Food Cans Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

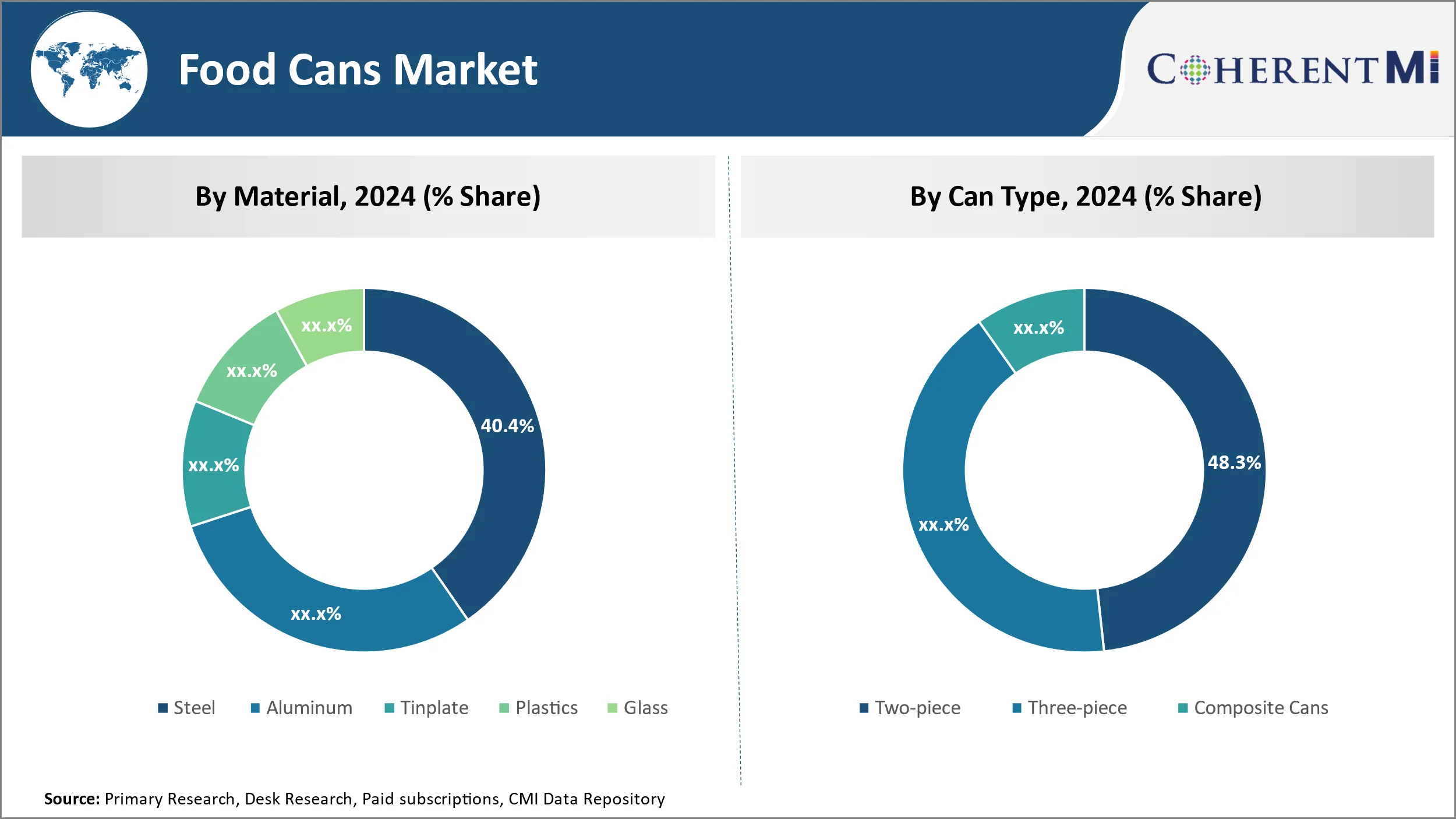

Food Cans Market is segmented By Material (Steel, Aluminum, Tinplate, Plastics, Glass), By Can Type (Two-piece, Three-piece, Composite Cans), By Closu....

