Electrical Appliances Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Electrical Appliances Market is segmented By Product (Refrigerator, Entertainment Appliances, Cooking Appliances, Washing Appliances), By Operation (A....

Electrical Appliances Market Size

Market Size in USD Bn

CAGR9.2%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 9.2% |

| Market Concentration | High |

| Major Players | Samsung Electronics, LG Electronics, Panasonic, Haier Group, Whirlpool Corporation and Among Others. |

please let us know !

Electrical Appliances Market Analysis

The Global Electrical Appliances Market is estimated to be valued at USD 611.1 Bn in 2024 and is expected to reach USD 1,341.3 Bn by 2031, growing at a compound annual growth rate (CAGR) of 9.2% from 2024 to 2031. Washing machines, dryers, dishwashers, refrigerators and other small appliances like fans are witnessing steady demand from households and commercial establishments across the world.

The market is expected to witness positive growth over the forecast period due to rising incomes, growth of the middle- class population globally, and increasing electricity access mainly in developing regions. Furthermore, innovation and development of energy efficient products suitable for smart homes will continue to present lucrative opportunities for manufacturers. However, high initial costs and presence of low-cost alternatives in certain product segments may restraint market growth.

Electrical Appliances Market Trends

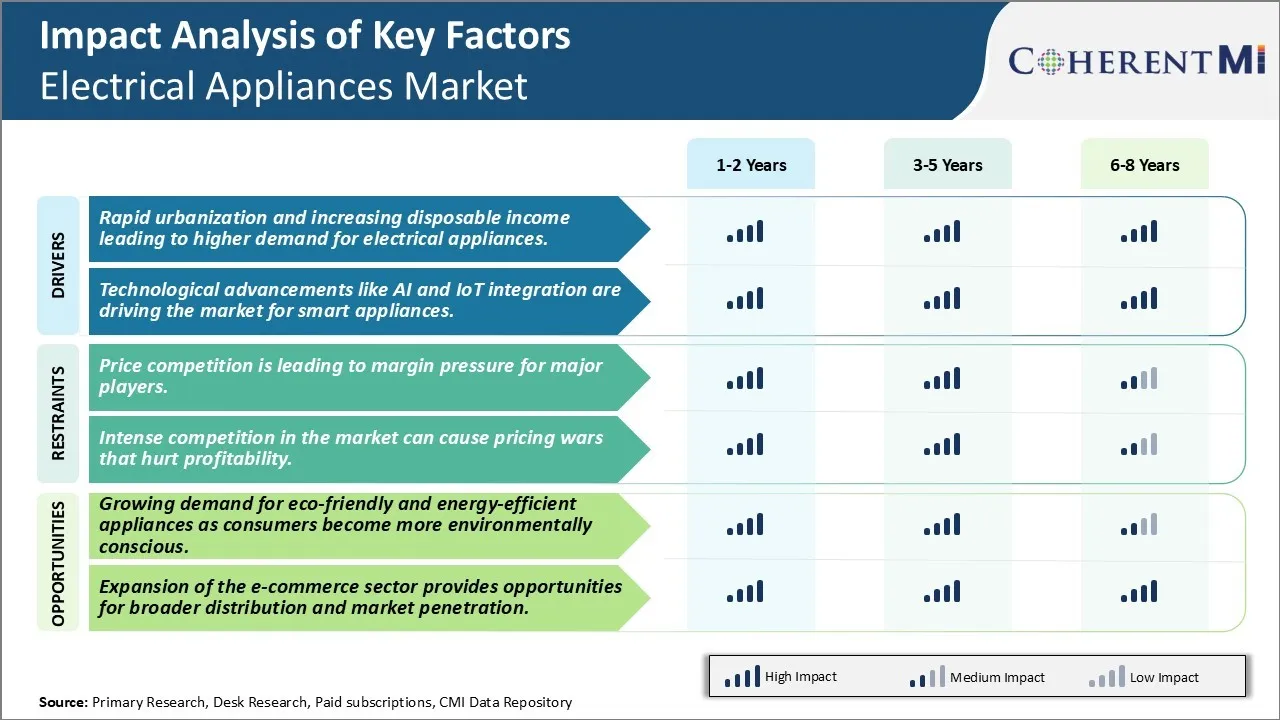

Market Driver - Rapid Urbanization and Increasing Disposable Income Leading to Higher Demand for Electrical Appliances

As population shift from rural to urban areas across developing nations, hundreds of millions now live in densely populated cities. With urbanization comes higher incomes on average, exposure to new trends, and evolving needs that traditional rural life did not require. Cities concentrate commerce and industry, which has created wealth and a burgeoning middle class in countries like India, Indonesia, and others.

