Firefighting Foam Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Firefighting Foam Market is segmented By Foam Type (Aqueous Film Forming Foam (AFFF), Alcohol Resistant Aqueous Film Forming Foam (AR-AFFF), Protein F....

Firefighting Foam Market Size

Market Size in USD Bn

CAGR3.62%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 3.62% |

| Market Concentration | Medium |

| Major Players | SFFECO GLOBAL, Johnson Controls International PLC, Dafo Fomtec AB, National Foam, Angus Fire Ltd. and Among Others. |

please let us know !

Firefighting Foam Market Analysis

The firefighting foam market is estimated to be valued at USD 5.48 Bn in 2024 and is expected to reach USD 7.03 Bn by 2031, growing at a compound annual growth rate (CAGR) of 3.62% from 2024 to 2031. The firefighting foams market is expected to witness positive trends due to recent innovations focused on developing more environmentally sustainable foams.

Firefighting Foam Market Trends

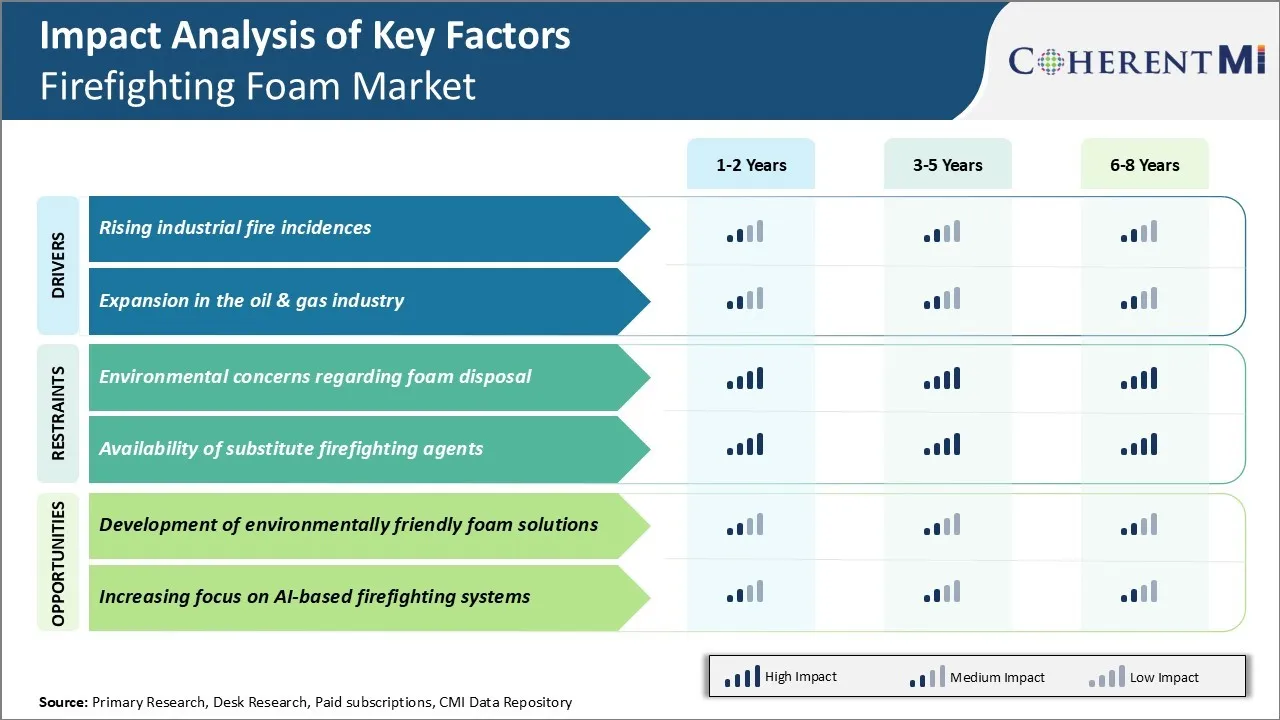

Market Driver - Rising Industrial Fire Incidences

With increasing industrialization and rapid urbanization taking place around the world, there has been a steady rise in industrial fire incidents globally. Moreover, aging infrastructure and lax safety standards in some developing regions of world have contributed to frequent mishaps. As facilities expand operations and strive for higher productivity and output, the associated fire risks also increase manifold if not managed carefully.

Work environments with congested layouts make fire containment all the more difficult. With sophisticated digitization and automation trends, the integration of IT systems and machinery interface has opened up newer possibilities of technical faults or cyber sabotage triggering facility fires.

