Fortified Dairy Products Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Fortified Dairy Products Market is segmented By Product (Milk, Yogurt, Cheese, Cream, Ice-cream), By Ingredients (Vitamins, Minerals, Probiotics, Omeg....

Fortified Dairy Products Market Size

Market Size in USD Bn

CAGR8.2%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 8.2% |

| Market Concentration | High |

| Major Players | Nestlé S.A., Dean Foods Company, General Mills Inc., Arla Foods UK Plc., Danone, BASF SE and Among Others. |

please let us know !

Fortified Dairy Products Market Analysis

The Global Fortified Dairy Products Market is estimated to be valued at USD 117.4 Bn in 2024 and is expected to reach USD 221.2 Bn by 2031, growing at a compound annual growth rate (CAGR) of 8.2% from 2024 to 2031. Consumers are increasingly conscious about their health and nutrition. Fortified dairy products provide essential vitamins and minerals which help address deficiencies. The fortified dairy products market is expected to grow steadily over the forecast period. Rising awareness about benefits of consuming nutrient-rich food is driving the demand. Products such as fortified milk, yogurt and cheese are gaining traction. Manufacturers are introducing new variants with customized fortification formulas to cater to diverse consumer needs. The market is also supported by growing focus on preventive healthcare and lifestyle diseases.

Fortified Dairy Products Market Trends

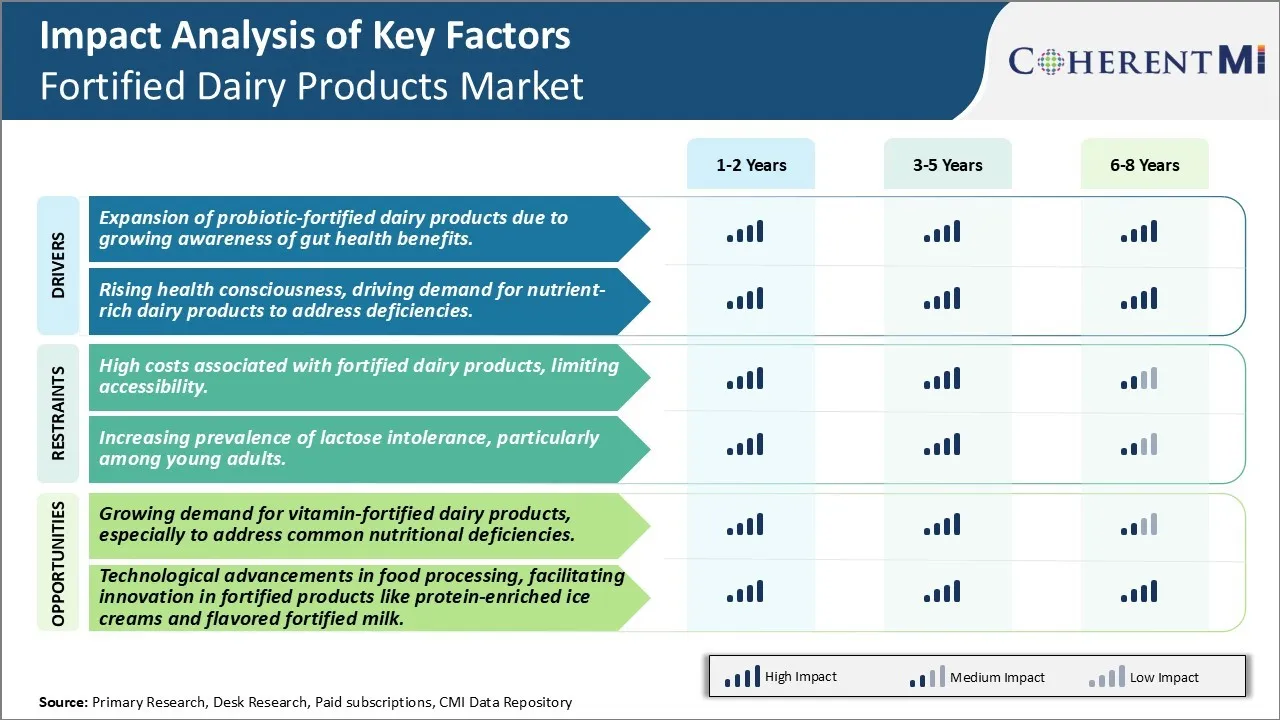

Market Driver - Expansion of Probiotic-Fortified Dairy Products Due to Growing Awareness of Gut Health Benefits

Probiotic fortified dairy products are witnessing increasing demand globally owing to growing awareness regarding the health benefits associated with consuming probiotics. Probiotics are live microorganisms that when consumed in adequate amounts provide numerous health advantages to the host. Regular consumption of probiotic-rich foods helps balance and promote growth of good bacteria in the gut. This, in turn, aids in better digestion, enhances immune response and lowers risk of certain diseases.