This massive urbanization and economic mobility are playing a pivotal role in transforming the market for electrical appliances. Where households once made do with basic necessities, more city dwellers now have additional disposable income to spend on appliances that make daily life and tasks more convenient. Features like washing machines, air conditioners, blenders and other small appliances are in higher demand as quality of life improves alongside incomes.

Those new to city life especially seek out appliances that allow more free time. Time that may have been spent manually washing dishes or clothes, or cooling homes naturally, can now be reallocated thanks to electric alternatives. Youth entering the workforce also have new appliances to simplify home management after long days. Urban nuclear families typically live in smaller spaces too, making appliances that integrate multiple functions especially attractive.

Mass production and standardized parts have further lowered appliance costs over time as brands are offering customized products to cater to consumer needs. Government schemes in nations like India have also helped boost rural electrification, extending these new lifestyles and product exposures deeper into the countryside. As long as urbanization continues shifting population and incomes rise overall, the steady sales growth of electrical appliances will very likely continue apace. New first-time appliance owners fuel this market, alongside routine replacements of aging models.

Market Driver - Technological Advancements Catalyze Smart Appliance Growth

Connectivity and artificial intelligence are increasingly embedded into the design of home appliances. Where appliances were once purely functional machines, new "smart" versions offer game-changing conveniences through internet integration. Features now possible include remote monitoring and control of appliances via mobile apps. Voice activation through virtual assistants like Alexa or Google Home allow for hands-free operation as well. These smart capabilities are driving major upgrades in the market as consumers welcome the newfound ease and insights. Linking devices introduces the ability to check on appliance status from anywhere, troubleshoot issues remotely, or schedule operations from afar. Families stay in close contact regardless of location. Safety too is enhanced through notifications of operations like unattended drying cycles finishing.

Artificial intelligence unlocks even more potential through machine learning over time. Refrigerators can track purchase history to suggest replacement items before they're depleted, while oven cameras help guide novices through recipes. Self-diagnostics and predictive maintenance assist in repairs. As appliances glean usage data, they'll offer increasingly personalized experiences tailored to each household. Younger tech-savvy customers especially show stronger demand for these smart functions versus basic units.

Early adoption challenges like high costs and technical learning curves are steadily improving as more universal connectivity standards emerge. Appliance makers dedicate major R&D to these features, helping drive innovations that maintain their edge against new tech-focused entrants. Existing brands have the production know-how and service networks to support smart lines long-term as well. Barring unforeseen events, it appears technological integration will continue radicalizing the appliance sector and pushing updates to even traditional product lines. Connected, intelligent functions represent a vision of the future that vendors race towards.

Market Challenge - Price Competition Is Leading to Margin Pressure for Major Players

Price competition in the electrical appliances market has been intense over recent years as major players fight for market share. With products becoming increasingly commoditized and buyers able to easily compare prices online, maintaining margins has become a significant challenge. Brand loyalty has declined as consumers focus more on getting the lowest prices. This has put tremendous pressure on the traditionally high-margin appliance manufacturers.

In order to compete on price, many companies have moved some manufacturing to lower-cost regions or implemented cost-cutting measures in their supply chains. However, with competition also pursuing these strategies, the margins gains have been minimal. Some players have even engaged in price wars by heavily discounting products below cost to grab short-term sales. While gaining customers in the short-run, this is damaging for profits. With e-commerce players also entering the market with ultra-competitive prices, the margin pressure looks set to continue intensifying in coming years. This poses a serious threat to the profitability and long-term viability of incumbent brands that have relied on their goodwill rather than being pure price-drivers. Finding innovative ways to effectively manage costs while also providing value to customers will be critical for the major players.