With a mix of these factors, global property loss from industrial and commercial fires have been rising sharply each year. The use of specialty firefighting foam concentrates for high-risk flammable liquid and gas fires has become almost imperative. This is expected to drive growth of the firefighting foam market in the coming years.

Market Driver - Expansion in the Oil & Gas Industry

The oil and gas industry has been witnessing sizable growth globally driven by increasing energy demands of developing economies and geopolitical issues. More oil and gas fields are being explored while existing facilities expand throughput to meet rising consumption.

A single fire incident in any part of the upstream or downstream supply chain from well-heads to refineries can turn catastrophic with immense loss of lives and assets. Oil spills from pipeline ruptures or tank/vessel failures often get ignited and spread rapidly on water. Even relatively minor building or plant fires at onshore facilities if not contained in time have potential to engulf large process areas or trigger bigger explosions. Effective and rapid-fire suppression is thus of utmost importance to maintain operational safety and business continuity in this sector. This will play a key role in growth for the players in the firefighting foam market.

Market Challenge - Environmental concerns regarding foam disposal

One of the key challenges faced by the firefighting foam market is the growing environmental concerns regarding the safe disposal of foam residues. Traditionally used aqueous film-forming foams (AFFFs) contained perfluoroalkyl and polyfluoroalkyl substances (PFAS), which have been gaining increased scrutiny due to their persistence in the environment and potential health risks. Prolonged and widespread use of AFFF during firefighting and training activities has led to PFAS contamination of soil and water bodies in and around airports and military facilities.

Stringent regulations are being introduced around the world to restrict the use of PFAS-containing foams and to remediate contaminated sites. This poses risks to the revenue stream of actors manufacturing and supplying legacy AFFF products. The liabilities associated with historical pollution from foams also raises concerns among existing players. Overall, the environmental and regulatory pressures present a significant challenge for the firefighting foam market.

Market Opportunity - Development of Environmentally Friendly Foam Solutions

One of the major opportunities for the firefighting foam market lies in the development of viable environmentally-friendly alternatives to legacy AFFF products containing PFAS chemicals. With growing restrictions on the use of PFAS foams, there is a crucial need as well as a lucrative market for greener foam solutions that are able to achieve the firefighting performance of traditional AFFFs without the environmental and health risks.

Leading manufacturers in the firefighting foam market have already invested heavily in R&D to formulate foams using newer fluorine-free and shorter-chain chemistry that can break down easily without leaving persistent residues. As more airports, oil & gas facilities and military bases mandate the use of PFAS-free foams, it can drive considerable demand for these green solutions.

Their adoption would open up opportunities for foam OEMs to tap into new revenue streams and carbon credits by offering products aligned with sustainability priorities. With the societal and regulatory push for non-toxic alternatives, the environmentally-friendly foam segment is expected to experience strong growth in the coming years.

Key winning strategies adopted by key players of Firefighting Foam Market

Concentration on product innovation and development - Major players like Tyco Fire Protection Products, Chemguard, National Foam, Amerex Corporation, Angus Fire, and DIC have focused heavily on R&D to develop new and improved foam concentrates.

Expansion of production capacity - To keep up with rising demand, players have consistently expanded production facilities over the years.

Acquisitions for portfolio enhancement - Many companies pursue acquisitions to enhance geographic reach and product portfolio.

Strategic partnerships and collaborations - Companies partner with distributors, equipment makers, and local players to strengthen global distribution networks. For instance, in 2021, Kidde Fenwal formed a strategic alliance with China's Jingyun Chemical to jointly develop special foam solutions for the Chinese market.

Focus on emerging economies - With developed markets saturating, players are targeting high growth developing regions like Asia Pacific and Middle East. For example, Tyco has set up multiple production bases across APAC to cater to the rising need and leverage the opportunities.

