Proximity Sensor Market Size - Analysis

The market is expected to witness significant growth due to increasing demand for proximity sensors from the consumer electronics and automotive industries. Growing concern for safety and increasing use of advanced driver-assistance systems (ADAS) features in vehicles will drive the automotive proximity sensor market. Moreover, the rising popularity of Internet of Things (IoT) and use of proximity sensors in various IoT applications will further support the market growth during the forecast period.

Market Size in USD Bn

CAGR8.00%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 8.00% |

| Market Concentration | High |

| Major Players | Broadcom Inc., IFM Electronic GmbH, Schneider Electric, Panasonic Corporation, Omron Corporation and Among Others |

please let us know !

Proximity Sensor Market Trends

The adoption of automation technologies is significantly increasing across major industries globally. Automotive, manufacturing, and industrial sectors are increasingly automating their production processes with advanced robotics, machinery and smart sensors to enhance efficiency, reduce costs, and ensure product quality and safety. Proximity sensors are playing a critical role in enabling automation in these industries. As autonomous guided vehicles, industrial robots, CNC machine tools are employed on large scales for material handling, assembly, quality inspection and packaging, the need for accurate object detection and distance measurement is rising. Proximity sensors allow robotic arms and automated equipment to sense nearby objects without making physical contact. This helps automated systems perform complex assembly, processing and packaging operations smoothly while avoiding collisions that could damage products or disrupt production.

The proliferation of Internet of Things (IoT) technologies and the wider adoption of Industry 4.0 practices termed as smart manufacturing is unveiling new growth avenues for proximity sensor vendors. At the heart of these advanced manufacturing paradigms lies the greater use of connected devices, real-time data collection, cloud computing and analytics to optimize operations and asset utilization. Proximity sensors are being widely incorporated into various IoT devices and smart machines enabling more effective remote monitoring, predictive maintenance and process optimization capabilities. For example, proximity sensors embedded in smarter industrial equipment help detect early signs of wear and tear, monitor material levels in real-time and trigger automated replenishment orders. This brings about significant improvements in overall equipment effectiveness while minimizing downtime.

Market Challenge - Limitations in Sensing Capabilities, Especially in Non-Metallic Objects, Restrict the Wider Adoption of Certain Types of Proximity Sensors

The proximity sensor market is poised to benefit tremendously from the rising adoption of consumer electronic devices globally. Devices such as smartphones, smartwatches, tablets, gaming consoles and virtual/augmented reality headsets use proximity sensors extensively for functionalities like auto screen-off/wake, gesture controls and biometrics. As new form factors and interaction paradigms are explored in the consumer electronics space, proximity sensing capabilities are becoming an integral part of the user experience. The market for consumer electronic devices has been growing at a rapid pace and is expected to further accelerate with the rollout of 5G networks and proliferation of IoT technologies. This expanding consumer electronics market presents a huge opportunity for proximity sensor vendors to increase volume shipments and tap into the growing demands of OEMs. Further innovations to shrink sensor sizes while enhancing capabilities also allow for proximity sensors to feature even more prominently in emerging categories of wearables and embedded devices.

Key winning strategies adopted by key players of Proximity Sensor Market

Focus on Technology Innovation- Proximity sensor vendors have continuously invested in R&D to develop new and advanced sensing technologies.

Focus on Application-specific Products - Players have developed proximity sensor products customized for specific applications like consumer electronics, and industrial equipment. For instance, Omron's XY3A-S proximity sensors launched in 2018 were developed specifically for industrial machinery detection needs with capabilities like vibration resistance. Texas Instruments also provides application-specific product families for industrial, automotive and consumer applications. Such focus helps players match customer demands better.