Over the past few years, researchers have discovered novel linkages between gut microbiota composition and various health conditions beyond digestive health. Studies now suggest that imbalance in gut microbiome is linked with obesity, depression, cardiovascular issues and certain types of cancer among other ailments. Such revelations have created renewed interest among health-conscious consumers regarding importance of microflora in our gut. They are making lifestyle changes to attain or maintain a state of balanced gut health through diet and supplementation with probiotic products.

Besides offering gut and overall health benefits, probiotic fortification provides opportunities for product differentiation in highly competitive markets. Additionally, it helps tackling competitive pressure from plant-based milk substitutes increasingly preferred by health-conscious customers. Hence more established dairy majors are exploring avenues to fortify their dairy product portfolio with probiotic cultures and drive top-line via new product development in this segment.

Growing consumer awareness of role of probiotics in holistic well-being combined with launch of innovative delivery formats is set to further propel demand and growth trajectory of probiotic-fortified dairy segment globally in the foreseeable future.

Market Driver - Rising Health Consciousness, Driving Demand for Nutrient-Rich Dairy Products to Address Deficiencies

With growing health and nutrition consciousness, consumers are placing increasing importance on balanced diet, supplementation and intake of micronutrient-rich foods. However, busy lifestyles and inconsistent dietary patterns lead to various deficiency states which adversely impact overall health and wellness. Diet experts often warn about lack of key vitamins and minerals in regular urban diets especially in developing countries undergoing nutrition transition. This has serious implications as deficiencies compromise immunity, cognitive function and increase chronic disease risk over the long-term. Recognizing micronutrient deficiency as critical public health issue, various organizations recommend staple foods be fortified with important vitamins and minerals. As one of most consumed dairy foods globally, milk is being advocated as ideal vehicle for large-scale micronutrient fortification programs. It is cheaply and easily available. Moreover, milk can deliver fat and water-soluble vitamins along with minerals to the bodies in readily bioavailable forms. Fortification allows addressing multiple deficiencies through single food vehicle on a daily basis thus helping people meet Recommended Dietary Allowances (RDAs).

Leading diary companies are now fortifying their products such as milk, yogurt and cheese with vitamins A, D and B-complex along with important minerals like calcium, zinc and iodine as per dietary gaps in target populations. While meeting regular nutrient needs of customers, fortified dairy items effectively function as supplements to salvage deficiencies- a factor driving steady demand growth. Further, nutritionally enhanced products help companies aligning with evolving health and wellness missions of consumers.

Market Challenge - High Costs Associated with Fortified Dairy Products, Limiting Accessibility

One of the key challenges faced by players in the fortified dairy products market is the high costs associated with fortifying dairy products. Fortifying dairy products entails adding various nutrients like vitamins, minerals, and proteins to regular dairy products which necessitates specialized equipment and techniques. This fortification process is a complex multi-step procedure that requires specific micronutrient premixes, additional processing facilities, robust quality control protocols, and specialized training for production staff. All these elements contribute to elevated production costs. Further, labeling and packaging of fortified products also require additional expenses. These increased costs of fortified dairy products, as compared to regular dairy items, poses affordability issues for lower-income population in developing countries where micronutrient deficiencies are highly prevalent. The higher prices can limit the accessibility of fortified dairy products for underprivileged consumers who need them the most. With the cost of fortification estimated to increase the final product prices by 10-15%, it becomes challenging for dairy companies to achieve profitable sales volumes given the price sensitivity of cost-conscious customers.

