Floating Power Plant Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Floating Power Plant Market is segmented By Power Source (Non-renewable, Renewable), By Capacity (Medium Scale, Small Scale, Large Scale), By Geograph....

Floating Power Plant Market Size

Market Size in USD Bn

CAGR8.9%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 8.9% |

| Market Concentration | High |

| Major Players | Ciel & Terre International, Caterpillar Inc., Floating Power Plant A/S, General Electric Company, Siemens Gas and Power GmbH & Co., and Among Others. |

please let us know !

Floating Power Plant Market Analysis

The floating power plant market is estimated to be valued at USD 1.53 Bn in 2024 and is expected to reach USD 2.78 Bn by 2031, growing at a compound annual growth rate (CAGR) of 8.91% from 2024 to 2031. The floating power plant market is expected to witness significant growth as land constraints become a challenge for conventional power plants.

Floating Power Plant Market Trends

Market Driver - Increased Electricity Demand and the Need for Sustainable Energy Solutions

Many countries across the world are facing chronic power shortages and regular blackouts due to insufficient power generation capabilities to meet rising consumption levels. There is also a growing global push for transitioning to cleaner and renewable sources of energy to reduce carbon emissions and tackle climate change.

Floating power plants have emerged as a promising solution that can help tackle both these challenges of growing electricity demand as well as the need for sustainable energy alternatives. By being located off the coasts and on seas, floating power plants do not require any valuable land area. The modular design also enables easier replication and scalability based on evolving demand patterns.

In addition, floating solar and wind power plants offer carbon-free means of electricity production. The offshore winds are much stronger and more consistent compared to onshore locations, making wind energy highly viable. As more nations aspire to reduce their carbon footprint and transition towards renewable energy, floating power plant market will experience heightened growth in coming years.

Market Driver - Floating Power Plants Offer Efficient Energy Production with Less Land and Water Impact

In contrast to conventional alternatives, floating power plants minimize the requirement of precious natural resources like land and freshwater bodies. These also require a steady supply of cooling water which is withdrawn in large volumes from rivers, lakes or seas and returned at higher temperatures. Some coal or nuclear plants are even abandoned or decommissioned when nearby water resources get depleted or polluted over long-term operations.

On the other hand, floating solar, wind and wave power stations located offshore or in reservoirs, bays and backwaters utilize only the water surface area and water currents/waves without altering land parcels or hydrological characteristics. They consume negligible amounts of water for operations and no water is returned, preventing thermal pollution issues.

Overall, floating facilities harness abundant offshore wind, solar, hydro, or wave resources more efficiently with minimal pressures on land or water. This is expected to boost growth of the floating power plant market.

Market Challenge - High Initial Setup Costs Compared to Traditional Land-Based Power Plants

One of the key challenges currently faced by the floating power plant market is the high initial setup costs compared to traditional land-based power plants. Developing a floating power plant requires the construction of a specialized floating vessel that can house all the necessary power generation equipment while also being able to withstand harsh marine environments.

Additionally, floating power plants also require marine equipment like anchoring systems, ballast systems, sea fastening etc. to ensure the floating platform remains stable in open waters. All these additional infrastructure and specialized equipment needed for a floating design pushes the initial capital expenditure much higher than conventional power projects on land.

Estimates suggest the setup costs for floating solutions can be 20-30% higher than similar capacity land-based facilities. The high upfront investment poses serious entry barriers for project developers and makes floating options less attractive economically.

Market Opportunity - Rising Innovations in Floating Technology with Higher Energy Efficiency

One of the major opportunities for the floating power plant market is the rising innovations in floating technology which can help improve energy efficiency. The concept of floating power generation is gaining more traction globally. So, technology providers are constantly working on innovative designs that can optimally harness renewable resources like solar, wind, wave etc. in offshore and remote locations.

Novel floating platforms are being developed which are more sturdy, compact and tailored to diverse marine conditions. Advanced technologies like modular construction techniques are also helping lower installation times and costs.

Similarly, the use of smart sensors and automation solutions in floating assets is improving overall operational efficiency. The evolving technology innovations are expected to gradually shrink the cost discrepancy with conventional power plants. The rising R&D efforts thus provide a strong opportunity to make floating power generation more competitive and scale up its adoption worldwide.

Key winning strategies adopted by key players of Floating Power Plant Market

Strategy #1: Partnerships and collaborations

One of the successful strategies adopted by major players in the floating power plant market has been partnering with other companies. For example, in 2017, Keppel partnered with Simply Blue Energy to develop a pilot floating wind farm off the coast of Wales.