Food Cans Market Size

Market Size in USD Bn

CAGR4.5%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 4.5% |

| Market Concentration | Low |

| Major Players | Ardagh Group, Ball Corporation, CAN-PACK S.A., Crown Holdings, Silgan Holdings, Sonoco Products Company and Among Others. |

please let us know !

Food Cans Market Analysis

The Global Food Cans Market is estimated to be valued at USD 25.4 Bn in 2024 and is expected to reach USD 32.9 Bn by 2031, growing at a compound annual growth rate (CAGR) of 4.5% from 2024 to 2031. Canned food products such as canned fruits and vegetables, fish, beans, soups and sauces have seen steady demand globally. The rising preference for convenient packaging formats aligned with increased disposable incomes is expected to drive the demand for canned foods over the next decade.

The food cans market is expected to witness positive trends over the forecast period. There is a rising demand for sustainable and recyclable packaging solutions among manufacturers and consumers. The canned packaging helps increase the shelf-life of foods without the need for preservatives and is fully recyclable. Cans also provide an excellent barrier against oxygen, moisture, light and other contaminants thereby retaining the quality and nutrients of food for long durations. This makes canned products ideal for global distribution and retail stores.

Food Cans Market Trends

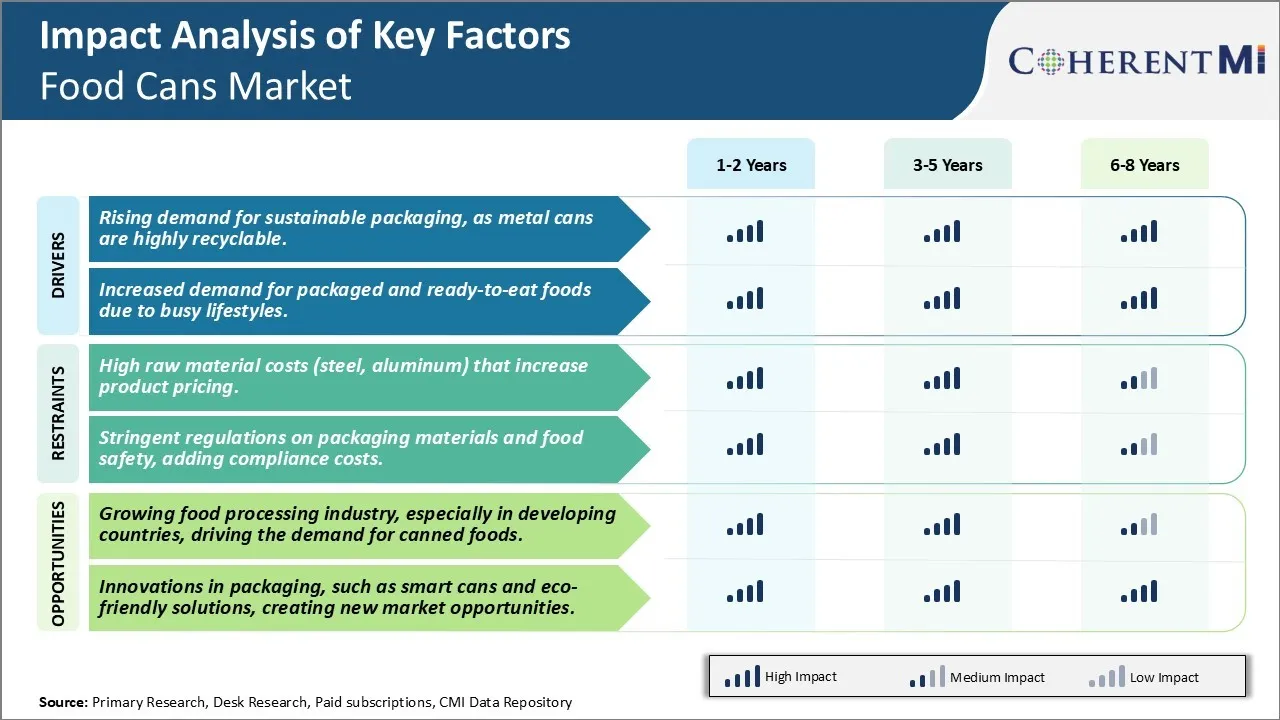

Market Driver - Rising Demand for Sustainable Packaging, as Metal Cans Are Highly Recyclable

The increasing awareness among consumers about the environmental impact of packaging is driving the demand for more sustainable options. Metal food cans are considered one of the most eco-friendly packaging formats available in the market today owing to their high recyclability and infinitesimal chances of leakage. Cans are made from steel or aluminum, both of which can be recycled endlessly without loss of quality. In fact, steel cans have one of the highest recycling rates across all packaging types with estimates showing that over 70% of all steel food cans consumed annually in developed markets like North America and Western Europe are eventually recycled.

The fully enclosed nature of metal cans also means there is essentially zero risk of products spilling or leaking out during transportation or storage as compared to other flexible formats. This leads to less wastage throughout the production and consumption cycle. Additionally, metal cans are highly durable and don't degrade over multiple recycling cycles like some plastic or paper-based alternatives. Manufacturers have also optimized can designs to reduce material usage without compromising on strength and protection of contents. All these properties make metal food cans one of the most sustainable choices for consumers who want packaging that creates minimum environmental footprint.

Growing awareness about issues like plastic pollution, climate change and sustainable consumption is compelling many big brands as well as smaller companies to switch to metal cans or give more prominence to canned ranges of products over other options. Eco-labels and certifications highlighting recyclability are also finding more traction among environmentally conscious buyers.