Market Opportunity: Demand for Energy-efficient and Eco-Friendly Appliances to Create Novel Opportunities in the Near Future

There is a growing demand for eco-friendly and energy-efficient appliances as consumers become more environmentally conscious. Buyers are increasingly interested in products that are sustainable, conserve resources and help reduce their environmental footprint. Awareness of issues like climate change has increased interest in "green" attributes and selecting appliances with energy-saving labels or certifications. This presents a major opportunity for firms to appeal to this socially responsible segment of customers.

Companies that leverage this consumer trend by developing eco-friendly products ahead of regulations can gain an edge over competitors and build brand reputation. Features like reduced power consumption, items made using recycled materials, longer product lifespans and sustainable packaging can all differentiate offerings in the market. Moving swiftly to address this opportunity also mitigates potential risks from future policy moves to curb carbon emissions and energy usage. The brands that successfully adapt to promote their greener credentials are likely to secure a loyal customer base willing to pay slightly premium prices for sustainability. Overall, the demand shift towards eco-appliances opens up a profitable market avenue, if captured early through innovation.

Key winning strategies adopted by key players of Electrical Appliances Market

Product Development: Key players in the electrical appliances market such as Samsung, LG, Whirlpool, and others have focused on continuous innovation and new product development to stay ahead of competition. For example, in the last 5 years, Samsung has launched multiple iterations of its flagship refrigerator models with improved features such as larger capacity, better cooling performance, Internet of Things connectivity. It has also introduced new categories such as convertible refrigerators to cater to evolving consumer needs. Regular product refreshment helps Samsung retain its leadership position in the market.

Branding: Companies have also invested heavily in branding and marketing. Whirlpool's 'sense and care' campaign highlighting energy efficiency and customized programs struck a chord with consumers. It led to 18% rise in sales for its front load washing machines in 2018. Earlier, LG's zero gap technology in refrigerators which allows more usable storage space was heavily promoted. This helped LG more than double its refrigerator market share from 10% in 2014 to 25% in 2017.

Strategic Partnerships: Partnerships and strategic acquisitions have also aided growth. In 2020, Haier acquired General Electric's appliance division, gaining access to GE's established brand and expanding its presence in the US market, the largest globally. This acquisition enabled Haier to become the No.1 major appliance manufacturer worldwide. Similarly, BSH Home Appliances (which owns Bosch and Siemens) formed a joint venture with Fisher & Paykel in 2018 to manufacture and distribute premium kitchen and laundry appliances across regions.

Through adoption of the above strategies focused on innovation, marketing and strategic partnerships at the right time, key players have seen immense success in expanding market share and leading industry growth. Regular product and campaigns supported by credible data have helped them make the right connect with target customers.

Segmental Analysis of Electrical Appliances Market

Insights, By Product, Convenience and Storage Space Drive Refrigerator Sales

By Product, Refrigerator is expected to contribute 40.4% in 2024 owing to consumers prioritizing convenience and optimization of storage space in their kitchens. Refrigerators allow busy households to efficiently store a variety of perishable and non-perishable items from groceries to leftovers. Their internal organization with adjustable shelves and drawers makes it easy to separately keep foods like vegetables, fruits, snacks and beverages. Larger refrigerator models provide ample room for weekly shopping whereas smaller versions suit requirements of individuals or couples. Beyond basic cooling and preservation, newer refrigerator designs incorporate features such as adjustable temperature zones, internal water dispensers and ice makers for added usefulness. Their ability to seamlessly fit under kitchen counters or into designated nooks makes them highly space-efficient appliances. Rising health-consciousness also increases demand as refrigerators help buyers keep track of expiration dates and consume fresh ingredients on a daily basis.

Insights, By Operation, Effortless Convenience Leads Automatic Appliances Sales

By Operation, Automatic appliances are expected to contribute 53.2% in 2024 as they offer unparalleled convenience by completing tasks with minimal human intervention. Automatic washing machines have revolutionized laundry work by directly sensing load weight and composition to select optimal wash cycles. Front-loading style allows hassle-free large loads of clothes, linens or other fabrics in one go. Similarly, automatic dishwashers deeply clean utensils, crockery and cutlery using installed detergent dispensers and optimized spray arm movements. Busy homemakers appreciate how they efficiently clean up after meals and parties. Automatic air-conditioners maintain user-set temperatures through thermostat control regardless of outdoor weather changes. Their scheduled on-off timers make it easy to cool homes just before arrival.

