Elevator Components Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Elevator Components Market is segmented By Component (Elevator Car and Shaft, Landing Door, Motor, Machiner Drive, Others), By Elevator Technology (Hy....

Elevator Components Market Size

Market Size in USD Bn

CAGR11.9%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 11.9% |

| Market Concentration | High |

| Major Players | Wittur Group, GAL Manufacturing Corp., Adams Elevator Equipment Company, Avire Ltd., Fermator Group and Among Others. |

please let us know !

Elevator Components Market Analysis

The Global Elevator Components Market is estimated to be valued at USD 48.1 Bn in 2024 and is expected to reach USD 118.4 Bn by 2031, growing at a compound annual growth rate (CAGR) of 11.9% from 2024 to 2031. Rapid urbanization and growing construction activity for residential and commercial properties are driving significant demand for elevator components across the world. The market is expected to witness positive growth over the forecast period supported by increasing buildings construction projects especially in developing countries of Asia Pacific and Middle East & Africa. Additionally, the needs for modernization and retrofitting of aging elevator infrastructure in metro cities will further provide impetus to elevator components demand during the forecast period.

Elevator Components Market Trends

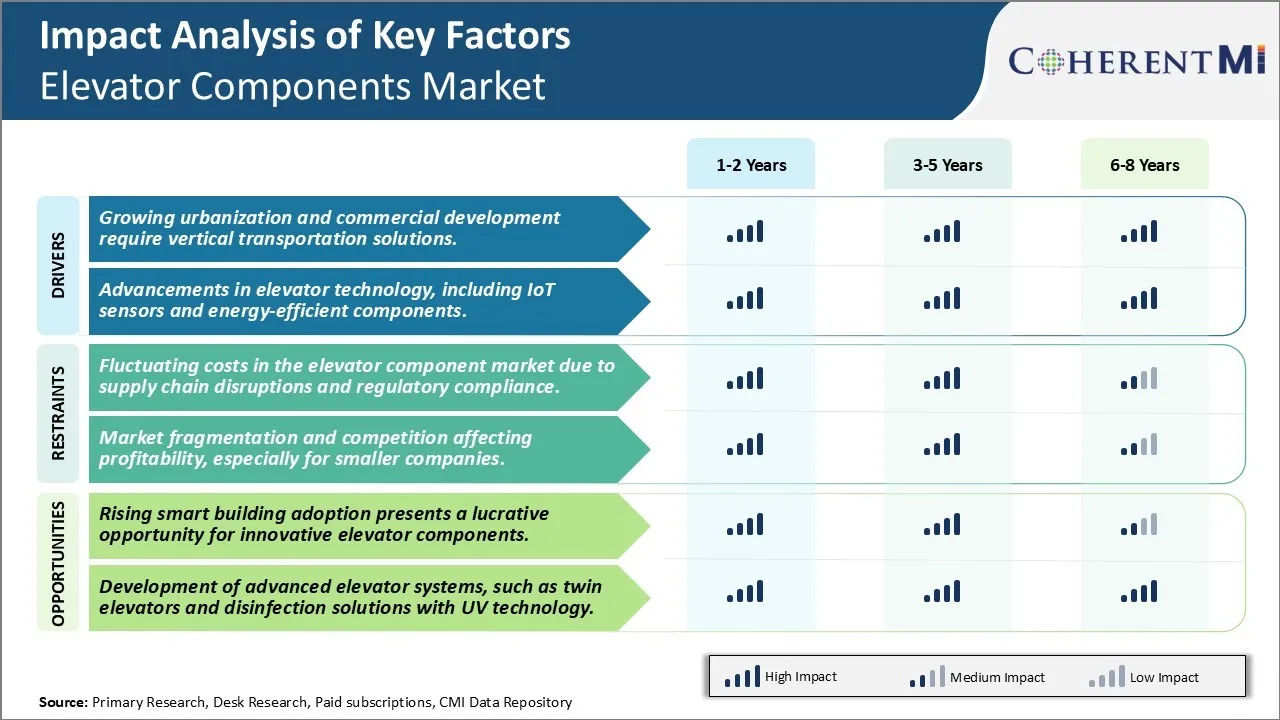

Market Driver - Growing Urbanization and Commercial Development Require Vertical Transportation Solutions

As cities continue growing rapidly around the world, the need for vertical expansion of residential and commercial real estate is ever more crucial. Limited land availability in urban areas forces construction to go upwards rather than outwards. High-rise buildings have become commonplace even in smaller cities, as property prices soar. This vertical growth naturally drives demand for safe and reliable elevator systems.

