Decorative Concrete Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Decorative Concrete Market is segmented By Product Type (Stamped Concrete, Stained Concrete, Concrete Overlays, Polished Concrete, Colored Concrete, O....

Decorative Concrete Market Size

Market Size in USD Bn

CAGR5.42%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 5.42% |

| Market Concentration | High |

| Major Players | LafargeHolcim Ltd., BASF SE, RPM International Inc., Sika AG, The Sherwin-Williams Company and Among Others. |

please let us know !

Decorative Concrete Market Analysis

The decorative concrete market is estimated to be valued at USD 18.49 Bn in 2024 and is expected to reach USD 26.76 Bn by 2031, growing at a compound annual growth rate (CAGR) of 5.42% from 2024 to 2031. The decorative concrete market is expected to witness positive growth owing to rapid urbanization, rising disposable income, and increasing demand for aesthetically appealing construction finishes.

Decorative Concrete Market Trends

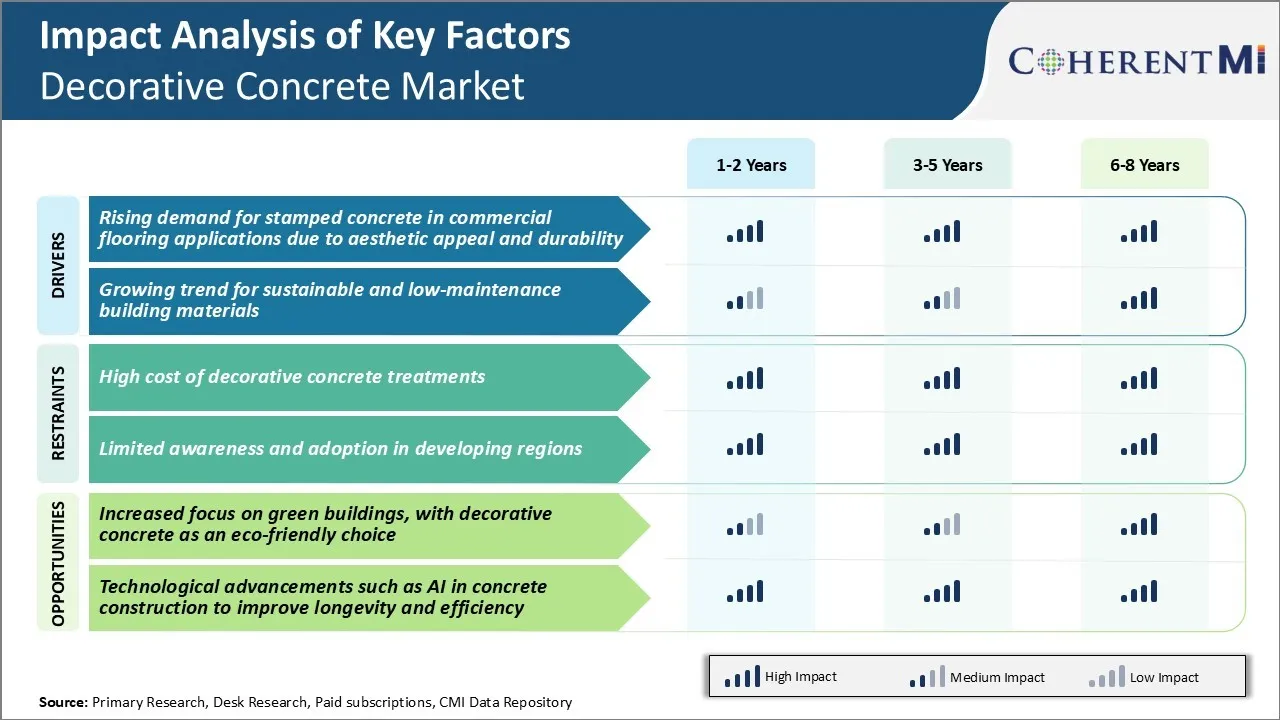

Market Driver - Rising Demand for Stamped Concrete in Commercial Flooring

Stamped concrete has been gaining significant popularity in commercial flooring applications over the recent years. The major reason behind this increasing adoption of stamped concrete is its aesthetic appeal. Stamped concrete allows architects and commercial building owners to create concrete floors that resemble natural materials like stone, wood or tile but at a much lower cost. It is also extremely durable which has further boosted its acceptance in commercial flooring projects.

Another key factor driving the popularity of stamped concrete in commercial applications is its versatility in design and application. Their monolithic pouring also means smooth, seamless floors without gaps or voids where dirt can accumulate. Such flexible design options along with inherent versatility in applications have made stamped concrete a go-to solution for multifaceted commercial construction projects.

Overall, rising focus on enhancing aesthetics, improving infrastructure lifespan through sustainable materials, and achieving design flexibility at competitive costs will drive growth of the decorative concrete market.

Market Driver - Growing Trend for Sustainable and Low-Maintenance Building Materials

In recent times, sustainability has become a core consideration across various industries including construction. At the same time, increasing construction and real-estate costs have accentuated the need for durable, long-lasting building materials needing lesser maintenance and repair expenses over the long run. Decorative concrete owing to its inherent properties addresses both these demands quite effectively.