Segmental Analysis of Proximity Sensor Market

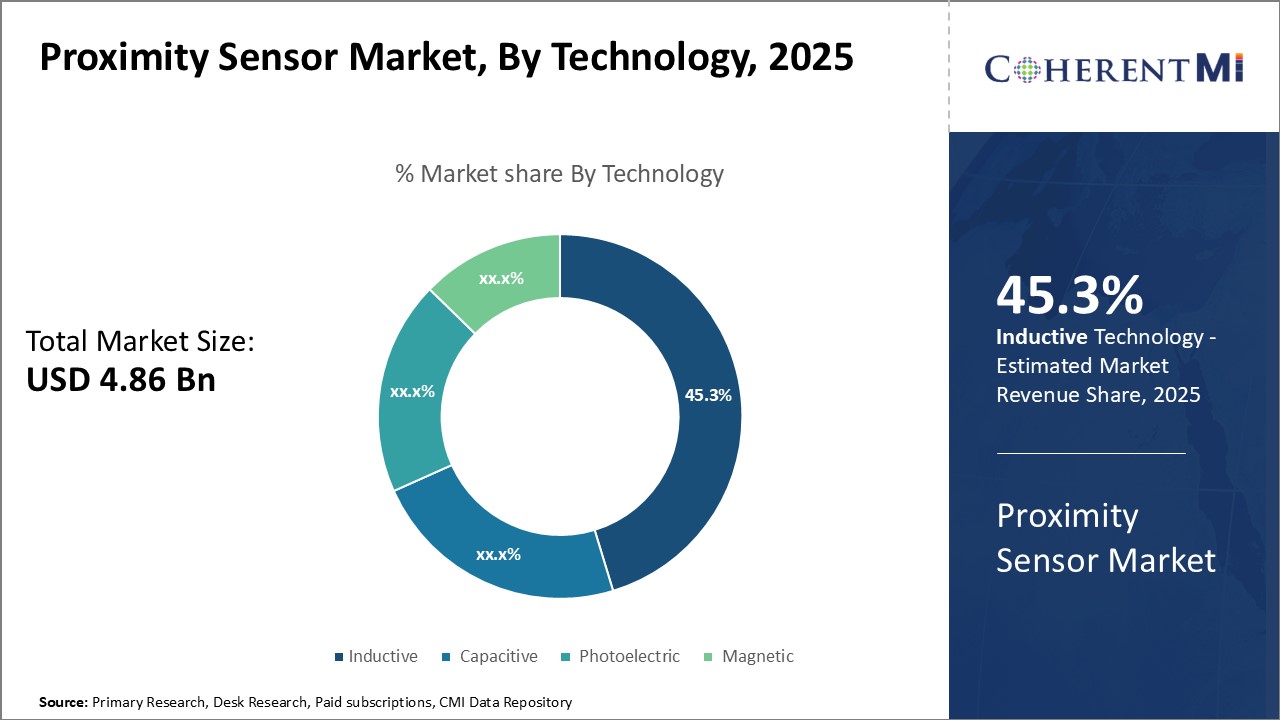

Insights, By Technology, Inductive Technology Drives Growth in Proximity Sensor Market Share

Inductive sensors offer significant advantages over competing technologies for many applications. Unlike capacitive sensors, inductive sensors can detect through non-conductive materials like plastic, making them well-suited for detecting objects enclosed in non-metallic packaging. They are also unaffected by dirt, dust or oil on the surface of detected objects, providing consistent detection even in harsh environments. This durability makes inductive sensors a top choice for industrial manufacturing applications where contaminants are common.

Taken together, inductive sensors' versatility, durability and proven reliability have cemented their leadership role in the market. These advantages will continue attracting demand and keeping inductive technology at the forefront of proximity detection solutions for the foreseeable future.

