also leveraging cloud-based solutions for collaborative documentation, real-time progress updates and paperless transactions across project sites. Focus on automation is increasing with robotics, AI and sensor driven systems finding applications in activities like 3D printing of structure components, autonomous vehicles for material transportation, drones for surveying and robotic inspection bots for safety checks. Such automated approaches promise enhanced safety, standardized quality and accelerated timelines. With growing complexity and scale of modern construction undertakings, sophisticated management tools that optimize resource use through automation and aid data backed decision making have become indispensable for maintaining competitiveness in the industry. Their ability to minimize delays, curb job site errors and maximize overall workflow efficiency is fueling significant demand and market opportunities.

Market Challenge - High Cost and Time of Deployment of Construction Software

The high cost and lengthy implementation time required for construction software solutions presents a significant challenge for adoption in the industry. Full-featured construction management platforms with modules for scheduling, budgeting, procurement, project collaboration and more require substantial upfront investments. Integrating these systems also takes time as existing business processes and data need to be migrated. This level of cost and disruption can be difficult for smaller construction firms and contractors to absorb. Additionally, the return on investment for software is not always immediately clear and quantifiable. Companies may be hesitant to dedicate extensive resources without guaranteed improvements in efficiency, cost savings or other measurable benefits. Overall, the high price tag and time commitment associated with deploying new construction software limits its adoption, particularly among smaller players.

Market Opportunity: Emergence of New Technologies like AI, Virtual Reality, and 3D Printing in Construction

The increasing application of technologies such as artificial intelligence, virtual reality and 3D printing within the construction industry presents significant opportunities for software vendors. New platforms that leverage AI have the potential to automate routine tasks, gain insights from massive amounts of project data, and enhance project management, scheduling and risk assessment. Applications of virtual and augmented reality allow contractors to visualize designs in 3D, flag and resolve issues virtually before construction begins. In addition, 3D printing technologies enable on-site fabrication of customized construction components, reducing waste. Construction software companies who develop solutions that integrate these emerging technologies stand to gain competitive advantages. They can offer contractors productivity improvements, cost reductions and safety benefits that help boost revenue and provide stronger returns on software investments. This makes their value proposition during the sales process much more compelling.

Key winning strategies adopted by key players of Construction Software Market

Cloud-Based Delivery Models: Many major construction software vendors like Autodesk, Oracle, and Trimble have shifted their software offerings to cloud-based models in the last 5 years. This allows construction firms easier access to software from any location and mobile devices. It also reduces upfront capital costs for customers.

Focus on Specialized Solutions: Players are focusing on building specialized solutions targeted at key areas like project management, cost estimation, scheduling, and document management. For example, Sage offers industry-specific solutions for general contractors, special trade contractors, and owners/developers. Oracle has separate construction ERP software for general contractors, subcontractors and owners. This targeted approach helps companies gain domain expertise and customer loyalty in their segment.

Bolt-on Acquisitions: Major vendors pursue strategic acquisitions to expand their product portfolio and capabilities. For instance, in 2020, Autodesk acquired Pype, a Construction Visualization platform startup. This helps Autodesk offer an end-to-end BIM and construction visualization solution. Similarly, Sage acquired Aconex, a leading web-based collaboration platform in 2018 to strengthen its construction project management offerings. Nearly 50% of Autodesk's revenue now comes from acquisitions done in last five years.

Partner Ecosystems: Companies invest in robust partner/alliance programs to enhance implementation capabilities. For example, Trimble has a global partner network of over 1500 firms to assist customers across 150+ countries. Partners provide localized services like customization, implementation, training and support. Partnerships also help gain customer access through mutual referrals.