Strategy #2: Developing innovative and cost-effective technologies

Floatgen, a French floating wind turbine launched in 2017 off the coast of France. It adopted an innovative floating foundation design that reduced installation and maintenance costs compared to traditional fixed structures.

Strategy #3: Securing long term contracts from governments/utility companies

In 2021, Principle Power secured €315 million contract from Portugal's state-owned utility company EDP to build a 30MW floating wind farm. Such long-term revenue commitments remove demand-side risks for developers and allow them to secure funding.

Strategy #4: Cost reductions through standardization and pre-assembly

Players like Samsung Heavy Industries invested heavily in standardizing floating wind farm design by adopting pre-built concrete or steel foundations and common electrical/control systems. This facilitated mass production and pre-assembly of major components onshore.

Segmental Analysis of Floating Power Plant Market

Insights, By Power Source: The Growing Adoption of Gas Turbines in the Floating Power Plant Market

In terms of power source, non-renewable sources contribute 79.1% share to the floating power plant market in 2024. Among the non-renewable sources, gas turbines have seen rising prominence owing to various advantages. Gas turbines are highly efficient and flexible power generation systems. They can utilize different types of gaseous fuels such as natural gas, kerosene, diesel fuels and various others.

The efficiency of modern gas turbines has also increased substantially. Combined cycle gas turbines can achieve thermal efficiencies as high as 60%, which helps lower the operating costs of floating power generation significantly. Their lower emissions profile compared to other fossil fuel alternatives also make gas turbines more environment-friendly.

Numerous power developers prefer gas turbine-based plants as they do not require sizable land areas and have smaller footprint. This makes gas turbines especially suitable for offshore and isolated regions where access to land is limited. This is expected to drive upcoming trends in the floating power plant market.

Insights, By Capacity: Medium Scale Floating Plants Dominate with Diverse Application Areas

When segmented by capacity, medium scale floating power plants accounting for 51MW to 250MW capacity hold the 44.5% share of the floating power plant market. These medium scale plants have found extensive usage across a wide variety of applications. Countries with distributed islands and islets which lack existing grid infrastructure frequently deploy medium scale floating power units. They offer a reliable source of electricity for both residential and industrial needs of such isolated communities. Furthermore, many developing regions experiencing rapid economic growth utilize medium scale plants on outdated barges or converted oil rigs to meet the rising power demands.

Other key application segments of medium scale floating generators include providing backup or temporary power during natural disasters and emergencies. Furthermore, some oil and gas production facilities, desalination plants and fish farming operations install medium floating units to fulfill their own private power requirements securely without grid dependence.

Additional Insights of Floating Power Plant Market

- India’s Rihand Dam Floating Power Plant: A significant renewable energy project located in Uttar Pradesh, supporting India’s push for renewable energy.

- Europe's Floating PV Plant by Q Energy: Construction began in September 2023, with a planned capacity of 74.3MW in France.

- Regional Market: Asia Pacific leads the global floating power plant market, driven by increased renewable energy adoption and underdeveloped power infrastructure.

- The deployment of the world's largest floating solar power plant in China, showcasing the potential of floating platforms to harness solar energy efficiently.

Competitive overview of Floating Power Plant Market

The major players operating in the floating power plant market include Ciel & Terre International, Caterpillar Inc., Floating Power Plant A/S, General Electric Company, Ideol SA, Kawasaki Heavy Industries, Ltd, Kyocera Corporation, MAN Diesel & Turbo SE, Seatwirl AB, Siemens Gas and Power GmbH & Co., and Wartsila.

Floating Power Plant Market Leaders

- Ciel & Terre International

- Caterpillar Inc.

- Floating Power Plant A/S

- General Electric Company

- Siemens Gas and Power GmbH & Co.

Floating Power Plant Market - Competitive Rivalry, 2024

Floating Power Plant Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Floating Power Plant Market

- In April 2024, the Solar2Wave project launched Indonesia's first marine floating solar power plant prototype, supported by funding from Innovate UK. The prototype, developed at the Orela shipyard in Gresik, East Java, consists of six monocrystalline and polycrystalline solar panels with a combined capacity of 600 watts.

- In August 2023, India launched one of the world’s largest floating solar power plants on Omkareswar Dam with a capacity of 600MW, with the first block of 0.5MW and 0.4MW solar modules.

- In July 2023, Siemens AG launched an advanced floating wind turbine technology designed to withstand harsh offshore conditions. The innovation is expected to lower the cost of offshore wind energy and accelerate the adoption of floating wind farms globally.

- In March 2023, Wärtsilä Corporation announced the successful testing of its new hybrid floating power plant, combining renewable energy sources with energy storage systems. This development aims to enhance efficiency and reduce emissions, positioning Wärtsilä as a leader in sustainable energy solutions.