Moreover, aging infrastructure in several developed markets is calling for modernization and replacement of older elevators. Strict safety regulations also necessitate upgrades to existing lifts. Governments and building owners recognize that elevators are a necessity to facilitate accessible travel for all. They ensure compliance through periodic maintenance and replacing outdated components that can pose risks.

With increasing affluence, consumers expect advanced amenities and technology integration even in residential spaces. Developers must cater to these evolving needs to make their properties attractive and sellable. Elevators emerge as a vital differentiator for real estate brands. Investments made towards installing energy-efficient and smart lifts allow builders to charge premiums as well as lower operating costs in the long run.

Market Driver - Advancements in Elevator Technology, Including Iot Sensors and Energy-Efficient Components

The elevator industry has come a long way from traditional hydraulic and machine room-less systems. Ongoing digital transformation is driving innovative product introductions. IoT connectivity and data analytics are playing a bigger role to optimize elevator performance, predict maintenance requirements, and provide enhanced rider experience.

Components' manufacturers are focusing on producing parts with lower energy usage such as highly efficient gearless machines, LED lighting, and regenerative drives. Sensors for operational monitoring and preventive diagnostics help reduce downtime from unplanned outages. This improves reliability and lowers overall expenditure on frequent repairs or replacements. The ability to remotely service equipment spares the cost of sending technicians on-site for minor issues.

Sophisticated features like destination selection using mobile apps, card-based access, cabin air purifiers and UV sterilizers have increased demand in the premium segment. The pandemic has accelerated adoption of such touchless interfaces and hygienic upgrades. Companies launching innovative AI-based solutions for passenger management, customized advertising inside lifts can better engage customers and open new revenue streams.

The industry recognizes that digitally advanced, energy-smart components will define the elevator technology of tomorrow. Their widespread application depends on solutions being affordable and user-friendly to install without disrupting operation. Strong investment on R&D helps lower equipment cost through scalability while steadily enhancing functionality. This drives the components market as innovations disseminate across global elevator inventory.

Market Challenge - Fluctuating Costs in The Elevator Component Market Due to Supply Chain Disruptions and Regulatory Compliance

The elevator component market has been facing significant challenges in terms of fluctuating costs owing to frequent disruptions in the global supply chain as well as stringent regulatory compliances. The COVID-19 pandemic severely impacted the supply chains for critical raw materials across multiple industries including steel, copper, and hardware used in elevator manufacturing. Extended lockdowns in major economies led to shutdowns of manufacturing facilities, thus reducing output and increasing lead times. This led to sharp rises in commodity prices steadily over the last year.

At the same time, markets in Europe and North America have been issuing new regulations for improving safety, accessibility, and energy-efficiency of elevators. For instance, the EN 81-20 and EN 81-50 regulations in Europe mandate the use of new technologies like machine-room-less systems, control governance systems, and emergency braking systems among others. Complying with such regulations entails additional investments in R&D and upgrading of manufacturing infrastructure. All these factors have collectively squeezed profit margins for elevator component suppliers over the recent past. Maintaining cost competitiveness while meeting regulatory standards is a significant challenge that needs to be addressed.

Market Opportunity- Rising Smart Building Adoption Presents a Lucrative Opportunity for Innovative Elevator Components

The growing trend of smart commercial buildings integrated with Internet of Things (IoT) solutions provides a major opportunity for elevator component manufacturers to develop smart and connected products. Many real estate developers and building owners are focusing on providing enhanced user experience and optimizing overall functionality through smart technologies. Features like remote condition monitoring, predictive maintenance, access control integration, digital call functions etc. are becoming increasingly important. Elevator component players can capitalize on this demand by launching innovative IoT-based solutions like intelligent call handling systems, smart drive systems for efficient operations, and touchless access panels utilizing facial recognition.