Segmental Analysis of Construction Software Market

Insights, By Type, Collaborative Technologies Fuel Project Management Growth

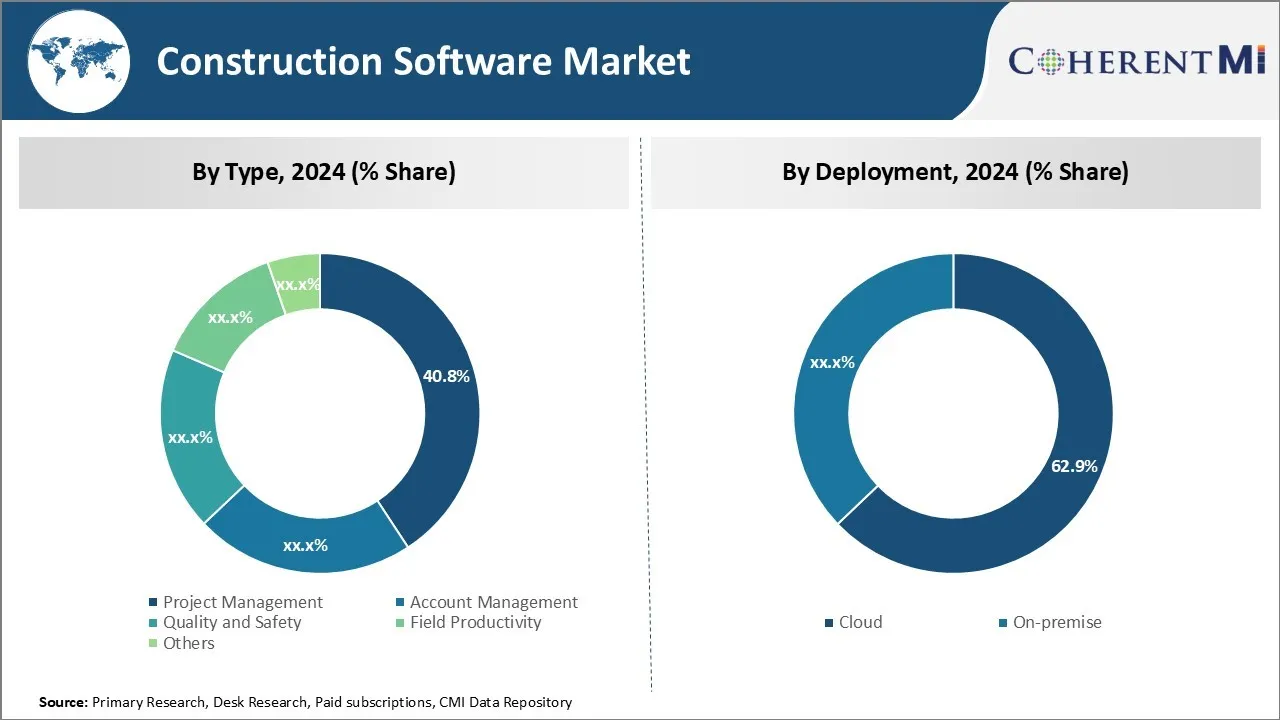

By Type, Project Management contributes the highest share of the market owning to its capabilities to streamline project workflows and facilitate collaboration among project stakeholders. Project Management software allows construction firms to effectively plan, coordinate and monitor all aspects of a project from its inception to completion. It helps centralize communication and documentation, track costs and schedules, manage vendors and supply chains. This has become increasingly important as construction projects involve coordination between multiple teams and remote work has become more prevalent.

The use of collaborative tools within Project Management solutions is a key driver of uptake. Features like central document repositories, real-time communication feeds and issue tracking systems promote engagement and information sharing across geographical and organizational boundaries. They minimize redundant work and ensure all parties have visibility into project milestones and deadlines. The integration of mobile apps further aids in capturing field updates and distributing information on-the-go. Such collaborative functionality has boosted productivity and cross-functional coordination on projects of all sizes.

Insights, By Deployment, Cloud Deployment Expands Access to Medium Enterprises

In terms of By Deployment, Cloud contributes the highest share of the market owing to the ease of access and minimal upfront costs it provides. Construction firms, especially medium-sized ones, are increasingly adopting cloud-based solutions as they do not require large capital investments in hardware and infrastructure. Cloud software can be accessed from any internet-connected device, allowing for flexible remote working models. They also ensure automatic updates and virtual scaling of resources as per changing project needs.

The availability of free trials and pay-as-you-go pricing has made cloud-hosted construction software reachable for even small to medium enterprises. This is stimulating greater experimentation and driving first-time purchases in this segment. Vendors are also offering migration services to help transition legacy on-premise implementations onto the cloud. The scalable pay-as-you-grow cloud model perfectly matches the variable project demands of medium enterprises. This, along with the compelling economic value proposition, is propelling their migration to cloud-based construction management suites.