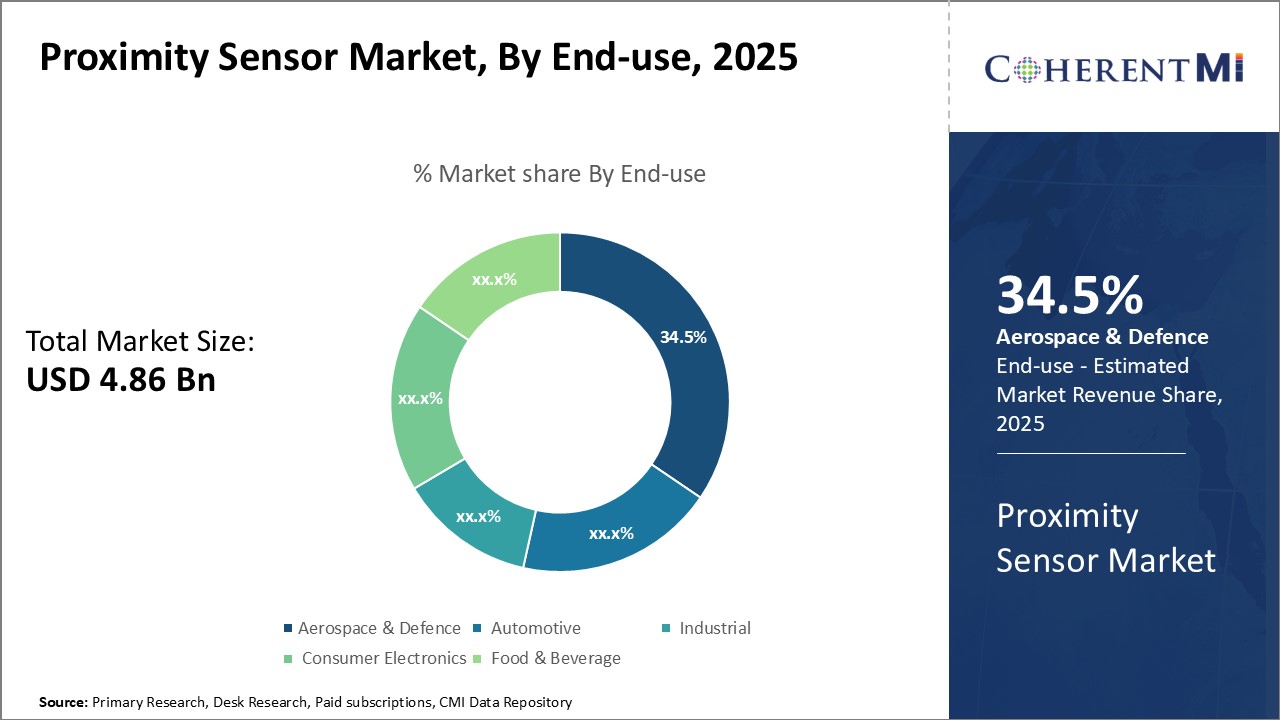

Insights, By End-use, Aerospace and Defense Demand Drives Proximity Sensor Market Growth

Insights, By End-use, Aerospace and Defense Demand Drives Proximity Sensor Market Growth

In aircraft, proximity sensors are used for critical functions like low-fuel alarms, ground proximity warnings, take-off and landing assistance. As autonomous flight capabilities progress, demand is surging for more advanced sensors to support functions like automatic taxiing, formation flying and sense-and-avoid collision protection. Space programs similarly rely on proximity sensors for rendezvous sensing, docking operations and proximity detection during launches.

Stringent aerospace and defense certification standards require ultra-reliable proximity sensors capable of withstanding vibrations, thermal cycles, pressure changes and electromagnetic interference. This pushes the industry to develop more resilient and higher-performance solutions. Continuous innovation will be needed to meet emerging demands for miniaturization, bandwidth and sensing ranges as next-gen programs evolve. Sustained investment in R&D ensures this segment maintains its clear leadership position driving overall market expansion.

Additional Insights of Proximity Sensor Market

The proximity sensor market is poised for steady growth driven by the increasing need for automation across industries. These sensors are being used extensively in automotive, industrial, and consumer electronics sectors for object detection, distance measurement, and enhancing safety. The integration of AI is further revolutionizing the market, allowing sensors to deliver intelligent, real-time data processing. Advancements in manufacturing, such as Industry 4.0, are driving demand for smart sensors, particularly in Asia Pacific and North America, where industrial automation and smart homes are on the rise.

Competitive overview of Proximity Sensor Market

The major players operating in the Proximity Sensor Market include Broadcom Inc., IFM Electronic GmbH, Schneider Electric, Panasonic Corporation, Omron Corporation, Honeywell International Inc., Balluff GmbH, Pepperl + Fuchs GmbH, Rockwell Automation and Sick AG.

Proximity Sensor Market Leaders

- Broadcom Inc.

- IFM Electronic GmbH

- Schneider Electric

- Panasonic Corporation

- Omron Corporation

Proximity Sensor Market - Competitive Rivalry

Proximity Sensor Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Proximity Sensor Market

- In July 2024, Elliptic Labs deployed its AI Virtual Proximity Sensor INNER BEAUTY on HONOR’s X60i smartphone, enhancing user experience with battery-saving features and reducing unintended touch inputs.

- In May 2024, Neura Robotics partnered with Omron Robotics to introduce cognitive robots into factory automation, leveraging AI and proximity sensor technologies to improve safety and efficiency in manufacturing.

- In February 2024, SICK introduced the W10 photoelectric proximity sensor, expanding its product line for automation technology by offering new detection capabilities for various industrial applications.

Proximity Sensor Market Segmentation

- By Technology

- Inductive

- Capacitive

- Photoelectric

- Magnetic

- By End-use

- Aerospace & Defence

- Automotive

- Industrial

- Consumer Electronics

- Food & Beverage

Would you like to explore the option of buying individual sections of this report?

Raj Shah is a seasoned strategy professional with global experience, from strategy to on-the-ground operational improvements. In last 13 years, he has executed number consulting projects focused on consumer electronics, telecom and consumer-internet business leading multiple long-term engagements towards mobilizing and executing on break-through strategy - leading to tangible sales results. Raj is also acting as a strategy consultant for one of the leading online hyper local service providers in India, contributing to their growth through critical strategic decisions. Raj usually spends time after office in talking to the passionate entrepreneurs, regardless of their funding status.