Market Driver - Increased Demand for Packaged and Ready-to-Eat Foods

With people's lifestyles becoming progressively busier, the demand for convenient packaged food options that save time has seen steady growth over the past decade. Metal food cans prove ideal for various ready-to-eat and on-the-go foods due to their sturdiness and hermetic sealing properties. The sealed container format keeps products fresh, sterile and safe from external contamination for extended periods without any special equipment or infrastructure. For consumers struggling with tighter schedules, cans present a reliable solution requiring minimum preparation or cooking efforts.

Working professionals, students and young urban populations have been opting more for canned soups, meals, fish or meat dishes and other perishable products that can be easily stored and consumed straight from the package. Cans have also gained traction for breakfast items like oats and for snack variants of nuts, fruits, vegetables and ready mixes. Foodservice providers and catering companies are leveraging canned formats for sandwiches, pasta salads and other packed lunch options targeted at time-starved demographics. Even traditional multi-cook meal categories are witnessing higher canned variants launched by major brands.

The rising dominance of nuclear families and one-person households farther encourages convenient portable packaging of foods. With amenities like microcooking gaining popularity for limited space living, cans complement these trends as ideal for compact storage and single-serve heating. As more people join the workforce and dual-income becomes commonplace, the dependence on easy packaged options preserving nutritional value will continue propelling the demand for metal food cans.

Market Challenge - High Raw Material Costs (steel, aluminum) Increase Product Pricing

One of the major challenges being faced by the food cans market is the high and volatile prices of raw materials used for can production such as steel and aluminum. Steel and aluminum prices have been on an upward trend over the past few years due to rising demand from various end-use industries and supply constraints. Steel is a primary raw material for making two-piece food cans while aluminum is used for making three-piece food cans. In 2021, steel prices increased by over 30% compared to the previous year due to supply chain bottlenecks caused by the COVID-19 pandemic along with rising demand from the construction industry. Similarly, aluminum prices have also seen an upward trend over the past five years driven by demand-supply dynamics. The rising raw material costs have put pressure on food can producers to increase the selling prices of canned food products in order to maintain margins. However, higher product prices make canned foods less competitive against flexible packaging solutions for certain food categories. This raw material price inflation can limit the growth in demand for canned foods if producers transfer the higher costs completely to consumers. Managing input costs efficiently while optimizing production is critical for food can manufacturers to sustain profitability in the current volatile market environment.