Adopting Industry 4.0 standards of connectivity and automation can help elevator components gain more relevance in smart building ecosystems. Partnerships with other facility management solution providers can also open up new revenue streams through comprehensive service contracts. The ease of remote management, troubleshooting, and upgrades offered by smart elevator solutions is appealing to both building owners and residents alike. Leveraging digital transformation trends presents a significant long-term growth driver for forward-looking elevator component manufacturers.

Key winning strategies adopted by key players of Elevator Components Market

Technological Innovation and Smart Solutions Integration

- Leading companies are incorporating smart technologies, such as IoT, AI, and predictive maintenance systems, into elevator components to enhance safety, efficiency, and user experience. By integrating real-time monitoring and diagnostics, these smart systems help reduce downtime, optimize energy consumption, and improve overall service reliability.

- Innovation in energy-efficient components, such as regenerative drives and energy-saving motors, is also a major focus. These developments address growing demands for sustainability in building operations and align with green building standards.

Expansion into Emerging Markets and Strategic Localization

- Key players are expanding their presence in emerging markets across Asia Pacific, the Middle East, and Latin America, where urbanization and infrastructure development are driving demand for elevators. By establishing local manufacturing facilities and strengthening regional distribution networks, companies can better meet the needs of high-growth markets while reducing logistics costs and delivery times.

- Additionally, strategic partnerships with local distributors and service providers allow companies to tailor their offerings to regional preferences and regulatory standards, making them more competitive in these regions.

Enhanced After-Sales Services and Modernization Offerings

- Recognizing the importance of lifecycle management, companies are enhancing after-sales services by providing maintenance, repair, and modernization solutions for existing elevator systems. As many buildings require upgrades to meet new safety standards or to improve energy efficiency, modernization has become a critical revenue stream.

- By offering tailored retrofit and upgrade options, companies help extend the lifespan of elevator systems, improve performance, and reduce operational costs for building owners. This focus on after-sales and modernization services builds brand loyalty and fosters long-term customer relationships.

These strategies enable companies to strengthen their market presence, drive innovation, and meet the evolving demands of the global elevator components market.

Segmental Analysis of Elevator Components Market

Insights, By Component, Elevator Car and Shaft to Enjoy a Prominent Position in the Coming Years

By Component, Elevator Car and Shaft is projected to account for 35.3% in 2024 owing to their indispensability in delivering comfortable vertical transportation. As high-rise structures continue to proliferate worldwide, there is growing demand for well-built and spacious elevator cars along with robust shafts that can accommodate increasing traffic loads safely and smoothly. Additionally, affluent consumers expect elevators to provide luxurious interiors, energy efficient features, and smart connectivity options for infotainment or work while commuting between floors. Leading manufacturers continuously invest in R&D to introduce elevator cars integrated with advanced technologies like Internet of Things, AI assistants, gesture controls and digital displays. This helps property developers to offer differentiated lifestyles, thereby fueling replacements and retrofits. Going forward, innovations in modular designs, material science and manufacturing techniques will further enhance passenger experience and convenience, driving greater reliance on elevator cars and shafts.

Insights, By Elevator Technology, Ubiquity of Hydraulic Systems

By Elevator Technology, Hydraulic Elevators are expected to account for 42.5% in 2024 owing to their cost-effectiveness and suitability for low to mid-rise buildings. Being mechanically simpler than other technologies, hydraulic elevators can be installed faster at a relatively lower cost. Their compact cylinder and plunger system makes them space-efficient for locations where machine room space is limited. Additionally, hydraulic elevators require less precision in installation and are easier to maintain locally. Consequently, they remain immensely popular in residential complexes, hospitals, retail spaces and commercial buildings with up to 10 floors. With rapid urbanization particularly in developing regions, demand for affordably-priced low-rise infrastructure is set to stay robust. This translates to continuing installations of new hydraulic elevators as well as replacements and modernizations of existing units over the foreseeable future.