Insights, By Distribution Channel, Seamless Online Shopping Boosts Multi-Category Appliance Sales

By Distribution Channel, Online sales contribute the highest market share as it empowers buyers with robust research capabilities and doorstep delivery convenience from virtual storefronts. Comprehensive product information like specifications, reviews and comparison tools help customers shortlist options as per their unique needs. Online marketplaces aggregate appliances from all major brands, thereby simplifying multi-vendor exploration. Cashback offers, discount deals and easy return policies further enhance the value proposition. Contactless payments eliminate waiting time at cash counters. Consumers in remote areas also gain accessibility to standard or specialized appliances unavailable locally. Mobile apps enable on-the-go shopping and track orders end-to-end. During pandemic, online emerged as a safe channel minimizing infection risk from crowded retail outlets. Its innovative customer experiences will continue expanding the online electronics and appliances consumer base nationwide.

Additional Insights of Electrical Appliances Market

The global electrical appliances market is experiencing strong growth driven by factors like rapid urbanization, technological advancements, and the rise of smart home devices. Consumers are increasingly adopting automated and IoT-enabled appliances that enhance comfort, efficiency, and convenience. The market is witnessing significant growth in Asia Pacific, where a rising middle-class population is leading to increased demand for smart and energy-efficient appliances. Meanwhile, challenges like intense price competition are affecting profit margins, but opportunities exist in the development of eco-friendly products, aligning with global sustainability trends. Key players like Samsung, LG, and Panasonic are at the forefront of innovation, investing heavily in R&D to create more sustainable, smart, and efficient appliances.

Competitive overview of Electrical Appliances Market

The major players operating in the Electrical Appliances Market include Samsung Electronics, LG Electronics, Panasonic, Haier Group, Whirlpool Corporation, Midea Group, Gree Electric Appliances, Koninklijke Philips, Robert Bosch GmbH and Electrolux AB.

Electrical Appliances Market Leaders

- Samsung Electronics

- LG Electronics

- Panasonic

- Haier Group

- Whirlpool Corporation

Electrical Appliances Market - Competitive Rivalry, 2024

Electrical Appliances Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Electrical Appliances Market

- In April 2024, Orient Electric launched a new air cooler lineup in India, including models like Smartchill 125L, Avante 105L, and Maxochill 100L with large tank capacities and advanced features.

- In April 2024, JD.com partnered with over 100 brands for a "Trade-in Alliance for Household Appliances and Home Goods," aiming to expand trade-in services across China.

- In July 2024, Syensqo launched five new high-performance circular polymer solutions as part of their Omnix ECHO lineup, focusing on eco-friendly household and food appliances.

- In June 2024, Havells India partnered with Jumbo Group to introduce kitchen appliances in the UAE, starting with mixer grinders, to expand its product portfolio and reach.

Electrical Appliances Market Segmentation

- By Product

- Refrigerator

- Entertainment Appliances

- Cooking Appliances

- Washing Appliances

- By Operation

- Automatic

- Semi-automatic

- By Distribution Channel

- Online

- Specialty Stores

- Multi-branded Stores

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Electrical Appliances Market?

The Global Electrical Appliances Market is estimated to be valued at USD 611.1 Bn in 2024 and is expected to reach USD 1,341.3 Bn by 2031.

What will be the CAGR of the Electrical Appliances Market?

The CAGR of the Electrical Appliances Market is projected to be 9.2% from 2024 to 2031.

What are the key factors hampering the growth of the Electrical Appliances Market?

The price competition is leading to margin pressure for major players. Intense competition in the market can cause pricing wars that hurt profitability are the major factors hampering the growth of the Electrical Appliances Market.

What are the major factors driving the Electrical Appliances Market growth?

The rapid urbanization and increasing disposable income leading to higher demand for electrical appliances. The technological advancements like ai and IoT integration are driving the market for smart appliances are the major factor driving the Electrical Appliances Market.

Which is the leading Product in the Electrical Appliances Market?

Refrigerator is the leading Product segment.

Which are the major players operating in the Electrical Appliances Market?

Samsung Electronics, LG Electronics, Panasonic, Haier Group, Whirlpool Corporation, Midea Group, Gree Electric Appliances, Koninklijke Philips, Robert Bosch GmbH, Electrolux AB are the major players.