Insights, Large Enterprise Specialized Requirements Drive Customized Deployments

By Organization, Large Enterprise contributes the highest share of the market owing to their specialized deployment needs arising from the scale and complexity of operations. Large construction firms handle diverse project portfolios spanning multiple geographies simultaneously. They require intrinsically customized and highly configurable solutions that can oversee diverse workload types and business processes under a single platform.

Vendors catering to large enterprises focus on delivering highly customizable and rules-driven software that can be tailored for unique workflows. Features like localized language interfaces, territorial-specific regulatory integrations and configurable business rules and access privileges allow adapting solutions as per the specialized needs of individual business segments or regional project sites. The implementations also involve tight integration with existing on-premise ERP and back-office systems.

Large enterprises appreciate vendors who can guarantee scalability, reliability and 24/7 support for their global operations. This drives them to choose configurable platforms that offer high degrees of flexibility and control over the system while reducing dependence on external support staff. Tailored solutions and robust support services are crucial determinants for software selection among top tier construction firms.

Additional Insights of Construction Software Market

The construction software market is expanding rapidly due to the increasing need for effective project management tools that help streamline construction operations, enhance decision-making, and improve efficiency. The rising urbanization and global demand for residential and commercial buildings have created a strong market for construction management software. The market is witnessing a transformation due to technological advancements such as AI, virtual reality, 3D printing, and digitization, all aimed at improving productivity and ensuring better project outcomes. Additionally, the adoption of cloud-based solutions is revolutionizing the construction sector, as real-time data and collaboration between different teams improve construction processes significantly. Large enterprises are driving this trend, with significant demand for large-scale construction projects across the globe. The growing focus on sustainability and smart cities is also fueling market growth, as governments and private entities look to integrate smart technologies for cost-effective, eco-friendly construction solutions.

Competitive overview of Construction Software Market

The major players operating in the Construction Software Market include Procore, Linarc, Builder Trend, Autodesk Construction Cloud, Raken, Trimble Inc, Jonas Construction Software Inc, Esticom Inc, Construct Connect, Corecon Technologies, Inc, CMiC and Fieldwire.

Construction Software Market Leaders

- Procore

- Linarc

- Builder Trend

- Autodesk Construction Cloud

- Raken

Construction Software Market - Competitive Rivalry, 2024

Construction Software Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Construction Software Market

- In August 2024, Hyphen Solutions launched a new website hub for home builders and suppliers, enhancing efficiency and innovation in residential construction projects.

- In September 2024, KPA launched a safety enhancement feature for construction sites, focusing on improving real-time efficiency and promoting a robust safety culture.

- In July 2024, Trimble released a new software suite, Trimble Unity, for lifecycle management of public infrastructure and capital projects, focusing on workflow connectivity.

Construction Software Market Segmentation

- By Type

- Project Management

- Account Management

- Quality and Safety

- Field Productivity

- Others

- By Deployment

- Cloud

- On-premise

- By Organization

- Large Enterprise

- Medium Enterprise

- Small Enterprise

- By Application

- General Contractors

- Building Owners

- Architects and Engineers

- Sub-contractors

- Specialty Contractors

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Construction Software Market?

The Global Construction Software Market is estimated to be valued at USD 4.9 Bn in 2024 and is expected to reach USD 9.1 Bn by 2031.

What will be the CAGR of the Construction Software Market?

The CAGR of the Construction Software Market is projected to be 9.2% from 2024 to 2031.

What are the major factors driving the Construction Software Market growth?

The rising advancements in smart cities and urbanization and increased demand for better construction management tools and automation are the major factors driving the Construction Software Market.

What are the key factors hampering the growth of the Construction Software Market?

The high cost and time of deployment of construction software and fluctuating accuracy in project management resulting in delays are the major factors hampering the growth of the Construction Software Market.

Which is the leading Type in the Construction Software Market?

Project Management is the leading Type segment.

Which are the major players operating in the Construction Software Market?

Procore, Linarc, Builder Trend, Autodesk Construction Cloud, Raken, Trimble Inc, Jonas Construction Software Inc, Esticom Inc, Construct Connect, Corecon Technologies, Inc, CMiC, Fieldwire are the major players.