Floating Power Plant Market Segmentation

- By Power Source

- Non-renewable

- Gas Turbines

- IC Engines

- Renewable

- Solar

- Wind

- Non-renewable

- By Capacity

- Medium Scale (51 MW to 250 MW)

- Small Scale (Up to 50 MW)

- Large Scale (Above 250 MW)

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the floating power plant market?

The floating power plant market is estimated to be valued at USD 1.53 Bn in 2024 and is expected to reach USD 2.78 Bn by 2031.

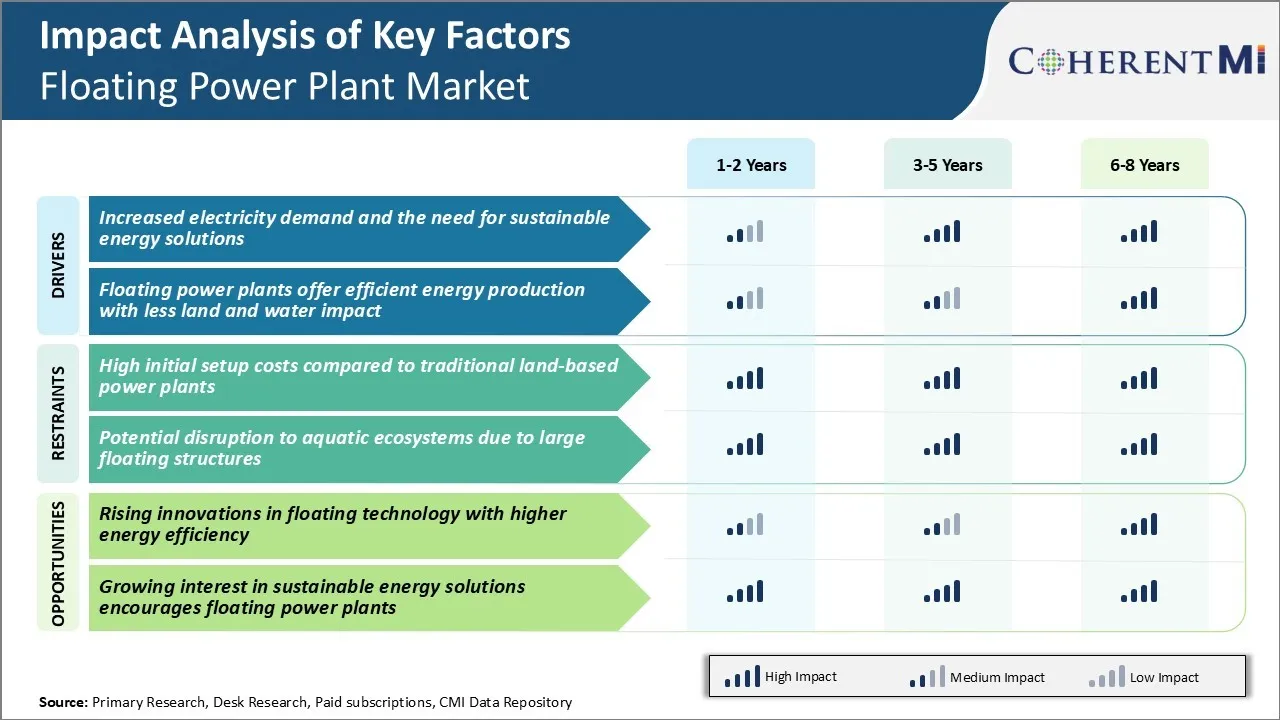

What are the key factors hampering the growth of the floating power plant market?

High initial setup costs compared to traditional land-based power plants and potential disruption to aquatic ecosystems due to large floating structures are the major factors hampering the growth of the floating power plant market.

What are the major factors driving the floating power plant market growth?

Increased electricity demand and the need for sustainable energy solutions and floating power plants offer efficient energy production with less land and water impact are the major factors driving the floating power plant market.

Which is the leading power source in the floating power plant market?

The leading power source segment is non-renewable.

Which are the major players operating in the floating power plant market?

Ciel & Terre International, Caterpillar Inc., Floating Power Plant A/S, General Electric Company, Ideol SA, Kawasaki Heavy Industries, Ltd, Kyocera Corporation, MAN Diesel & Turbo SE, Seatwirl AB, Siemens Gas and Power GmbH & Co., and Wartsila are the major players.

What will be the CAGR of the floating power plant market?

The CAGR of the floating power plant market is projected to be 8.9% from 2024-2031.