Elevator Components Market Trends

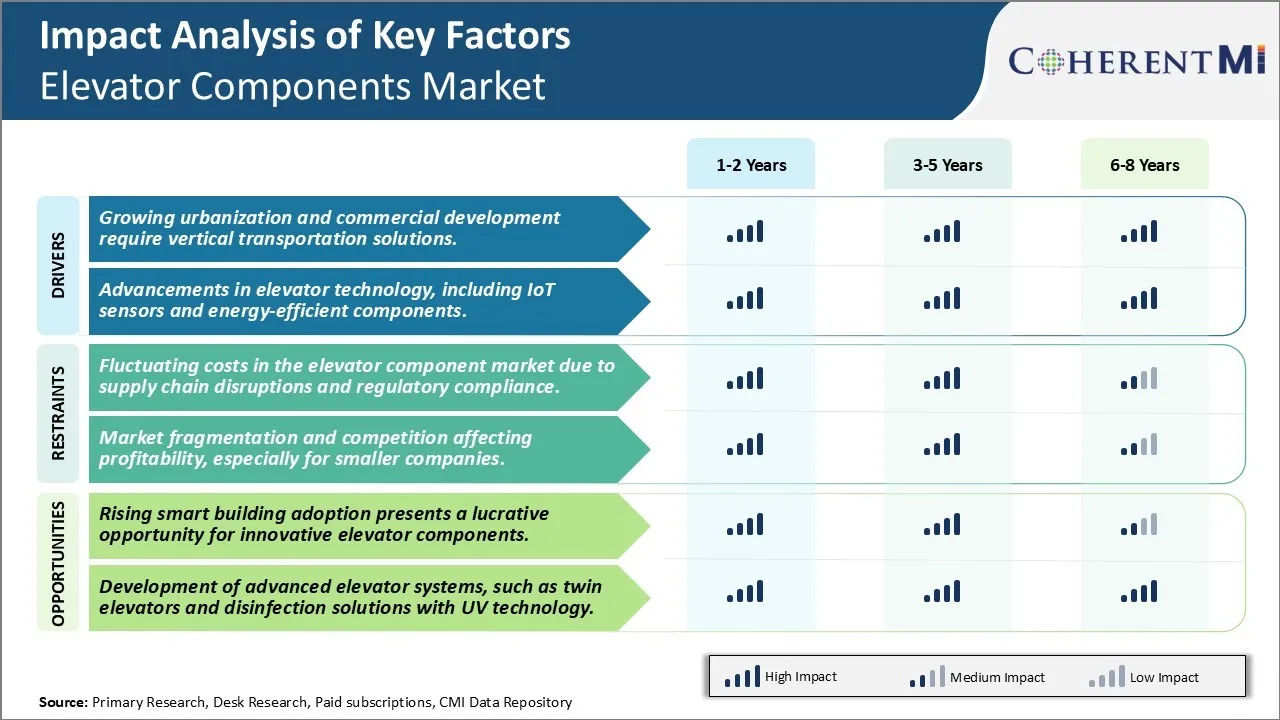

Market Driver - Growing Urbanization and Commercial Development Require Vertical Transportation Solutions

As cities continue growing rapidly around the world, the need for vertical expansion of residential and commercial real estate is ever more crucial. Limited land availability in urban areas forces construction to go upwards rather than outwards. High-rise buildings have become commonplace even in smaller cities, as property prices soar. This vertical growth naturally drives demand for safe and reliable elevator systems.

Moreover, aging infrastructure in several developed markets is calling for modernization and replacement of older elevators. Strict safety regulations also necessitate upgrades to existing lifts. Governments and building owners recognize that elevators are a necessity to facilitate accessible travel for all. They ensure compliance through periodic maintenance and replacing outdated components that can pose risks.

With increasing affluence, consumers expect advanced amenities and technology integration even in residential spaces. Developers must cater to these evolving needs to make their properties attractive and sellable. Elevators emerge as a vital differentiator for real estate brands. Investments made towards installing energy-efficient and smart lifts allow builders to charge premiums as well as lower operating costs in the long run.

Market Driver - Advancements in Elevator Technology, Including Iot Sensors and Energy-Efficient Components

The elevator industry has come a long way from traditional hydraulic and machine room-less systems. Ongoing digital transformation is driving innovative product introductions. IoT connectivity and data analytics are playing a bigger role to optimize elevator performance, predict maintenance requirements, and provide enhanced rider experience.

Components' manufacturers are focusing on producing parts with lower energy usage such as highly efficient gearless machines, LED lighting, and regenerative drives. Sensors for operational monitoring and preventive diagnostics help reduce downtime from unplanned outages. This improves reliability and lowers overall expenditure on frequent repairs or replacements. The ability to remotely service equipment spares the cost of sending technicians on-site for minor issues.

Sophisticated features like destination selection using mobile apps, card-based access, cabin air purifiers and UV sterilizers have increased demand in the premium segment. The pandemic has accelerated adoption of such touchless interfaces and hygienic upgrades. Companies launching innovative AI-based solutions for passenger management, customized advertising inside lifts can better engage customers and open new revenue streams.

The industry recognizes that digitally advanced, energy-smart components will define the elevator technology of tomorrow. Their widespread application depends on solutions being affordable and user-friendly to install without disrupting operation. Strong investment on R&D helps lower equipment cost through scalability while steadily enhancing functionality. This drives the components market as innovations disseminate across global elevator inventory.

Market Challenge - Fluctuating Costs in The Elevator Component Market Due to Supply Chain Disruptions and Regulatory Compliance

The elevator component market has been facing significant challenges in terms of fluctuating costs owing to frequent disruptions in the global supply chain as well as stringent regulatory compliances. The COVID-19 pandemic severely impacted the supply chains for critical raw materials across multiple industries including steel, copper, and hardware used in elevator manufacturing. Extended lockdowns in major economies led to shutdowns of manufacturing facilities, thus reducing output and increasing lead times. This led to sharp rises in commodity prices steadily over the last year.

At the same time, markets in Europe and North America have been issuing new regulations for improving safety, accessibility, and energy-efficiency of elevators. For instance, the EN 81-20 and EN 81-50 regulations in Europe mandate the use of new technologies like machine-room-less systems, control governance systems, and emergency braking systems among others. Complying with such regulations entails additional investments in R&D and upgrading of manufacturing infrastructure. All these factors have collectively squeezed profit margins for elevator component suppliers over the recent past. Maintaining cost competitiveness while meeting regulatory standards is a significant challenge that needs to be addressed.

Market Opportunity- Rising Smart Building Adoption Presents a Lucrative Opportunity for Innovative Elevator Components

The growing trend of smart commercial buildings integrated with Internet of Things (IoT) solutions provides a major opportunity for elevator component manufacturers to develop smart and connected products. Many real estate developers and building owners are focusing on providing enhanced user experience and optimizing overall functionality through smart technologies. Features like remote condition monitoring, predictive maintenance, access control integration, digital call functions etc. are becoming increasingly important. Elevator component players can capitalize on this demand by launching innovative IoT-based solutions like intelligent call handling systems, smart drive systems for efficient operations, and touchless access panels utilizing facial recognition.

Adopting Industry 4.0 standards of connectivity and automation can help elevator components gain more relevance in smart building ecosystems. Partnerships with other facility management solution providers can also open up new revenue streams through comprehensive service contracts. The ease of remote management, troubleshooting, and upgrades offered by smart elevator solutions is appealing to both building owners and residents alike. Leveraging digital transformation trends presents a significant long-term growth driver for forward-looking elevator component manufacturers.