Market Opportunity - Growing Food Processing Industry, Especially in Developing Countries, Driving the Demand for Canned Foods

The food processing industry has been growing rapidly across many developing regions of the world such as Asia Pacific, Latin America, Middle East and Africa. Countries like India, Indonesia, Brazil and Egypt have witnessed strong growth in the food processing sector over the past decade as consumption patterns shift towards more processed and packaged food categories. The expansion of the middle-income population segment coupled with rapid urbanization in these developing economies has boosted the demand for convenient packaged food options such as canned foods. Canned foods offer advantages of long shelf life and portability making them popular substitutes for fresh produce. This has encouraged many food manufacturers in developing countries to invest in new cannery production lines to cater to the evolving needs. The growth in food processing augurs well for the canned foods market as volume sales as well as new product innovations pick up pace in developing country markets. If this trend continues, cans will become an increasingly important packaging format for various food categories beyond just fruits, vegetables and seafood in the future.

Key winning strategies adopted by key players of Food Cans Market

Focus on Product Innovation and New Product Development: Companies are constantly innovating and developing new product varieties and formats to attract consumers.

Optimize production capabilities and expand capacity: Leading players like Crown Holdings, Ball Corporation, Toyo Seikan Group Holdings etc. are increasing output through heavy capital investments to setup/expand production facilities globally. In 2017, Crown acquired a Spain-based aluminum can manufacturing plant to support growing European beverage can demands. This helped strengthen their market position.

Pursue Strategic Mergers and Acquisitions: Companies acquire other brands/firms to enhance product portfolio and expand geographic/client footprint.

Focus on sustainability and recyclability: With rising eco-conscious consumers, companies emphasize cans made from recycled aluminum which has high recycling rates of around 70% globally. Ball Corporation developed revolutionary infinitely recyclable aluminum cup in 2019 to promote sustainability. This boosted its brand image significantly.

Forge key partnerships with Food & Beverage clients: Long-term partnerships with dominant F&B brands ensure stable revenue streams.

The above examples show how through continuous innovations, strategic expansion plans, partnering with major clients and focusing on sustainability, leading food cans manufacturers have strengthened their market presence considerably over the past few years.

Segmental Analysis of Food Cans Market

Insights, By Material, Steel Dominates the Food Cans Market in the Forecast Period

By Material, Steel is expected to contribute 40.4% in 2024 market share owing to its sturdy and cost-effective nature. Steel is a strong yet affordable material that protects the food contents well during transportation and storage. It does not dent or break easily like other materials. Steel cans are reusable and steel is a 100% recyclable material, making steel cans environmentally sustainable. Many food brands prefer steel for packaging canned foods as it maintains freshness without allowing air or moisture to seep in. Steel cans withstand various temperatures ranging from freezing to heating without compromising on quality and safety of the contents. Their compact and stackable design also helps optimize warehousing and shipping costs for manufacturers and retailers.

Insights, By Can Type, Two-piece Cans Gain Traction in Food Packaging Due to Convenience

By Can Type, Two-piece Cans contribute the highest share of the market due to the convenience they provide in opening. Two-piece cans have a cylindrical body that is locked with the can ends, making them easy to access the contents. Users simply have to open the ends without struggling with additional pieces. This effortless open-close feature is appealing to consumers who want quick meals on-the-go. Many ready-to-eat food brands prefer the lightweight yet practical two-piece design for maximizing portability. Their production process is also relatively simple and cost-effective compared to another complex can structures.

