Firefighting Foam Market Trends

Market Driver - Rising Industrial Fire Incidences

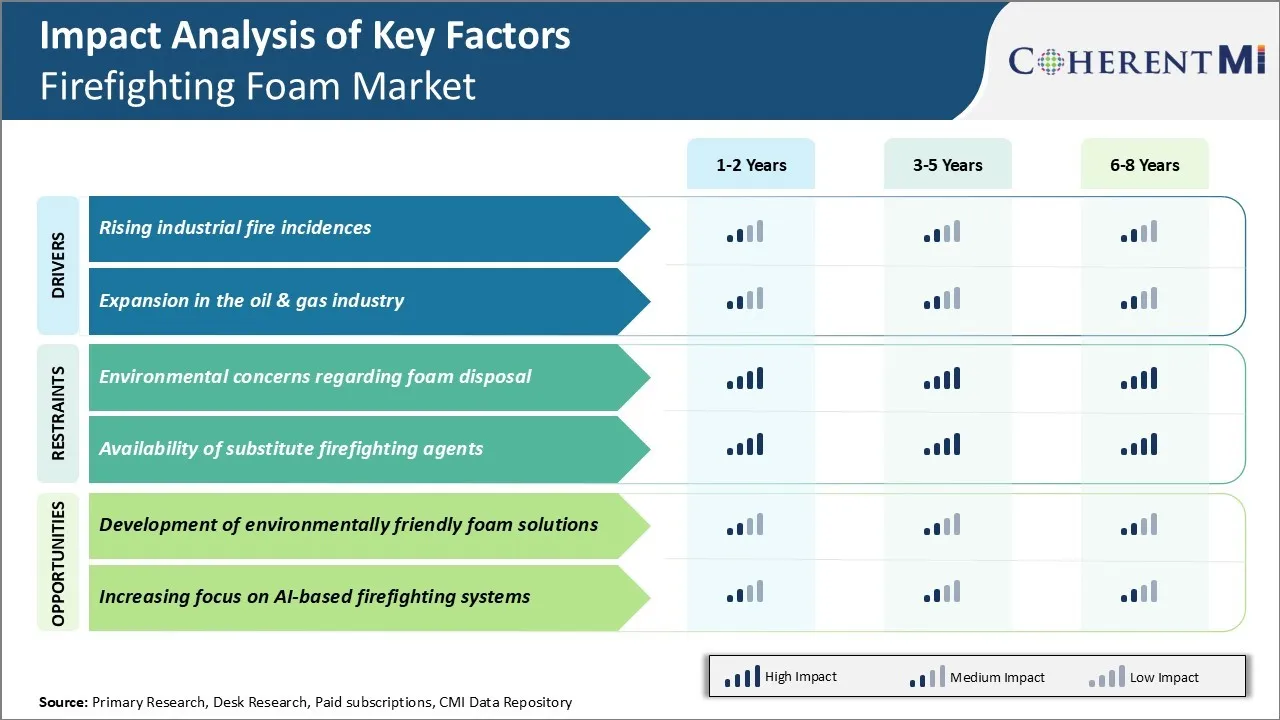

With increasing industrialization and rapid urbanization taking place around the world, there has been a steady rise in industrial fire incidents globally. Moreover, aging infrastructure and lax safety standards in some developing regions of world have contributed to frequent mishaps. As facilities expand operations and strive for higher productivity and output, the associated fire risks also increase manifold if not managed carefully.

Work environments with congested layouts make fire containment all the more difficult. With sophisticated digitization and automation trends, the integration of IT systems and machinery interface has opened up newer possibilities of technical faults or cyber sabotage triggering facility fires.

With a mix of these factors, global property loss from industrial and commercial fires have been rising sharply each year. The use of specialty firefighting foam concentrates for high-risk flammable liquid and gas fires has become almost imperative. This is expected to drive growth of the firefighting foam market in the coming years.

Market Driver - Expansion in the Oil & Gas Industry

The oil and gas industry has been witnessing sizable growth globally driven by increasing energy demands of developing economies and geopolitical issues. More oil and gas fields are being explored while existing facilities expand throughput to meet rising consumption.

A single fire incident in any part of the upstream or downstream supply chain from well-heads to refineries can turn catastrophic with immense loss of lives and assets. Oil spills from pipeline ruptures or tank/vessel failures often get ignited and spread rapidly on water. Even relatively minor building or plant fires at onshore facilities if not contained in time have potential to engulf large process areas or trigger bigger explosions. Effective and rapid-fire suppression is thus of utmost importance to maintain operational safety and business continuity in this sector. This will play a key role in growth for the players in the firefighting foam market.

Market Challenge - Environmental concerns regarding foam disposal

One of the key challenges faced by the firefighting foam market is the growing environmental concerns regarding the safe disposal of foam residues. Traditionally used aqueous film-forming foams (AFFFs) contained perfluoroalkyl and polyfluoroalkyl substances (PFAS), which have been gaining increased scrutiny due to their persistence in the environment and potential health risks. Prolonged and widespread use of AFFF during firefighting and training activities has led to PFAS contamination of soil and water bodies in and around airports and military facilities.

Stringent regulations are being introduced around the world to restrict the use of PFAS-containing foams and to remediate contaminated sites. This poses risks to the revenue stream of actors manufacturing and supplying legacy AFFF products. The liabilities associated with historical pollution from foams also raises concerns among existing players. Overall, the environmental and regulatory pressures present a significant challenge for the firefighting foam market.

Market Opportunity - Development of Environmentally Friendly Foam Solutions

One of the major opportunities for the firefighting foam market lies in the development of viable environmentally-friendly alternatives to legacy AFFF products containing PFAS chemicals. With growing restrictions on the use of PFAS foams, there is a crucial need as well as a lucrative market for greener foam solutions that are able to achieve the firefighting performance of traditional AFFFs without the environmental and health risks.

Leading manufacturers in the firefighting foam market have already invested heavily in R&D to formulate foams using newer fluorine-free and shorter-chain chemistry that can break down easily without leaving persistent residues. As more airports, oil & gas facilities and military bases mandate the use of PFAS-free foams, it can drive considerable demand for these green solutions.

Their adoption would open up opportunities for foam OEMs to tap into new revenue streams and carbon credits by offering products aligned with sustainability priorities. With the societal and regulatory push for non-toxic alternatives, the environmentally-friendly foam segment is expected to experience strong growth in the coming years.