Frequently Asked Questions :

How big is the proximity sensor market?

The global proximity sensor market is estimated to be valued at USD 4.86 Bn in 2025 and is expected to reach USD 8.33 Bn by 2032.

What will be the CAGR of the Proximity Sensor Market?

The CAGR of the Proximity Sensor Market is projected to be 7.8% from 2024 to 2031.

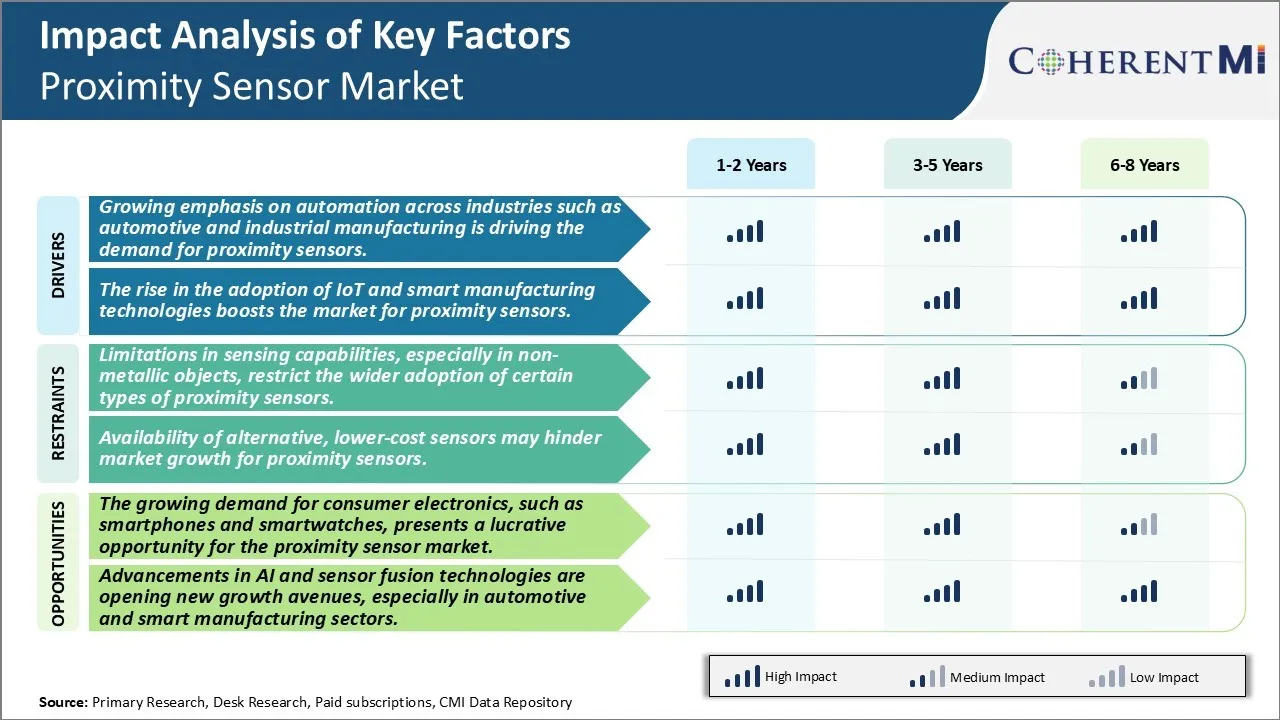

What are the major factors driving the Proximity Sensor Market growth?

The growing emphasis on automation across industries such as automotive and industrial manufacturing is driving the demand for proximity sensors. The rise in the adoption of IoT and smart manufacturing technologies boosts the market for proximity sensors are the major factors driving the Proximity Sensor Market.

What are the key factors hampering the growth of the Proximity Sensor Market?

The limitations in sensing capabilities, especially in non-metallic objects, restrict the wider adoption of certain types of proximity sensors. Availability of alternative, lower-cost sensors may hinder market growth for proximity sensors are the major factor hampering the growth of the Proximity Sensor Market.

Which is the leading Technology in the Proximity Sensor Market?

Inductive is the leading Technology segment.

Which are the major players operating in the Proximity Sensor Market?

Broadcom Inc., IFM Electronic GmbH, Schneider Electric, Panasonic Corporation, Omron Corporation, Honeywell International Inc., Balluff GmbH, Pepperl + Fuchs GmbH, Rockwell Automation, Sick AG are the major players.