Being comprised mostly of locally available materials like cement, sand and water; concrete production involves significantly lower emissions compared to non-local substitutes like ceramic tiles, polished stones etc. This makes it a much greener alternative that also supports local economics.

Decorative finishes like stamped or stained patterns add years to the lifespan of concrete through their resilient hardened layers protecting against weathering and damage. Very minimal, if any, repair work or replacements are needed during the entire building lifecycle. This translates to considerable savings on maintenance man-hours and disposal of replaced components over time. Consequently, this will prove to be an important catalyst in growth of the global decorative concrete market.

Market Challenge - High Cost of Decorative Concrete Treatments

One of the key challenges faced by the decorative concrete market is the high cost associated with decorative concrete treatments. Decorative concrete options such as stained, stamped, or dyed concrete can significantly increase the cost of a project compared to traditional bare concrete. The additional materials, labor and specialized tools, and equipment required for decorative concrete treatments drive up prices.

Moreover, many decorative concrete techniques such as acid staining are complex and require experience to achieve high quality results, again contributing to higher costs. The expense of decorative concrete can limit its applicability especially for residential projects where budgets are tighter compared to commercial construction.

Contractors also charge premium pricing for decorative concrete work due to increased complexities. The high relative cost of decorative concrete compared to standard concrete poses a challenge for its widespread adoption in the construction industry.

Market Opportunity - Increased Focus on Green Buildings, with Decorative Concrete as an Eco-Friendly Choice

One of the key opportunities for growth in the decorative concrete market is the increased emphasis on sustainable and green construction globally. With growing environmental regulations and consumer demand for green buildings, companies and individuals are looking to utilize more eco-friendly materials in new projects. Decorative concrete is an attractive choice as it is made from cement which is a naturally occurring and largely recycled material.

Concrete production also emits fewer greenhouse gases than alternative flooring materials such as wood, vinyl or carpet. Additionally, decorative concrete options provide longevity and require little maintenance as they are highly durable. This reduces replacement needs and prevents additional resource consumption over the lifespan of a project.

Decorative concrete techniques allow creative expression while having minimal environmental impact. The green building movement has been growing, driven by regulatory tailwinds as well as consumer sentiments. Thereby, decorative concrete is well positioned to garner greater interest from builders and architects aiming to certify projects as green. This will create lucrative opportunities for players in the decorative concrete market.

Key winning strategies adopted by key players of Decorative Concrete Market

Product innovation: Continuous product innovation has helped players gain an edge over competitors and capture more market share. For example, BASF launched a new line of stamped concrete overlays and stains in 2017 that are more durable and easier to install.

Strategic acquisitions: Acquiring complementary businesses has allowed players to expand their portfolio and capabilities. In 2020, CEMEX acquired Sakrete, a leading brand in concrete accessories and admixtures in North America.

Focus on green products: With growing emphasis on sustainability, players have introduced eco-friendly decorative concrete products. For example, Quartz Corp launched a line of stamped and stained concrete goods with lesser carbon footprint in 2019. They saw nearly 15% increase in sales that year as their green credentials resonated well with customers.

Superior branding and marketing: Aggressive branding and marketing campaigns have boosted brand awareness and trials. For example, 3M invested heavily in social media marketing of its new stains range in 2021 and gained 400 basis points increase in market share within 6 months as a result.

Segmental Analysis of Decorative Concrete Market

Insights, By Product Type: Stamped Concrete's Distinctive Aesthetics Drive Demand

In terms of product type, stamped concrete contributes 35.7% share of the decorative concrete market in 2024, owning to its unique designs and patterns that add visual appeal to spaces.

Homeowners and builders increasingly favor stamped concrete for floors because of the variety of style options it offers. From brick and stone motifs to customized logos or images, stamped concrete allows customers to personalize the look of their homes or buildings. This distinctive quality makes it a popular choice for driveways, patios, pool decks, and other outdoor areas. The longevity of stamped concrete is also appreciated as its stamped patterns withstand weathering better than other flooring alternatives.

Moreover, installing stamped concrete does not require specialized skills and presents cost savings compared to laying natural stone or tile. These factors drive the continued growth momentum of the stamped concrete segment within the decorative concrete market.

Insights, By Application: Floors Drive Growth in Application Segment

In terms of application, floors account for 40.3% share of the decorative concrete market in 2024, due to its widespread usage. Whether residential or commercial, well-finished and attractively designed floors are an essential element in enhancing the overall aesthetic appeal and visual dynamics of indoor spaces. Decorative concrete options like stained, polished, and colored concrete are ideal for flooring as they offer durability as well as rich, multifaceted looks. Their hard-wearing properties make them suitable for withstanding foot traffic in high use areas.

Moreover, decorative concrete floors require very little maintenance over time. This has boosted their acceptance in applications ranging from entranceways and grand lobbies to patios, garages and basements. Easy installation and multi-purpose functionality continue to propel the floors segment as a major growth driver within decorative concrete applications.