Segmental Analysis of Firefighting Foam Market

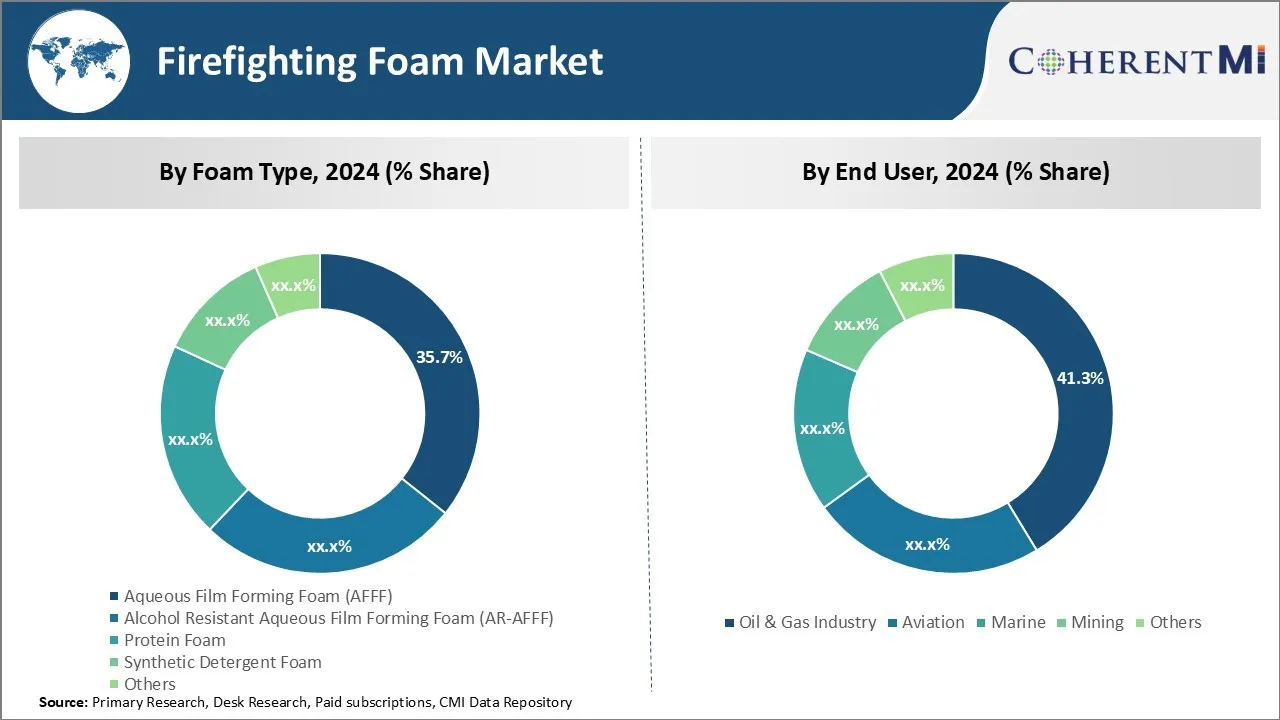

Insights, By Foam Type: Growing Industrialization Drives Demand for Aqueous Film Forming Foam (AFFF)

In terms of foam type, aqueous film forming foam (AFFF) contributes 35.7% share of the firefighting foam market owing to its widespread industrial applications. AFFF is predominantly used in industrial sectors that involve flammable liquid hazards such as oil and gas, aviation, shipping and petrochemicals. AFFF aids in protecting the assets and infrastructure of industrial operators from losses due to liquid fuel fires.

Stringent fire safety regulations stipulated by government agencies have also acted as a key growth driver for AFFF demand. Regulators worldwide have mandated the installation of professional-grade firefighting systems for high-risk industrial premises. Since AFFF offers a proven solution for quickly dousing liquid fuel fires as per international fire safety standards, it remains the foam concentrate of choice for many industrial facilities.

Insights, By End User: Oil & Gas Industry Drives Demand owing to High Fire Risks

In terms of end user, the oil & gas industry contributes the highest share to the firefighting foam market owing to the high risks of fires and explosions that are inherent to these industries. Oil rigs, refineries, pipelines and storage depots employed in the extraction, processing and transportation of oil and gas deal with massive quantities of hazardous flammable liquids on a daily basis.

Professional grade AFFF and other special foam agents are mission-critical for the safety of oil and gas industry personnel as well as integrity of assets worth billions of dollars. Firefighting foam solutions provide rapid knockdown of deep-seated liquid pool and spray fires, thus helping to contain damages and losses.

Stringent process safety regulations for the oil and gas industry also drive foam consumption. Overall, energy sector thus remains a core consumer segment for the firefighting foam market to help realize goals of enhanced safety and business continuity.

Insights, By Fire Type: Ease of Application Boosts Demand for Class A Foam

In terms of fire type, class A foam contributes the highest share to the firefighting foam market owing to its uncomplicated application and effective fire suppression ability against common combustibles. Foams designed for Class A fires work by cooling the fuel and forming an insulating barrier between it and oxygen. This suffocation effect is more than enough to douse small domestic and commercial fires involving common solids.

The simplicity of use increases Class A foams' access across a wide range of indoor settings in residential, commercial, institutional and industrial verticals. Factors like minimal training needs, lightweight and affordable equipment options, and low maintenance requirements have popularized firefighting foam of this type.