Insights, By Load Capacity, Below 650 Kg Enjoys a Prominent Position in the Forecast Period

By Load Capacity, Below 650 Kg contributes the highest share of the market owing to its high suitability for residential and low traffic commercial applications. Elevators with below 650kg capacity are optimally designed to accommodate 1-10 passengers in a cost-effective and energy-efficient manner. Their relatively simpler configurations ensure less space requirements both within the shaft and machine room. This makes them attractive for installation in walk-up apartments, duplex units and small offices with 3-5 floors. As urban density increases globally with growing homeownership rates, greater numbers of residential high-rises are being erected. Furthermore, rebuilding activity within existing structures also fuels installation of low-capacity elevators tailored for households or organizations. Their compact footprint and functionality continue satisfying needs of price-sensitive buyers seeking basic vertical mobility. Hence, this segment is positioned to sustain momentum led by resilient demand from housing and small business sectors worldwide.

Additional Insights of Elevator Components Market

The Elevator Components Market is witnessing robust growth due to global urbanization and the increasing need for vertical transportation solutions in high-rise structures. Technological advancements such as IoT-enabled smart systems, predictive maintenance, and energy-efficient motors are transforming the industry. The Asia Pacific region, led by China and India, dominates due to rapid urbanization, government-backed infrastructure projects, and high population density. In developed regions like North America, retrofitting aging infrastructure with energy-efficient, smart elevators is a major growth driver. Challenges such as fluctuating raw material costs and stringent regulations pose challenges for smaller market players. However, the industry is set to expand as innovations like twin elevator systems and UV disinfection technologies emerge, meeting evolving safety and operational demands.

Competitive overview of Elevator Components Market

The major players operating in the Elevator Components Market include Wittur Group, GAL Manufacturing Corp., Adams Elevator Equipment Company, Avire Ltd., Fermator Group, Elevator Equipment Corporation, EMI/Porta Inc., DMG, Bohnke and Partner GmbH, Hans and Jos. Kronenberg, Hissmekano AB, Hydroware, Kinds Teknik AB and Nidec Kinetek Elevator Technology.

Elevator Components Market Leaders

- Wittur Group

- GAL Manufacturing Corp.

- Adams Elevator Equipment Company

- Avire Ltd.

- Fermator Group

Elevator Components Market - Competitive Rivalry, 2024

Elevator Components Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Elevator Components Market

- In July 2022, Wittur launched an upgraded model of semantic-C mode doors, featuring advanced motor functionalities, aimed at reducing electricity consumption and enhancing cost efficiency.

- In 2024 Ongoing, Expansion in Asia Pacific, particularly in China, with the government pushing urbanization projects and affordable housing schemes, increasing demand for elevator components.

Elevator Components Market Segmentation

- By Component

- Elevator Car and Shaft

- Landing Door

- Motor

- Machiner Drive

- Others

- By Elevator Technology

- Hydraulic Elevators

- Traction Elevators

- Machine-Room Less Elevators

- Pneumatic Elevators

- By Load Capacity

- Below 650 Kg

- 650-1000 Kg

- 1000-1600 Kg

- 2500-5000 Kg

- Above 5000 Kg

- By End-use

- Passenger

- Freight

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Elevator Components Market?

The Global Elevator Components Market is estimated to be valued at USD 48.1 Bn in 2024 and is expected to reach USD 118.4 Bn by 2031.

What will be the CAGR of the Elevator Components Market?

The CAGR of the Elevator Components Market is projected to be 11.9% from 2024 to 2031.

What are the major factors driving the Elevator Components Market growth?

The growing urbanization and commercial development require vertical transportation solutions and advancements in elevator technology, including IoT sensors and energy-efficient components are the major factors driving the Elevator Components Market.

What are the key factors hampering the growth of the Elevator Components Market?

The fluctuating costs in the elevator component market due to supply chain disruptions and regulatory compliance and market fragmentation and competition affecting profitability, especially for smaller companies are the major factors hampering the growth of the Elevator Components Market.

Which is the leading Component in the Elevator Components Market?

Elevator Car and Shaft are the leading Component segment.

Which are the major players operating in the Elevator Components Market?

Wittur Group, GAL Manufacturing Corp., Adams Elevator Equipment Company, Avire Ltd., Fermator Group, Elevator Equipment Corporation, EMI/Porta Inc., DMG, Bohnke and Partner GmbH, Hans and Jos. Kronenberg, Hissmekano AB, Hydroware, Kinds Teknik AB, Nidec Kinetek Elevator Technology are the major players.