Insights, By End Use: Residential Sector Leads through Innovation

In terms of end use, residential segment contributes the highest share of the decorative concrete market on account of constant innovation. Homeowners continually seek new flooring, wall and outdoor décor ideas to reflect their unique tastes and personalities. Decorative concrete meets this demand through its bespoke design options and malleability. It lends an interior or exterior space a personalized high-end ambience. Its durability and eco-friendliness have also increased its popularity in residential construction.

Meanwhile, aspiring do-it-yourself homeowners are increasingly experimenting with decorative concrete techniques. This is improving accessibility and further raising residential sector demand. As innovative new products and customizable techniques emerge, the residential end use segment leads the way, sustaining its momentum within the decorative concrete market.

Additional Insights of Decorative Concrete Market

- The Europe region in decorative concrete market is valued at USD 7.77 billion in 2024 and projected to grow at a CAGR of 5.52%.

- Cement production in 2023 shows China as the largest producer, followed by India and Vietnam.

- Adoption in Luxury Housing: There's a growing trend of using decorative concrete in luxury residential projects for its durability and design flexibility.

- Commercial Spaces Transformation: Retail and hospitality sectors are increasingly using decorative concrete to enhance the aesthetic appeal of floors and walls.

- Sustainability Focus: Approximately 30% of new construction projects are incorporating decorative concrete due to its sustainable properties.

Competitive overview of Decorative Concrete Market

The major players operating in the decorative concrete market include LafargeHolcim Ltd., BASF SE, RPM International Inc., Sika AG, The Sherwin-Williams Company, PPG Industries, Inc., Akzo Nobel N.V., Huntsman Corporation, Boral Limited, CEMEX, S.A.B. de C.V., HeidelbergCement AG, Fosroc International Ltd, RPM Belgium Vandex, Parchem Construction Supplies Pty. Ltd., The Euclid Chemical Company, The Dow Chemical Company, Ultratech Cement Ltd, MAPEI Corporation, 3M Company, Italcementi Group, and Mapei S.p.A..

Decorative Concrete Market Leaders

- LafargeHolcim Ltd.

- BASF SE

- RPM International Inc.

- Sika AG

- The Sherwin-Williams Company

Decorative Concrete Market - Competitive Rivalry, 2024

Decorative Concrete Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Decorative Concrete Market

- In July 2024, AJAX Engineering introduced Concrete GPT, an AI-driven platform designed to assist professionals in the concrete and construction sectors. This platform offers expert-validated technical information, including market insights, innovations, and regulatory updates.

- In March 2024, Geostone, Holcim Australia's decorative concrete brand, introduced the South East Queensland Range. This collection features 24 new decorative concrete colors, developed in collaboration with local architects, builders, and installers.

- In February 2024, Nuvoco Vistas Corp. Ltd., India's fifth-largest cement group, inaugurated its second Ready-Mix Concrete (RMX) plant in Patna, named Patna-II. Located at Ranipur Milki Chak, Begampur bypass, this facility aims to meet the growing construction demands in the region.

- In December 2023, Generational Equity facilitated the sale of Power Rental & Sales, LLC to Pearlman Group, a portfolio company of The Stephens Group. This acquisition is expected to enhance Pearlman Group's market capabilities in the decorative concrete supplies and equipment sector.

Decorative Concrete Market Segmentation

- By Product Type

- Stamped Concrete

- Stained Concrete

- Concrete Overlays

- Polished Concrete

- Colored Concrete

- Others

- By Application

- Floors

- Walls

- Driveways & Sidewalks

- Patios

- Others

- By End Use

- Residential

- Non-residential

- Commercial Buildings

- Industrial Facilities

- Infrastructure Projects

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the decorative concrete market?

The decorative concrete market is estimated to be valued at USD 18.49 Bn in 2024 and is expected to reach USD 26.76 Bn by 2031.

What are the key factors hampering the growth of the decorative concrete market?

High cost of decorative concrete treatments and limited awareness and adoption in developing regions are the major factors hampering the growth of the decorative concrete market.

What are the major factors driving the decorative concrete market growth?

Rising demand for stamped concrete in commercial flooring applications due to aesthetic appeal and durability and growing trend for sustainable and low-maintenance building materials are the major factors driving the decorative concrete market.

Which is the leading product type in the decorative concrete market?

The leading product type segment is stamped concrete.

Which are the major players operating in the decorative concrete market?

LafargeHolcim Ltd., BASF SE, RPM International Inc., Sika AG, The Sherwin-Williams Company, PPG Industries, Inc., Akzo Nobel N.V., Huntsman Corporation, Boral Limited, CEMEX, S.A.B. de C.V., HeidelbergCement AG, Fosroc International Ltd, RPM Belgium Vandex, Parchem Construction Supplies Pty. Ltd., The Euclid Chemical Company, The Dow Chemical Company, Ultratech Cement Ltd, MAPEI Corporation, 3M Company, Italcementi Group, and Mapei S.p.A. are the major players.

What will be the CAGR of the decorative concrete market?

The CAGR of the decorative concrete market is projected to be 5.42% from 2024-2031.