Going forward, continuous growth in the built infrastructure across developing economies will fuel further uptake of Class A foams in the firefighting foam market.

Additional Insights of Firefighting Foam Market

- The banning of PFAS-containing foams in several countries has led to a significant shift towards fluorine-free alternatives.

- Incidents of large-scale industrial fires have underscored the importance of effective firefighting foams, prompting increased investment in R&D.

- Asia-Pacific Growth: The Asia-Pacific region is expected to witness the highest growth rate, with a CAGR of over 6%, in the global firefighting foam market due to rapid industrialization and urbanization.

- Environmental Regulations Impact: Over 30% of companies are reallocating budgets to develop eco-friendly firefighting foams in response to environmental regulations.

- Class A fire type accounted for over 43% of the firefighting foam market in 2023.

Competitive overview of Firefighting Foam Market

The major players operating in the firefighting foam market include SFFECO GLOBAL, Johnson Controls International PLC, Dafo Fomtec AB, National Foam, Angus Fire Ltd., BIO EX S.A.S, DIC Corporation, Buckeye Fire Equipment, Kidde-Fenwal Inc., Chemguard (A Tyco Fire Protection Products (TFPP) brand), Perimeter Solutions, Kerr Fire, and Solberg Company.

Firefighting Foam Market Leaders

- SFFECO GLOBAL

- Johnson Controls International PLC

- Dafo Fomtec AB

- National Foam

- Angus Fire Ltd.

Firefighting Foam Market - Competitive Rivalry, 2024

Firefighting Foam Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Firefighting Foam Market

- In February 2024, CheckFire Ltd. introduced the CommanderEDGE enviroFoam fire extinguisher range, a fluorine-free solution designed to combat Class B flammable liquid fires. This development addresses environmental concerns associated with Per- and PolyFluoroAlkylated Substances (PFAS) found in traditional aqueous film-forming foam (AFFF) extinguishers.

- In September 2023, Swadeshi Empresa conducted successful trials of their indigenously developed firefighting robots aboard the Indian Navy's aircraft carrier, INS Vikrant. These autonomous robots are designed to detect and extinguish fires using water or foam jets, enhancing automation and safety by minimizing human exposure to hazardous conditions.

- In May 2023, Johnson Controls introduced the NFF-331 3%x3% Non-Fluorinated Firefighting Foam Concentrate under its ANSUL®, CHEMGUARD®, and SKUM® brands. This product serves as a flexible and efficient replacement for existing alcohol-resistant aqueous film-forming foam (AR-AFFF) concentrates in conventional foam sprinkler systems.

- In May 2023, Johnson Controls introduced the NFF-331 3% x 3% Non-Fluorinated Firefighting Foam Concentrate under its ANSUL®, CHEMGUARD®, and SKUM® brands. This product is designed as a flexible and efficient replacement for existing alcohol-resistant aqueous film-forming foam (AR-AFFF) concentrates in conventional foam sprinkler systems.

Firefighting Foam Market Segmentation

- By Foam Type

- Aqueous Film Forming Foam (AFFF)

- Alcohol Resistant Aqueous Film Forming Foam (AR-AFFF)

- Protein Foam

- Synthetic Detergent Foam

- Others

- By End User

- Oil & Gas Industry

- Aviation

- Marine

- Mining

- Others

- By Fire Type

- Class A

- Class B

- Class C

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the firefighting foam market?

The firefighting foam market is estimated to be valued at USD 5.48 Bn in 2024 and is expected to reach USD 7.03 Bn by 2031.

What are the key factors hampering the growth of the firefighting foam market?

Environmental concerns regarding foam disposal and availability of substitute firefighting agents are the major factors hampering the growth of the firefighting foam market.

What are the major factors driving the firefighting foam market growth?

Rising industrial fire incidences and expansion in the oil & gas industry are the major factors driving the firefighting foam market.

Which is the leading foam type in the firefighting foam market?

The leading foam type segment is aqueous film forming foam (AFFF).

Which are the major players operating in the firefighting foam market?

SFFECO GLOBAL, Johnson Controls International PLC, Dafo Fomtec AB, National Foam, Angus Fire Ltd., BIO EX S.A.S, DIC Corporation, Buckeye Fire Equipment, Kidde-Fenwal Inc., Chemguard (A Tyco Fire Protection Products (TFPP) brand), Perimeter Solutions, Kerr Fire, and Solberg Company are the major players.

What will be the CAGR of the firefighting foam market?

The CAGR of the firefighting foam market is projected to be 3.62% from 2024-2031.