Insights, By Closure Type, Universal Acceptance: Can Ends Dominate as Closure of Choice in Food Packaging

By Closure Type, Can Ends contribute the highest share of the market owing to their universal acceptance. Can ends securely seal the opening of steel or aluminum cans. They provide a firm, corrosion-resistant closure that protects the contents over long shelf-life without any risk of spillage. Their small indented design also allows full visualization of contents without opening. Most importantly, can ends can be shipped empty and assembled at packaging sites, making just-in-time inventory management flexible for manufacturers. Their ease of recycling further enhances sustainability. Due to the above advantages, can ends have emerged as the preferred and internationally approved closure for canned food products across regions.

Additional Insights of Food Cans Market

The food cans market is growing steadily, primarily driven by rising consumer demand for convenient and long-lasting food products, particularly in North America. Metal cans, especially steel and aluminum, are increasingly popular due to their sustainability benefits and recyclability. As environmental concerns rise and governments worldwide implement stricter regulations on plastic packaging, food cans present an eco-friendly alternative for packaging. Moreover, innovations such as smart cans and recyclable packaging solutions are transforming the market. Companies are investing heavily in technological advancements, like AI for improved production efficiency, and adopting new designs to cater to changing consumer needs. The food cans market is also benefiting from the growth of the pet food industry and the rise of ready-to-eat meals, which require durable, secure, and safe packaging. The Asia Pacific region, particularly China and India, is expected to witness significant growth due to increasing food production and exports.

Competitive overview of Food Cans Market

The major players operating in the Food Cans Market include Ardagh Group, Ball Corporation, CAN-PACK S.A., Crown Holdings, Silgan Holdings, Sonoco Products Company, Dell Monte Foods, Nampak, Kaira Cans, Dole plc, Kian Joo Group, Kraft Heinz and Trivium Packaging.

Food Cans Market Leaders

- Ardagh Group

- Ball Corporation

- CAN-PACK S.A.

- Crown Holdings

- Silgan Holdings

- Sonoco Products Company

Food Cans Market - Competitive Rivalry, 2024

Food Cans Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Food Cans Market

- In May 2024, Ball Corporation partnered with CavinKare in India to launch two-piece aluminum cans for milkshake packaging, enhancing packaging options for food and beverages.

- In June 2024, Sonoco Products acquired Eviosys, a European supplier of food cans, for USD 3.9 billion, aiming to expand its market presence and invest in high-return opportunities.

Food Cans Market Segmentation

- By Material

- Steel

- Aluminum

- Tinplate

- Plastics

- Glass

- By Can Type

- Two-piece

- Three-piece

- Composite Cans

- By Closure Type

- Can Ends

- Screw Caps

- Pull Tabs

- Easy-open Lids

- By Application

- Food & Beverages

- Pet Food

- Industrial Products

- Pharmaceuticals

- Personal Care Products

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Food Cans Market?

The Global Food Cans Market is estimated to be valued at USD 25.4 Bn in 2024 and is expected to reach USD 32.9 Bn by 2031.

What will be the CAGR of the Food Cans Market?

The CAGR of the Food Cans Market is projected to be 4.5% from 2024 to 2031.

What are the major factors driving the Food Cans Market growth?

The rising demand for sustainable packaging, as metal cans are highly recyclable and increased demand for packaged and ready-to-eat foods due to busy lifestyles are the major factor driving the Food Cans Market.

What are the key factors hampering the growth of the Food Cans Market?

The high raw material costs (steel, aluminum) that increase product pricing. and stringent regulations on packaging materials and food safety, adding compliance costs are the major factor hampering the growth of the Food Cans Market.

Which is the leading Material in the Food Cans Market?

Steel is the leading Material segment.

Which are the major players operating in the Food Cans Market?

Ardagh Group, Ball Corporation, CAN-PACK S.A., Crown Holdings, Silgan Holdings, Sonoco Products Company, Dell Monte Foods, Nampak, Kaira Cans, Dole plc, Kian Joo Group, Kraft Heinz, Trivium Packaging are the major players.