Market Opportunity - Growing Demand for Vitamin-Fortified Dairy Products, Especially to Address Common Nutritional Deficiencies

One of the major opportunities for players in the fortified dairy products market lies in the growing demand for milk and other dairy items fortified with crucial vitamins and minerals. Micronutrient deficiencies or ‘hidden hunger’ is widely prevalent across both developing and developed regions with lack of essential vitamins and minerals severely impacting public health. Fortified dairy products provide a simple solution to bridge the gap as milk and other dairy items are naturally deficient in certain key vitamins like A, D, B12, and minerals like iron, iodine and zinc. The rising health-conscious consumer base is increasingly relying on fortified foods to meet their daily dietary needs. Food companies are therefore able to earn goodwill by offering fortified options that aid in prevention of common deficiencies and support overall wellness. As awareness about benefits of micronutrient-rich diet increases globally, sales potential of fortified dairy products is expected to rise tremendously in the coming years.

Key winning strategies adopted by key players of Fortified Dairy Products Market

Product Innovation and Health-Centric Fortification:

- Companies are fortifying dairy products with vitamins (such as A, D, B12), minerals (calcium, zinc), and other nutrients tailored for specific health benefits like bone health, immunity, and cognitive development.

- Probiotics, prebiotics, and other functional ingredients are added to cater to gut health and immunity-focused consumers. This includes fortified yogurt, kefir, and fermented milk with added live cultures and digestive enzymes.

- Many companies are developing age-specific products, such as high-calcium, vitamin D-enriched milk for children or high-protein fortified options for seniors.

Strategic Mergers, Acquisitions, and Partnerships:

- Acquisitions and Partnerships with nutrition and biotech companies allow dairy brands to incorporate advanced fortification techniques and proprietary ingredient technologies, such as more bioavailable vitamins or stabilized minerals.

- Collaborations with academic institutions and health organizations help validate the health claims of fortified dairy products, enhancing consumer trust and scientific credibility.

- Joint Ventures with local dairy producers in emerging markets (like India and Southeast Asia) help global players tap into new regions, localize products, and cater to regional nutritional deficiencies and preferences.

Geographic Expansion and Market Penetration:

- Expansion into emerging markets with high demand for nutrient-rich dairy products, particularly in Asia-Pacific and Latin America, where concerns over malnutrition drive demand for fortified options.

- Companies are tailoring product formulations to meet regional nutritional needs and regulatory standards, such as fortified milk in regions with widespread vitamin D deficiency.

Investment in Sustainable and Clean Label Practices:

- Brands are increasingly focused on natural, clean-label ingredients, which are in high demand among health-conscious consumers. This includes organic vitamins and minerals, as well as non-GMO and hormone-free dairy.

- Many players are investing in eco-friendly packaging, aligning with consumer preferences for sustainable options. This is part of a broader commitment to environmental responsibility, such as reducing carbon footprints and water usage in dairy farming and production.

Diverse Distribution Channels and E-Commerce:

- Expanding into e-commerce and direct-to-consumer channels to meet the growing demand for fortified dairy products online, especially among urban, health-conscious consumers.

- Subscription Models for health-focused products, such as fortified milk and yogurt, enable consumers to receive regular deliveries, increasing brand loyalty and ensuring consistent consumption.

- Retail Partnerships with health-focused grocery stores and specialty food retailers to position fortified dairy products alongside other premium health products.

Segmental Analysis of Fortified Dairy Products Market

Insights, By Product, Convenience drives dominance of Milk in the Fortified Dairy Products market

By Product, milk products are expected to contribute 43.3% in 2024 owing to its unmatched convenience. As a versatile staple enjoyed by both children and adults alike, milk can be easily consumed on-the-go or with any meal. Its liquid form means it requires no preparation time, making milk perfect for busy modern lifestyles. Milk is also affordable and versatile, acting as a nutritious base for breakfast cereals as well as ingredient in recipes. Furthermore, light flavors like regular and chocolate allow milk to complement both sweet and savory dishes. Due to these convenience aspects, milk sees consistent high demand and is the first choice for fortified dairy.

Insights, By Ingredients, Vitamins Lead Fortified Dairy Ingredients Due to Health Awareness

Among the Fortified Dairy Product ingredient segments, Vitamins are projected to contribute 36.2% in 2024 owing to growing consumer health awareness. As lifestyle diseases rise, customers increasingly seek nutrition from their food to support body functions. Vitamins play a key role in immunity, metabolism and growth. The addition of Vitamins A, D and B-complex to dairy helps fulfill Recommended Daily Intakes. This fortification addresses concerns around deficiencies. It also allows products to tout specific benefits like strengthened bones or energy levels. As customers prioritize preventative healthcare, the vitamins segment leads as the premier functional ingredient for fortified dairy products.

Insights, By Natural flavors Dominate due to Focus on Clean Label

Within the Fortified Dairy Product flavor segments, Natural flavors hold the highest share due to intensifying clean label trends. Customers carefully scrutinize labels, avoiding artificial colors, preservatives or unfamiliar ingredients. They favor short, simple lists leaning towards nature-derived components. Natural dairy flavors satisfy this demand through their simple, easy-to-understand nature. Whether subtly sweet like vanilla, or subtly savory like pumpkin, natural flavors let products spotlight minimal processing for health-conscious buyers. They also allow for subtle twists on the dairy base without obscuring it. Due to aligning with clean label philosophy, natural flavors spearhead the dairy market.

Additional Insights of Fortified Dairy Products Market

Fortified dairy products are increasingly sought after as consumers prioritize health and nutrition. Essential nutrients like vitamins, minerals, and probiotics are fortified in dairy products to address dietary deficiencies and support various health benefits, from bone health to immunity. Technological advancements in food processing, combined with consumer preferences for functional foods, propel the market. As the demand for natural, nutritious products rises, fortified dairy becomes a convenient solution for obtaining essential nutrients, especially in regions like Asia Pacific and Europe, where health consciousness and dietary diversity are strong. The future of fortified dairy includes innovations in flavors, protein content, and probiotics, providing both nutritional benefits and appealing tastes.

Competitive overview of Fortified Dairy Products Market

The major players operating in the Fortified Dairy Products Market include Nestlé S.A., Dean Foods Company, General Mills Inc., Arla Foods UK Plc., Danone, BASF SE, China Modern Dairy Holdings Ltd., CMMF Ltd., Fonterra Group Cooperative Ltd and Bright Dairy & Foods Co.

Fortified Dairy Products Market Leaders

- Nestlé S.A.

- Dean Foods Company

- General Mills Inc.

- Arla Foods UK Plc.

- Danone

- BASF SE

Fortified Dairy Products Market - Competitive Rivalry, 2024

Fortified Dairy Products Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Fortified Dairy Products Market

- In June 2024, Galaxy Foods in Tanzania launched ‘Kilimanjaro Fresh,’ a fortified yogurt with Arla Foods Ingredients, aimed at enhancing nutrition in dairy.

- In January 2024, Yoplait introduced ‘Yoplait Protein,’ a high-protein dairy snack in the U.S. market, combining ultra-filtered milk with traditional yogurt fermentation.

- In May 2023, Aavin, a state-run cooperative in India, launched a new fortified milk variant in a unique purple sachet, expanding its range with enhanced vitamin fortification.

Fortified Dairy Products Market Segmentation

- By Product

- Milk

- Yogurt

- Cheese

- Cream

- Ice-cream

- By Ingredients

- Vitamins

- Minerals

- Probiotics

- Omega-3 Fatty Acids

- Proteins

- Others

- By Flavor

- Natural

- Flavored

- By Distribution Channel

- Hypermarkets & Supermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the Fortified Dairy Products Market?

The Global Fortified Dairy Products Market is estimated to be valued at USD 117.4 Bn in 2024 and is expected to reach USD 221.2 Bn by 2031.

What are the key factors hampering the growth of the Fortified Dairy Products Market?

The high costs associated with fortified dairy products, limiting accessibility. and increasing prevalence of lactose intolerance, particularly among young adults. are the major factor hampering the growth of the Fortified Dairy Products Market.

What are the major factors driving the Fortified Dairy Products Market growth?

The expansion of probiotic-fortified dairy products due to growing awareness of gut health benefits. and rising health consciousness, driving demand for nutrient-rich dairy products to address deficiencies. are the major factor driving the Fortified Dairy Products Market.

Which is the leading Product in the Fortified Dairy Products Market?

The leading Product segment is Milk.

Which are the major players operating in the Fortified Dairy Products Market?

Nestlé S.A., Dean Foods Company, General Mills Inc., Arla Foods UK Plc., Danone, BASF SE, China Modern Dairy Holdings Ltd., CMMF Ltd., Fonterra Group Cooperative Ltd, Bright Dairy & Foods Co. are the major players.

What will be the CAGR of the Fortified Dairy Products Market?

The CAGR of the Fortified Dairy Products Market is projected to be 8.2% from 2024-2031.